Brent Crude Surpasses $70 Benchmark Amid Geopolitical Risk Premium and Supply-Demand Uncertainty

23:31 September 27, 2025 EDT

Key Points:

With escalating geopolitical pressures, market concerns over constrained Russian supply have intensified, driving the global benchmark Brent crude to close above $70 per barrel for the first time since late July. Geopolitical factors have once again become the primary driver of oil market volatility.

Strong U.S. PCE inflation data provided additional support for oil prices, boosting expectations that the Federal Reserve may cut rates again in October. At the same time, a weakening U.S. dollar has made dollar-denominated commodities more attractive to buyers holding other currencies.

From a fundamental perspective, the global economy faces considerable challenges, with oil demand growth remaining sluggish. On the supply side, OPEC+ production increases are outpacing expectations, compounded by anticipated output growth from the U.S. and other producers, suggesting that oversupply pressures may continue to weigh on oil markets.

International crude prices recorded the largest weekly gain in over three months. On September 26, the London ICE Brent November 2025 futures contract closed at $70.13 per barrel, surpassing the $70 mark for the first time since July 31 and rising more than 4.5% on the week, marking the largest weekly gain since June 2025. Over the same period, the New York Mercantile Exchange WTI November contract closed at $65.72 per barrel.

Source: TradingView

This rally broke the previous stalemate in oil markets, driven primarily by the concentrated release of geopolitical risk and the weakening U.S. dollar. Meanwhile, the complex dynamics on both supply and demand sides set the stage for future price developments. As geopolitical pressures mount, market concerns over constrained Russian supply have intensified. At the same time, trader positioning has further amplified the rally, with commodity trading advisors (CTAs) turning net long for the first time since early August.

Breaks Key Psychological Level

Since Q2 2025, Brent crude has been confined to a narrow trading range of $65–70 per barrel, with the core tension stemming from the tug-of-war between recurring geopolitical risks and expectations of oversupply. This balance has now been disrupted, as oil futures entered a consecutive rebound mode this week, with the global benchmark showing strong performance over the past three trading days.

Brent crude closed at $70.13 on September 26, surpassing the high on September 2 and breaking above both the 100-day and 55-day moving averages as well as the lower bound of the daily Ichimoku cloud, signaling a bullish breakout. If the price can surpass the August 1 high of $71.95, it could extend toward the August peak of $73.07.

Source: TradingView

The number of active U.S. oil rigs increased to 424, the highest level since July, indicating potential growth in future U.S. production. This metric is typically regarded as a leading indicator of U.S. crude output.

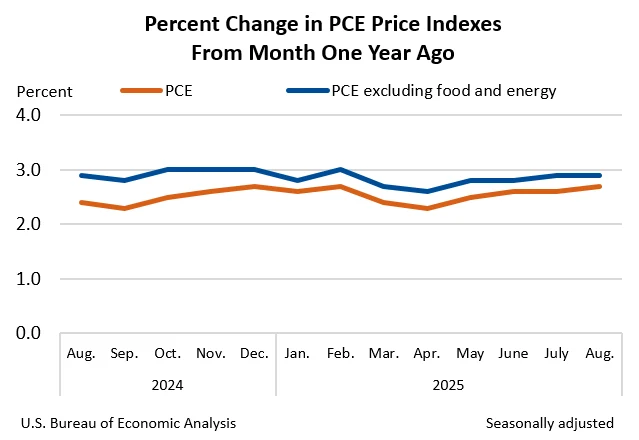

Notably, strong U.S. PCE inflation data on Friday provided additional support to oil prices. The U.S. Personal Consumption Expenditures (PCE) Price Index rose 0.3% month-over-month and 2.7% year-over-year in August, alleviating concerns about near-term demand deterioration.

Source: BEA

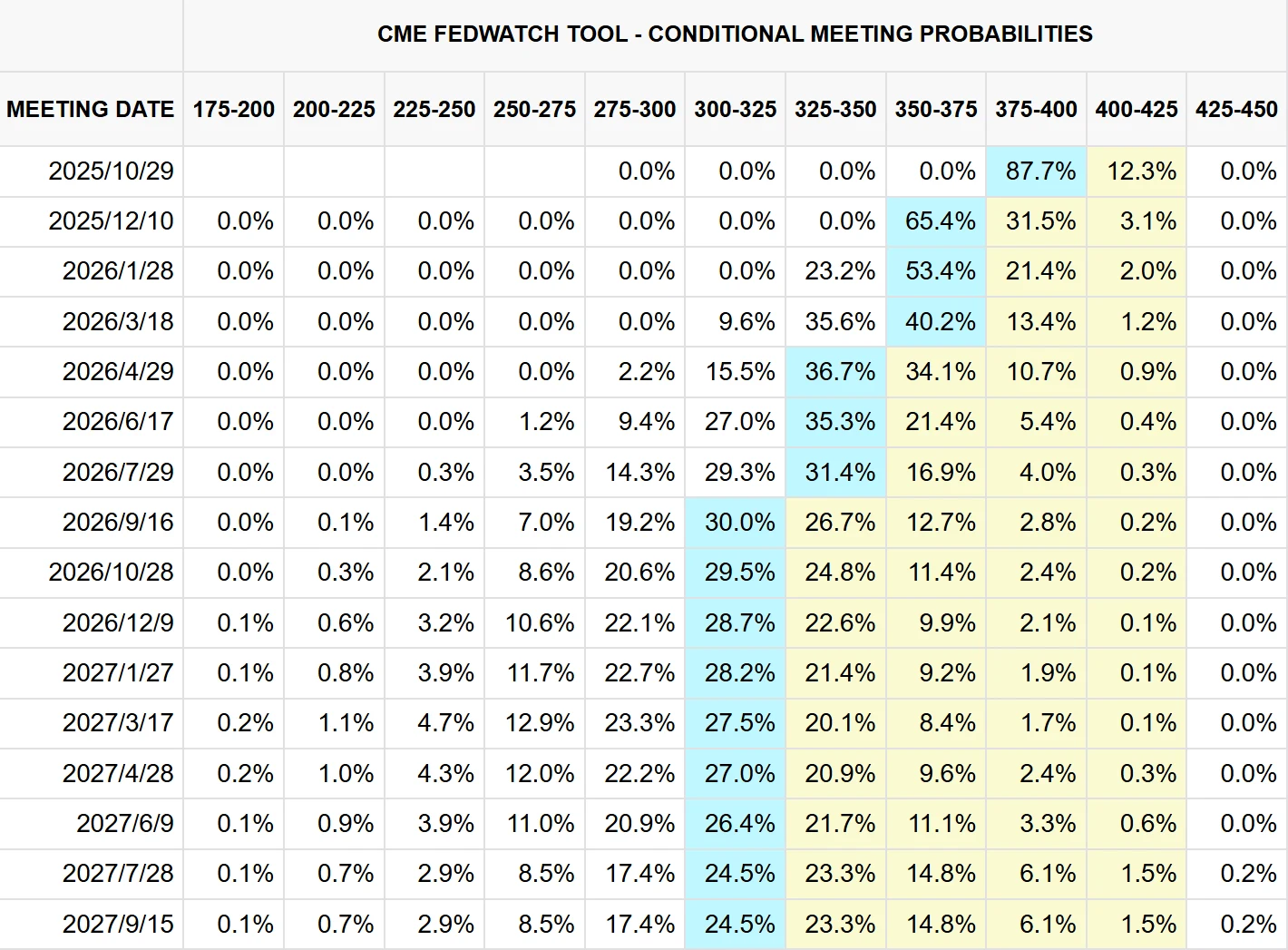

The inflation data, in line with expectations, strengthened market bets on another Fed rate cut in October. According to the CME FedWatch Tool, the market still prices an 87.7% probability of a Fed cut in October, while the likelihood of a third consecutive cut in December remains around 65%.

Source: CME Group

Meanwhile, a weaker U.S. dollar has made dollar-denominated commodities more attractive to buyers holding other currencies.

Source: TradingView

Geopolitical Risks Intensify

This week’s relative strength in the oil market has been driven by multiple factors, including the Russia-Ukraine conflict, ongoing negotiations over Iran’s nuclear program, and export restrictions in Venezuela, with developments in the Russia-Ukraine situation particularly rattling market nerves.

On September 25, U.S. President Donald Trump publicly stated during a White House meeting with Turkish President Recep Tayyip Erdoğan, “I hope he (Erdoğan) stops buying oil from Russia.” Earlier this week, he also criticized NATO members purchasing Russian fuel. These statements have heightened concerns over potential constraints on Russian energy exports.

Attacks by Ukraine on Russian energy facilities have clearly intensified. In August, roughly 1.2 million barrels per day of Russian refinery capacity—about 17% of total domestic refining capacity—was affected by attacks. In September, Russian refinery throughput further declined to 4.94 million barrels per day, down 150,000 barrels per day from the August average.

The scope of Ukrainian attacks has expanded from refineries to include critical energy transport infrastructure such as pumping stations and ports, further intensifying market concerns about energy supply. From August through mid-September, Ukrainian drone strikes are estimated to have reduced Russian refining capacity by approximately 300,000 barrels per day.

In response, Russian Deputy Prime Minister Alexander Novak announced that the existing gasoline export ban will be extended through the end of the year and that, in addition to gasoline restrictions, diesel exports by non-producing entities will also be prohibited. This decision has further fueled expectations of tighter global energy supply.

Market tension is also reflected in trading dynamics. Algorithmic trading has become a powerful force in the oil market, accounting for as much as 70% of daily crude trading volume. These computer-driven strategies have materially altered the trading landscape.

Commodity Trading Advisors (CTAs) are key participants in the oil market. Although CTAs represent only one-fifth of fund managers active in the U.S. oil market, they accounted for nearly 60% of net trading volume within this group this year. This is the largest share since 2017, signaling their growing influence on the market.

These algorithmic CTAs typically act as trend followers and amplifiers. When prices rise, they increase buying, pushing prices higher; when prices fall, they accelerate selling, exacerbating declines. Some analysts estimate that CTAs may have contributed to an overvaluation of oil prices by as much as $7 per barrel during the recent rebound.

Supply and Demand Fundamentals

Despite geopolitical risks pushing oil prices higher, the market’s supply outlook remains complex. Forecasting agencies, including the International Energy Agency (IEA), expect that later this year the market could experience a supply surplus, driven by production increases from OPEC+ and non-OPEC producers, particularly in the Americas.

The Russian government has raised its 2025 oil export forecast by 4.5% to 240.1 million tons, presenting an interesting contrast to current market concerns over restricted Russian supply. The upward revision indicates Russia’s efforts to maintain oil revenues despite ongoing geopolitical pressures.

In addition, Iraq’s Kurdistan region plans to resume crude exports, with oil transported via pipelines to Turkey’s Ceyhan port. This additional supply could partially alleviate market concerns about tight supply.

A comparison of supply and demand indicators suggests the market is in a delicate balance. On the supply side, the picture is mixed: Russian refining capacity has been reduced by ongoing attacks, resulting in daily losses of roughly 1 million barrels and directly constraining its refined product exports; at the same time, the number of active oil rigs in the U.S. has risen to 424, the highest level since July, indicating potential future production growth. Meanwhile, the planned resumption of crude exports from Iraq’s Kurdistan region introduces further incremental supply.

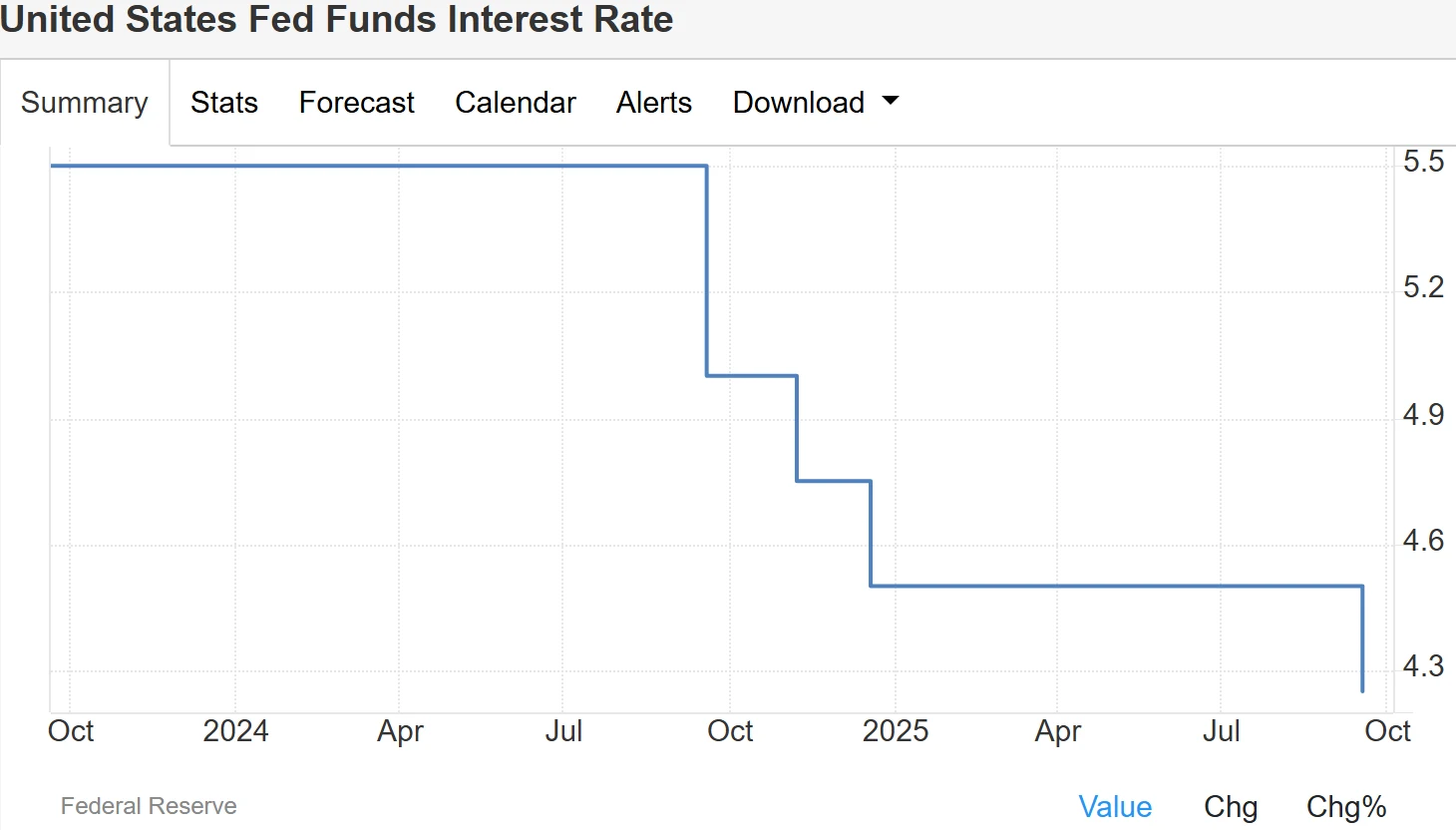

The demand side also reflects a mix of bullish and bearish factors. The U.S. economy remains resilient, with the latest annualized GDP growth rate revised up to 3.8%, providing fundamental support for oil demand. On the policy front, the Federal Reserve cut interest rates by 25 basis points in September, the first reduction this year, which helps lower borrowing costs and stimulate economic activity. Additionally, a 0.33% decline in the U.S. dollar index makes dollar-denominated crude more attractive to buyers holding other currencies, indirectly supporting demand.

Source: TradingEconomics

This subtle balance of supply and demand forces makes oil prices particularly sensitive to short-term news events, as even minor changes on either side could disrupt the current equilibrium.

Analysts note that the most direct support for oil prices currently comes from two sources: first, supply concerns driven by geopolitical conflict, particularly Ukraine’s attacks on Russian energy facilities, which directly reduce Russia’s refining and export capacity; second, assistance from U.S. weekly inventory data, as recent crude draws suggest that supply-demand fundamentals have so far not exerted strong downward pressure on prices.

High Volatility May Become the New Normal

Future oil price movements are likely to remain primarily driven by the interplay between “geopolitical risk premium” and “supply surplus concerns.” Some market analysts argue that while geopolitical conflicts create risk premiums, such support is often short-lived; the key question is whether the events cause “long-term, large-scale disruptions to actual supply.”

From a fundamentals perspective, the global economy faces significant challenges, and demand growth in the oil market remains moderate, providing limited support to crude prices. On the supply side, OPEC+ production plans have exceeded expectations, and anticipated increases from other producers, including the U.S., continue to exert downward pressure, maintaining the risk of oversupply.

Analysts note that the period around China’s National Day holiday could mark another key window for geopolitical developments, with both the Russia-Ukraine conflict and Iran nuclear negotiations potentially seeing new developments. If tensions in Eastern Europe escalate further, Russian crude and refined product exports could be reduced due to infrastructure disruptions, leaving oil prices exposed to short-term upside risk.

The direction of U.S. Federal Reserve monetary policy will also influence oil prices. Although the Fed cut rates by 25 basis points last week, stronger-than-expected economic data could make the central bank more cautious in future decisions. Traders currently assign an 87.7% probability to a 25-basis-point rate cut at the next meeting, down from nearly 92% a week ago.

Additionally, with the northern hemisphere approaching the winter energy demand peak, the oil market balance will face increased uncertainty. Traders will closely monitor weekly U.S. crude and refined product inventory reports, which serve as a key gauge of supply-demand strength. In the absence of a direct escalation in military conflict, geopolitical factors are unlikely to have a sustained impact on actual crude exports, instead causing primarily short-term disruptions and shifts in export flows.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates