Ford Motor: Should Investors Pick It Now?

06:23 October 7, 2025 EDT

Ford faces a tough task as it attempts to challenge the ultra-competitive electric vehicle market.

The auto industry is undergoing numerous transformations, but no traditional automaker is undergoing a more dramatic transformation than Ford (F -0.90%), which recently announced it will use new production processes to build and launch an entirely new line of electric vehicles (EVs), starting with a pickup truck priced around $30,000.

It's an ambitious plan, and Ford hasn't released all the details yet, but it's clearly on the company's roadmap for the next few years. So, it's worth taking a closer look at what Ford has to say about its plans, as well as some of the biggest challenges it will face.

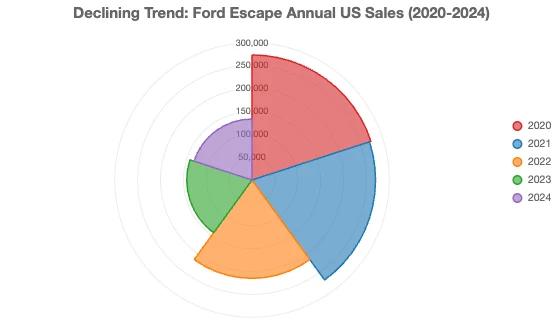

Ford's announcement surprised many, as both crossovers are popular and selling well. In fact, the Escape had sold 93,805 units in the United States through July, surpassing Ford's iconic Bronco and Bronco Sport, with Bronco sales up a whopping 45% year-over-year. Meanwhile, the Corsair was Lincoln's second-best-selling model in July, trailing only the Nautilus.

For consumers, if you're a die-hard Escape fan, don't worry, as Ford will continue to sell the 2026 model year vehicle into next year. But if you're an investor, it might be a little concerning, because one of the most important things you can do in the auto industry is to cover key segments. Exiting those segments without a plan usually doesn't end well—just ask Stellantis, which is currently struggling to find a replacement for the Jeep Cherokee, which contributed a significant portion of Jeep's sales before being discontinued in the early 2000s.

However, as you can see in the chart below, despite outselling the hot hatch through July, the Escape has actually had its worst sales ever over the past five years.

Unlike Stellantis, Ford may already have its replacement in mind. The company recently announced the upcoming launch of a mid-size electric pickup truck, more similar in size to the Maverick than the Ranger, priced around $30,000. This is a very attractive price point for an electric vehicle (EV), especially a truck, even if we won't see it until 2027.

In fact, Ford's current approach is the opposite of Stellantis, which is working on a replacement for its Cherokee-sized SUV and launching a gasoline-powered version of its Charger muscle car, while pausing development of its all-electric Ram pickup truck.

Ford, on the other hand, will directly replace Escape and Corsair production at its Louisville Assembly Plant with the upcoming pickup truck. Ford has invested approximately $5 billion in the Louisville Assembly Plant, creating approximately 4,000 jobs and preparing for its recently unveiled general electric vehicle platform, which will launch as many as eight new electric vehicles.

Factors affecting sales

Ford is making a big bet by replacing its more profitable gasoline-powered vehicles with an electric pickup truck. This may unsettle some investors, considering that Ford's Model-e division, responsible for electric vehicles, lost $5.1 billion in 2024. The good news is that Ford expects the electric pickup truck to be profitable early on, marking a substantial step forward in the development of electric vehicles, which have so far failed to generate any profits globally.

Replacing two popular gasoline-powered models with electric pickups also carries risks, given that electric vehicle sales in the U.S. have been growing slower than expected. Furthermore, the current administration's determination to eliminate incentives and tax credits for electric vehicles could make the transition to electric vehicles more difficult in the short term.

Ford's growth is also being hampered by another factor: recalls. And there are recalls everywhere.

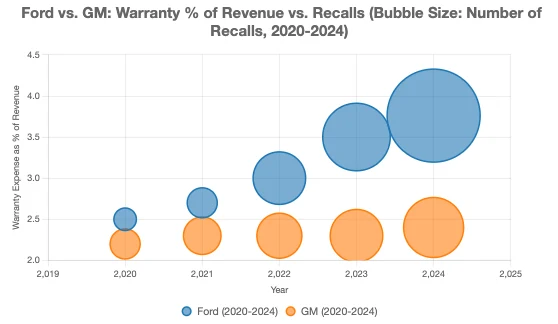

First, let's be clear: recalls are simply part of the auto industry's business. Typically, they don't impact auto stocks. In fact, automakers estimate future warranty costs when they sell a vehicle and set aside cash to handle these costs. The problem is that when warranty costs exceed or significantly exceed initial estimates, the excess costs accumulate and weigh on company profits.

That said, Ford recently recalled nearly 700,000 crossovers in the United States due to a fuel leak issue that could increase the risk of fire. This marks the automaker's 90th recall of 2025—a staggering number. According to the National Highway Traffic Safety Administration (NHTSA), Ford's 90 recalls so far this year exceed the combined total of the next five automakers and already set a record for the most recalls by a single automaker in a full year, surpassing General Motors' previous record of 77 recalls in 2014 due to its massive ignition switch scandal.

To be fair, not all recalls are created equal. Issues that can be resolved with over-the-air software updates cost the company next to nothing. On the other hand, when vehicles require repairs, adjustments to parts, or additional labor, expenses can quickly add up. Therefore, it's unfair to draw any conclusions based on just 90 recalls without knowing more details. Ford says that 33 of its 2025 recalls so far are related to a software review implemented in March, and that these costs should be much lower than other recalls.

Ford said the recall remediation will cost the company approximately $570 million and will be included in its second-quarter earnings report as a "special item." For investors, this means the increased warranty costs will not impact the company's adjusted earnings (which Wall Street expected), adjusted earnings per share (EPS), or adjusted free cash flow.

In the early 2000s, Ford's warranty expenses as a percentage of revenue were much lower. In the second quarter of last year, that percentage soared to about 4%, a high figure for the automaker, which was being hammered by rising warranty costs. Let's look at some long-term trends. Here's what Ford's warranty expenses as a percentage of revenue have been over the past 20 years.

For comparison, competitor General Motors' warranty expenses as a percentage of revenue are expected to be 2.4% and 2.3% in 2024 and 2023, respectively.

Ford insists it's making significant quality improvements, noting that 2024 model years saw a 30% improvement in quality over previous years within the first three months of service.

Currently, Ford's warranty costs and quality issues are among the biggest uncertainties facing investors. Ford has said and done all the right things on quality, but investors have been sorely disappointed so far. This is certainly something to keep in mind in your Ford investment thesis, and recalls and warranty costs will also be a key focus for you over the next 18 months, hopefully as quality improvements gradually materialize and recalls decrease.

Ford's employee pricing

If investors were counting on employee discounts to attract consumers, Ford certainly delivered. As consumers capitalized on the incentives, Ford benefited significantly. U.S. light vehicle sales increased 14% year-over-year in the second quarter. This growth was roughly 10 times the industry's estimate of 1.4%. Furthermore, Ford's market share jumped 1.8 percentage points.

"Our second-quarter sales shocked the industry," Andrew Frick, president of Ford Blue and Model e, said in the release.

Now, with the second quarter drawing to a close, analysts generally expect U.S. auto sales to decline in the second half of 2025 as the effects of tariffs begin to filter through the industry. We are already seeing some impact, particularly in the electric vehicle (EV) sector.

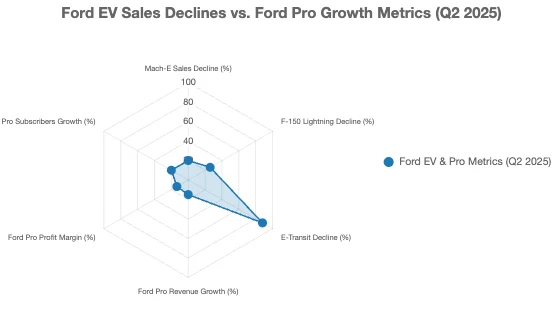

After Ford announced a price hike in May for the Mach-E (which is produced in Mexico and subject to tariffs), sales of the model fell 20% in the second quarter. F-150 Lightning and E-Transit sales plummeted 26% and 88%, respectively. But the good news for Ford investors is that the automaker isn't simply ending incentives. It's about to launch the second part of its "double whammy."

Ford's reliance on employee pricing and deep discounts presents both opportunities and risks. While these strategies have boosted sales in the short term, their sustainability raises concerns, particularly amid rising costs from tariffs and slowing growth in the electric vehicle market. Investors will closely monitor whether Ford can alleviate margin pressure through scale expansion, supply chain efficiencies, or new product launches. Meanwhile, growing competition from General Motors, Tesla, and overseas automakers makes Ford's pricing a double-edged sword for revenue.

One of the biggest criticisms of investing in auto companies is their inability to attract repeat purchases. This is especially true for high-priced items. This stands in stark contrast to businesses that sell low-cost, frequently purchased products and services. As a result, Ford could face demand fluctuations.

Management is working to change that. A bright spot is its Ford Pro division, which sells vehicles, software, and services to commercial and government customers. The division is projected to grow revenue 15% in 2024 and achieve an operating margin of 13.5%, significantly higher than the company's overall level.

As of March 31, Ford Pro had 675,000 subscribers, a 20% year-over-year increase. “Ford Pro Intelligence continues to drive recurring, high-margin, non-cyclical revenue,” Chief Financial Officer Sherry House said on the company’s fourth-quarter 2024 earnings call. Ford Pro Intelligence is a cloud platform that helps customers manage their vehicles.

The dividend is an obvious reason for investors to buy Ford stock. With a current dividend yield of 5.73%, this substantial dividend could be very attractive to some investors.

Of course, this also means the stock is cheap. As of June 25, the stock traded at 8.4 times earnings. If Ford's valuation multiple could return to its five-year average of 10.1, the stock would have a 20% upside potential.

Why Investors Choose Ford

Few companies have stood the test of time like Ford Motor Company. Founded in 1903, the Detroit automaker remains a vital part of the U.S. economy. Its F-Series pickup trucks are among its most popular models, demonstrating strong buyer interest.

The current White House administration's trade policies have impacted Ford, with its management team implementing price incentives to stimulate demand. Ford is offering employee pricing to all customers, a strategy that has attracted buyers.

Ford Motor's second-quarter sales increased by an impressive 14.2% year-over-year. Pickup truck sales increased by 15.1%, while sales of the Lincoln luxury brand surged by 31%, the largest increase in 18 years. These figures clearly demonstrate that consumers remain eager to purchase new vehicles before tariffs have a more significant impact on the auto industry and the broader economy.

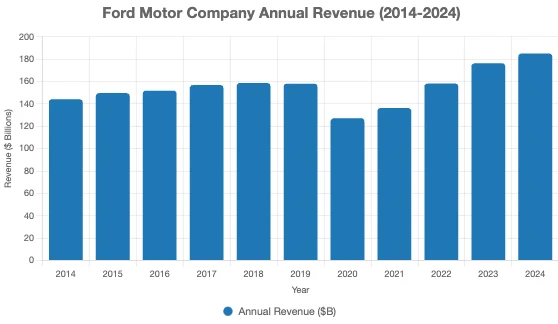

But investors shouldn't expect Ford to maintain its double-digit growth momentum. In fact, it's best to lower expectations. Ford is a low-growth company, driven by a mature industry. Ford's revenue in 2024 is projected to be $185 billion, a mere 28% increase from 2014, a decade earlier. Recent changes in trade policy have undoubtedly provided a short-term boost for Ford. However, this boost may not be sustainable, as the recent pullback in demand could lead to weak sales in the second half of the year.

Another thing investors need to keep in mind is that auto companies are typically cyclical. For most people, buying a new car is their second-largest purchase. When economic conditions worsen, these purchases may be postponed. Consequently, Ford's revenue could take a significant hit. If a recession were imminent, the company's thin profit margins could result in net losses.

Besides the recent surge in sales, which I believe is only temporary, the only reason investors might want to buy Ford stock right now is its 5.12% dividend yield. Income investors might be interested in this opportunity, as the stock trades at a price-to-earnings ratio of 9.4.

The stock's valuation might be hard to ignore. But I think Ford is cheap for a reason. This company has been around a long time, even though I wouldn't consider it a high-quality company.

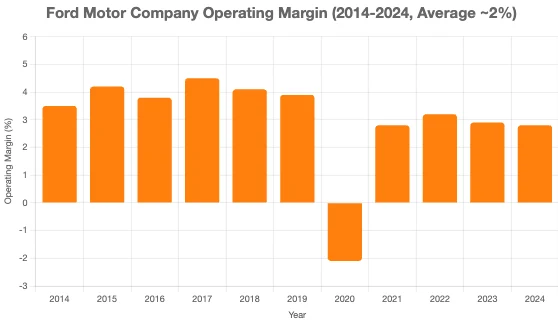

We've already mentioned the cyclicality and low profit margins. Ford's average operating profit margin over the past decade has been just 2%. This puts its dividend at risk if economic conditions worsen. In other words, investors shouldn't be surprised if Ford suddenly cuts its dividend to conserve cash if it faces financial difficulties.

A look at recent history makes this clear. If an investor had purchased $10,000 worth of Ford stock in July 2015, that stake would be worth $13,840 today. Even factoring in dividends, the stock purchase yielded a total return of only 38.4% over 10 years. This is a disappointing record.

I believe a good starting point for finding profitable stocks is to focus on companies that have performed well in the past. Unfortunately, Ford doesn't meet this criteria. Since June 2015, Ford stock has delivered a total return of 19%. Including dividends, this gain lags far behind the S&P 500 and its 245% total return. I'm not confident this trend will change.

Ford won't see meaningful growth. The auto industry is so mature that sales are barely growing. This is hindering Ford's ability to expand. Wall Street analysts expect Ford's revenue to grow by just 2% between 2024 and 2027.

The company's current dividend is high, but it may not be sustainable. This is because Ford's profit margins are extremely thin. In the first quarter, the company had revenue of $40.7 billion, but an adjusted operating profit of only $1 billion. This leaves little room for maneuver.

This is a concerning proposition. Ford's business is cyclical. If consumers are concerned about the economy, they'll hold off on buying new vehicles. This could significantly impact demand and sales. With earnings down, management might even suspend the dividend altogether to conserve cash.

Beyond the economic climate, Ford must contend with factors completely beyond its control. This year, that became clear, as the evolving tariff landscape forced the leadership team to implement price discounts to stimulate demand. Operating a complex supply chain made things difficult.

Labor disputes could also drive up costs over time, and unless Ford is willing to risk significant disruption to its operations, it will eventually have to work with unionized employees.

The best strategy for long-term success for investors is to strive to build a diversified portfolio of at least 25 stocks. However, this doesn't mean you need to own companies from every industry and sector. Avoiding mass-market automakers like Ford is generally a good rule of thumb to keep in mind.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates