The Fed's adjustments may open up a new economic landscape

11:41 October 8, 2025 EDT

The third revision to the new GDP data indicates that the US economy is growing faster than initially expected. Consumer spending data has been revised upward, with growth figures suggesting a stronger US economy than previously anticipated. These figures appear consistent with a supply-side driven economy, meaning that the economy returns to its fundamentals after a shock.

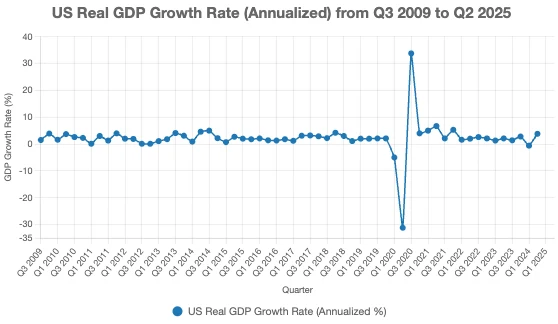

The current monetary policy approach was introduced by Federal Reserve Chairman Ben Bernanke in 2009 and continues to this day. Over the past 15 years, the United States has experienced a recession on record... the shortest in U.S. history. As the chart shows, the recession, which occurred between February and April, was severe but brief. Once the economic volatility subsided, the U.S. economy returned to a growth rate very similar to that before the turmoil.

This is consistent with a supply-side-driven economy. It's likely that economic growth will continue to hover around 2.5% for some time. However, the future is more uncertain due to President Trump's attempts to implement tariff changes and his proposed changes to Federal Reserve policy.

It's worth noting that the U.S. economy grew at a compound annual rate of 2.4% from the third quarter of 2009 to the second quarter of 2025. Policymakers would like the U.S. economy to grow at a higher rate than that, but Mr. Powell and the Fed seem satisfied with what they have achieved so far...relatively stable growth, relatively low inflation, and relatively low unemployment. Furthermore, they are pleased with the fact that they have experienced only one very brief recession during this period.

The Federal Reserve appears to have slowed the pace at which it is reducing the size of its securities portfolio. Over the past five weeks, the Fed's securities holdings have fallen by $4.7 billion, or less than $1 billion per week. This is certainly less than the amount the Fed reduced its securities portfolio by last year (backdated to mid-September 2024).

From mid-September 2024 to the last week of August 2025, the amount of securities held by the Federal Reserve fell by about $360 billion, an average decline of about $30 billion per month.

While the Fed hasn’t announced it’s undertaking a new round of quantitative tightening, or some other “change of pace” related to the “quantitative” management of securities portfolios, the significant reduction in the rate cut lends some credibility to the move.

We need to be mindful of this possibility—especially as the Federal Reserve lowers its policy rate, the target range for the federal funds rate. Now that markets appear to be pricing in at least one, if not two, more rate cuts for the rest of the year, one might expect the Fed to adjust the interest rate it pays on its managed securities portfolio.

However, going forward, we need to keep a close eye on this.

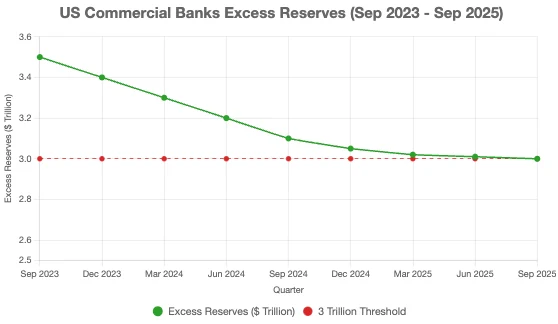

One thing we can watch is the reserve balances held by commercial banks, also known as the "excess reserves" maintained by the Federal Reserve. As of September 24, 2025, the total excess reserves in the banking system were $2,999.7 billion. This is the second time in the past two years that the level of excess reserves in the commercial banking system has fallen below $3.0 trillion.

The Federal Reserve's response to the financial crisis during the 2020-2022 period was to purchase excessive securities, aiming to "err on the side of monetary easing" during this period rather than causing a greater financial disaster than the one that already occurred. The commercial banking system holds a large amount of "excess reserves" in its vaults, allowing it to withstand systemic shocks that could cause further trouble for the banking system. However, for the commercial banking system to return to a "more normal" state, the Federal Reserve needs to see these "excess reserves" return to more normal levels. And returning to "more normal" levels means further reducing the securities holdings in the Federal Reserve's securities portfolio.

But what exactly is a “more normal” level? A trillion? $500 billion? Or even less? And what about the Trump administration’s efforts to lower the Fed’s policy rate by, say, 200 basis points?

We already have sufficient reserves to achieve this. The Fed's current policy is to allow reserves to be used solely for lending, lowering lending rates, or increasing the money supply. However, if government debt becomes excessive, banks will use more accommodative policies to address liquidity issues in the economy and ease government debt. Furthermore, with Jerome Powell retiring next year and other board members sympathetic to President Trump's views taking office, the Fed's management may undergo a change. The "cash" to inject funds into the economy already exists; all that's needed is a stimulus.

The impact of the Federal Reserve's interest rates

The S&P 500's rise is part of the ongoing impact of the Federal Reserve's reliance on inaccurate employment data to justify its first public statement that it would keep the federal funds rate unchanged at its July 29-30, 2025, meeting. In a press conference following the Fed's announcement, Fed Chairman Jerome Powell described the state of the U.S. job market as "solid" and "balanced." He further stated, "You're not seeing any softening in the labor market."

Notably, newly published research finds that another rationale for the Federal Reserve to maintain high interest rates for a long time—that President Trump’s tariffs could lead to persistent inflation—has little historical support. The findings suggest that the impact of tariffs on prices is only short-lived and temporary, undermining the argument made by Fed officials in recent months to resist rate cuts.

The lingering effects of these perceived policy mistakes have put the number, size, and timing of interest rate cuts in the remainder of the year in sharp focus. The early departure of Fed official Adriana Kugler, who had strongly opposed rate cuts, presents President Trump with an opportunity to push the Fed to implement rate cuts more quickly by appointing her successor.

Due to the ongoing impact of the shockwaves, the outlook for interest rate cuts is shifting. CME's FedWatch Tool predicts a 25 basis point cut in the federal funds rate at the Fed's meeting on September 17 (Q3 2025). Following this, the FedWatch tool predicts another 25 basis point cut on October 29 (Q4 2025) and January 28 (Q1 2026). As of Friday, August 8, 2025, the biggest question mark remains whether the Fed will implement a third rate cut before the end of 2025 (in December).

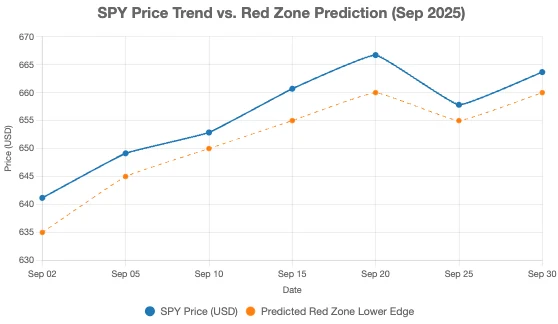

A recent update to the alternative futures chart hints at this possibility. We currently find the S&P 500 index trading along the bottom edge of the latest red-zone forecast range we previously added to the chart, based on the assumption that investors are prioritizing current stock prices with a forward-looking focus far into the future, namely, the first quarter of 2026. We can't help but notice that the index's movement over the past week is more consistent with investors suddenly shifting their forward-looking focus to the fourth quarter of 2025, suggesting that the Fed's issues are indeed generating significant concern and even panic as investors question how many rate cuts will ultimately occur this quarter.

Employment data

Recent employment data shows that growth has slowed, market expectations for new jobs have been significantly reduced, and there is a risk of a gradual increase in the unemployment rate; consumer confidence has also declined significantly. Even though expectations for income and prices remain pessimistic, consumption is the foundation of US stock earnings and macroeconomic recovery. In the short term, this weakness will limit the overall upward space, especially for companies that rely on mass consumption (retail, automobiles, aviation, etc.).

It's important to emphasize that even as overall confidence declines, high-income individuals and the wealth effect (asset prices, real estate) continue to support some consumption, explaining why service or high-end consumption may not decline simultaneously. In August, the US added only 22,000 non-farm jobs, far below market expectations, and the unemployment rate rose to 4.3%, one of the highest levels since the pandemic. The Federal Reserve indicates that nearly one million jobs should have been added. These data collectively remind us that the strong support for employment is fading.

Peaking employment and slowing hiring intentions will naturally be reflected in spending through the pivotal factor of consumer confidence. The University of Michigan's Consumer Confidence Index fell to 58.2 in August, down from a high of 61.7. Meanwhile, the Conference Board's confidence index continued to decline (98.7 to 97.4). The market is becoming more cautious about future incomes, prices, and employment. Even though retail sales grew by 0.6% month-over-month in August, this was largely due to factors such as promotions, seasonal demand, and inventory pull, and does not necessarily indicate a full recovery in consumer spending.

This period of weakness has been unevenly distributed. "Discretionary" sectors like consumer goods, automobiles, and appliances have been hit first, as these products offer the greatest flexibility in household budgets. Once confidence declines and income expectations become uncertain, these are the first areas households cut back on. Conversely, among higher-income groups, those with accumulated wealth from asset appreciation, investment returns, and real estate increases have a certain degree of disposable income cushion. Their spending on entertainment, travel, and high-end services may be less severely constrained.

Starbucks, for example, is a bellwether: it recently announced plans to cut approximately 900 non-retail positions and close approximately 100 North American stores to combat declining sales. This demonstrates that even though its target demographic is relatively conservative, it cannot completely escape the impact of overall consumer weakness. On the other hand, customer traffic at its core chain stores in high-end cities and commercial districts may remain somewhat resilient, as consumers in these locations prioritize brand and experience over price alone.

Therefore, we see an emerging picture: while consumption growth remains a strength at the macro level, its performance is unevenly distributed. Spending among the middle and lower income groups is being compressed, while spending among the upper income groups is unstable. This phenomenon suggests that the US economy will continue to require strong policies to prevent a decline in economic data in the coming quarters.

Conclusion

From a stock market perspective, this shift in the consumer landscape means that companies heavily reliant on mass consumption (retail, fast-moving consumer goods, automotive, home appliances, tourism, and aviation) will face greater performance pressure. Meanwhile, sectors moving upmarket, valuing brand premiums, or those involved in the experience economy may become safe havens for capital. Our portfolios need to respond to this structural trend.

Under the Fed's current policies, absent unexpected external catalysts, the consumer sector is unlikely to lead the market. Companies that can find a niche in the "mid- to high-end funnel" or offer premium brand, experience, or service within consumer stratification are better choices. Meanwhile, the period of sideways trading will likely be prolonged, creating a "top and bottom" situation for the overall market.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates