Global AI Expenditure Soars, Driving a New Growth Phase in Semiconductors

20:00 October 1, 2025 EDT

Key Points:

Driven by the AI wave, the semiconductor industry has continued to perform strongly so far in 2025. Year-to-date, the Philadelphia Semiconductor Index has risen nearly 27%, more than double the return of the S&P 500.

The sector’s momentum is closely linked to AI investment, and whether the current high growth can be sustained depends primarily on two factors—demand scale and growth pace.

Over the long term, the AI-driven enthusiasm for semiconductor stocks is expected to continue, but the growth pattern is likely to shift from “broad-based gains” to “structural differentiation.”

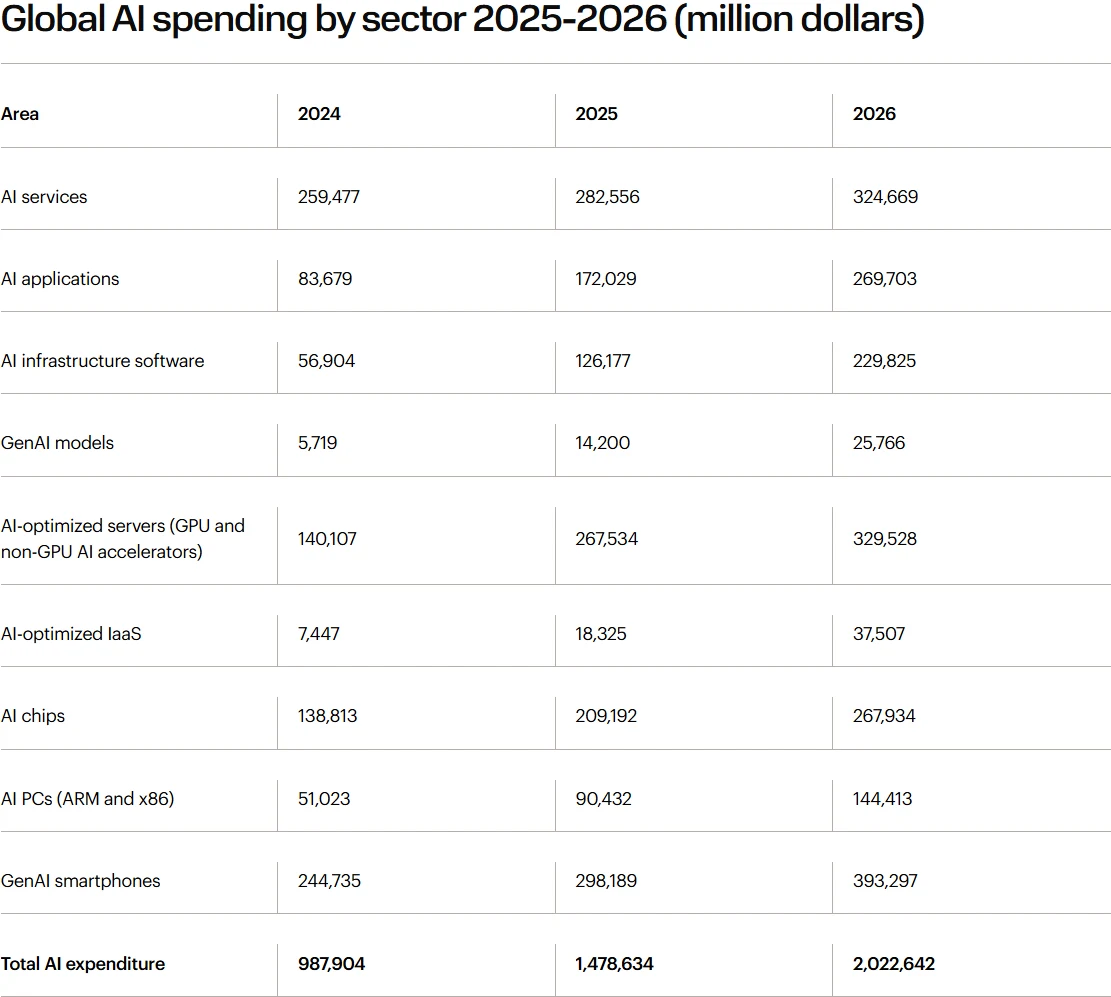

In 2025, global AI spending is projected to reach $1.5 trillion, up significantly from $987.9 billion in 2024. This growth is largely driven by the expansion of AI infrastructure, including sustained investments by major cloud service providers in AI-optimized hardware and GPUs.

Fueled by the AI wave, the semiconductor industry has shown robust performance. Year-to-date, the Philadelphia Semiconductor Index has gained nearly 27%, more than twice the overall U.S. stock market return. Individual companies have performed even better, with Broadcom up 47% and NVIDIA up 31% this year.

Source: TradingView

This wave of growth reflects market optimism about the prospects for AI applications and underscores the central role of AI-related semiconductor products in key areas such as data centers, cloud computing, and high-performance computing. Analysts note that the continued rise in AI compute demand has pushed the semiconductor industry into a rapid expansion phase after the volatility of 2023–2024. At the same time, this growth carries potential uncertainties, including capex base effects, industry cyclicality, and valuation pressures in certain subsectors.

Global AI Investment Scale and Structure

According to the latest Gartner forecast, global AI spending is expected to reach $1.5 trillion in 2025, up significantly from $987.9 billion in 2024, and is projected to surpass $2 trillion in 2026. This growth reflects the accelerated penetration of AI technologies in enterprise applications, cloud computing, and emerging industries, as well as continued corporate investment in data-driven decision-making and intelligent operations. Analysis indicates that the increase in spending is concentrated in three main areas: AI services, AI application software, and AI-optimized servers.

Source: Gartner

In the AI chip segment, the global AI semiconductor market is projected to jump from $138.8 billion in 2024 to $209.2 billion in 2025, and further to $267.9 billion in 2026, representing substantial year-on-year growth. The strong demand for AI chips is underpinned by the expansion of data center capacity and continued investment in high-performance computing by hyperscale enterprises. Companies including Microsoft, Amazon, Google, Meta, and Oracle are expected to invest $450 billion annually in AI infrastructure by 2027, nearly double the 2023 level.

Analysis by UBS Wealth Management shows that global AI capital expenditure will grow 67% year-on-year to $375 billion in 2025, rise to $500 billion in 2026, and reach $960 billion by 2030. Notably, capex growth is not limited to hardware procurement, but also encompasses data center construction, network upgrades, and AI algorithm development, indicating synchronized expansion across the AI industry value chain.

By segment, AI application software spending is expected to see the most significant growth, increasing from $83.7 billion in 2024 to $172 billion in 2025, effectively doubling. This highlights rapidly rising enterprise demand for automation, intelligent analytics, and AI-driven business decision-making.

At the same time, spending on AI-optimized servers—including both GPU and non-GPU accelerators—will rise from $140.1 billion to $267.5 billion, gradually accounting for a larger share of the overall AI chip market. The continued expansion of high-performance computing and AI-dedicated servers provides chip designers and manufacturers with a stable source of orders, while also enhancing the investment value of semiconductor equipment and materials segments.

Current Performance of the Semiconductor Industry

In the summer of 2025, the semiconductor industry showed a marked rebound. Research indicates that the world’s top 60 semiconductor companies achieved 9% quarter-on-quarter revenue growth in Q2 2025, with Q3 growth expected to remain around 8% quarter-on-quarter. This trend suggests that, driven by continued demand for AI and high-performance computing, the semiconductor industry is emerging from the previous short-term adjustment cycle.

By segment, performance shows some variation. The memory sector saw 25% quarter-on-quarter revenue growth in Q2 2025, reflecting both volume and price increases, driven by data center expansion and sustained enterprise storage demand. The packaging and testing segment posted 9% quarter-on-quarter revenue growth, with Q3 expected to reach 14% quarter-on-quarter, indicating rising demand for advanced packaging technologies such as CoWoS and InFO in high-performance chip production.

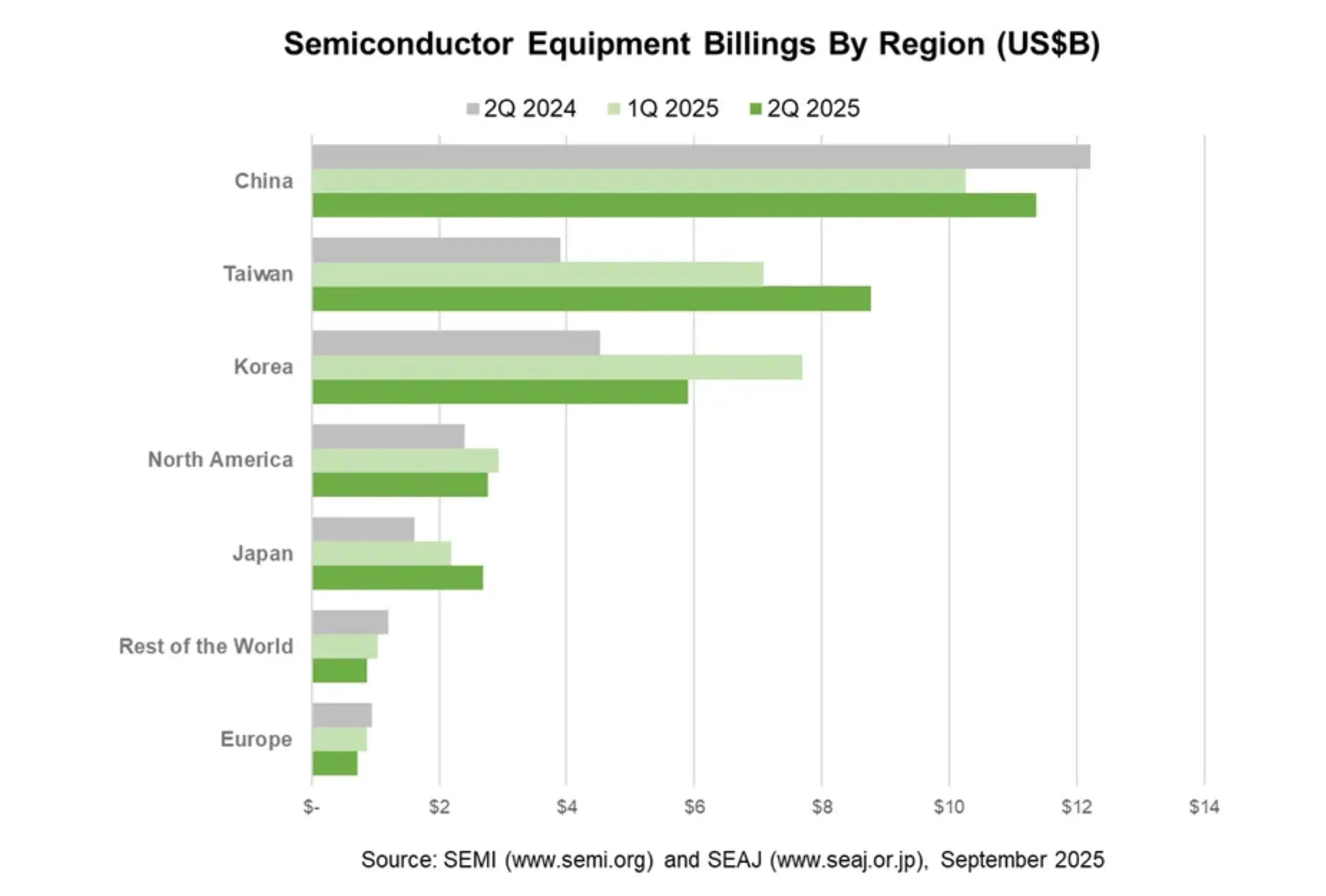

The semiconductor equipment market also maintained its growth momentum. SEMI data show that global semiconductor equipment shipments reached $33.07 billion in Q2 2025, up 24% year-on-year. The China mainland market performed particularly strongly, with equipment sales reaching $11.36 billion, up 11% quarter-on-quarter, representing roughly 34.4% of the global market—exceeding one-third of the worldwide total for the first time. This again underscores China’s rapid expansion in semiconductor manufacturing investment and industrial upgrading.

Source: SEMI

In the capital markets, the Philadelphia Semiconductor Index rose 8% in Q2 2025. Currently, the U.S. semiconductor sector’s price-to-earnings ratio is near a 25-year high, reflecting investor optimism about the industry’s prospects and AI-driven growth, while also signaling potential valuation pressures.

AI-Driven Demand Dynamics

AI technology iteration and application penetration have created a new demand growth curve for the semiconductor industry.

Analysts predict that global hyperscale enterprises—including Microsoft, Alphabet, Amazon, Meta Platforms, and Oracle—are expected to double their total annual AI investment from $150 billion in 2023 to $450 billion by 2027. Continued investment by cloud computing giants in data center expansion and AI compute infrastructure will provide stable demand for semiconductor chips, servers, and high-performance computing equipment.

In the Chinese market, AI infrastructure investment is also accelerating. Alibaba recently announced a ¥380 billion AI infrastructure plan, including data center expansion, GPU server procurement, and AI algorithm-optimized hardware deployment. Huawei unveiled a three-year roadmap for its Ascend AI chips, aiming to continuously enhance in-house capabilities for high-performance AI training and inference. These initiatives will directly drive local demand for semiconductor design, manufacturing, and packaging equipment.

Technological progress also supports industry growth. Rising demand for AI servers, high-performance computing platforms, and advanced packaging technologies is boosting orders for core manufacturing processes such as etching, thin-film deposition, and wafer cleaning. Semiconductor manufacturers are upgrading processes and expanding capacity to meet the high-performance and compute requirements of AI chips.

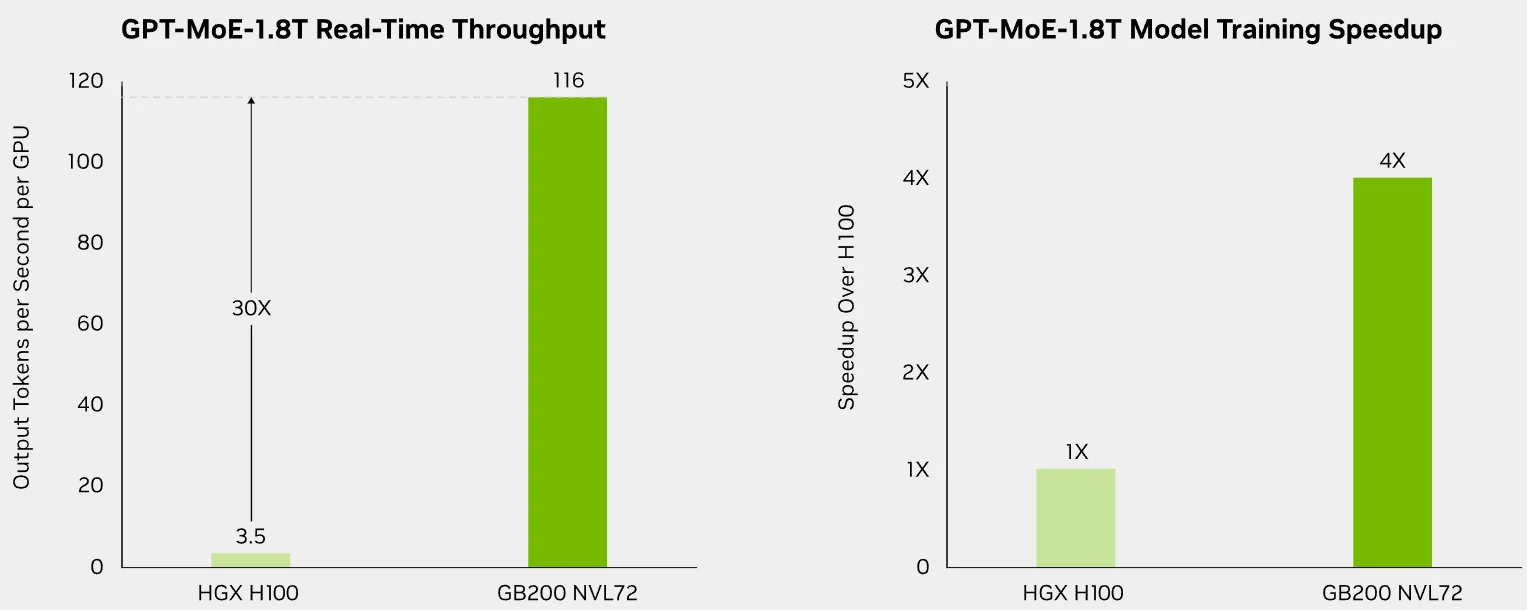

For example, NVIDIA’s Blackwell B200 chip integrates 208 billion transistors, a 2.6-fold increase over the previous generation, with AI task processing speeds up 30 times, making it a core component of current compute infrastructure. AMD’s Instinct MI350 series, built on TSMC’s 3nm process, integrates 185 billion transistors, achieving peak performance of 20 PFLOPS at FP4/FP6 precision and capable of running 520 billion-parameter large-scale models, with inference performance 35 times higher than the prior generation. Technological iteration directly translates into product competitiveness, driving rapid expansion of the AI chip market.

Source: NVIDIA

In addition, emerging application areas such as automotive electronics, industrial IoT, and smart home devices are providing incremental demand for the semiconductor industry. Although overall consumer electronics demand has not fully recovered, products such as AI chips, power devices, and sensors continue to benefit from the expansion of AI and automation applications. Diversified application scenarios offer broader growth opportunities for the industry and enhance semiconductor companies’ resilience to cyclical fluctuations.

Risks

Although AI investment provides sustained growth for the semiconductor industry, the market still faces a range of potential risks.

First, base effects may begin to emerge. With AI-related capital expenditure already reaching hundreds of billions of dollars, future growth rates are unlikely to maintain previous high levels. Even if absolute spending continues to increase, annualized growth may slow, potentially putting pressure on overall industry profit growth and stock performance.

The semiconductor industry’s inherent cyclical characteristics pose another constraint on the sustainability of the AI boom. Historical data show that global semiconductor market cycles of boom and bust average around four years, closely related to the capacity expansion and supply adjustment cycles required for companies to respond to shortages. Even with AI-driven demand, fluctuations in demand or overcapacity may occur in the coming years, leading to cyclical declines in prices and margins.

In addition, elevated valuation levels increase market sensitivity. In the U.S., for example, the Philadelphia Semiconductor Index’s current PE ratio is near a 25-year high, with some leading stocks showing significant gains. High valuations amplify market volatility to some extent, requiring investors to exercise caution while pursuing returns.

Source: TradingView

Geopolitical factors also add uncertainty. The global semiconductor supply chain is highly dependent on specific countries and regions, and trade policies, tariff adjustments, and technology export restrictions could disrupt supply chains, creating risks of higher costs or capacity constraints. At the same time, intensified competition in core semiconductor technologies among countries may trigger market segmentation and technology barriers, further increasing industry uncertainty.

Undeniably, the AI investment boom has provided unprecedented growth momentum for the semiconductor industry, but investors still need to comprehensively consider the potential impact of base effects, industry cycles, valuation levels, and geopolitical risks. In such an environment, companies with technological barriers and market leadership, such as TSMC and NVIDIA, are better positioned to mitigate certain risks through scale advantages and differentiated products. Nevertheless, the overall industry is still likely to experience volatility.

Conclusion

In the long term, the AI-driven boom in semiconductor stocks is expected to continue, but the growth pattern is likely to shift from broad-based gains to structural differentiation.

On the demand side, the compute requirements driven by AI implementation are long-lasting. Capital expenditure plans by hyperscale enterprises, along with sustained investment in the private market, are expected to support double-digit compound growth for the AI chip market through 2030, with growth resilience far exceeding the cyclical fluctuations seen during the mobile internet era. IDC forecasts indicate that AI will drive the global semiconductor market to surpass $1 trillion around 2030, becoming the industry’s core engine.

However, growth faces constraints. Base effects will slow growth rates, gradually reducing corporate profit growth, while industry cycle fluctuations may trigger periodic corrections. This implies that semiconductor stocks are unlikely to sustain the explosive gains seen in 2023–2024, with future performance expected to show significant divergence.

In this context, companies with core technological advantages, foundry firms with advanced manufacturing capabilities, and leading equipment and materials providers are likely to hold an edge amid the differentiation. Conversely, companies lacking technological barriers and relying on low- to mid-end markets may face the dual pressures of slowing growth and valuation corrections.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates