The Frenzy of Gold

23:15 September 29, 2025 EDT

Key Points:

As of 2025 year-to-date, the gold market has set more than 30 nominal all-time highs, with prices surging 46% since the start of the year.

In the short term, gold prices will remain sensitive to developments around a potential U.S. government shutdown, the Federal Reserve’s October policy decision, and geopolitical tensions. However, elevated volatility and pullback risks also persist.

Regardless of near-term price swings, gold’s strategic role in the restructuring of the global monetary system has been reasserted. The latest record highs in 2025 may prove to be just another milestone in a longer-term uptrend, rather than the peak.

The gold market is undergoing a record-breaking rally. On September 29, spot gold crossed above $3,800 per ounce for the first time, reaching an intraday high of $3,819.81—an all-time record. As of September 30, prices in major global gold markets remain elevated: New York gold last traded at $3,877.3 per ounce, while London spot gold stood at $3,848.4 per ounce.

So far in 2025, the gold market has already set over 30 nominal all-time highs, with year-to-date gains of 46%. Driven by the Federal Reserve’s rate cuts, escalating geopolitical risks, and the global trend of “de-dollarization,” gold—long regarded as a traditional safe-haven asset—is now displaying a renewed pricing logic.

Source: TradingView

Upside Momentum

The latest gold rally has been directly triggered by domestic political deadlock in the United States.

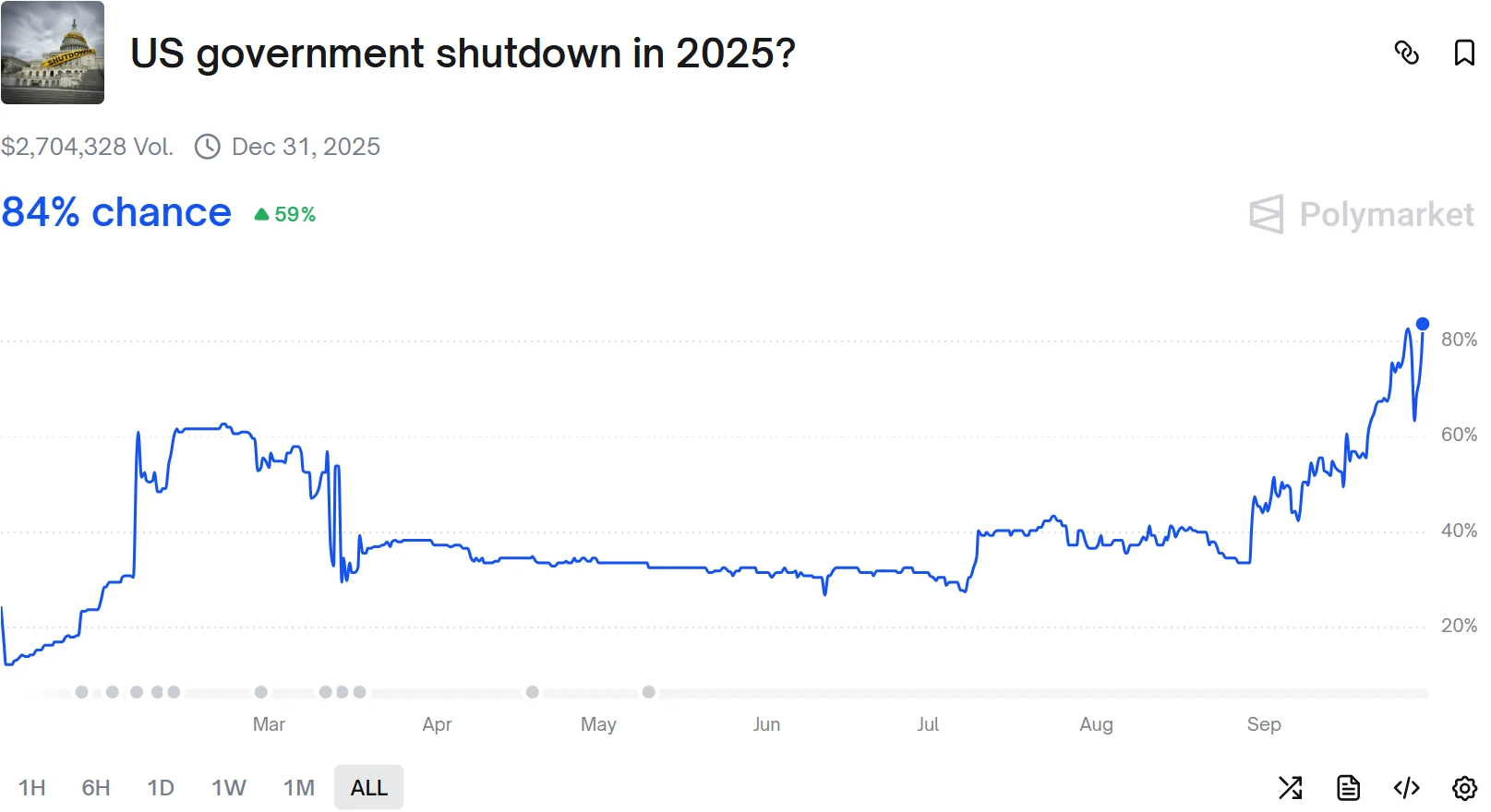

On September 29, U.S. President Trump and congressional leaders failed to reach a consensus on government funding. The Democrats insisted on including an extension of the Affordable Care Act tax credits in the appropriations bill, while the Republicans advocated passing a short-term funding measure first and negotiating later, highlighting stark differences. Data showed that the probability of a U.S. government shutdown after midnight on September 30 surged from 69% over the weekend to 84%, with Vice President Pence even publicly stating that the government is “heading toward a shutdown.”

Source: PolyMarket

The risk of a government shutdown immediately impacted market expectations: the U.S. dollar index weakened under heightened risk aversion, U.S. Treasury prices were pushed higher, and gold, as the ultimate safe-haven asset, saw massive inflows. On September 29, spot gold rose 1.88% intraday to $3,831 per ounce, marking a fresh all-time high.

Source: TradingView

Importantly, the U.S. Department of Labor has confirmed that, in the event of a shutdown, the Bureau of Labor Statistics would cease operations entirely. The scheduled release of September nonfarm payrolls on October 3, weekly initial jobless claims, and the October 15 CPI report would all be delayed. These data points are key inputs for the Federal Reserve’s October rate decision. The resulting uncertainty over monetary policy further amplifies market risk aversion, reinforcing gold’s appeal as a strategic allocation.

From a deeper perspective, multiple factors have converged to drive gold prices higher.

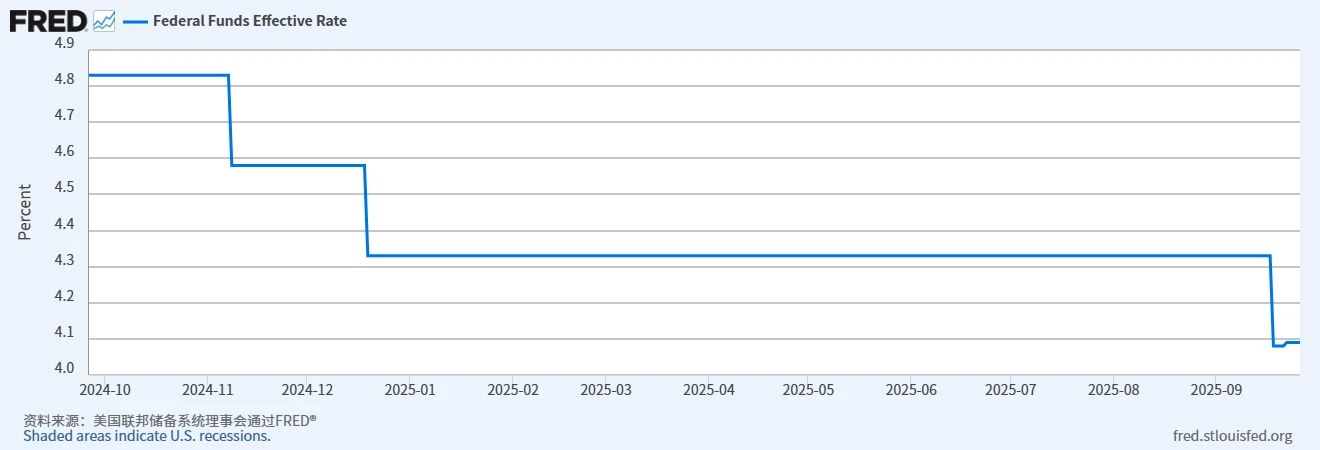

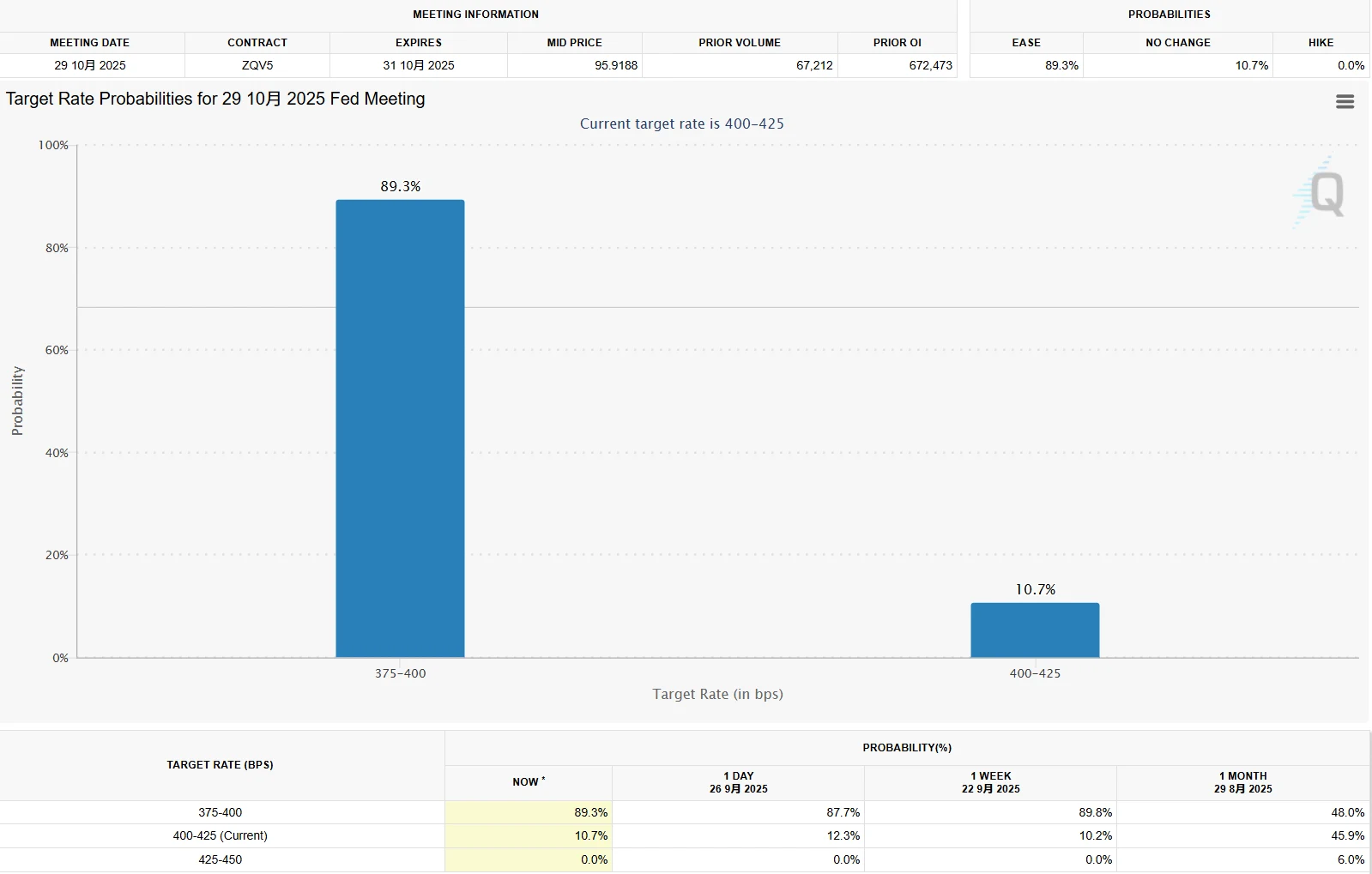

First, the shift in monetary policy provides the core support for the rally. On September 17, the Federal Reserve lowered its target range for the federal funds rate by 25 basis points to 4.00%-4.25%—the first rate cut of 2025 and a continuation of the easing cycle following three cuts in 2024. Market expectations have further heated up, with Morgan Stanley projecting that cumulative rate cuts from this point through mid-2026 could approach 100 basis points.

Source: FRED

The easing policy has lowered real interest rates. As a zero-yield asset, gold benefits from the inverse relationship between its holding cost and real rates.

At a deeper level, the weakening of dollar credit also plays a role. U.S. GDP reached $29.18 trillion in 2024, with federal debt accounting for 126.8% of GDP. Under a “rolling debt” repayment model, the dollar’s creditworthiness is increasingly strained.

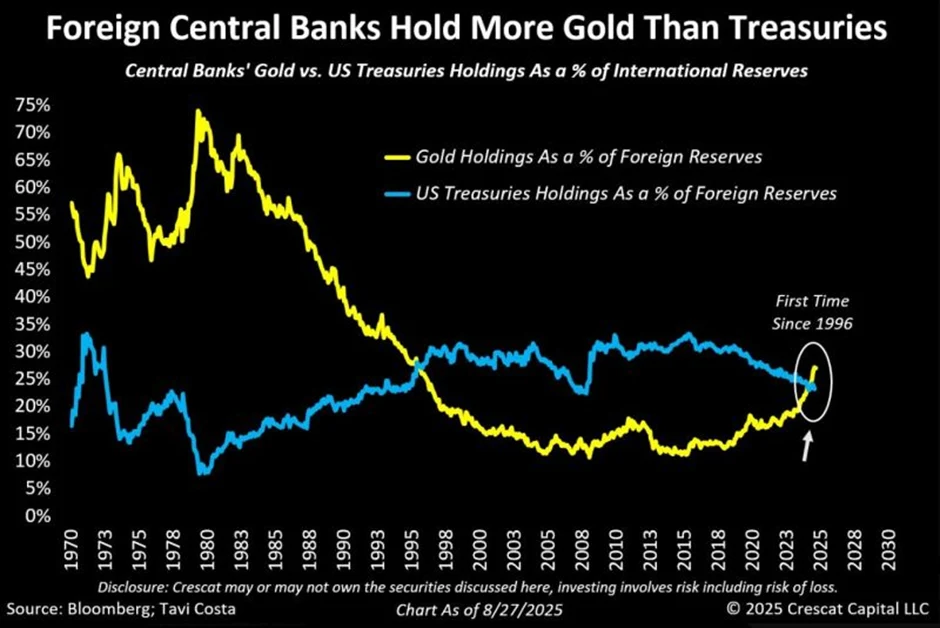

A World Gold Council survey shows that 73% of central banks expect the U.S. dollar share of global reserves to decline over the next five years, while the share of gold in central bank reserves has surpassed U.S. Treasuries for the first time since 1996.

Source: Crescat Capital

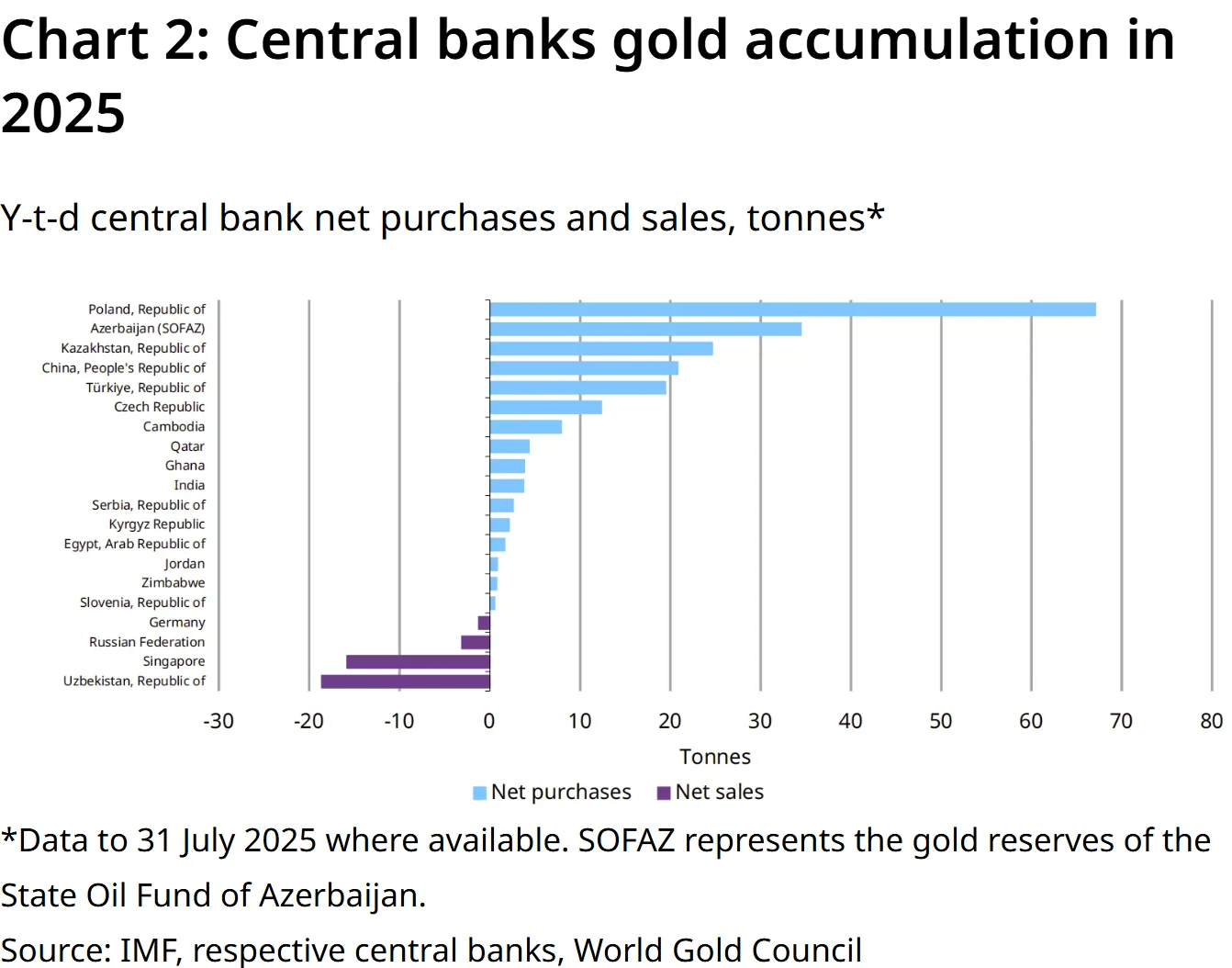

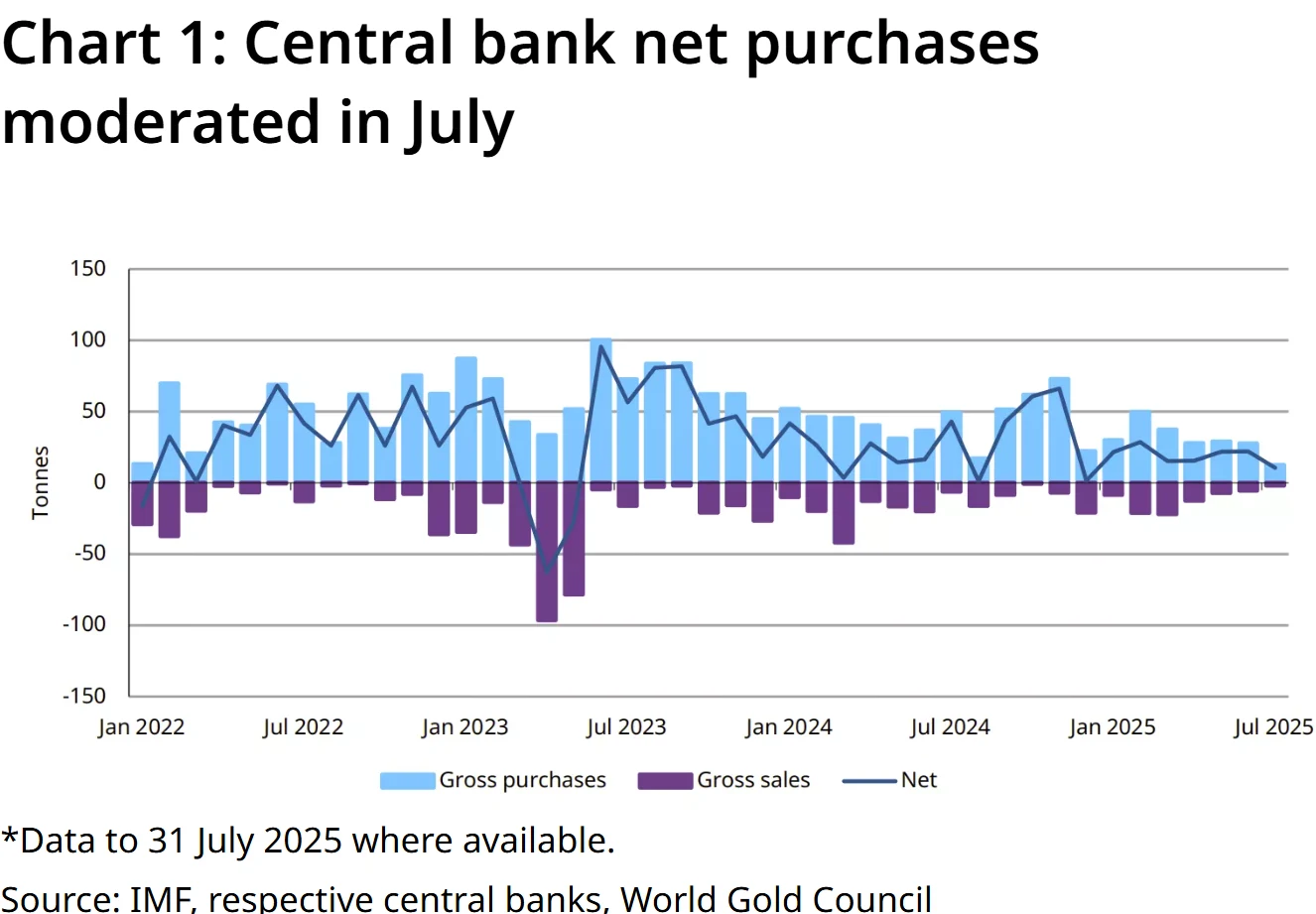

Following this trend, central banks worldwide have accelerated gold purchases. In Q2 2025, net gold purchases reached 166 tons. The People’s Bank of China has increased its reserves for ten consecutive months, reaching 74.02 million ounces by the end of August, highlighting gold’s central role in the restructuring of the international credit system.

Source: World Gold Council

Meanwhile, the normalization of geopolitical risks has allowed gold’s risk premium to accumulate over the long term. The Russia-Ukraine conflict remains in stalemate, tensions in the Middle East are rising again, and frequent skirmishes along the India-Pakistan border heighten South Asian geopolitical risk. Combined with domestic political uncertainty, the market has become increasingly sensitive to “black swan” events. In the short term, these factors directly boost gold’s safe-haven demand; over the long term, geopolitical risk reshapes the fundamentals of the precious metals market through supply chain adjustments.

For example, the Russia-Ukraine conflict has prompted Europe to invest heavily in energy infrastructure, and the expansion of alternative energy industries has driven up silver demand. Meanwhile, regionalization of supply chains has increased long-term costs, indirectly reinforcing gold’s value proposition.

Within this context, the collective strength of the precious metals sector has further amplified gold’s gains. In September 2025, London spot silver broke $46 per ounce, a 14-year high, up 62% year-to-date. Platinum surpassed $1,500 per ounce, a 12-year high, with gains exceeding 72% YTD. Silver’s rally has been fueled by strong demand from photovoltaics, electric vehicles, and semiconductors, with the supply-demand deficit projected to exceed 3,000 tons for the year. Platinum benefits from rapid growth in the hydrogen energy value chain and traditional automotive catalytic converter demand.

Source: TradingView

The broader rally in precious metals has accelerated capital inflows into the entire sector, with gold naturally emerging as the core beneficiary. According to the World Gold Council, global gold demand in Q2 2025 rose 3% year-on-year to 1,249 tons, while value terms surged 45% to $132 billion. Despite a 26% year-on-year decline in China’s gold jewelry consumption in the first half of the year, investment demand has fully offset weakness in the consumer market, demonstrating that capital flows are increasingly driving gold prices over traditional consumption.

Ultimately, market sentiment and capital flows have created a positive feedback loop, directly fueling gold’s near-term strength. Gold ETFs have seen unprecedented inflows, with $10.5 billion added in September alone and over $50 billion year-to-date, bringing total holdings to 3,779.4 tons—the highest since 2022.

Notably, skepticism over paper gold has led some investors to turn to physical bullion. Domestic retail gold prices in China have risen to 1,105 RMB per gram, and tight physical supply further reinforces bullish expectations. Research indicates that, amid record gold prices, investment logic is shifting from short-term speculation toward long-term value reassessment, significantly extending the investment cycle.

What Lies Ahead

Looking ahead, gold’s trajectory is likely to show clear short-, medium-, and long-term differentiation. In the short term, prices will remain influenced by developments around a potential U.S. government shutdown, the Federal Reserve’s October policy stance, and ongoing geopolitical tensions, though high-level volatility and correction risks persist.

From a technical perspective, the RSI has entered overbought territory. Historical data indicate that September sees a 70% probability of gold price declines, suggesting a “rise first, fall later” pattern.

Source: TradingView

If a government shutdown occurs as expected, heightened risk aversion could briefly push gold toward $4,000 per ounce. However, if the shutdown is short-lived and a bipartisan compromise is reached quickly, a “buy the rumor, sell the fact” scenario may trigger profit-taking. Market expectations currently price in nearly a 90% probability of a 25-basis-point rate cut in October, yet in the absence of key economic data and amid internal Fed disagreements, gold is likely to remain range-bound with substantial swings.

Source: CME Group

Over the medium term, gold’s bull market fundamentals remain relatively solid, suggesting a “stair-step” upward pattern. With several future Fed rate cuts anticipated, real interest rates are expected to trend lower—a scenario historically associated with double-digit gold returns. Central bank demand is also steadily releasing; the World Gold Council reports that 76% of surveyed central banks plan to increase their gold holdings over the next five years, up noticeably from the prior year.

Multiple institutions project that gold could breach the $4,000 mark around 2026. Goldman Sachs and Deutsche Bank have raised their targets to $4,000, while Morgan Stanley anticipates that under extreme scenarios, gold could test $4,500–$5,000. According to World Gold Council modeling, given current debt levels and geopolitical conditions, the probability of gold surpassing $4,000 before 2028 is high.

Over the long term, gold is positioned within a supercycle driven by economic crises and shifts in the global power structure, with the upward trend potentially lasting over a decade. Against a backdrop of debt monetization, U.S. Treasury interest payments now exceed 20% of federal revenue, further straining dollar credibility. Japan, Italy, and other nations face sovereign debt risks, reinforcing gold’s role as a hedge.

Additionally, the dollar’s dominance is being challenged. Gold purchases by emerging market central banks now account for more than 80% of global activity, positioning gold as a core strategic reserve in a “de-dollarization” context. Some institutions offer even more aggressive long-term forecasts: Incrementum AG views the market as entering a new “golden decade,” projecting gold could reach $8,900 per ounce by 2030. Morgan Stanley estimates that an outflow of U.S. Treasury funds over just two quarters into gold could push prices above $5,000.

Possible Setbacks

Although the long-term bull case for gold remains relatively clear, potential risks have not disappeared.

First, central bank demand for gold could decline. In Q2 2025, global central bank net purchases totaled just 166 tons, down 21% from the same period in 2024 and significantly below Q1’s 290 tons. If elevated gold prices further dampen official buying appetite, demand-side support could weaken.

Source: World Gold Council

Second, if U.S. inflation remains persistently above 3%, the Federal Reserve may be forced to slow the pace of rate cuts, with rising real interest rates directly weighing on gold prices.

Third, from a technical standpoint, overbought conditions increase the risk of a correction. Concentrated profit-taking by speculative funds could trigger significant short-term volatility.

Finally, disruptive technological breakthroughs—such as nuclear fusion or artificial general intelligence—or the emergence of a supranational currency within a new global governance framework could fundamentally alter gold’s value proposition.

Nonetheless, regardless of short-term price swings, gold’s strategic role in the restructuring of the global monetary system has become increasingly evident. The 2025 record highs may represent only a milestone in a longer-term upward trajectory, rather than its endpoint.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates