Market Focus: September U.S. Nonfarm Payrolls in Spotlight as Rate Cut Expectations Cool; Government Shutdown Crisis Looming; Tesla Releases Q3 Delivery Data

23:00 September 28, 2025 EDT

FoolBull Brings You This Week’s Market Highlights:

Market Focus

U.S. Economic Data in Focus: Market Zeroes in on Employment Figures

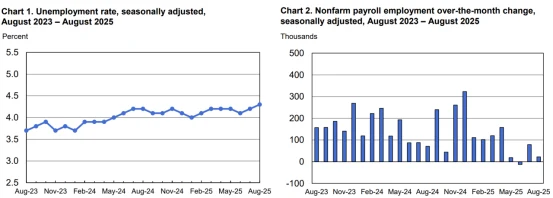

A series of U.S. economic data releases is due this week, with the market laser-focused on employment indicators. The September Nonfarm Payrolls report, scheduled for release on Friday, takes center stage. Market consensus forecasts a addition of 50,000 nonfarm payrolls in September, compared to a prior reading of a 22,000 increase.

Source: Bureau of Labor Statistics

Prior to that, several key labor market metrics warrant investor attention. Specifically:

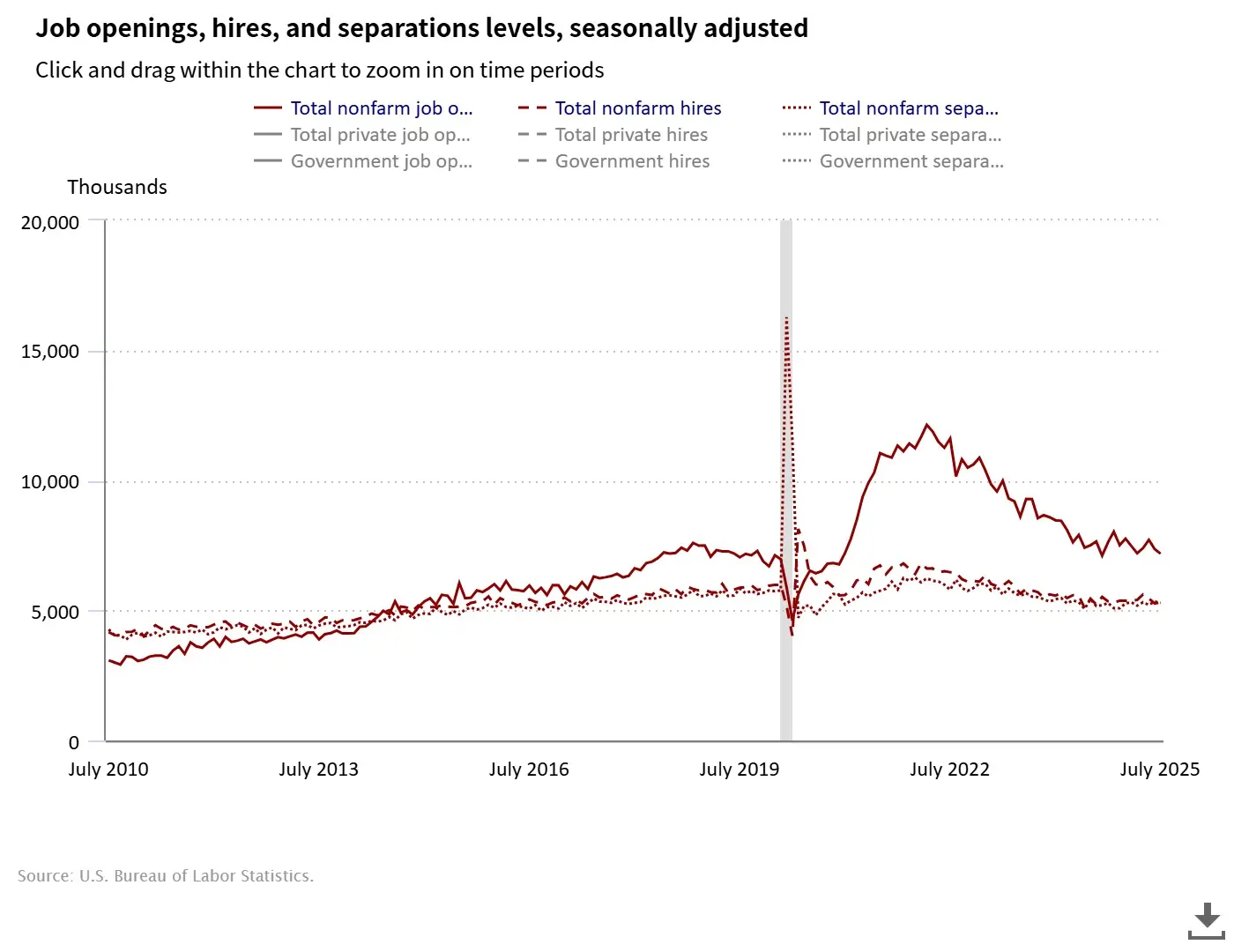

The August JOLTS Job Openings data will be released on Tuesday, September 30. Market expectations are for 7.10 million openings, down from the previous figure of 7.181 million. The July JOLTS figure had already declined to 7.181 million, hitting the lowest level since September 2024. Furthermore, the ratio of job openings to unemployed persons fell to 0.992 from a downwardly revised 1.049 in June, dropping below 1.0 for the first time since April 2021.

Source: Bureau of Labor Statistics

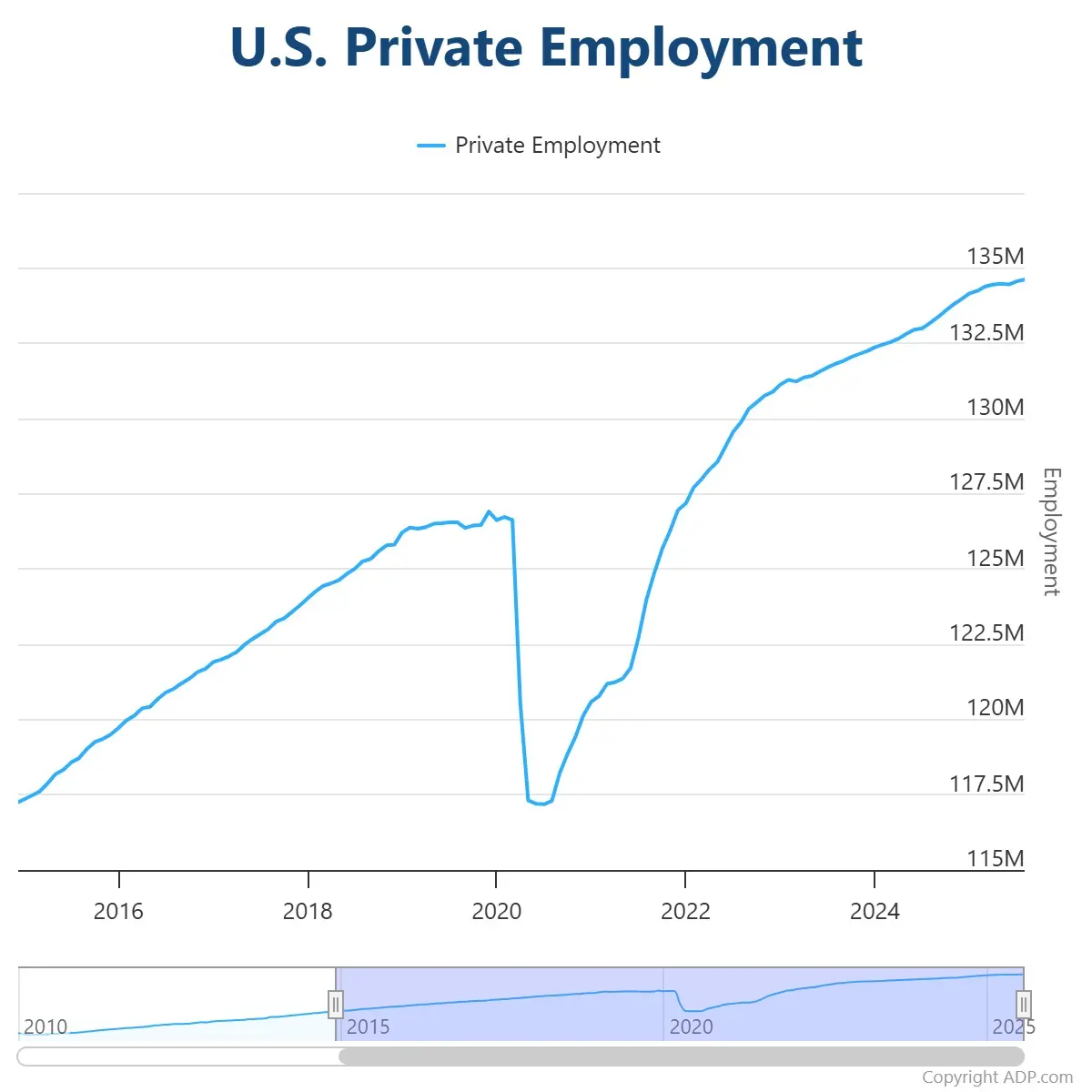

The September ADP National Employment Report, covering private payrolls, is due on Wednesday, October 1. The prior August report showed an increase of 54,000 jobs, significantly missing market expectations of 68,000 and marking a sharp slowdown from the downwardly revised July gain of 104,000.

Source: ADP

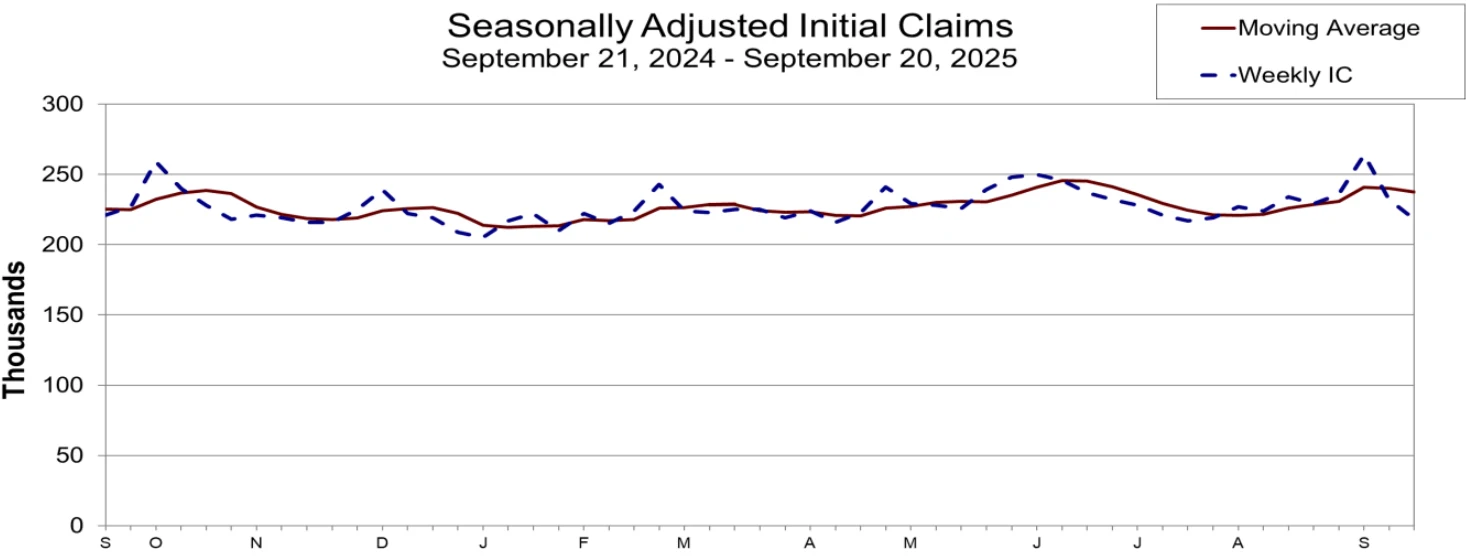

Additionally, for the week ending September 20, seasonally adjusted initial jobless claims came in at 218,000, the lowest level since mid-July. This represented a decrease of 14,000 from the upwardly revised prior week and was also substantially better than economists' forecast of 235,000. The next release for this data is scheduled for Thursday, October 2.

Source: U.S. Department of Labor

Recent Nonfarm Payrolls reports have consistently fallen short of market expectations, with significant downward revisions to prior months' data. Overall, the trend in employment growth points to a notably slowing economy. Investors will be keen to see if this trend persisted into September.

Trump to Meet Congressional Leaders as Government Shutdown Crisis Looms

According to Reuters, citing two informed sources, the four top Congressional leaders are scheduled to meet with President Trump at the White House on Sunday, September 29, as the risk of a federal government shutdown on October 1 intensifies.

Previously, on September 20, Senate Minority Leader Chuck Schumer and House Democratic Leader Hakeem Jeffries requested a meeting with President Trump before a potential shutdown to discuss averting it. President Trump agreed to meet but expressed skepticism about achieving a positive outcome.

This meeting represents the first face-to-face discussion between President Trump and Democratic leaders as the funding deadline approaches. In a joint statement on the evening of September 27, Jeffries and Schumer confirmed the September 29 meeting, stating they are "firmly committed to avoiding a government shutdown."

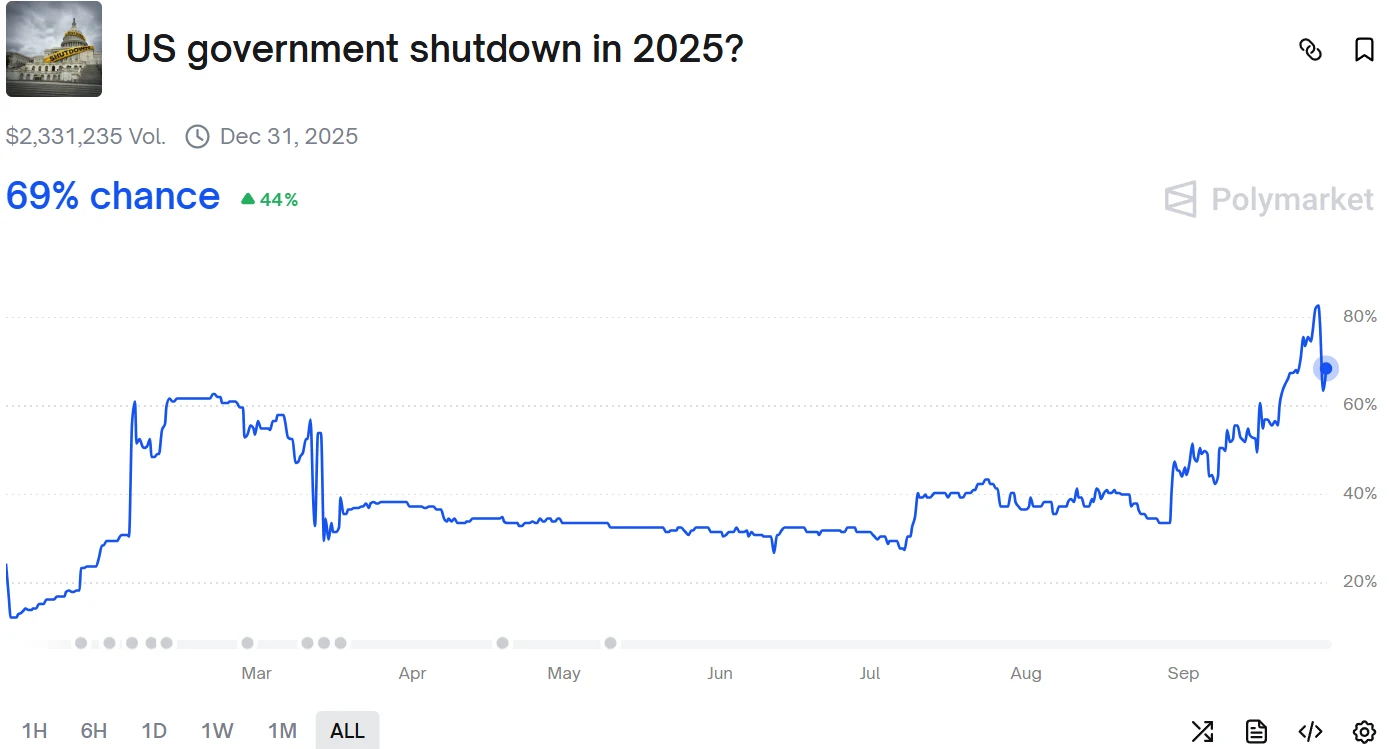

If Congress fails to act, the government could partially shut down on October 1, and the jobs report would not be released on schedule. Currently, market-implied probability suggests a nearly 70% chance of a shutdown.

Source: PolyMarket

According to contingency plans released by the Department of Labor earlier this year, a federal government shutdown would delay the scheduled October 3 release of the September employment report. A plan updated in March 2024 indicates that in the event of a shutdown, all data collection and scheduled releases would be suspended. If a shutdown persists until October 15, the release of the CPI report would also likely be immediately impacted. This would leave the Federal Reserve without crucial employment and inflation data ahead of its October 28-29 policy meeting, increasing policy-setting risks.

Nomura Securities noted in a research report that the lack of timely inflation and jobs data would significantly complicate the Fed's ability to assess the economic landscape, greatly reducing the likelihood of deviating from the trajectory outlined in the September Summary of Economic Projections at its October 29 meeting.

However, some Fed officials, like Governor Christopher Waller, have emphasized the importance of private data. During a shutdown, Fed officials might place greater reliance on private-sector data such as the ADP report and weekly state-level unemployment claims to gauge labor market conditions, though the FOMC is unlikely to treat private data as full substitutes for official figures.

Multiple Fed Officials Set to Speak

This week will see a dense schedule of public appearances from Fed officials including Williams, Bostic, Harker, Logan, Daly, and Bowman.

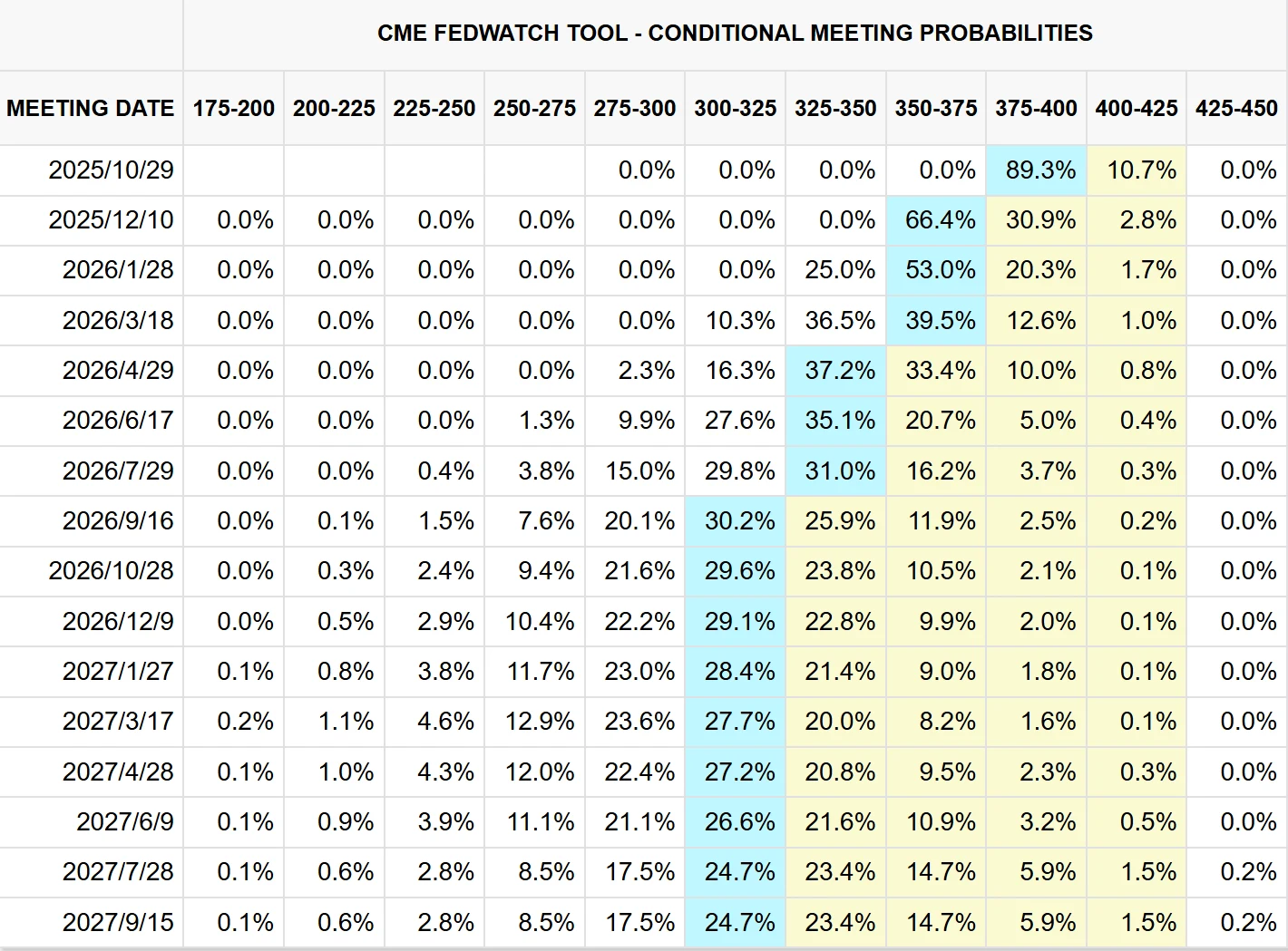

Investors are still digesting the Fed's less-dovish-than-expected September meeting outcome. While the latest "dot plot" indicated that policymakers aligned with market expectations for two rate cuts this year, the median projection for 2026 suggested only an additional 25 basis points of easing. In contrast, markets continue to price in the possibility of three more rate cuts next year.

Source: CME Group

However, in his speech last Tuesday, Fed Chair Jerome Powell struck a cautious tone. Powell stated that even after last week's rate cut, he still considers the current monetary policy stance "moderately restrictive." This suggests that if policymakers continue to judge that recent labor market weakness is a greater concern than persistent inflation, there remains room for further rate cuts this year.

Powell also noted, "The near-term risks to inflation are to the upside, while the risks to employment are to the downside—this is a challenging situation, with two-sided risks meaning there is no risk-free path." Cutting rates too quickly or too much could allow inflation to linger near 3% rather than converge toward the Fed's 2% target. Conversely, maintaining restrictive policy for too long could unnecessarily suppress the labor market.

Regarding the next FOMC meeting on October 28-29, Powell did not send a strong signal, nor did he explicitly push back against market expectations for another rate cut. He stated officials would watch growth, employment, and inflation data and ask, "Is our policy stance about right? And if it's not, then we'll need to adjust."

Trump Administration Considers Tariffs Based on Chip Count

The Trump administration is reportedly considering imposing tariffs based on the number of semiconductors in foreign electronic devices. Under the proposal, the Commerce Department would levy tariffs on a certain percentage of the estimated value of the chips in a product. Sources indicate the Commerce Department is considering a 25% tariff on the chip-related portion of imported devices, with a 15% tariff potentially applied to electronics from Japan and the EU, though these rates are preliminary.

White House spokesperson Kush Desai stated, "America cannot rely on imports for semiconductors that are vital to our national and economic security," emphasizing the administration's commitment to various measures for reshoring critical manufacturing. If implemented, this move would signal an attempt by the Trump administration to extend its trade measures to a wider range of consumer goods, from toothbrushes to laptops, potentially adding to inflationary pressures.

Furthermore, reports suggest the administration is considering requiring chip companies to maintain a 1:1 ratio between the number of chips they produce domestically and those they import. Failure to maintain this ratio over the long term could subject companies to tariff penalties. This model could pose challenges for major tech firms like Apple and Dell, which import vast quantities of products containing various chips from global supply chains.

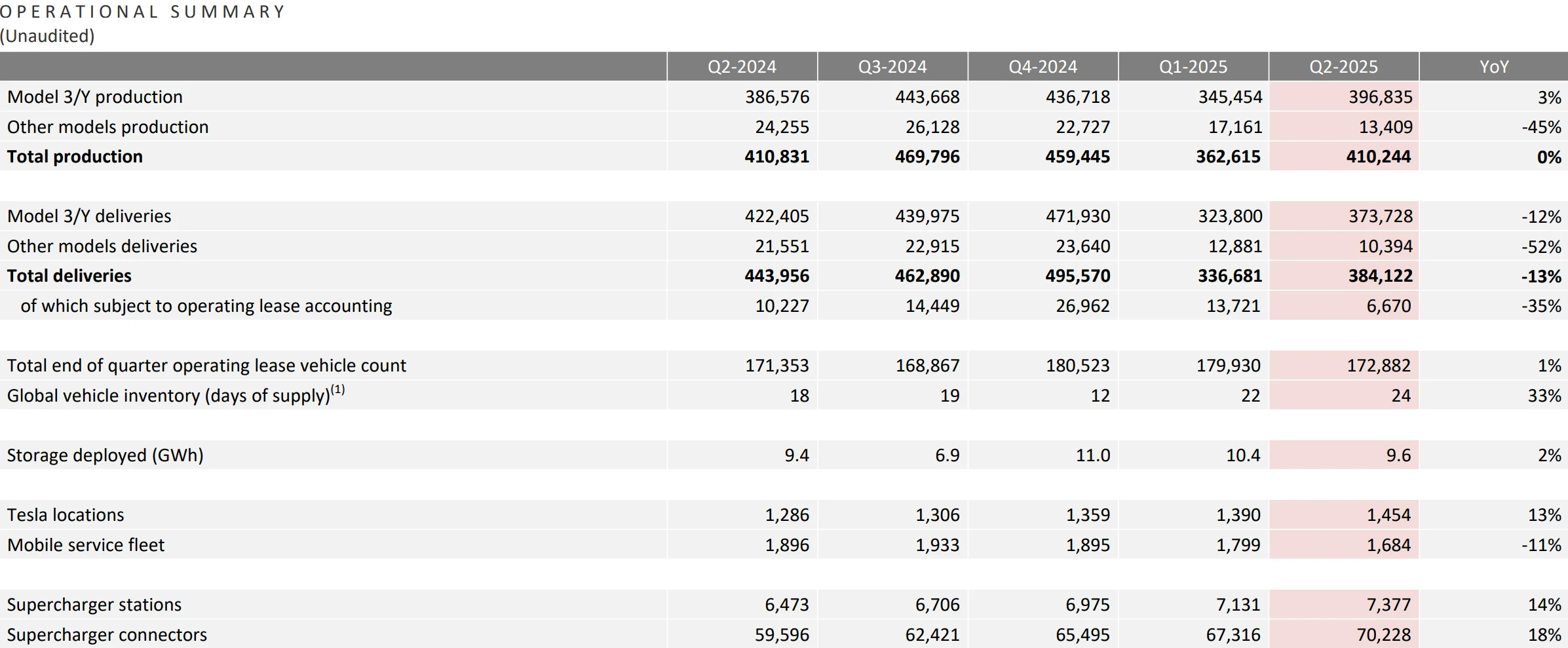

Tesla Q3 Delivery Data Imminent

On Thursday, Tesla is expected to report its global Q3 delivery figures. Market consensus points to strong performance, anticipating 446,000 global deliveries for Q3, reflecting a 16% sequential increase but a 4% year-over-year decline. This strength is partly attributed to U.S. consumers making purchases ahead of the September 30 expiration of federal EV tax credits for certain models.

Source: Tesla

UBS believes Tesla's U.S. deliveries should be very robust, driven by the promotional push for the upgraded Model Y and consumers seeking to utilize the expiring tax credit. The firm raised its Q3 delivery estimate to 475,000, representing 3% YoY growth and 24% sequential growth. UBS also expressed optimism that Tesla could potentially exceed its own expectations this quarter, potentially setting a new all-time record for quarterly deliveries.

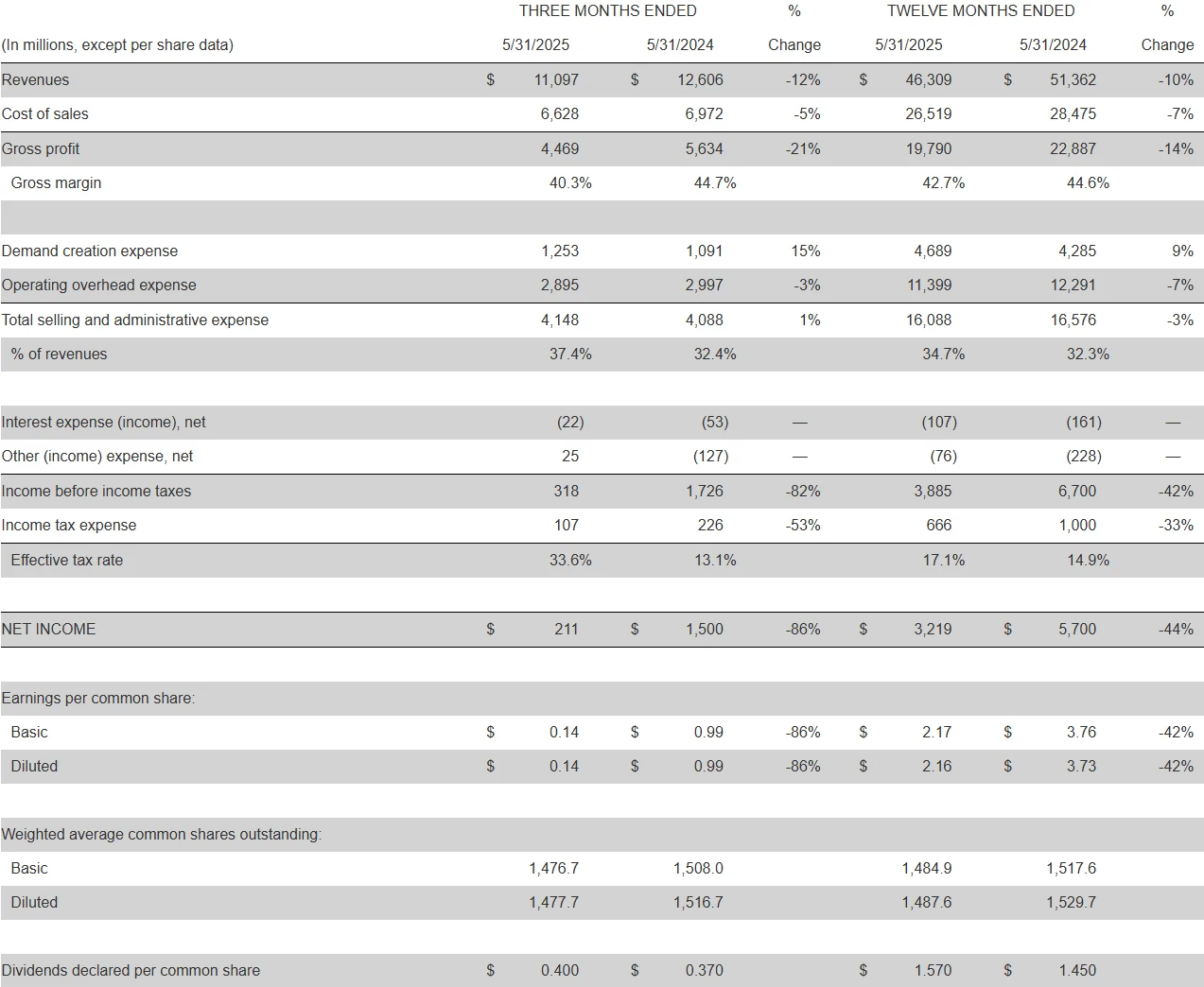

Nike Reports Q1 FY2026 Earnings

Nike is scheduled to report its fiscal first-quarter 2026 earnings after the U.S. market closes on Tuesday, September 30. Analyst consensus estimates project revenue of $10.9907 billion and EPS of $0.267.

For fiscal Q4 2025 and the full fiscal year 2025, Nike reported:

Q4 FY2025: Revenue of $11.097 billion, down 12% from $12.606 billion YoY; Net income of $211 million, down 86% from $1.5 billion YoY. Greater China revenue was $1.476 billion, down 21% YoY.

Full FY2025: Revenue of $46.309 billion, down 10% from $51.362 billion YoY; Net income of $3.219 billion, down 44% from $5.7 billion YoY. Greater China revenue was $6.586 billion, down 13% YoY.

Source: Nike

Market Review

U.S. equity markets exhibited a "rise-then-fall" pattern throughout the week of September 23-29, with all three major indices closing lower for the week. Specifically, the Dow Jones Industrial Average fell 0.15%, the S&P 500 declined 0.31%, and the Nasdaq Composite dropped 0.65%.

Source: TradingView

Market sentiment received a notable boost from inflation data on Friday, helping the major averages snap a three-day losing streak and close higher on the final trading day. This rebound occurred despite the Trump administration's announcement of new, hefty tariffs on a range of imported goods effective October 1—including 100% on patented and brand-name drugs, 30% on furniture, and 25% on heavy-duty trucks—which sparked concerns over trade tensions and weighed on broader market sentiment. Contrary to the tariff news, the CBOE Volatility Index (VIX) fell, at one point dropping nearly 9%.

Source: TradingView

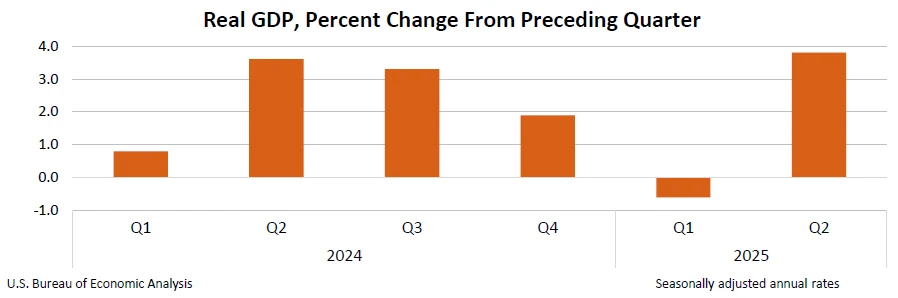

Furthermore, a series of robust economic releases during the week influenced market expectations for Federal Reserve rate cuts. The final reading for Q2 U.S. GDP growth came in at 3.8%, surpassing the estimate of 3.3%. Initial jobless claims fell to 218,000, the lowest level since July, and August durable goods orders also showed strength. These strong data points underscored uncertainty around the Fed's future easing path, pushing Treasury yields higher and adding pressure to tech stocks.

Source: Bureau of Economic Analysis

Meanwhile, Fed Chair Powell, in public remarks, emphasized the need to balance risks between labor market softening and persistent inflation. Treasury Secretary Bescent criticized Powell for not providing a clearer rate-cut agenda. While expectations for an October rate cut persist, heightened divergence among investors led some to adjust their positions prematurely.

Individual stock performances were markedly mixed.

Intel stood out with significant gains, buoyed by positive news. Reports indicated that Intel's CEO is actively seeking investments to advance its turnaround plan and has approached companies including Apple and TSMC regarding potential investment or manufacturing partnerships. On Thursday, while the broader market sold off, Intel's stock surged nearly 9% to close at $33.99 per share. The rally continued into Friday, resulting in a staggering weekly gain of approximately 20%.

Source: TradingView

Despite lingering market concerns over AI-related stocks, Nvidia managed to post a solid performance for the week, registering a five-day gain of 0.86%. The stock edged up 0.41% by Thursday's close and continued its ascent on Friday, providing support to the technology sector.

Source: TradingView

Oracle was among the notable underperformers last week, as persistent market skepticism regarding the sustainability of the AI transaction boom weighed on its shares. The stock extended its decline, falling over 5% on Thursday and bringing its pullback from recent highs to nearly 16%. For the full week, Oracle shares declined 8.16%.

Source: TradingView

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates