The moat of semiconductor equipment leader WFE

07:23 October 6, 2025 EDT

Business Strategy and Outlook

Applied Materials is the world's largest supplier of semiconductor wafer fabrication equipment. We believe the company has the broadest product portfolio, which should enable it to maintain its leading market share. We believe Applied Materials' extensive experience in chip manufacturing enables it to more effectively attract customers by selling integrated solutions across multiple technologies. We expect Applied Materials to benefit from long-term chip sophistication trends, including gate-all-around transistors, advanced packaging, and artificial intelligence, resulting in mid-single-digit growth across market cycles.

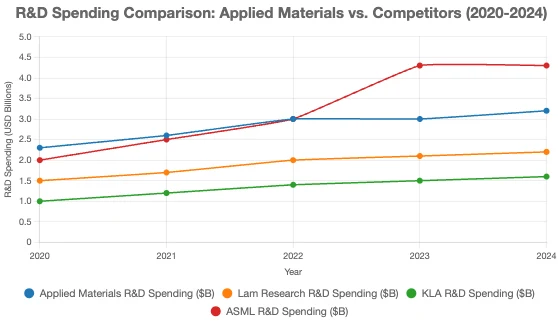

We assign a wide economic moat rating to Applied Materials, driven by its strong presence in leading-edge chip manufacturing and high switching costs for its customers. Applied Materials is the only WFE supplier that effectively competes in all three market segments—etch, deposition, and process control—enabling it to compete aggressively with more specialized competitors such as Lam Research and KLA. We believe Applied Materials' market-leading R&D budget (over $3 billion annually) creates substantial intangible assets and strengthens the company's ability to win and retain customers in these three distinct market segments, driven in part by its integrated solutions. We also believe the complexity of Applied Materials' equipment and embedded services businesses presents significant challenges. We believe its competitive advantages enable the company to achieve strong margins and robust cash flow generation.

While we expect Applied Materials' performance to be susceptible to cyclical fluctuations in the semiconductor market, we believe it will achieve long-term growth. Its sales are driven by global chip production and overall chip complexity, and while the former is cyclical, the latter is poised for sustained growth. We are monitoring the geopolitical risks posed by US-China export restrictions on Applied Materials, but we believe these measures currently primarily impact lithography equipment and chip design companies. We are optimistic about Applied Materials' strong cash flow and the potential for strong shareholder returns.

Financial strength

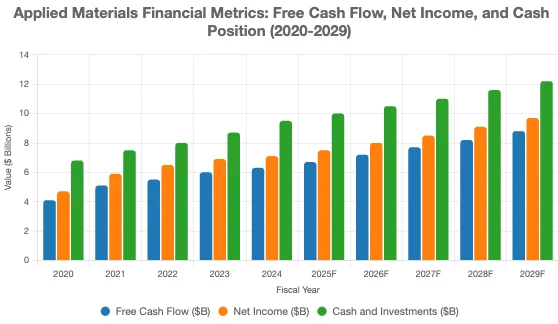

We expect Applied Materials to focus on generating strong cash flow while prioritizing R&D investments. We also expect it to maintain a moderate leverage ratio. As of October 2024, Applied Materials will hold a net cash position with $9.5 billion in cash and liquid investments and $6.3 billion in total debt. We like Applied Materials' strong balance sheet, which is supported by its long-term debt, most of which is not due until after 2030. Applied Materials also has a $1.5 billion revolving credit facility that can be drawn upon if needed.

Applied Materials' strong balance sheet is supported by robust free cash flow. Over the past five fiscal years, Applied Materials has averaged $5.6 billion in annual free cash flow, and as the business scales, we expect this figure to exceed our five-year forecast, reaching over $8 billion. Both these sources of income account for nearly 90% of Applied Materials' net revenue.

Economic moat

We assign a wide economic moat rating to Applied Materials, based on its intangible assets and switching costs. We believe Applied Materials' expertise in wafer fabrication equipment stems from its best-in-class design expertise, and we view its embedded services business and long-term customer roadmap as highly sticky. We also believe the level of investment required to maintain chip development leadership, particularly across so many market segments, creates significant barriers to entry for all but the largest and most capitalized chip equipment manufacturers. We estimate that Applied Materials' returns on investment will likely be significantly higher than its cost of capital over the next 20 years.

We found that Applied Materials possesses the most comprehensive portfolio of semiconductor manufacturing equipment. Its product line spans every area of chipmaking, providing leading-edge equipment to both logic and memory chipmakers, encompassing nearly every category and covering a wide range of costs and capabilities. While many of its WFE peers occupy only one or two markets (for example, Lam dominates etch and deposition, and KLA dominates process control), Applied Materials plays a significant role in all. The only exception is lithography, where ASML holds a commanding position.

Deposition accounts for approximately a quarter of the total WFE market, and Applied Materials' market share of over 40% is more than double that of its nearest competitor. In etch and process control, Applied Materials holds third and second place, respectively, and is the only company with a market share exceeding 10% in all three markets. Applied also holds a dominant position in smaller WFE segments, such as thermal processing and doping (the intentional introduction of impurities into intrinsic semiconductors to modulate their electrical, optical, and structural properties). To us, these strong market shares are driven by an unparalleled product portfolio breadth and depth, coupled with a market-leading $3 billion annual R&D budget. This budget far exceeds that of all but the largest WFE competitors, enabling Applied Materials to continue building its substantial intangible asset base. This strong product portfolio helps the company achieve a healthy non-GAAP gross margin of approximately 45%.

Applied Materials' broad and deep product portfolio helps it win over customers, and we're seeing rapid adoption once its products are installed. Chip manufacturing is incredibly complex and precise. Applied Materials' equipment is responsible for manufacturing transistors more than a thousand times smaller than a human hair, packing trillions of them onto 12-inch diameter wafers with minimal defects. Customers demand the ability to produce millions of these wafers per month. Development and manufacturing at this level of precision are tailored to the customer's specific product line, and chipmakers build workflows around their equipment with the singular goal of efficient production. Applied Materials deploys field service engineers to customer fabs, acting as an extension of the chipmaker's engineering team. These service engineers help calibrate equipment during R&D, adjust and fix errors during production, and work with chipmakers to meet manufacturing requirements. They also perform equipment upgrades or recalibration to allow for reuse. We believe the high complexity of WFE machines and the integration capabilities of Applied Materials' service engineers make the company difficult to replace.

In addition to the cost of acquiring new equipment (which can run $1 million or more per machine), chipmakers also need to redesign their manufacturing processes, thoroughly learn new hardware and software interfaces, and restart knowledge sharing with new service engineers. The multi-decade lifespan of Applied Materials' equipment allows it to build deep connections with customer engineering teams and enhance customer loyalty. Applied Materials' deep customer relationships also mean its project roadmap is forward-looking, extending up to 10 years, giving the company an advantage in winning new customers because it can tailor new machines to their specific needs. Finally, with its industry's broadest product portfolio, Applied Materials is increasingly selling integrated solutions to customers, sometimes combining up to seven different process steps and chambers into a single, unified tool. We believe this provides chipmakers with better performance, lower costs, and shorter development times, while also making Applied Materials' equipment more customer-friendly.

Applied Materials' broad product portfolio, strong customer relationships, and ongoing significant investment give us confidence in the durability of its competitive position and healthy profitability, which we believe will enable the company to continue to generate strong economic profits and develop a wide economic moat over the next 20 years.

Fair value and profit drivers

Our fair value estimate for the company is $200 per share. Our valuation implies a 21x FY2025 adjusted P/E ratio and a 5x FY2025 EV/Sales multiple. The biggest drivers of our valuation are growth in fab equipment spending and Applied Materials' ability to gain market share.

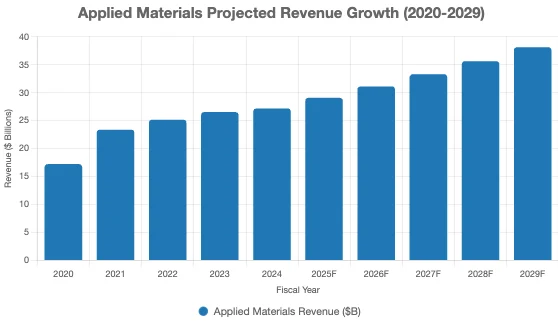

We forecast Applied Materials' sales to grow at a compound annual rate of 7% through fiscal 2029. We expect strong growth over the medium term, driven in part by chipmakers aggressively expanding capacity to meet the demands of artificial intelligence. Thereafter, we anticipate mid- to high-single-digit growth over the medium term. We expect this growth to be driven by more advanced chip designs from chipmakers, which rely on Applied Materials' equipment to produce technologies such as gate-all-around transistors, chiplet designs, and high-bandwidth memory. Applied Materials' systems sales are the most cyclical, while its services business is fairly stable, which helps offset some of the cyclical impact of revenue. We expect this services revenue stream to grow at a double-digit annual rate, exceeding our forecast.

We expect Applied Materials' non-GAAP gross margin to expand from 48% in fiscal 2024 to nearly 49% in fiscal 2029, driven primarily by higher sales. We expect operating margin to expand faster than gross margin, with effective control of overhead expenses. We anticipate strong growth in R&D to maintain its competitive moat. We project non-GAAP operating margin to reach 32% in fiscal 2029, up from 29% in fiscal 2024.

Risk and uncertainty

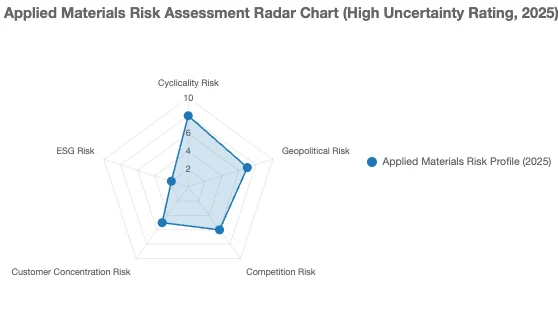

We assign a Morningstar High Uncertainty Rating to Applied Materials. Applied Materials is susceptible to the cyclical nature of the semiconductor industry, with periods of oversupply and reduced capital spending followed by periods of strong demand and capacity expansion. While performance may fluctuate based on changes in semiconductor end-use demand, we remain confident that Applied Materials can maintain growth over the long term.

Applied Materials also faces the risk of geopolitical uncertainty, primarily between China and the United States. The US government has imposed export restrictions on advanced semiconductor manufacturing equipment, limiting Applied Materials' ability to ship to Chinese chipmakers. We believe this impact has been priced in, with Applied Materials largely able to offset demand from other regions of the world. However, the risk of further escalation of restrictions remains, which could adversely impact the company's sales.

Competitors are often more specialized than Applied Materials. Lam Research specializes in etch and deposition, while KLA specializes in process control. Applied Materials faces the risk of fighting on two fronts and could lose to these formidable competitors if it fails to invest adequately. Applied Materials also faces the risk of a concentrated customer base. If its relationships with large manufacturers like TSMC, Samsung, or Intel deteriorate, its competitive position could deteriorate further.

We expect Applied Materials to have relatively low environmental, social, and governance (ESG) risks. Its primary risk lies in talent loss to other WFE companies. If Applied Materials is unable to retain its key engineers, its intangible assets could begin to erode.

Capital Allocation

We assign Applied Materials an Exemplary Capital Allocation rating, driven by its strong balance sheet, excellent investments, and good shareholder returns.

Applied Materials has a strong balance sheet, with a net cash position and no long-term debt. The company also generates healthy free cash flow, much of which is returned to shareholders. Applied Materials has increased its dividend every year since 2018 and plans to return over 80% of its free cash flow (including buybacks) to shareholders.

We believe Applied Materials has made excellent investments in this business. We believe the company is right to prioritize R&D investments for organic growth in a consolidating industry. Its R&D spending significantly outpaces all competitors, and we attribute its strong organic investment to its WFE market share gains over the past five years. We believe this investment has created a wide economic moat for the company. The WFE market is highly consolidated, with the top five suppliers (including Applied Materials) contributing over 70% of total revenue. Due to anti-competitive concerns, we do not expect large-scale transactions between these large players. The failed 2015 merger between Applied Materials and Tokyo Electron is a prime example. However, Applied Materials occasionally pursues small, add-on deals to enhance its software capabilities or expand its depth in specific chemistries.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates