Smiths Group is developing a new technology blueprint for industrial technology

01:51 October 1, 2025 EDT

Business Strategy and Outlook

Smiths Group is reinventing itself as a focused industrial technology company. Its core business includes two world-class companies, John Crane and Flex-Tek, specializing in engineered fluid and thermal management solutions. Both companies focus on attractive, non-commoditized market segments where performance, reliability, and service support are critical to customers. Both companies have strong positions in markets impacted by long-term drivers such as energy efficiency, industrial decarbonization, and electrification.

John Crane provides mission-critical mechanical seals and filtration systems for rotating equipment in the energy and industrial sectors. Its business is supported by high-margin, recurring aftermarket revenue, which accounts for approximately 70% of its total revenue and spans the entire lifecycle of the equipment. Flex-Tek produces flexible tubing and heating components for HVAC, aerospace, and industrial applications. The company benefits from a leading share position in a fragmented market, recurring revenue from original equipment manufacturer relationships, and innovation-driven growth.

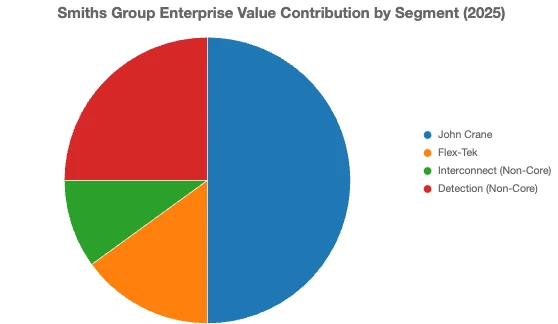

To focus its portfolio and unlock value, Smiths plans to divest Smiths Interconnect and Smiths Detection. Interconnect is scheduled for sale by the end of 2025, with the Detection business to follow later, either through a UK spin-off or a third-party sale, depending on which approach maximizes shareholder value. Proceeds will be used for a £500 million buyback program, while maintaining leverage within investment-grade ranges.

The restructured "Future Smith" will have a leaner structure and more focused capital allocation, and is expected to become an industrial group with higher returns and more attractive growth prospects. In the short term, the successful execution of these divestitures is critical to unlocking the full value potential of Future Smith's business.

Financial strength

Smiths Group maintains a strong financial position. Its net debt/EBITDA ratio of 0.7x as of fiscal year 2025 reflects its conservative balance sheet. While the group has historically been highly leveraged, proceeds from the sale of its medical division in 2022 have been used to significantly strengthen its balance sheet. Strong operating margins, recurring revenue, and a capital-light business model underpin the group's cash generation capabilities, and we believe Smiths Group will continue to meet its financial and investment obligations.

Management is committed to returning the majority of the proceeds from the planned sale through share repurchases while maintaining a strong balance sheet.

Economic moat

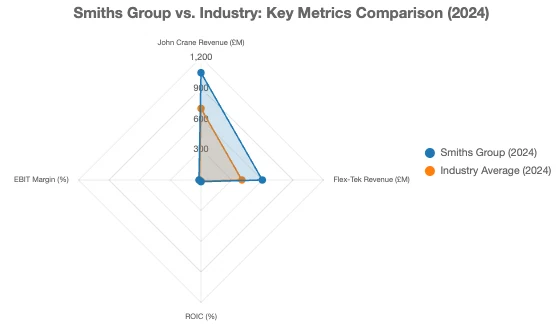

We assign Smiths Group a wide economic moat, primarily due to the superior competitive positioning of its John Crane division, which benefits from intangible assets and high customer switching costs. Smiths Group has historically demonstrated the ability to consistently generate returns on invested capital (ROIC) significantly above its cost of capital, driven by the structural strengths of its core businesses. Given that the Interconnect & Detection division is now classified as non-core and is slated for divestiture, our moat assessment focuses on Smiths Group's remaining core platforms: John Crane and Flex-Tek. For reference, we assess non-core assets as having no moat.

John Crane is the undisputed global leader in the design, manufacture and repair of highly engineered mechanical seals – critical components used in rotating equipment such as pumps, compressors and agitators in a wide range of critical industrial processes.

John Crane's strong moat stems from two enduring advantages: intangible assets and high customer switching costs. Its seals operate in some of the harshest industrial environments—under extreme pressures, temperatures, and speeds—and are critical to preventing gas or liquid leaks in industries such as oil refining, gas processing, petrochemicals, pharmaceuticals, mining, and power generation. In these environments, seal failure can have catastrophic consequences, including environmental damage, production downtime, or safety risks. Consequently, customers value proven reliability, engineering expertise, and regulatory compliance—all strengths John Crane offers.

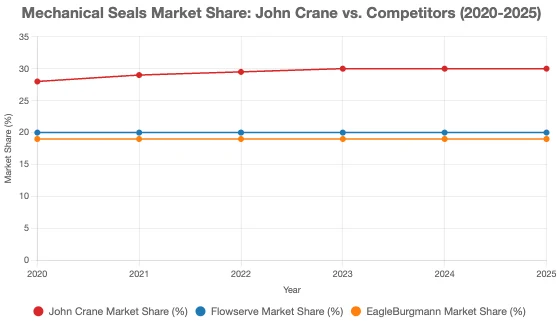

Most of John Crane's products aren't off-the-shelf components; instead, they're tailored solutions tailored to a customer's specific process requirements and regulatory standards. This high level of specialization distinguishes John Crane's products from lower-end static and dynamic seals, which are largely commoditized and supplied by fragmented regional suppliers. Few global competitors possess the technical capabilities, application knowledge, and certification infrastructure necessary to meet these demanding applications. With approximately 30% global market share, John Crane is significantly ahead of its two largest competitors, Flowserve and Eagle Burgmann, which each hold approximately 20% of the market.

John Crane boasts the world's largest installed base of engineered mechanical seals, paving the way for customers to significantly reduce conversion costs. Thanks to its integrated after-sales service model encompassing on-site engineering support, refurbishment, predictive maintenance, and condition monitoring, customers often develop long-term relationships with John Crane. These services are crucial for minimizing downtime, optimizing energy utilization, and maintaining regulatory compliance. Furthermore, John Crane's global service network, comprised of thousands of field engineers and service centers, provides rapid response support, especially in high-risk industries such as oil and gas and pharmaceuticals, where seal failure is unacceptable.

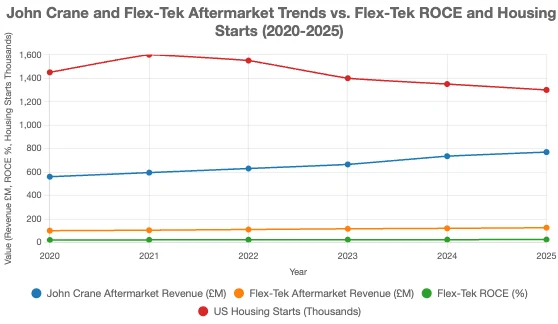

As a result, John Crane's aftermarket business has demonstrated remarkable resilience and profitability, accounting for approximately 70% of its segment revenue and an even higher percentage of operating income. Seals typically have an installed lifespan of 15 to 25 years, during which time they generate recurring revenue streams from seal refurbishment, replacement parts, and seal support system maintenance. This aftermarket dynamic transforms each original equipment sale into a long-term revenue annuity, strengthening the company's economic moat.

We define a narrow economic moat for the Flex-Tek segment, supported by its intangible assets, such as engineering know-how and a long-standing reputation for superior quality in demanding end markets. This moat is narrow rather than wide because while approximately half of Flex-Tek's revenue comes from mid- to high-end applications with differentiated products and relatively few qualified competitors, the remainder comes from commoditized, cyclical end markets, where pricing pressures are greater and competitive advantages are less durable.

Flex-Tek designs and manufactures components used to control the flow and temperature of fluids and gases. These components, which include flexible hoses, tubing, pipes, and heating elements, are used in a wide range of applications, including aerospace, medical equipment, and residential and commercial HVAC systems. Approximately 50% of Flex-Tek's revenue comes from mid- to high-end applications, including aerospace (18%), specialized industrial heating, medical respiratory equipment, and commercial HVAC systems. These end markets typically require engineered components that meet high-performance standards and regulatory certifications, which narrows the field of reliable suppliers and helps enhance pricing power and customer retention. Flex-Tek typically works directly with original equipment manufacturers (OEMs) and provides ongoing support through product replacements and modifications.

These high-value applications also demonstrate superior economics. Flex-Tek has achieved a high and stable return on capital employed (ROCE) of 20-25% over the past five years, even amidst macroeconomic fluctuations such as the COVID-19 pandemic and inflationary cost pressures. This high level of profitability demonstrates pricing power and operational efficiencies not often seen in purely commodity-based industrial companies.

Flex-Tek derives the remainder of its sales from the residential construction market, primarily in the United States, where it supplies HVAC duct, gas piping, and related components through distributors. This business is more cyclical—correlated to U.S. housing starts—and serves more price-sensitive customers. Competition is also more fragmented, and product differentiation is less pronounced. Despite Flex-Tek's scale and distribution reach, there are limited barriers preventing customers from switching to lower-cost alternatives, particularly during periods of economic weakness or rising costs.

While Flex-Tek benefits from aftermarket revenue, particularly in aerospace and certain industrial sectors, it's not the source of its strong economic moat. Unlike John Crane, which has high-margin, recurring service revenue directly tied to its installed equipment, Flex-Tek's aftermarket sales stem from ongoing replacement demand generated through original equipment manufacturer (OEM) and distributor relationships, rather than exclusive service contracts or embedded equipment placements. Its operating model is more of an "operate and repair" model, which provides valuable revenue but doesn't create the same degree of switching costs or customer lock-in.

Fair value and profit drivers

Based on our discounted cash flow model, we estimate Smiths Group's fair value at £2,500 per share. This reflects our expectation of mid-single-digit revenue growth and gradual margin expansion from the group's remaining core businesses – John Crane and Flex-Tek.

Over our five-year forecast period, we forecast 6.5% annual revenue growth, driven primarily by internal investments, pricing strategies, and targeted bolt-on acquisitions. John Crane is expected to grow at a more modest 4% annual rate, primarily driven by pricing, benefiting from its resilient aftermarket foundation and selective growth in energy transition-related sectors. Flex-Tek is expected to grow faster, with 4% organic growth and an additional 5% annual growth from acquisitions, driven by diversification in its end markets and opportunities for scale through M&A.

We expect the core group EBIT margin to expand from 20% in 2024 to 21.5% in 2030, supported by operational efficiencies, layout rationalization and improved product mix.

For non-core businesses, we value the interconnection and testing businesses based on enterprise value/earnings before interest, taxes, depreciation and amortization (EV/EBITDA), using peer-derived multiples of 11x and 14x, respectively. The interconnection business accounts for 10% of the group's enterprise value, while the testing business accounts for 25%.

We use a weighted average cost of capital of 8.5% to discount the projected cash flows.

Risk and uncertainty

Smith Group has a "Moderate" uncertainty rating. Both John Crane and Flex-Tek's businesses are exposed to cyclical end-markets. John Crane's revenue is closely tied to industrial and energy capital spending, particularly in the oil and gas sector. While the business benefits from the high-margin aftermarket (approximately 70% of sales) and has stabilized through the cycle, a prolonged slowdown in project activity could reduce future aftermarket sales. In addition, approximately 40% of John Crane's revenue remains tied to hydrocarbon-related infrastructure, which presents long-term transition risks as capital investment shifts to lower-emission technologies. While the company is actively expanding into growth areas such as carbon capture, liquefied natural gas, and hydrogen, these emerging areas may not fully offset declines in traditional markets.

Meanwhile, Flex-Tek has significant exposure to the US residential construction cycle through its heating, ventilation, and air conditioning (HVAC) product line, which accounts for the majority of the division's revenue. While this business has historically outperformed the broader market, demand remains sensitive to macroeconomic conditions, interest rates, and real estate activity. Its aerospace and industrial heating divisions provide some diversification but are also subject to aircraft manufacturing rates and industrial investment cycles.

The outlook also depends on the successful execution of the planned divestiture of the interconnection and test businesses. While both businesses are performing well, regulatory hurdles, market timing, and buyer willingness create uncertainty around transaction execution and whether full value can be realized.

Finally, Smith's vertically integrated operations and engineering complexity introduce some operational risks. A cyber incident in early 2025 temporarily disrupted John Crane's ability to provide after-sales service, highlighting the potential impact of IT and supply chain disruptions on the business.

Capital Allocation

We assign a Standard Capital Allocation rating to Smiths Group. The company has taken steps to streamline its portfolio and focus on higher-quality, higher-return businesses. The company sold its medical division in 2022 and is currently divesting its Smiths Interconnect and Smiths Detection divisions, aiming to focus the group's efforts on its two strongest divisions, John Crane and Flex-Tek.

The Group focuses on organic growth, investing approximately 3% of sales in R&D to support innovation, maintain technological advantages, and maintain pricing power in the professional market. This not only strengthens the Group's long-term competitiveness but also supports premium profit margins.

The second priority is to pursue complementary acquisitions to supplement the existing product portfolio and expand the Group's capabilities. Flex-Tek, in particular, has a fragmented business landscape where targeted acquisitions could enhance scale, product breadth, and operating leverage.

The company follows a strict dividend policy that mandates a dividend coverage ratio of at least 2. This makes the dividend sustainable and is unlikely to restrict reinvestment or damage the balance sheet.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates