Robust Economic Data Weighs on Rate-Cut Expectations: What Are the Odds the Fed Continues Easing?

23:08 September 25, 2025 EDT

Key Points:

The final reading of the U.S. core PCE price index for Q2 was revised up to an annualized 2.6%, above both expectations and the prior 2.5%. At the same time, Q2 real GDP annualized quarter-on-quarter growth was sharply revised up to 3.8%, well above the forecast and the previous 3.3%, marking the strongest performance since Q3 2023.

The data underscore an overall picture of “strong growth, elevated inflation, and relatively stable employment” in the U.S. economy. This stands in stark contrast to prior market expectations of a “moderate slowdown,” significantly reducing the near-term necessity for another rate cut.

Looking ahead, if economic growth remains robust and inflation stays elevated, the Federal Reserve may delay the pace of further monetary easing.

On September 25 (ET), a series of key U.S. economic indicators released by the Bureau of Economic Analysis (BEA) and the Department of Labor came in stronger than expected, signaling continued resilience in the U.S. economy alongside persistent inflationary pressures.

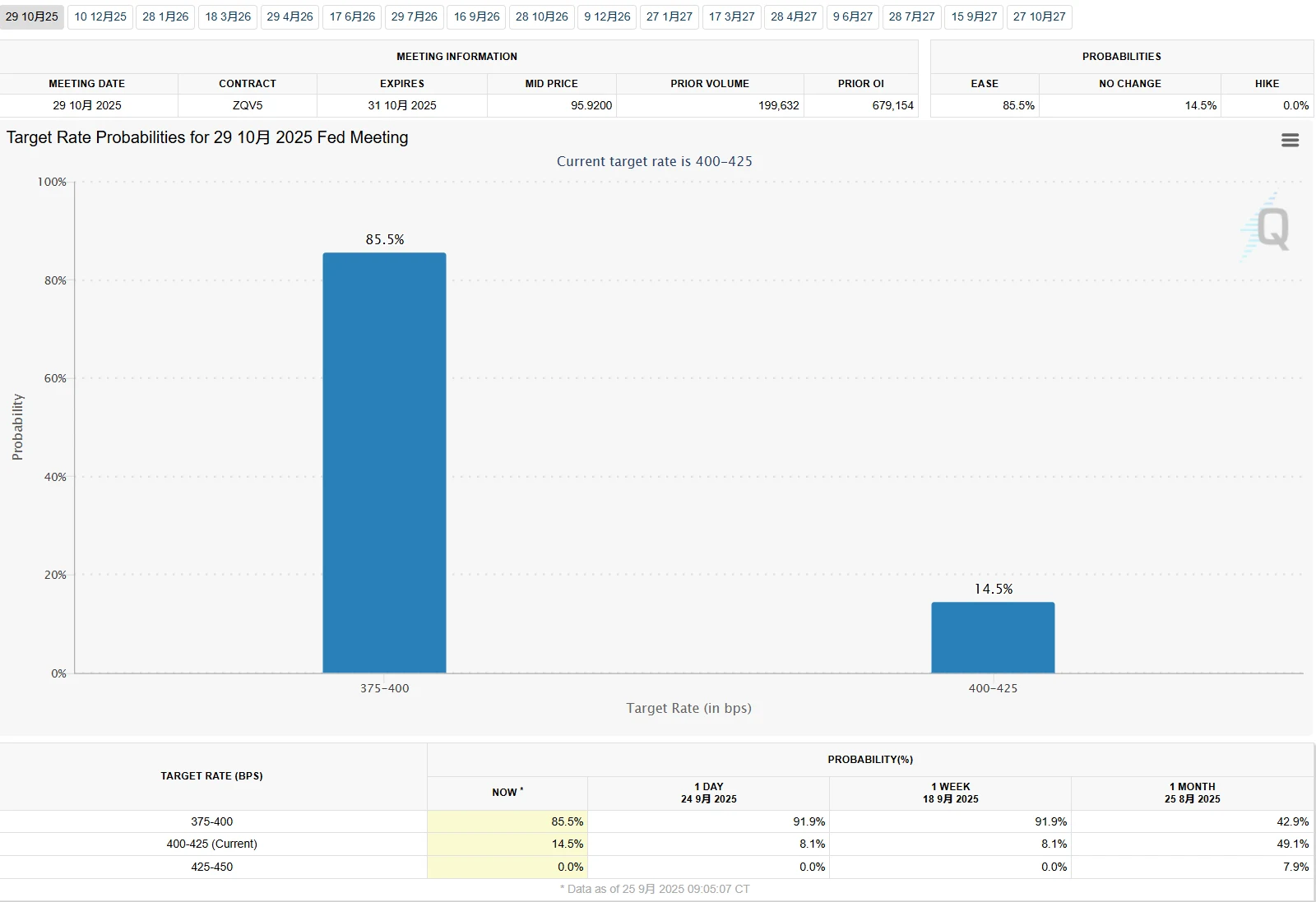

This trend has directly challenged earlier market optimism about a potential Fed rate cut in October. According to the CME FedWatch Tool, the probability of a 25-basis-point cut at the October FOMC meeting has dropped from over 90% in recent days to 85.5%, while the odds of holding rates steady have risen to 14.5%.

Source: CME Group

Key Economic Data Surpasses Expectations

A series of economic data reflect the current overall picture of the U.S. economy as “strong growth, high inflation, and relatively stable employment.” This stands in sharp contrast to the earlier market expectation of a “moderate slowdown,” thereby significantly reducing the necessity for another rate cut in the short term.

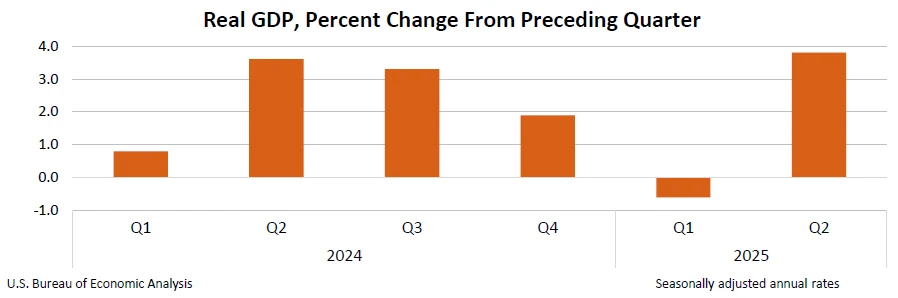

According to the BEA, the final reading of U.S. real GDP for the second quarter was revised up by 0.5 percentage points to an annualized 3.8% quarter-on-quarter, higher than both expectations and the prior 3.3%, marking the fastest pace since the third quarter of 2023 (4.7%).

Source: BEA

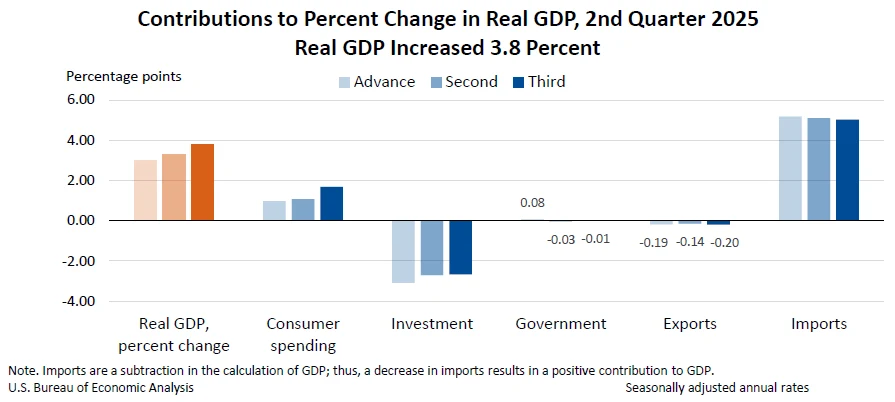

Personal consumption expenditures became the core driving force of growth, contributing 1.68 percentage points to the 3.8% GDP increase, nearly half of the overall expansion and well above the 1.07 percentage points in the advance estimate. This shows that household spending on durable goods and healthcare services has been far more resilient than expected, indicating that U.S. consumer vitality remains strong.

Source: BEA

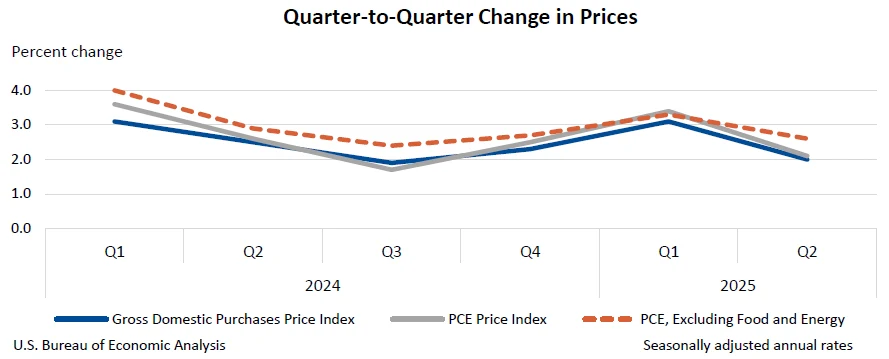

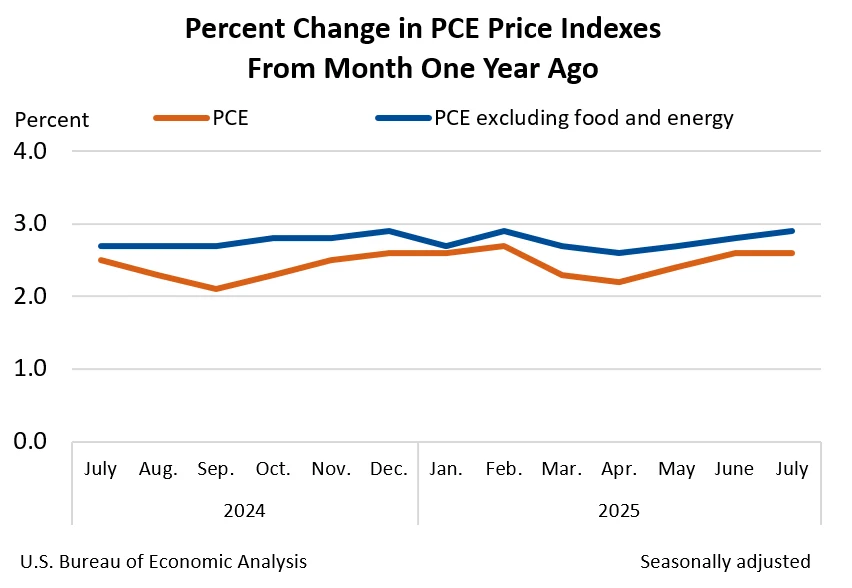

Inflation data also came as a surprise. As the Fed’s most closely watched inflation gauge, the core PCE price index for the second quarter was revised up by 0.1 percentage points to an annualized 2.6%, above the 2% policy target; at the same time, the headline PCE price index was also revised higher to 2.1%, ending two consecutive quarters of decline. Persistently high inflation has placed greater pressure on monetary policymakers.

Source: BEA

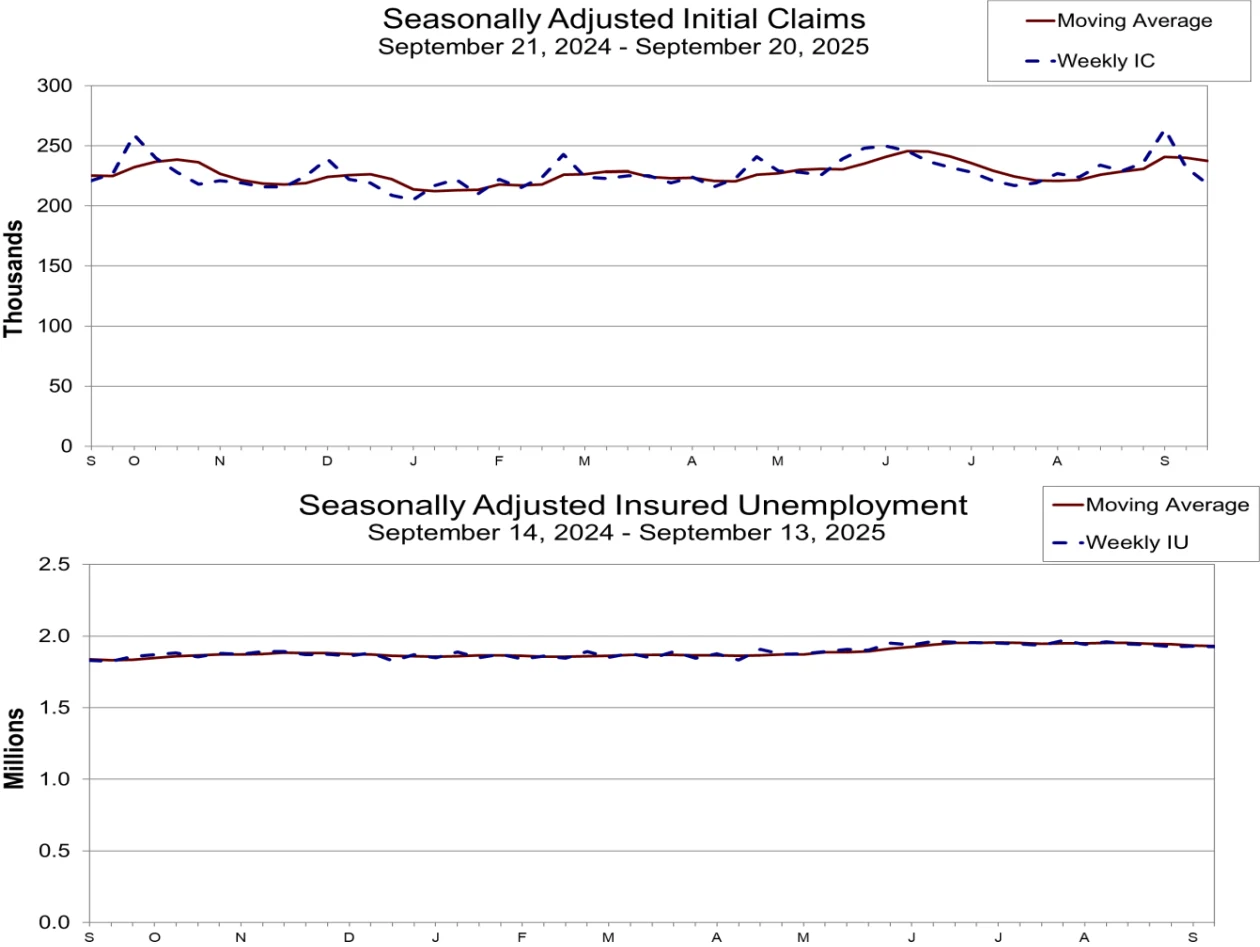

The labor market also delivered positive signals. Data from the U.S. Department of Labor showed that for the week ending September 20, seasonally adjusted initial jobless claims fell to 218,000, down 14,000 from the prior week, the lowest level since July and well below the market expectation of 235,000. This indicates that companies’ willingness to lay off workers remains at historically low levels and suggests that the labor market may not be cooling as quickly as anticipated.

Source: U.S. Department of Labor

But in the medium to long term, signs of weakness are gradually emerging: Fed Vice Chair Bowman noted that since April, average monthly job growth in the U.S. has been only around 25,000, far below the 150,000 pace earlier this year; meanwhile, under the impact of tariff policies, U.S. manufacturing lost 12,000 jobs in August and a cumulative 42,000 since April, with durable goods producers being the hardest hit.

This divergence makes the Fed’s assessment of the labor market more complex and reduces the urgency to cut rates due to employment pressures.

Deepening Internal Divisions

Amid a complex economic landscape, divisions within the Federal Reserve have further intensified. Recent public remarks by several officials reveal that the FOMC (Federal Open Market Committee) has effectively split into two camps—those prioritizing inflation and those prioritizing employment. Recent personnel changes have further amplified the impact of these divergences.

Kansas City Fed President Schmid and Atlanta Fed President Bostic see sticky inflation as the primary policy risk at present and have openly opposed further rate cuts in October. Schmid stated that the current federal funds rate of 4%–4.25% is only “slightly restrictive” and must be maintained to suppress inflation, while warning of the possibility that inflation could rebound to 3%. Bostic likewise remarked, “I am more concerned about inflation staying persistently above target, so I do not plan to support a rate cut in October.”

Chicago Fed President Goolsbee, while not ruling out rate cuts entirely, also emphasized that “cutting aggressively and prematurely on the basis of softening labor market data carries risks.” He argued that action should wait until inflation clearly moves back toward the 2% trajectory. He also pointed out that the current environment shows signs of a “stagflationary shock,” calling it the greatest challenge to the Fed’s dual mandate.

Fed Vice Chair Bowman and newly appointed Governor Milan, however, place greater emphasis on labor market fragility, viewing this risk as outweighing inflation and arguing that proactive rate cuts are needed to stabilize the economy.

Bowman noted that the slowdown in job growth since April suggests the labor market is weaker than expected, while inflation is already “close enough” to the 2% target. She described the price impact of tariffs as a one-off shock, arguing that “it is time for the Committee to take decisive, proactive action.”

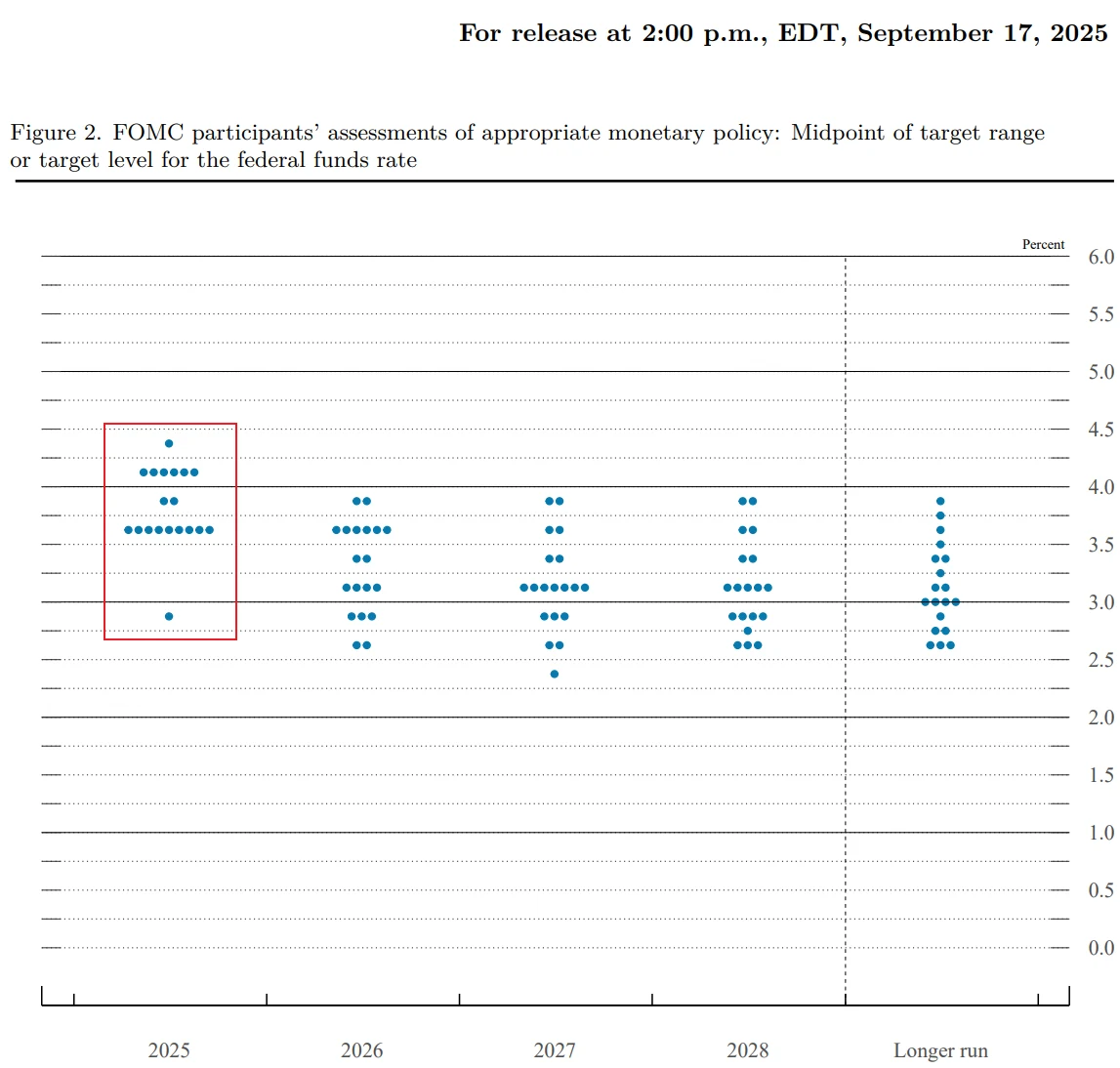

Milan has adopted an even more aggressive stance. As the only dissenting vote in last week’s FOMC meeting, he advocated for rapid easing through “50 basis points at a time, totaling 150–200 basis points,” to bring rates back to neutral. He believes the current policy rate is well above his estimate of a 2.5% neutral rate, and that excessive tightening could trigger a “sudden deterioration” in the labor market. Notably, Milan was nominated by President Trump and confirmed by the Senate on September 15 by a narrow 48–47 vote. His policy stance has been widely interpreted as closely aligned with Trump’s calls for aggressive rate cuts.

Source: Federal Reserve

San Francisco Fed President Daly has taken a middle ground leaning dovish, saying that “further cuts may be needed over time,” while stressing the need to balance both inflation and labor market signals.

At a deeper level, the divisions stem from differing judgments about the neutral rate and the relative weight assigned to the Fed’s dual mandate. Milan pegs the neutral rate at 2.5%, while the median estimate among Fed officials is 3%. Some policymakers continue to prioritize the fight against inflation, while others are more concerned about the drag of high rates on growth. Chair Powell’s remarks at the September FOMC meeting also reflected this balancing act. He acknowledged that “inflation remains above target” while also noting that “employment risks are rising,” but refrained from signaling a clear policy direction.

In addition, some officials are shifting their attention toward reforms of the Fed’s policy framework itself, underscoring the challenges of adapting existing tools to current market structures. Dallas Fed President Logan has proposed abandoning the “outdated” federal funds rate in favor of the Tri-Party General Collateral Rate (TGCR) as the new policy rate. She argued that TGCR covers over $1 trillion in daily transactions, providing far more efficient transmission than the federal funds market, where daily volumes are under $100 billion, making it better suited to today’s monetary market structure.

Fed Governor Barr, meanwhile, has focused on financial stability, calling for stress testing and regulatory capital requirements for banks to be separated. He argued that such a move would enhance the “dynamism and rigor” of stress tests and prevent a loosening of regulation from increasing vulnerabilities in the financial system.

Political Pressure and the Fed’s Independence

One factor that cannot be ignored is the ongoing escalation of tensions between U.S. President Trump and the Federal Reserve.

On August 25, Trump publicly announced the dismissal of Fed Governor Lisa Cook, citing alleged false statements in mortgage applications. Cook subsequently filed a lawsuit and continued to perform her duties.

On September 26 (ET), Cook’s legal team submitted documents to the Supreme Court, warning that her removal could bring “chaos and disruption” to financial markets. The lawyers emphasized that this would “sound the death knell for central bank independence, which has helped make the U.S. economy the strongest in the world.”

Source: Federal Reserve

Looking at the background, since returning to the White House, Trump has repeatedly criticized the Fed for “not cutting rates fast enough” and has sought to influence policy through personnel changes: nominating Milan to the Fed Board and dismissing Cook under the pretext of “mortgage fraud.” These actions have been widely interpreted as clear signals of political interference in monetary policy.

If Cook were successfully removed, Trump would have the opportunity to appoint a fourth member to the Fed’s seven-member board, achieving an outright majority. Analysts warn that this could lead to Fed decisions being more influenced by political considerations, potentially affecting the dollar’s status as the global reserve currency.

Final Thoughts

In the coming months, Federal Reserve decisions are expected to rely more heavily on incoming data. The August PCE report, to be released this Friday, is particularly critical. Economists forecast that headline PCE will increase 2.7% year-over-year, while core PCE is expected to rise 2.9% year-over-year. If the data again exceed expectations, the room for rate cuts will be further constrained.

Source: BEA

The employment reports for September and October will serve as key references for the Fed’s October meeting. A continued slowdown in the labor market could strengthen dovish arguments for a rate cut.

If the labor market continues to soften and inflation shows a clear downward trend, the Fed may proceed with 25 basis-point cuts in both October and December as planned. However, if economic growth remains strong and inflation stays elevated, the Fed may delay further easing.

Chair Powell has repeatedly emphasized that the Fed operates in a “two-way risk” environment: cutting rates too much or too quickly could make it difficult for inflation to return to the 2% target, while maintaining restrictive policy for too long could unnecessarily weaken the labor market. Moreover, with Powell’s term set to end next year, the independence and direction of U.S. monetary policy may face even greater tests.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates