Rocket Lab Shares Pull Back on Secondary Offering — Is Now the Time to Buy In?

03:07 September 28, 2025 EDT

On September 15, Rocket Lab announced the launch of a $750 million at-the-market (ATM) equity offering program, replacing its previous sales agreement that allowed for up to $500 million in stock issuance.

An ATM offering is a flexible equity financing mechanism that enables a company to gradually sell shares when market conditions are favorable, thereby minimizing the immediate impact on its share price. However, the announcement triggered a nearly 13% drop in Rocket Lab’s stock price. The company—often referred to as the “second space stock”—had earlier this year seen its shares reach an all-time high of $55.17, with its market capitalization surpassing $23.5 billion.

Source:TradingView

The market’s reaction highlights investors’ mixed sentiment toward space-related equities—a combination of enthusiasm and risk aversion. While the fundraising news prompted selling pressure, Rocket Lab has still posted a gain of more than 80% year-to-date, far outpacing the broader market.

Market Positioning

Rocket Lab’s core value restructuring began with its push toward vertical integration across the space industry value chain. Unlike SpaceX, which focuses on large-scale rockets and satellite constellations, Rocket Lab has pursued a differentiated strategy of “small-scale entry, full-chain coverage.”

At the foundation of its business, the Electron small rocket provides a stable source of cash flow. As the second most frequently launched small-lift vehicle in the U.S., Electron completed 16 missions in 2024 with a success rate above 90%. Leveraging full 3D-printing technology, Rocket Lab has kept the per-unit manufacturing cost at just $8.4 million, positioning Electron as a “high-frequency taxi” for the small-satellite market. Beyond generating consistent revenue, the Electron platform has also built strategic relationships with key clients, including the U.S. military and NASA.

The true inflection point, however, has come from the rise of the Space Systems division. Through acquisitions such as SolAero and Advanced Solutions, Rocket Lab has expanded its capabilities to cover the entire value chain—from satellite components to launch services. In Q2 2025, the company posted record revenue of $144 million, up 36% year-over-year, with the Space Systems division contributing nearly 70% of total sales and establishing itself as the company’s primary growth driver.

This shift in business structure has transformed Rocket Lab’s market positioning from a pure-play launch provider into a higher-value “end-to-end space solutions provider.” As a result, its valuation logic is increasingly aligned with that of high-margin defense contractors.

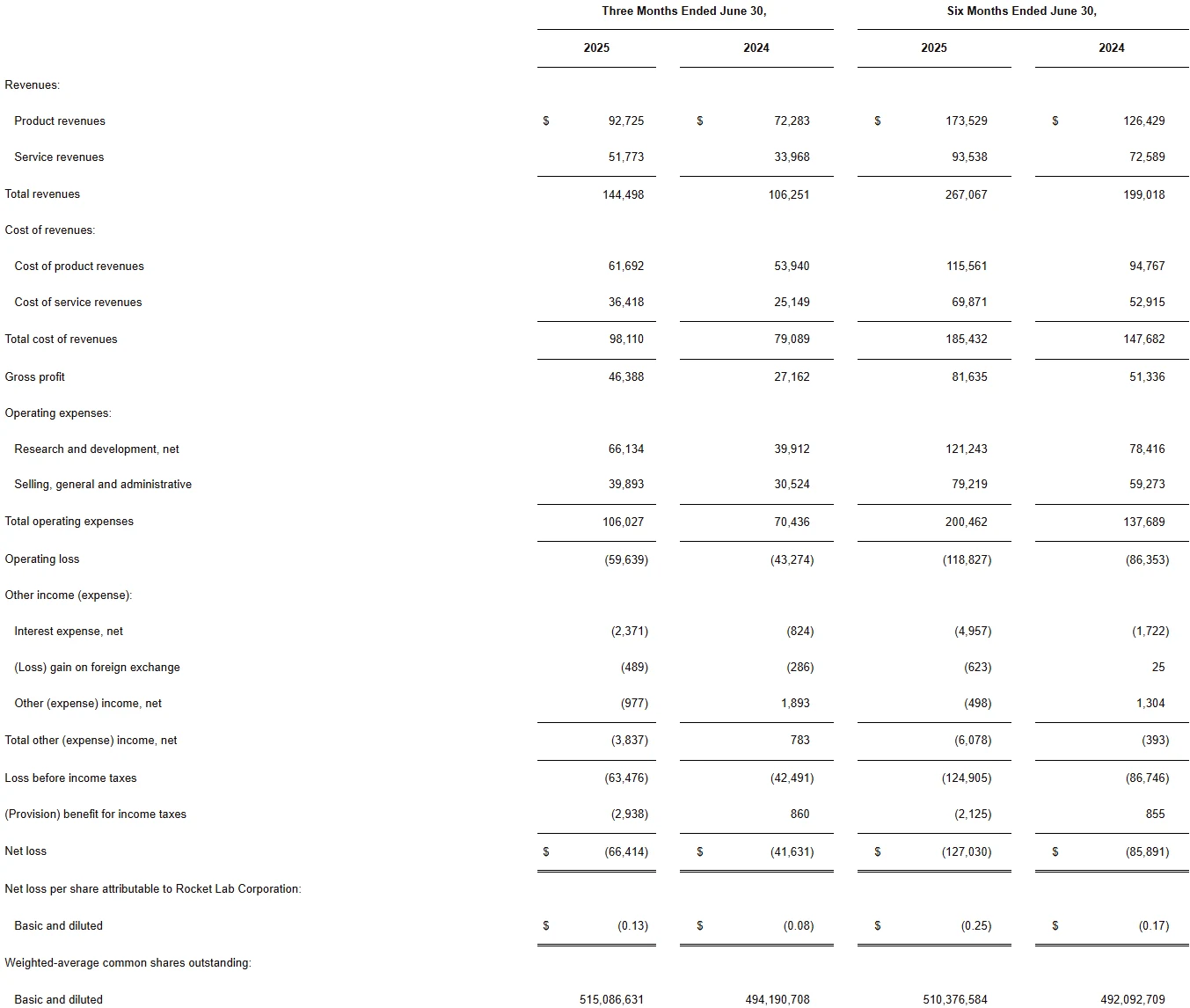

Financial Performance

Rocket Lab has demonstrated strong revenue growth, though profitability remains a key concern. In Q2 2025, the company’s GAAP gross margin improved to the 35%–37% range, signaling greater operational efficiency.

However, Rocket Lab has yet to achieve profitability, posting an adjusted EBITDA loss of $21 million to $23 million for the quarter. R&D spending continues to rise, reaching $55.1 million in Q1 2025, a 43% increase year-over-year.

On the backlog front, Rocket Lab continues to show robust momentum. As of the end of Q2 2025, the company reported a total contracted backlog of $1.05 billion, including $422 million in launch services and $645 million in space systems. This solid backlog provides visibility for future revenue streams.

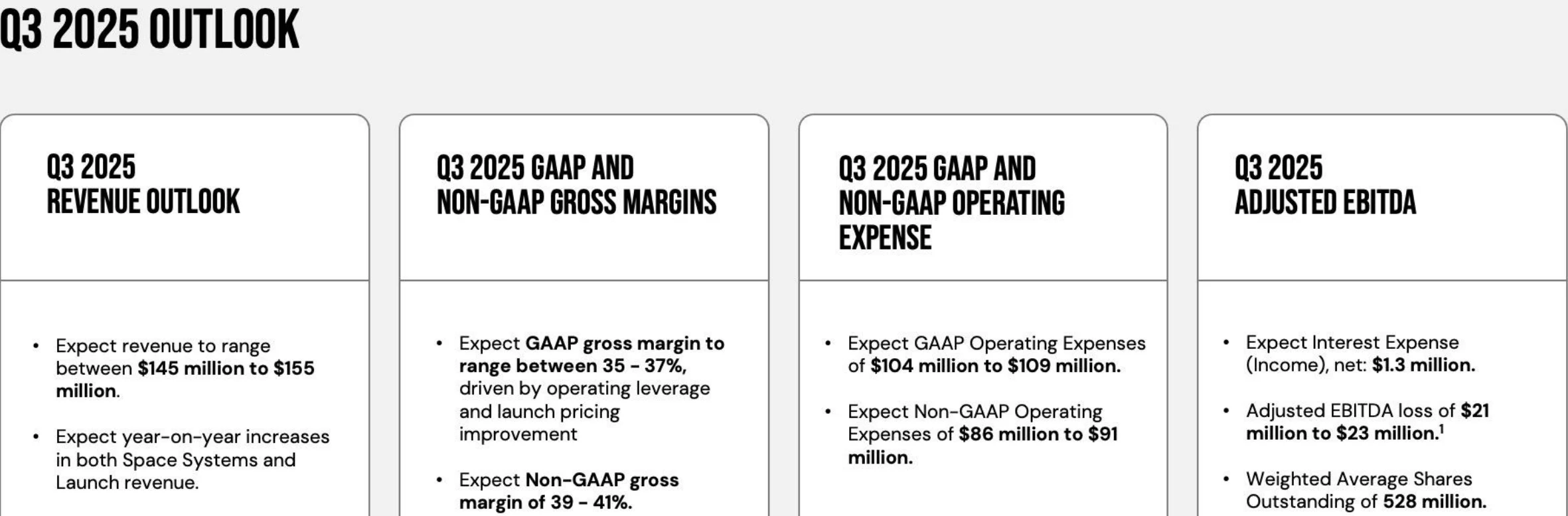

Source: Rocket Lab

For Q3 guidance, the company expects revenue in the range of $145 million to $155 million, indicating continued year-over-year growth. Investors will be closely watching whether Rocket Lab can deliver further improvements in gross margin during the quarter.

Source: Rocket Lab

Strategic Layout

Rocket Lab has recently strengthened its positioning across the space value chain through a series of strategic acquisitions. On September 25, 2025, the company announced plans to acquire German laser communications developer Mynaric for up to $150 million. The deal structure includes an upfront payment of $75 million and up to $75 million in performance-based earnouts, with closing expected after Mynaric completes its domestic restructuring in Germany.

Importantly, this acquisition goes beyond simple technology supplementation—it targets a critical bottleneck in satellite communications: the lack of high-volume, low-cost laser communication terminals. Mynaric’s Condor Mk3 product has already been validated under a $515 million SDA contract to support Rocket Lab’s Tranche 2 Transport Layer-Beta satellites. Post-acquisition, Rocket Lab can leverage its scalable production capabilities to commercialize this technology, filling a significant market gap.

Source: Mynaric

The deal also provides Rocket Lab with its first European foothold in Munich, absorbing over 300 specialized engineers and acquiring a full set of production assets and IP. This European presence opens critical channels to expand into European government and commercial satellite constellation markets.

Earlier, Rocket Lab acquired Geost for $275 million, a U.S. developer of electro-optical and infrared (EO/IR) payloads with deep ties to the national security community. Geost specializes in miniaturized, low-power EO/IR sensors, widely applicable in space domain awareness (SDA), missile warning, and ISR missions—perfectly aligned with the U.S. Space Force’s push for “low-cost, space-based sensors.”

Just one month after the acquisition closed, Geost secured an expanded U.S. Space Force contract worth $80.7 million, tasking it with developing two optical payloads for GEO missions to monitor potential adversary spacecraft. This validates Geost’s technical credibility and establishes Rocket Lab as a key payload supplier in U.S. national security missions.

Together, these acquisitions fit tightly with Rocket Lab’s long-term strategy of building a vertically integrated ecosystem spanning launch, satellite platforms, payloads, and in-orbit services. The company has steadily executed on this vision—previous acquisitions such as spacecraft separation system manufacturer PSC and flight software provider ASI laid the foundation for supply chain independence. Mynaric and Geost now fill two critical gaps: communications and mission payloads.

In practice, Geost’s EO/IR sensors and Mynaric’s laser terminals can integrate directly with Rocket Lab’s Photon satellite platform, creating a closed-loop “sense–communicate–platform–launch” solution. For example, in defense missions, a Photon satellite equipped with Geost’s infrared sensors could detect missile launches in real time, transmit data via Mynaric’s laser terminal with low latency, and be deployed into orbit on Rocket Lab’s own rockets—substantially reducing integration risk and cost for customers.

On the market expansion front, Rocket Lab is also actively pursuing participation in the U.S. government’s GoldenDome defense program, which aims to reduce reliance on SpaceX. Rocket Lab has already been identified as a potential supplier. If successful, this could secure the company a role in a $175 billion defense market, offering a stable, long-term revenue stream.

Key to Future Growth

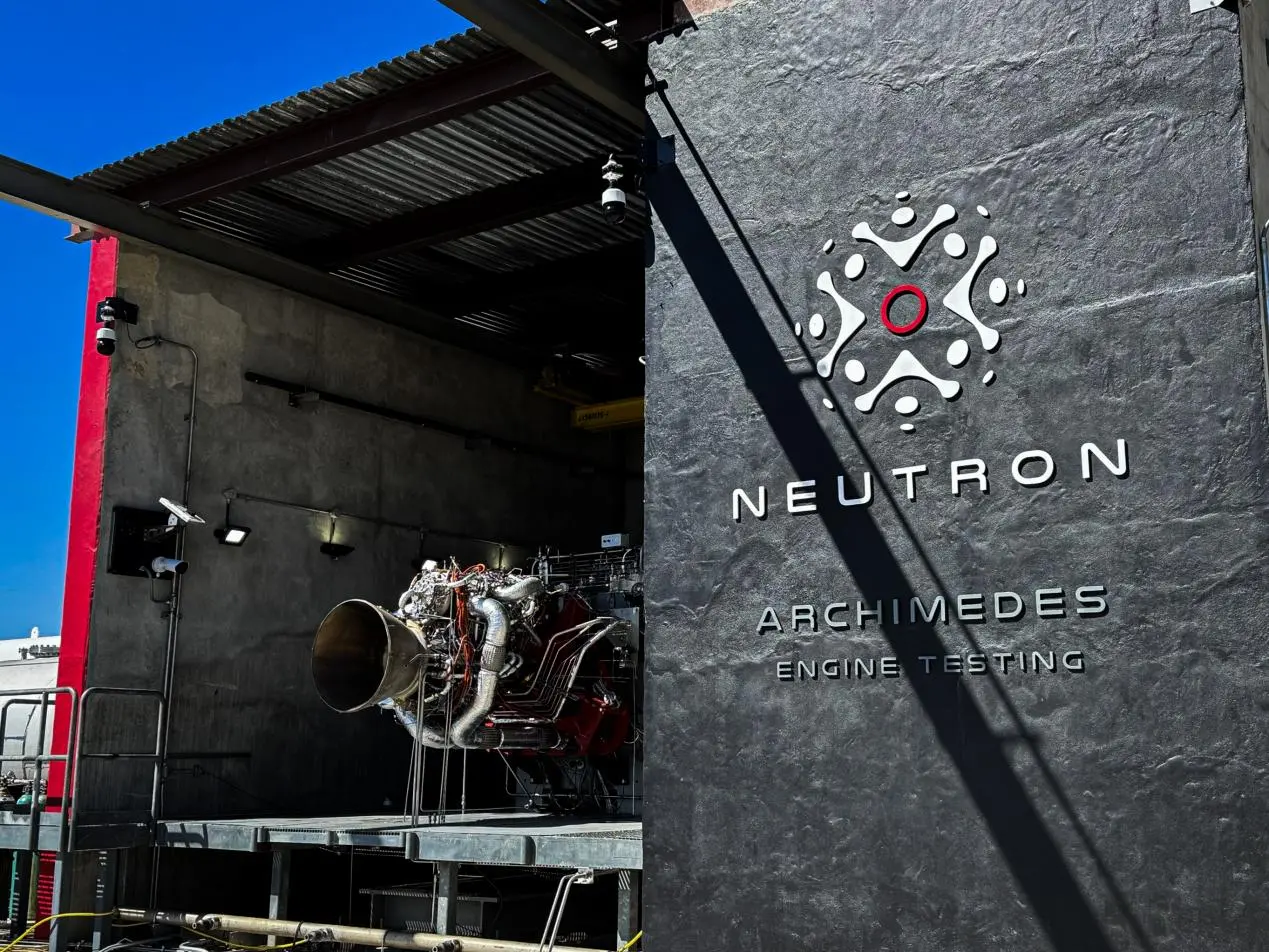

The development of the Neutron rocket represents a core growth driver for Rocket Lab. This medium-class, reusable launch vehicle is designed to deploy large satellite constellations and conduct crewed missions, with its inaugural launch planned for the end of 2025.

Source: Rocket Lab

In a recent research note, Goldman Sachs maintained a “Neutral” rating on Rocket Lab with a $32 price target, while highlighting that development risks for the Neutron rocket are “difficult to underestimate.” Analysts note that although the company still expects to launch the Neutron by year-end, the timeline is challenging and subject to potential bottlenecks.

The Neutron rocket is critical to Rocket Lab’s market positioning. Once operational, it will allow the company to enter the medium-lift launch segment, directly competing with SpaceX’s Falcon 9.

Management has provided positive updates regarding Neutron’s manufacturing capacity and expected demand, forecasting that the rocket will further drive growth in the Space Systems business. Rocket Lab has also received recognition from the U.S. Department of Defense, with Neutron included in the National Security Space Launch (NSSL) program, making it eligible to compete for government launch contracts valued in the tens of billions of dollars.

High Valuation and Execution Risk

Despite Rocket Lab’s promising outlook, investors should remain mindful of several risk factors. Technical execution risk for the Neutron rocket tops the list. Goldman Sachs explicitly notes that “Neutron rocket development risks are difficult to underestimate.” The company itself acknowledges that the timeline is challenging and contingent on resolving a limited set of issues. Any significant delays could undermine market confidence and future revenue expectations.

From a valuation perspective, the company is currently trading at a relatively high level. To date, Rocket Lab’s share price has ranged between $45.21 and $55.17, with a market capitalization of approximately $22.38 billion. Relative to its current revenue scale, this valuation already reflects substantial growth expectations. Meanwhile, the company remains unprofitable, reporting a net loss of $66.41 million in Q2 2025, and continues to invest heavily in the development and testing of the Neutron rocket.

The competitive landscape also warrants attention. With rivals such as Blue Origin and United Launch Alliance accelerating the development of reusable rockets, competition in the launch services market is intensifying. Although Rocket Lab differentiates itself through its vertical integration model, it remains uncertain whether it can sustain a long-term competitive edge.

Customer concentration is another notable risk. The company’s revenues are highly dependent on U.S. government contracts, particularly projects from the Space Development Agency and the Department of Defense. Any government budget cuts or contract changes could materially impact its business.

For investors, Rocket Lab represents a classic growth-stock opportunity: high risk paired with high potential reward. The company’s ongoing transformation from a launch service provider to a vertically integrated space enterprise will determine whether it can secure a favorable position in the rapidly expanding space economy.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates