You Need to Watch This Energy Giant That Has Far Outperformed the S&P 500

18:00 October 3, 2025 EDT

Since the start of 2025, the U.S. energy market has been facing both supply-demand imbalances and policy shifts. Vistra Energy Corp. (Vistra), headquartered in Irving, Texas, has leveraged its unique asset structure and market positioning to deliver a stock performance that has far outpaced the broader market—year-to-date, the stock has gained more than 40%, exceeding the S&P 500’s return of roughly 13% by over 30 percentage points.

Source: TradingView

Vistra’s stock performance reflects a combination of rising industry demand, a favorable policy backdrop, and the company’s distinctive competitive advantages. This article will examine energy sector trends alongside Vistra’s fundamentals and market performance, analyzing its growth drivers, financial health, and investment value, while also assessing its strategic positioning and potential opportunities within the energy space.

Industry-Leading in Scale and Financially Sound

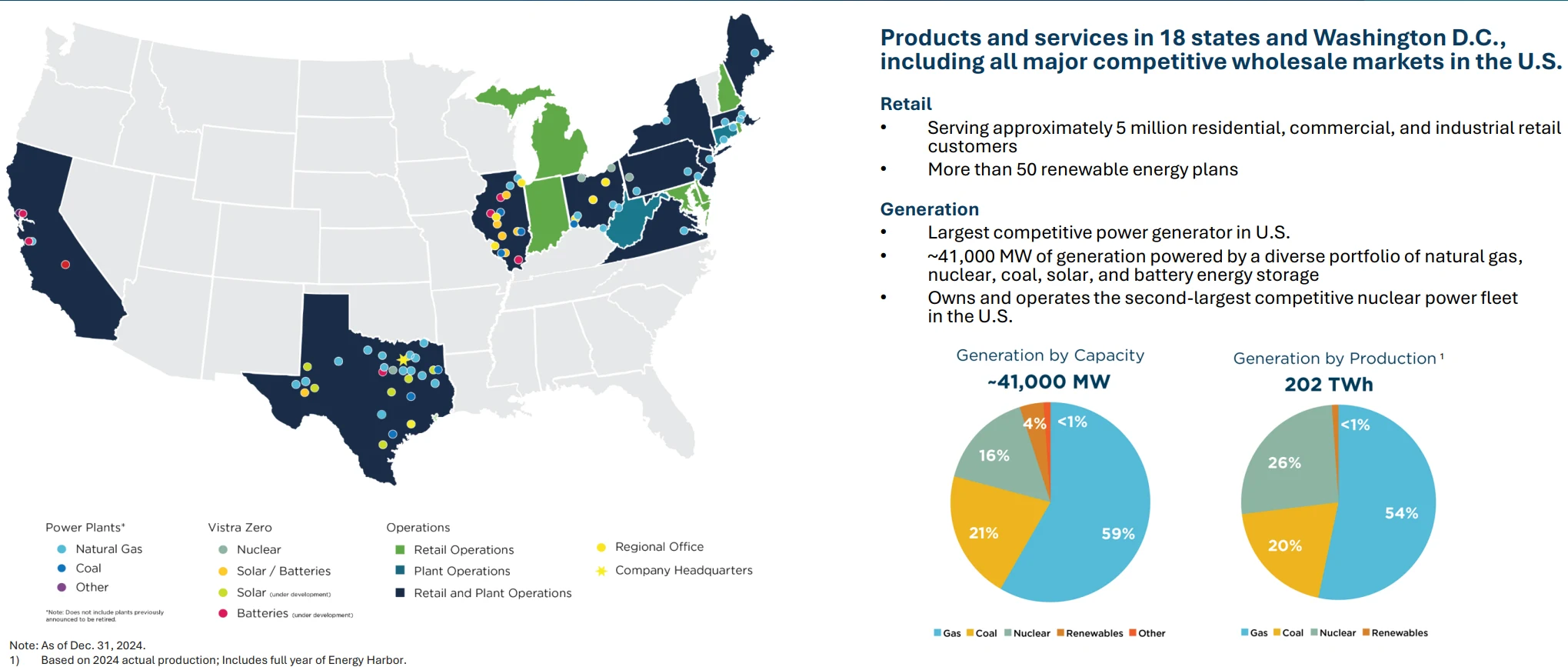

Founded in 2016, Vistra has grown to its current scale through a series of mergers and acquisitions. Today, it operates approximately 41,000 megawatts of generation capacity across key power markets including Texas and the PJM Interconnection, making it one of the largest competitive power generators and electricity providers in the United States.

Source: Vistra

The company’s operations are divided into two main segments: generation and retail. Its generation portfolio includes natural gas (54%), nuclear (26%), coal, and renewable energy. On the retail side, Vistra serves more than 5 million customers through brands such as TXU Energy, offering flexible pricing contracts. This structure allows the company to sell power into wholesale markets while simultaneously securing revenue through retail channels, reducing exposure to price volatility and further strengthening its risk-hedging capabilities.

From a business portfolio perspective, Vistra benefits from both scale and a diversified energy mix. The company’s total installed capacity of 41 GW spans natural gas, nuclear, coal, solar, and storage. Nuclear assets are particularly critical: with four nuclear plants, including Comanche Peak in Texas and Beaver Valley in Pennsylvania, totaling 6.4 GW, Vistra is the second-largest competitive nuclear operator in the U.S. In storage, its Moss Landing Energy Storage Facility in California has a capacity of 750 MW/3,000 MWh, ranking as the world’s largest utility-scale storage project. On the customer side, Vistra’s retail brands serve around 5 million residential, commercial, and industrial users across markets extending from California to Maine, providing a stable base for long-term growth.

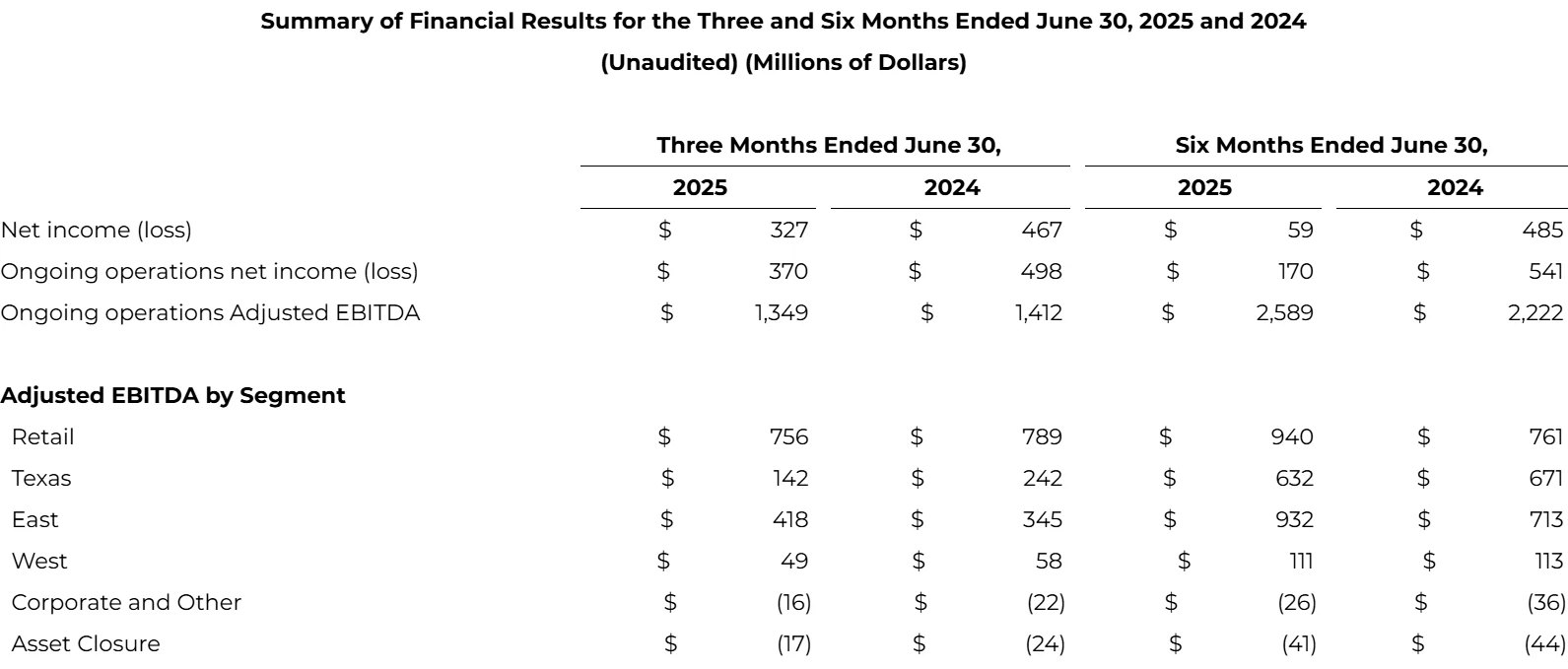

Financial results highlight Vistra’s strong performance. For Q2 2025, GAAP net income came in at $327 million, while operating cash flow reached $1.171 billion. Net income from continuing operations was $370 million, and adjusted EBITDA from continuing operations totaled $1.349 billion.

Source: Vistra

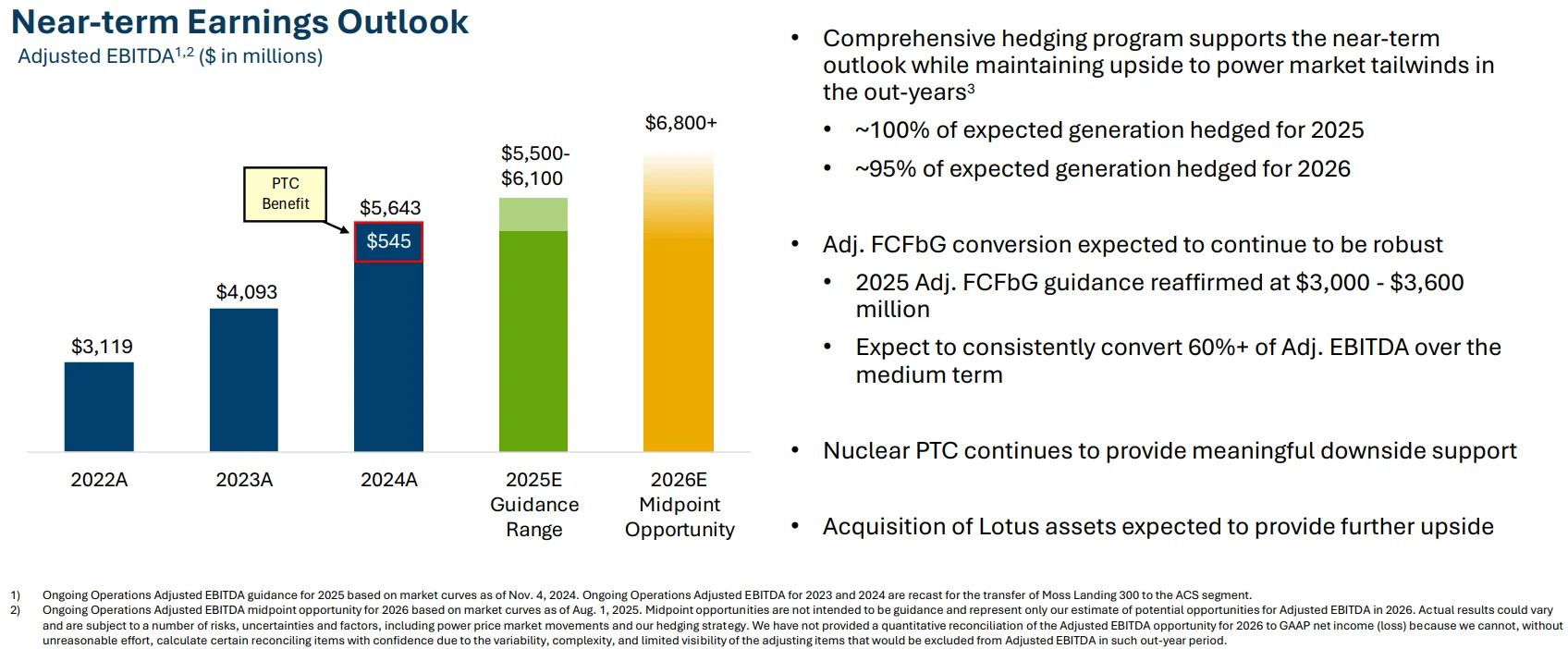

For the full year, Vistra has guided EBITDA in the range of $5.5 billion to $6.1 billion, and has raised its 2026 adjusted EBITDA floor from $6.0 billion to $6.8 billion, with potential upside toward $7.0 billion. Policy support continues to boost profitability—nuclear tax credits added roughly $545 million to EBITDA in 2024, with benefits expected to persist under current legislation.

Source: Vistra

Strategically, Vistra has implemented a series of initiatives that further reinforce its competitive edge. In 2021, the Moss Landing storage facility came online, establishing the company’s leadership in energy storage. In March 2024, the integration of Energy Harbor was completed, adding the second-largest fleet of nuclear plants in the U.S. Meanwhile, Vistra has committed to reducing emissions by 60% by 2030 and achieving net-zero by 2050—targets aligned with the broader energy transition and supportive of the company’s ability to continue outperforming the sector.

Industry Outlook

The U.S. power sector is currently grappling with a supply-demand imbalance: electricity demand is rising rapidly while supply expansion lags behind. Policy preferences toward certain energy categories have created clear growth opportunities for companies with core assets.

A key driver of demand growth is the expansion of the AI industry and data centers. According to Goldman Sachs, in 2025, capital expenditures by Microsoft, Google, and the other two major tech giants are projected to reach $364 billion, with more than $100 billion earmarked for building and expanding data centers. The International Energy Agency forecasts that global data center electricity consumption will rise from 500 TWh in 2024 to 945 TWh by 2030, with AI workloads accounting for as much as 35% to 50% of the increase. In the U.S., data center capacity demand is expected to grow from today’s 35 GW to between 78 GW and 123 GW by 2035, directly driving higher baseload power demand. In the PJM market—the largest wholesale power market in the U.S.—peak summer prices in 2025 are projected to rise 15% to 20% compared with 2024, underscoring tightening supply conditions.

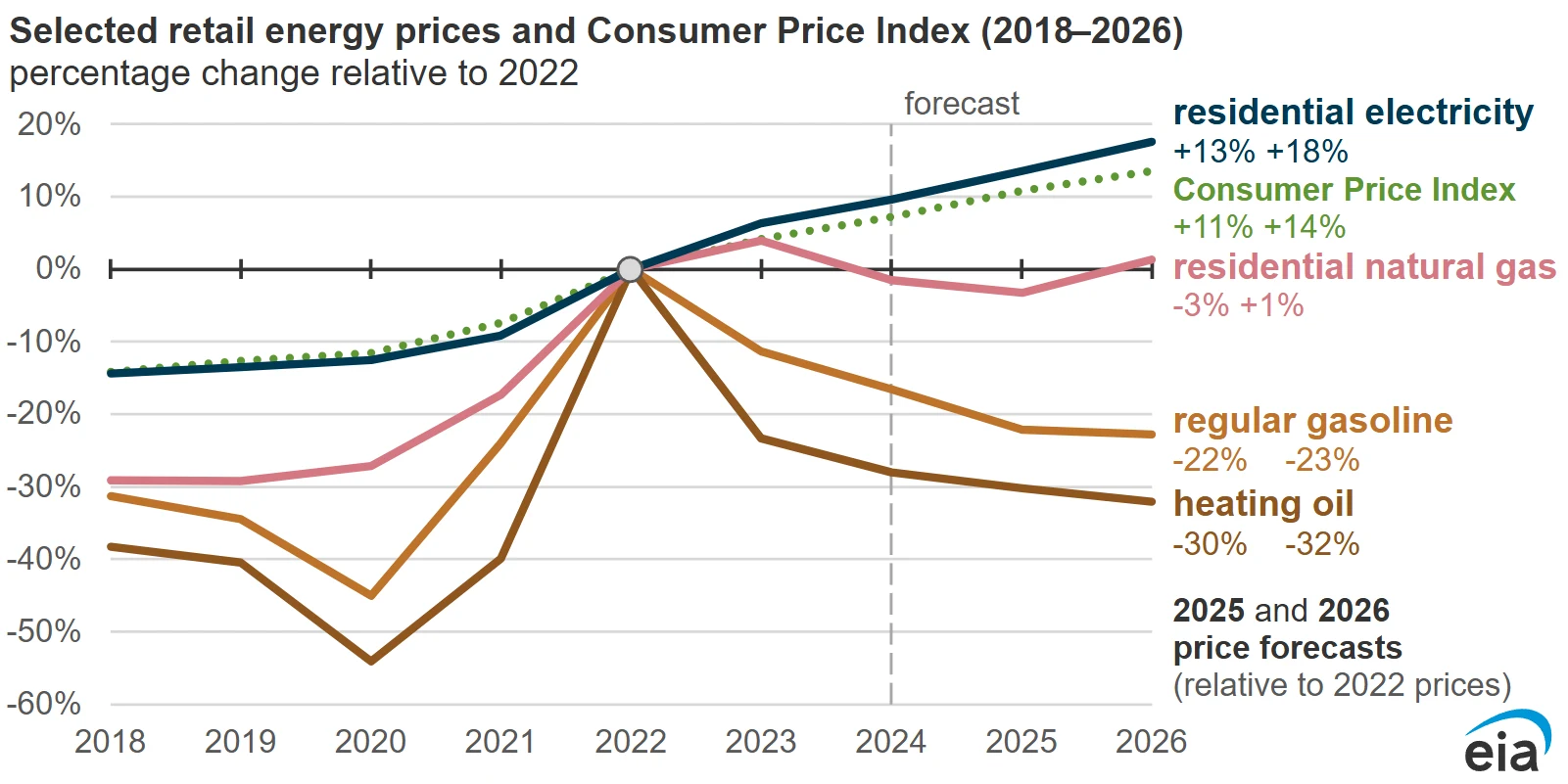

On the supply side, expansion has been slow. Many solar and wind projects have been canceled due to financing hurdles and frequent policy changes. The Department of Energy has even warned that, absent a faster buildout of generation capacity, the number of U.S. blackout events could double by 2030. The supply-demand imbalance has kept electricity prices on an upward trajectory. Data from the U.S. Energy Information Administration show that since 2020, average residential power prices have climbed more than 30%. Carnegie Mellon University projects that by 2030, nationwide average electricity bills will rise another 8%, while in data center–heavy regions such as Virginia, costs could increase by as much as 25%.

Source: U.S. Energy Information Administration

Policy support has also provided long-term tailwinds for nuclear operators. The “Build Beautiful Act,” which took effect in 2025, revised tax credits for solar and wind but extended nuclear incentives through 2036. With the U.S. government showing a favorable stance toward nuclear energy, Vistra stands as one of the key beneficiaries of these policy incentives, further strengthening its market position and profitability within the sector.

Vistra’s Competitive Advantages

Against the backdrop of industry tailwinds and policy support, Vistra’s competitive edge is underpinned by three key pillars: scarcity, capacity flexibility, and risk-hedging through a diversified energy mix.

First, the scarcity of nuclear assets forms Vistra’s core moat. Nuclear accounts for roughly 20% of total U.S. power generation, yet new nuclear facilities have been virtually absent since 1996, making existing assets highly scarce. Vistra operates 6.4 GW of nuclear capacity, positioning it as the second-largest competitive nuclear operator in the U.S., ahead of peers such as Talen Energy, which has 2.2 GW. Nuclear assets benefit from low, stable operating costs and federal tax credits. During periods of rising electricity prices, their profit elasticity is markedly stronger than that of fossil fuel–based generators.

Source: Vistra

For example, when wholesale power prices increase from $50/MWh to $80/MWh, nuclear operators can see margin expansion up to 1.5 times greater than fossil-based peers. This profit elasticity has been a key driver of Vistra’s stock outperformance relative to the broader market.

Second, Vistra’s capacity flexibility enables it to respond swiftly to rising demand. While its nuclear fleet is running near full capacity, utilization rates at its natural gas and coal-fired plants remain at around 63% or lower, leaving significant spare capacity. In today’s high-price environment, the company can ramp up fossil generation to meet incremental demand from AI data centers and other new loads, capturing a “price plus volume” dual profit driver. Such flexibility is particularly valuable in a tight supply-demand market, allowing Vistra to maximize industry upside while sustaining earnings growth above the market average.

Finally, Vistra’s diversified energy portfolio provides robust risk-hedging capabilities. Natural gas accounts for 54% of installed capacity, offering flexibility to manage short-term load fluctuations. Nuclear represents 26%, providing stable baseload generation alongside policy incentives. Storage assets help mitigate the intermittency of wind and solar, improving grid integration efficiency.

This mix insulates the company from single-fuel price volatility. For instance, in the event of international natural gas price spikes, nuclear and storage assets can offset cost pressures while simultaneously meeting grid requirements for reliability and decarbonization.

Wall Street Is Generally Bullish

Looking back, Vistra’s stock has posted three consecutive years of gains: up 70% in 2023, more than 260% in 2024—making it one of the top-performing stocks in the S&P 500—and nearly 50% year-to-date in 2025. This growth has closely tracked key industry inflection points, including tightening supply-demand dynamics, rising power prices, and the rollout of nuclear policy incentives.

For instance, following the completion of its Energy Harbor integration in March 2024, Vistra’s nuclear capacity doubled, and the stock gained 23% in the second quarter alone—underscoring the direct impact of asset value expansion on share performance.

Source: TradingView

Short-term volatility has been largely sentiment-driven and sector-related, without altering the long-term thesis. In early 2025, Vistra shares plunged nearly 29% in a single session amid turbulence triggered by DeepSeek’s AI breakthrough in the tech sector, but recovered more than half of the decline within a month. This highlights the market’s return to core fundamentals of rising power demand and the scarcity value of nuclear assets.

As of September 25, 2025, Vistra’s stock traded at $201.62, with a market capitalization of $68.31 billion. Its forward valuation appears well aligned with 13% earnings growth, suggesting no evident signs of a bubble relative to peers.

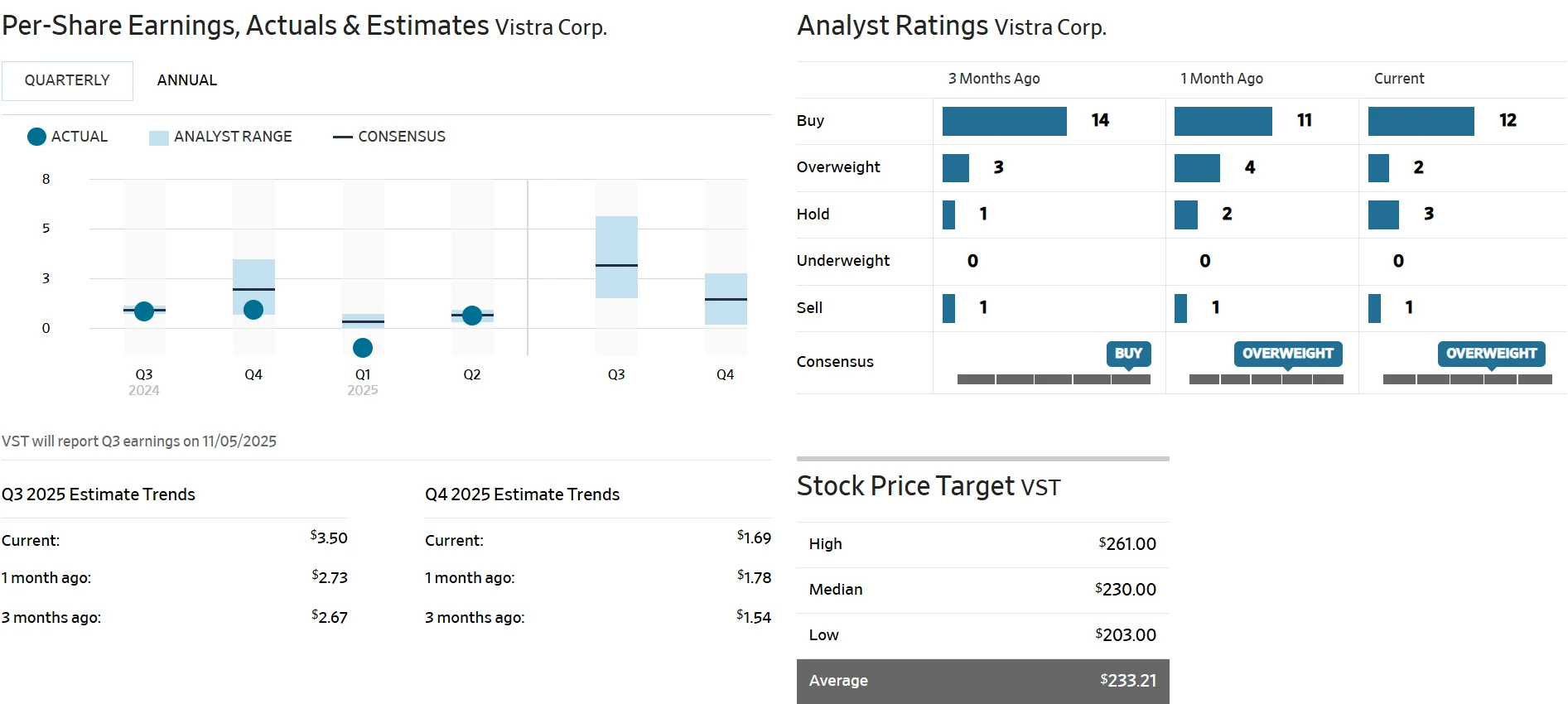

Vistra has also drawn broad support from Wall Street analysts. According to The Wall Street Journal, 18 analysts have covered the stock in the past three months, with 12 rating it a “Buy”—a rare level of consensus within the energy sector. Their average price target stands at $233.21, implying nearly 16% upside from current levels. If realized, Vistra’s performance gap versus the S&P 500 could widen further.

Source: WSJ

Optimistic institutions have continued to lift estimates. JPMorgan raised its price target from $227 to $248 while maintaining an “Overweight” rating. Scotiabank initiated coverage with a “Sector Outperform” and a $256 target. Even Jefferies, taking a relatively cautious stance by downgrading to “Hold,” still set its target at $230—above the current price—indicating a steady expectation of long-term outperformance.

Differences among analysts are largely focused on short-term volatility risks, while the core fundamentals remain consistent. Jefferies flagged the potential for near-term pullbacks tied to tech-sector fluctuations, but reaffirmed the underlying logic of nuclear asset value and rising power prices. Most firms emphasize long-term value, citing Vistra’s capacity flexibility and policy tailwinds as drivers of potential earnings outperformance in the next cycle of rising electricity prices.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates