Where Are the Investment Opportunities in Spotify?

05:22 September 29, 2025 EDT

In recent years, Spotify (NYSE: SPOT), as a key player in the global music streaming industry, has experienced a significant upward trajectory in its stock price. As of September 2025, the stock has gained over 60% year-to-date, effectively doubling from its 52-week low of approximately $362, significantly outperforming the S&P 500’s roughly 13% gain and the global media sector’s 32% average increase, establishing itself as a high-growth and closely watched asset in the capital markets.

Source: TradingView

However, alongside the sustained stock appreciation, market divergence has gradually emerged. Some investors contend that the current share price has already priced in core positives, including subscription price increases and advertising revenue growth, while the 0.4% single-quarter return in the most recent quarter indicates a slowdown in momentum, potentially limiting further upside.

Conversely, other perspectives suggest that considering the company’s fundamental resilience, quality of user growth, and long-term profitability potential, the current consolidation phase should not be interpreted as the end of the rally. Rather, it may represent a critical stage where institutional investors are accumulating shares within the trading range and optimizing their positions to position for the next growth phase.

Market Momentum

As of September 2025, Spotify’s stock exhibits a “strong year-to-date performance with short-term deceleration” pattern, having gained 60.16% year-to-date, reflecting robust upward momentum. However, this momentum has recently moderated, with the stock posting only a 0.4% return in the third quarter of 2025 (July–September) and trading in a prolonged $700–$750 range. The noticeable slowdown in short-term momentum has prompted some investors to question whether the rally has peaked.

From a market dynamics and asset-specific perspective, this short-term consolidation should not be interpreted as a risk signal. For technology and internet companies like Spotify, which are heavily influenced by momentum-driven capital, temporary price stagnation often reflects deeper structural logic.

First, the prior 60% cumulative gain allowed short-term traders to realize profits, necessitating a period of consolidation to absorb selling pressure and prevent over-concentration of shares from causing volatility. Second, institutional investors often use consolidation periods to strategically accumulate shares at relatively stable prices. Data from Q3 2025 shows that Spotify’s institutional ownership increased slightly from 69.8% in Q2 to 70.2%, laying the financial groundwork for a potential subsequent breakout.

Historically, the investment value during high-price consolidation phases depends primarily on the alignment between fundamentals and stock price. Reviewing comparable cases in the U.S. market—such as Netflix in 2023 and Meta in 2024—when high-growth stocks entered consolidation, if core business metrics remained stable, there was over a 60% probability that the stock would break above the prior trading range within the following 3–6 months.

Price Appreciation Potential

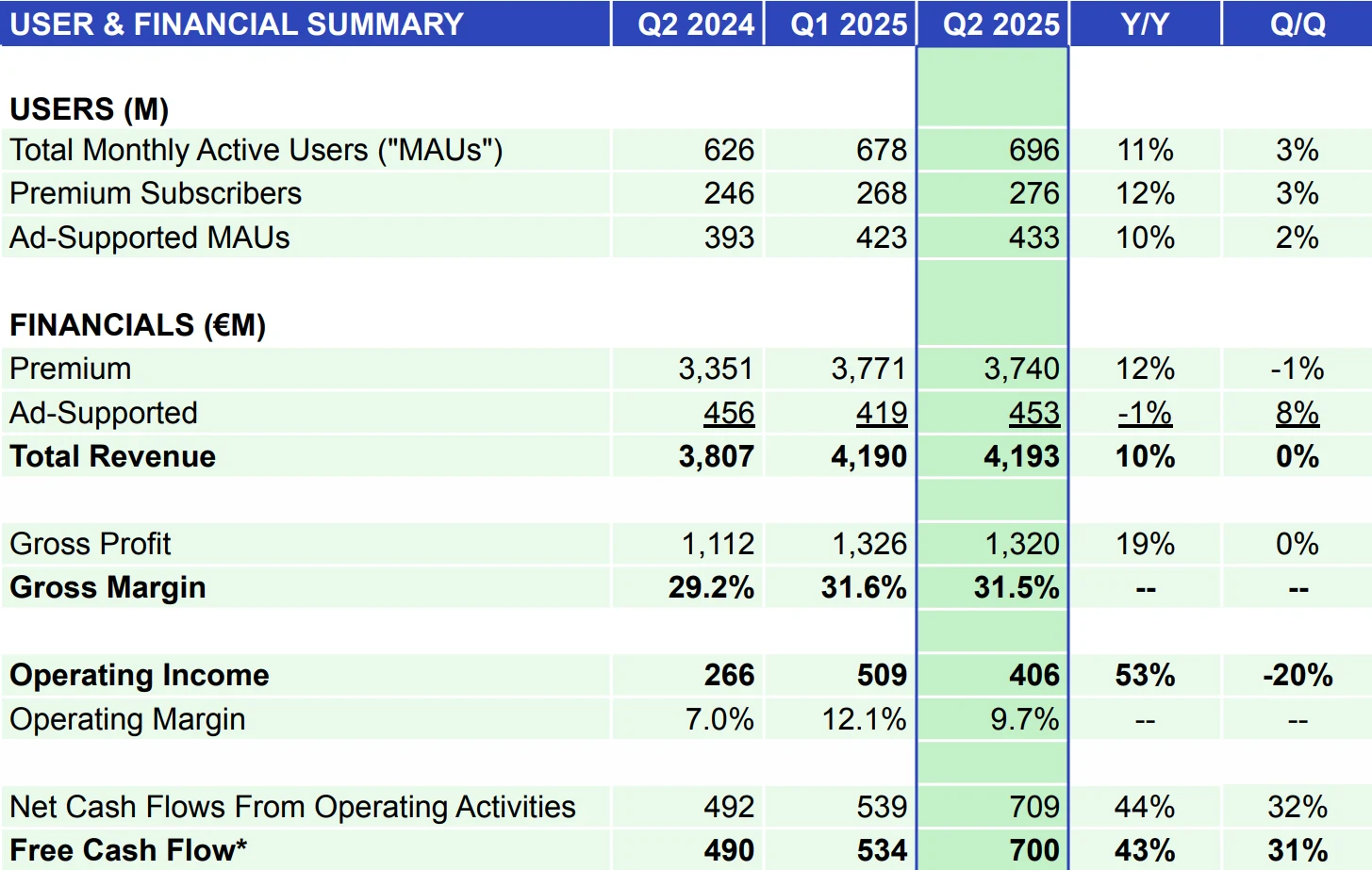

For Spotify, the fundamental support during the current consolidation phase has not weakened. The Q2 2025 financial report shows monthly active users (MAU) reached 696 million, up 11% year-over-year; paid subscribers reached 276 million, up 12% year-over-year, with user growth still exceeding the global streaming industry average of 8%. Core profitability metrics are even more resilient—excluding non-recurring impacts from revaluation of exchangeable notes, operating cash flow doubled year-over-year to $1.2 billion, and gross margin increased by 227 basis points to 31.5%, indicating that the underlying earning capacity of the business continues to strengthen.

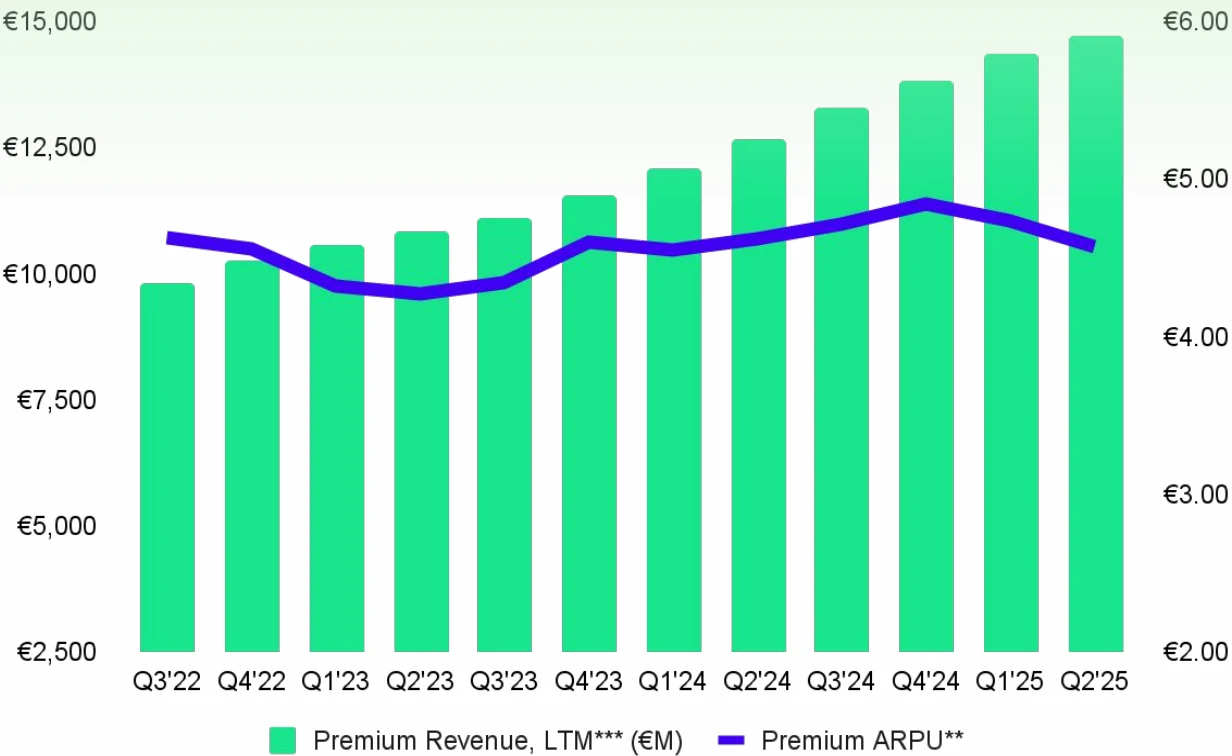

Source: Spotify

It is worth noting that Spotify’s current consolidation phase is also coupled with “yet-to-be-fully-realized positive catalysts,” further increasing the likelihood of a subsequent breakout. The global subscription price increase initiated in September 2025, covering key markets in Europe, Asia-Pacific, and other regions, raised individual plan prices by 9–12%, and is expected to gradually impact revenue starting in Q4. Estimates indicate this could increase average revenue per user (ARPU) by 2.3–2.8%, corresponding to an annual revenue gain of €170–200 million.

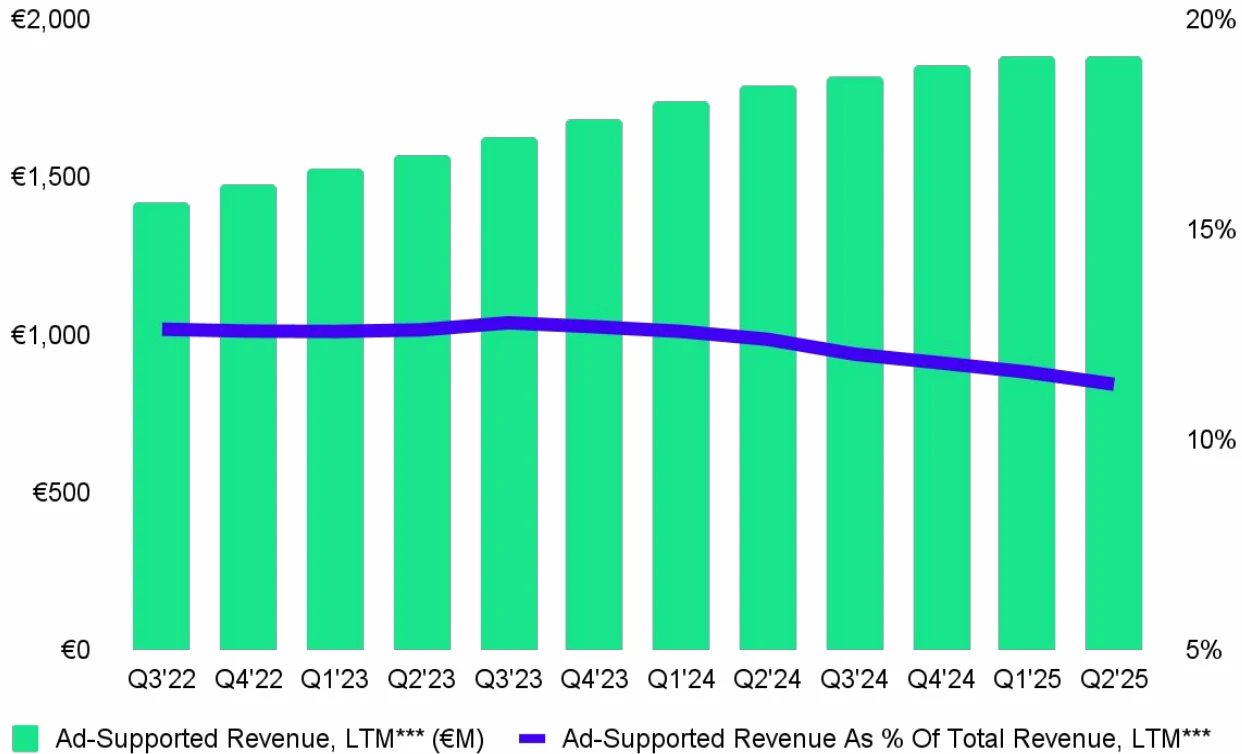

Source: Spotify

At the same time, during the Federal Reserve’s rate-cut cycle, corporate marketing expenditure growth is expected to rise from 4.5% to 6.5%. Spotify’s advertising business, which grew 15% year-over-year in Q2, as a cost-effective streaming advertising channel, is likely to capture more incremental budgets and serve as a core driver of the secondary growth trajectory. These partially unpriced positive factors explain why institutional investors remain in the stock during the consolidation period and continue to accumulate shares.

Source: Spotify

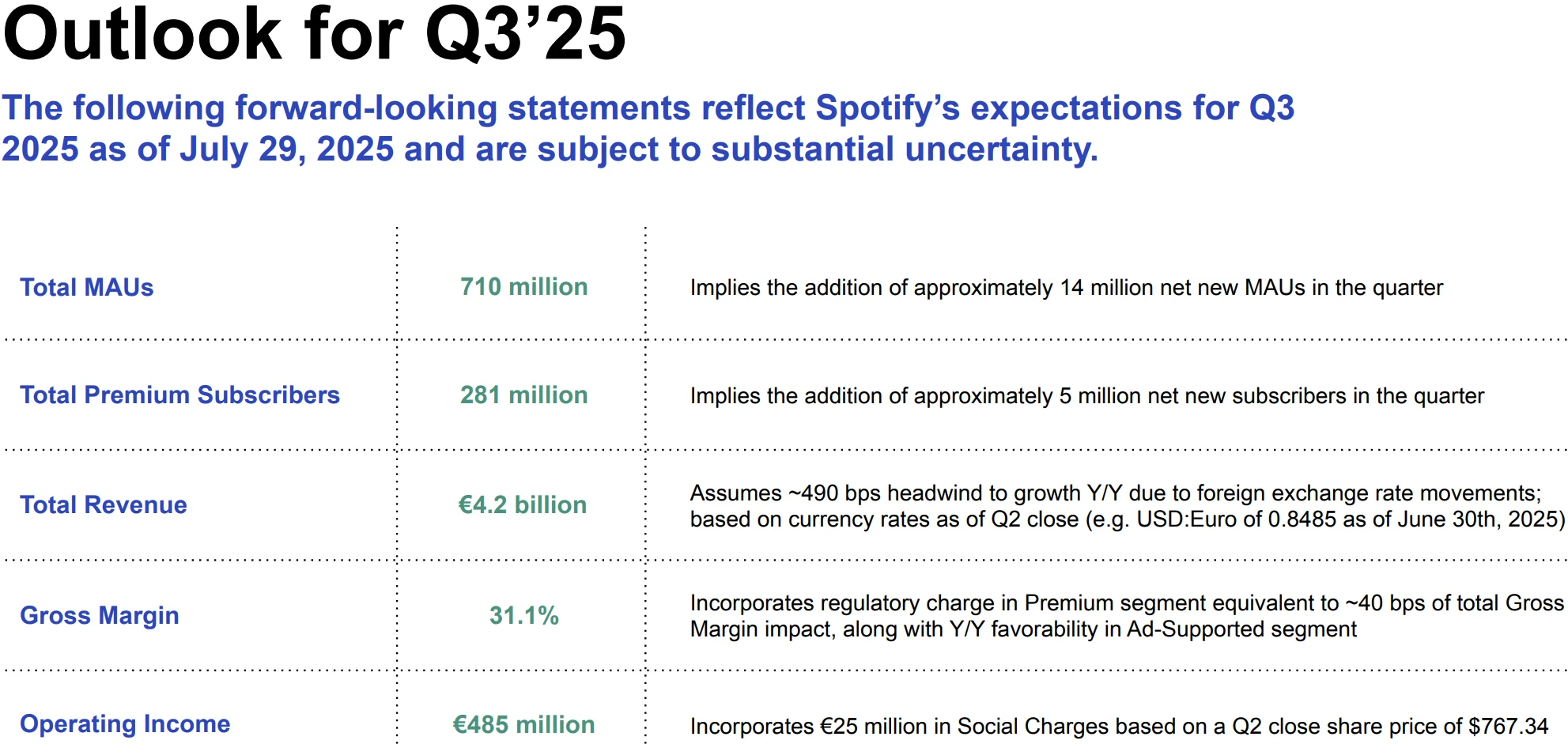

Therefore, evaluating Spotify’s current high-level consolidation should not focus solely on the “short-term 0.4% quarterly return,” but should be considered from three dimensions: capital behavior, fundamental resilience, and the pace of positive catalyst realization. If Q3 user metrics (company guidance of MAU 710 million, paid subscribers 281 million) are realized as expected, and post-price-increase subscriber retention remains above 98.5%, the current consolidation range is more likely a “medium-term accumulation platform” rather than a “long-term peak.” The short-term momentum slowdown may instead provide a strategic entry opportunity for investors focused on growth logic.

Source: Spotify

Wall Street Consensus

Against the backdrop of Spotify’s stock entering a high-level consolidation phase, the stance of Wall Street analysts and institutional investors can serve as a reference for investors assessing its long-term value.

As of September 2025, among the 26 analysts covering Spotify, 84.61% have issued a Buy rating, 15.39% have issued a Hold rating, and no Sell ratings were recorded. The analyst community has formed a consensus on the company’s long-term growth prospects, and target prices from leading institutions point to a clear upside potential.

From the perspective of market consensus, the current average target price for Spotify is $795.28, implying approximately 11% upside from the current stock price. The consensus EPS estimates for 2025 and 2026 have been revised upward from $1.0 and $1.3 to $1.2 and $1.5, respectively, reflecting analysts’ confidence in the resilience of its business.

From a valuation standpoint, Spotify currently trades at a price-to-sales ratio of approximately 7.57x, below the industry average of 8.17x and notably lower than major competitors such as Apple (Apple Music) and Amazon (Amazon Music). This indicates that Spotify’s valuation within the streaming music segment remains reasonable, providing investors with a margin of safety.

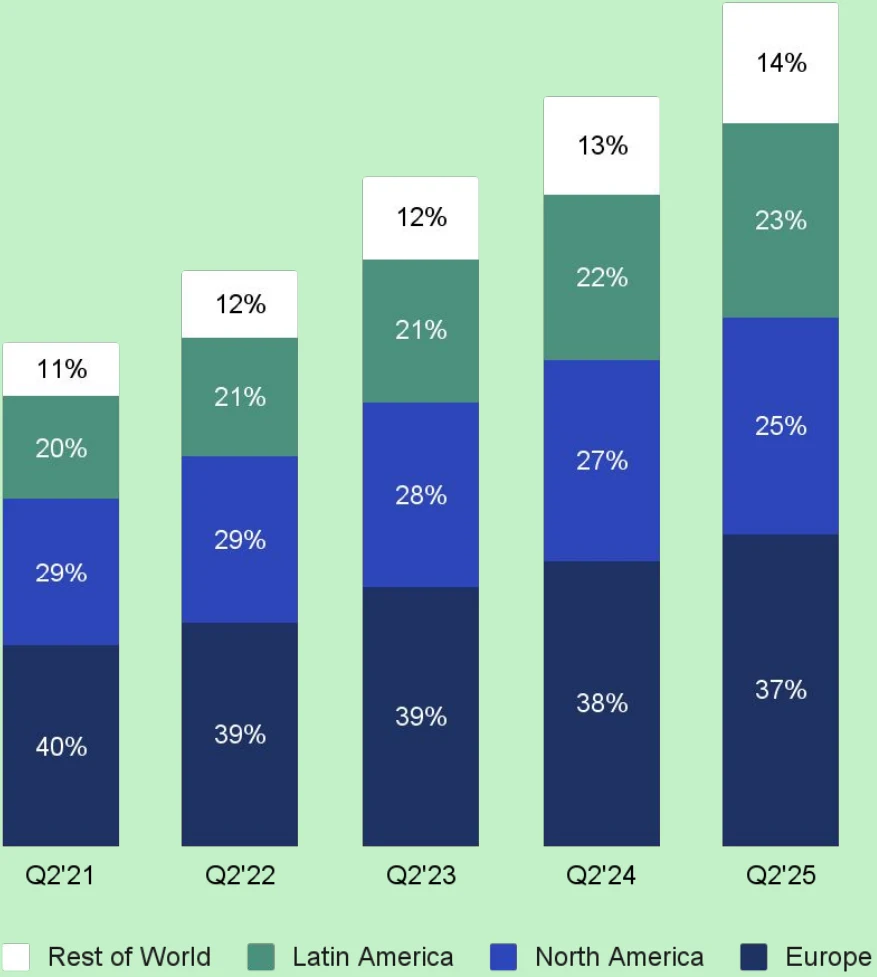

In terms of competitive positioning, Spotify holds a leading position in the global streaming music and podcast markets. As of Q2 2025, Spotify had 696 million active users, including 276 million paid subscribers and 433 million ad-supported users, representing approximately 32% of the global music streaming subscription market. Excluding China, its global market share remains stable at around 40%.

Source: Spotify

In the podcast market, Spotify also maintains a dominant position. Based on user numbers, its podcast market share reached 38.4%, significantly higher than Apple Podcasts at 11.5%. Regarding its content library, as of Q2 2025, Spotify hosted approximately 7 million podcasts, 430,000 video podcasts, and 350,000 audiobooks.

Final Takeaways

Spotify’s current valuation already partially reflects user growth and improvements in gross margins, yet certain latent signals—such as positive cash flow trends, realized pricing power, and advertising recovery—remain only partially priced in. Should the Q3 earnings report validate the impact of subscription price increases on ARPU and the monetization efficiency of non-music content, the stock may break out of its current trading range.

Investors monitoring Spotify’s future performance should focus on several key indicators: user retention rates, particularly whether churn remains manageable following the price adjustments; the growth trajectory of advertising revenue, with an emphasis on sustaining double-digit expansion; and operational leverage, specifically whether gross margins can remain above 30%.

Given the long-term trends of increasing streaming penetration and diversified audio content, Spotify remains on a steady growth path. Nevertheless, potential macroeconomic fluctuations that could impact advertising spending warrant continued attention.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates