Can Fastenal's strong dividend continue to be an investment focus?

08:24 October 2, 2025 EDT

Fastenal has a long history of increasing its dividend while offering a market-beating yield. This streak of dividend growth is particularly impressive considering that Fastenal operates in an industry where consistent dividend increases are uncommon.

First, Fastenal's business model was incredibly strong, resulting in consistently rising dividends for over 25 years. Unfortunately, this knowledge, widely known in the market, led to its valuation soaring to exorbitant levels. While I found much to like about the company at the time, concerns about its valuation led most analysts to rate Fastenal a "hold."

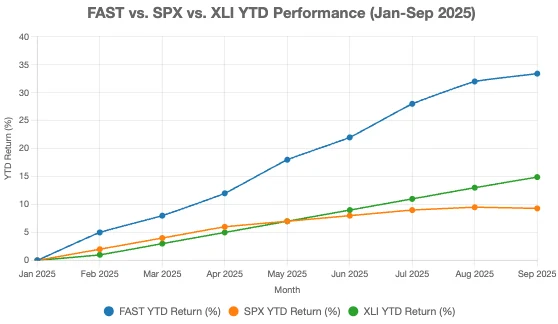

Since 2023, its stock price has risen nearly 31%, nearly triple the S&P 500's gain. While I remain bullish on the company, I still believe its valuation is very high. They are an industrial manufacturer, and their business has been attractive from a profitability perspective during their time as a public company; this is FAST's main selling point: its ability to make money.

Their IR website isn’t plastered with fancy AI stories; they make fasteners and industrial equipment, and they do so in a “lean” way to reduce costs and increase profitability.

FAST stock is a component of both the S&P 500 and Nasdaq-100 indices, but with a market capitalization of less than $50 billion, it carries a relatively low weighting. However, over the past decade, the stock's returns have kept pace with the S&P 500, and its cycles have been somewhat insulated from the market's; the same is true for the fortunes of industrial companies.

FAST is a profitable company, which is paramount for investors. This is thanks to the company's resilience over the past year, with growing revenue, healthy margins, and strong cash flow. Earnings per share and dividends per share have continued to grow, and the low number of shares outstanding has further enhanced this performance. While the number of shares outstanding has rebounded from its 2023 low, it has generally been declining over the past decade. FAST's model is designed to help companies achieve "lean"—meaning achieving more business value with less effort. Fastenal's vending products, systems, and services not only understand where tools are stored, but also provide greater control and visibility into how and how much they are being used. This not only saves time but also contributes to a better financial position, helping to improve working capital and potentially save costs.

This is why Fastenal is trending well. The more value a company can create, the greater its potential for sustained revenue growth. Not only will more companies adopt it, but existing companies will also use it more, allowing for cross-selling, upselling, and even eventual price increases due to the moat and demand for these services. In niche sectors like stadium operations, being a flagship partner can command a premium. Every industry has "default" partner organizations—companies that are desirable because of their excellent reputations. This makes the stock more attractive for acquisition, and investors perceive it as "goodwill." There are always reasons for a stock to rise, and Fastenal is one such stock with many reasons. However, when the market declines, even if Fastenal itself performs well, it often pulls all stocks down with it. We saw this happen in April of this year. Everything has a beta.

Analysis of recent results

Will it outperform the SPX? How will the sector (XLI) perform?

It's hard to say. Even if these companies continue to grow at their current rates, the market won't necessarily reward them. Much of the strong growth momentum and moat story is already priced in, and we don't see a worthy entry point for FAST in my portfolio at this point.

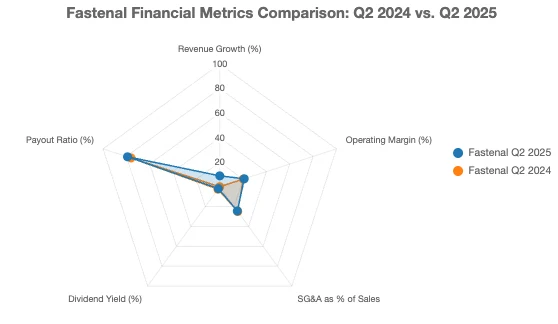

Fastenal reported its second-quarter results on July 14, 2025. The results were excellent. Revenue grew nearly 9% to $2.08 billion, exceeding market expectations by $14 million. Earnings per share were $0.29, up from $0.25 in the same period last year and $0.02 higher than expected. Despite a soft market environment, Fastenal's products continued to see strong demand, resulting in high-single-digit sales growth.

Even more impressive, the company implemented a series of price increases to offset rising costs. Management stated that this pricing strategy drove at least 140 basis points of revenue growth during the period. Customers were willing to bear the higher costs to purchase the products they needed from Fastenal.

Price increases accelerated in the second quarter, despite no decline in demand, further demonstrating Fastenal's importance to its customers' business models. Furthermore, management indicated that further price increases will be implemented in the third quarter of 2025.

While price increases could eventually impact product demand, monthly results since the beginning of the third quarter suggest this has yet to occur. Monthly sales in July increased by nearly 13% year-over-year, with all regions achieving at least high-single-digit growth. All end markets also saw strong growth during the period. Revenue in July 2024 was essentially flat, so the year-over-year growth for the month suggests the company is in much better shape than it was in 2024.

August sales figures remained largely unchanged. Net sales increased 6.7%, despite one additional business day compared to August last year. Average daily total sales increased 11.8%, with continued strong growth across all regions and end markets.

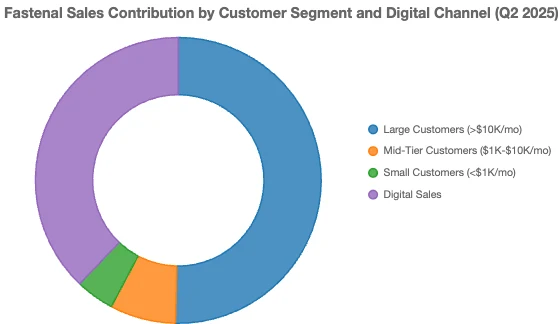

This growth was driven primarily by Fastenal's largest customers. While sales to customers spending less than $10,000 per month remained flat in the most recent quarter, sales to customers spending at least $10,000 per month increased by 11.6%. This customer group accounts for over 81% of the company's total sales. Sales to customers spending at least $50,000 per month increased by 14.5%, representing slightly more than half of the company's total sales. The fact that the company's most important customers are continuing to spend is a very positive sign.

The sheer number of customers using Fastenal products also helps sales.

Fastenal has seen steady growth in its customer base, with a 6.7% increase in customers who spend at least $10,000 a month. It's important to remember that these customers make up the majority of the company's sales.

These growth rates demonstrate that Fastenal's most important customer segment demands the company's products and is willing to pay a premium to obtain them. Digital sales, a key area of focus for the company, achieved 11.5% growth this quarter. The company's digital business accounted for 61% of total sales this quarter. This channel is crucial to the company's business, as its growth rate has outpaced the company's overall performance. Recent results, along with monthly sales figures for July and August, demonstrate that Fastenal's business is operating at a high level, suggesting positive expectations for the company as a whole.

Adjusted for its 2-for-1 stock split in May, the company is expected to generate $1.11 in earnings per share in 2025, representing full-year growth of nearly 11%. Similar growth rates are expected in 2026.

If Fastenal can continue to see increased demand for its products while raising prices, it should be able to achieve these ambitious growth targets.

Dividend and Valuation Analysis

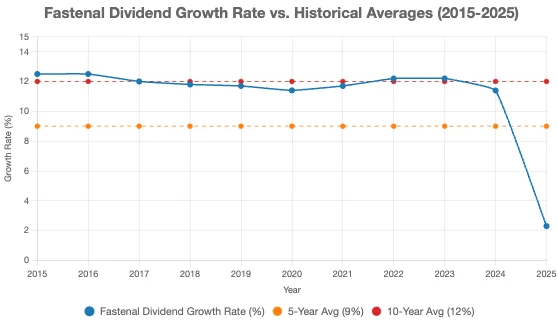

Fastenal last raised its dividend in April, increasing it by 2.3%. By comparison, the company's average dividend increases over the past five and ten years have been around 9% and 12%, respectively. While the company has maintained a 26-year streak of dividend increases, recent increases are far below what investors are used to. Overall, Fastenal earns an Outstanding rating for its consistent dividend growth.

Investors will note that Fastenal's dividend growth cycle is significantly longer than its industry median, demonstrating its ability to raise dividends in a challenging industry. One reason for the slower-than-usual dividend increases is the projected payout ratio for 2025, which is 79%. This would be the highest payout ratio in at least a decade, suggesting that Fastenal currently has little room to significantly increase its dividend. Unless earnings per share growth exceeds expectations, investors will likely see slower growth in the coming years. The stock yields 1.9%, below the stock's 10-year average of 2.5%, but above the S&P 500's average yield of 1.2%.

Fastenal's stock price has risen over 30% since the end of last year and currently trades at a price-to-earnings ratio of 42.3 times projected 2025 earnings per share. This compares to the industry's median forward P/E ratio of 20.7 times. Fastenal's valuation is typically high, with a five-year average P/E ratio of 33.6 times. While the stock deserves a premium valuation given its business, its current P/E ratio is already quite high.

JPMorgan currently maintains its previous valuation target range of 28 to 30 times earnings per share because I believe this range takes into account the company's successful business model and historical valuation, while also allowing for some margin of error.

Total return potential

Fastenal is expected to achieve double-digit growth over the next two years, exceeding its historical growth rate. Over the past decade, earnings per share have grown at a compound annual rate of 9.4%, but this growth has slowed to 7.7% over the past five years alone. Considering the company's growth rate and analyst estimates, 7% earnings growth is feasible. The 1.9% dividend yield will also contribute to total returns.

However, these factors could be significantly offset by a contraction in the P/E ratio. A decline in the P/E ratio from its current level to the midpoint of our valuation target of 29x could significantly reduce total returns. Looking ahead five years, if the stock reaches our target P/E ratio by then, the valuation could reduce total returns by 7.3% annually. A contraction in the P/E ratio could result in Fastenal's total returns in the low single digits. For this reason, I believe the stock is worth holding.

Investment Risk Topic

Despite the weak total return forecast, Fastenal's stock isn't a sell-off at this point. During the conference call, management noted that the overall market for similar products remains weak, but Fastenal has proven so far that its customers are still paying for its products. The company has been supported by its largest customer. If this trend continues, Fastenal should be able to outperform its peers.

However, a manufacturing downturn could affect even the best operators. If this were to happen, Fastenal's price-to-earnings ratio would likely shrink, significantly reducing its expected total return. Another concern is that operating costs are rising across many industries. The industrial sector in general, and Fastenal in particular, are no exception.

The company's selling, general, and administrative expenses (SG&A) increased 6.3% in the second quarter. Due to higher revenue growth, expenses accounted for only 24.4% of net sales, down from 24.9% in the second quarter of 2024. As a result, operating margins expanded 80 basis points to 21%. The faster revenue growth than the expense growth indicates the company's exceptionally efficient operations.

If revenue growth slows below the growth of expenses, Fastenal's profitability could decline, which could ultimately jeopardize the dividend given its already high payout ratio. While the dividend has shown strong growth momentum, it could be threatened in an economic downturn.

Finally, many income investors may find Fastenal's sub-2.0% yield unappealing, but I'm not opposed to a lower yield, especially with a significantly higher dividend payout. That said, recent gains have been much lower than in the past, and the dividend payout ratio may suggest that the high-growth period is at least paused for now.

Conclusion

Fastenal continues to perform strongly, with growth across nearly all of the company's business areas last quarter. The stock price has responded, currently trading at over 42 times forward earnings. This makes it difficult to buy the stock at its current price, as earnings growth and dividend yield could be largely offset by the contracting multiple if the valuation declines.

In my opinion, the company does deserve a premium valuation, but today's P/E ratio is too high to justify buying Fastenal's shares. Therefore, I maintain my Hold rating on the stock.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates