New Opportunities Emerging in the U.S. Equity Market

18:00 September 30, 2025 EDT

The U.S. small-cap market is entering a phase of recovery.

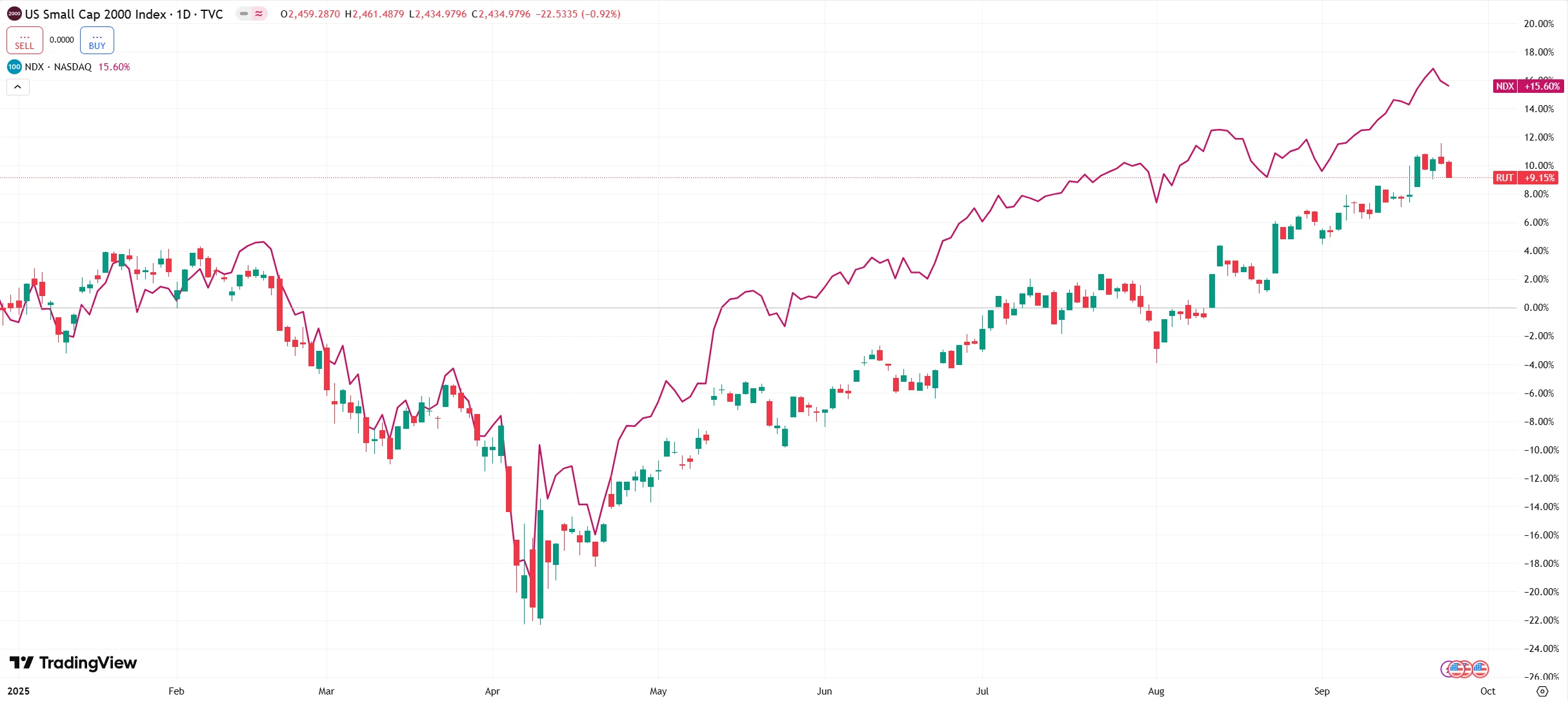

On September 18, 2025, the Russell 2000 Index — the primary benchmark for small-cap stocks — reached its highest level since 2021. Year-to-date, its gains have been steadily narrowing the gap with those of the Nasdaq 100, which is dominated by mega-cap technology companies. This trend reflects a shift in market structure, with investors showing renewed interest in small-cap equities.

Source: TradingView

Against the backdrop of the Federal Reserve’s renewed easing cycle, the divergence between the Russell 2000 and the Nasdaq 100 is expected to widen further. The market’s key focus now lies in the valuation gap: while the “Magnificent Seven” tech giants continue to trade at elevated multiples, small-cap stocks remain at deeply discounted levels. With supportive policy conditions and improving fundamentals, whether small caps can break through their market-cap constraints and deliver sustained outperformance has become one of the central questions for investors.

Valuation Advantages at Historical Lows

U.S. small-cap stocks are currently exhibiting a pronounced relative valuation advantage, a characteristic that has become a key rationale for investors’ portfolio allocation decisions.

As of September 2025, the S&P 500 Index trades at an expected forward P/E of approximately 22.5x for the next 12 months, well above its long-term average of 16.8x since 2000, indicating that large-cap stocks — particularly the tech giants — remain at historically elevated valuations. By contrast, the S&P 600 Index, a representative benchmark for small-cap stocks, has a forward P/E of just 16x, pushing the valuation gap between large and small caps close to the highest levels of the past decade. This discrepancy highlights an overly optimistic market expectation for large-cap tech earnings growth while underscoring the relative attractiveness of small-cap stocks at current discounted levels.

Valuation disparities are also evident at the sector level. Small-cap industrial stocks trade roughly 35% below their large-cap peers, while small-cap financials are about 40% cheaper. Even after accounting for differences in growth prospects, small-cap valuations remain compelling. According to JP Morgan research, the median P/E of small-cap growth companies stands at 18x, compared with 28x for comparable large-cap firms.

From a market-cap perspective, small-cap stocks account for only about 5% of the total U.S. equity market, a historically rare occurrence that has been observed just three times since the Great Depression. Historical data suggest that when small-cap market share is low and valuations are depressed, it often precedes a sustained period of valuation re-rating.

For example, following the bursting of the 2000 dot-com bubble, the S&P 500 took three years to return to pre-bubble levels, whereas the Russell 2000 Index gained approximately 62% over the same period, driven primarily by a reversion of small-cap valuations from excessive premiums back to reasonable levels. Such historical experience indicates that the current relative undervaluation of small-cap stocks versus large caps may present a structural opportunity for medium- to long-term investors.

Source: TradingView

It is also noteworthy that the current valuation percentile of the Russell 2000 closely resembles that of small caps in the aftermath of the 2009 financial crisis. In the five years following the crisis, the Russell 2000 delivered cumulative returns of roughly 187%, significantly outpacing the S&P 500’s 107% gain over the same period. This historical precedent suggests that, in an environment of gradually stabilizing macro conditions and supportive liquidity policies, small-cap equities often have the potential to generate sustained excess returns over the long term.

Direct Tailwinds from the Fed’s Policy Shift

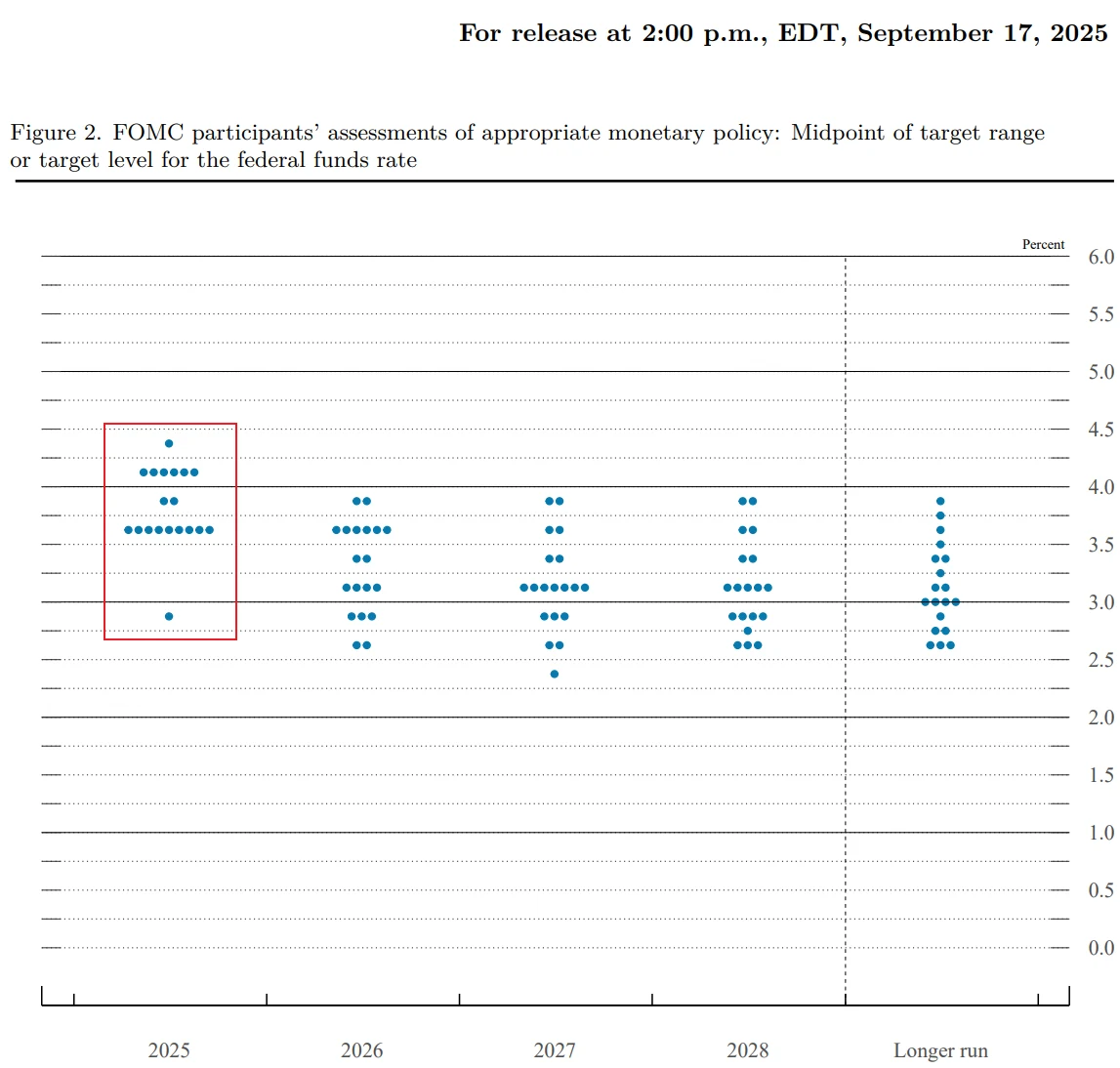

The shift in the Federal Reserve’s monetary policy is emerging as a direct catalyst for small-cap valuation re-ratings. On September 17, 2025, the Fed announced a 25-basis-point reduction in the federal funds target range to 4.00%-4.25%, marking the first rate cut since December 2024. The latest dot plot indicates that the Fed still has room for two additional rate cuts in 2025, creating a policy environment that significantly improves financing conditions for small- and mid-cap companies.

Source: Federal Reserve

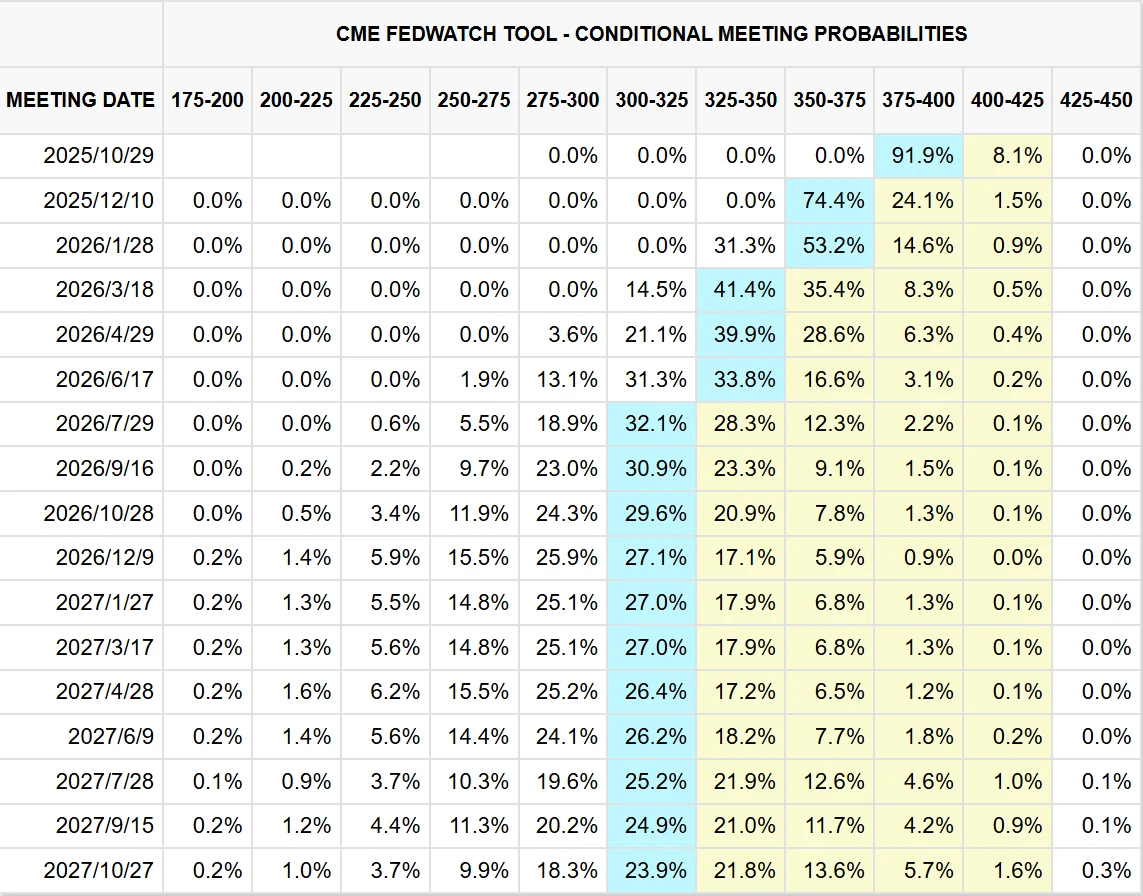

Notably, market expectations for easing are considerably more aggressive than the Fed’s official guidance. According to LSEG data, futures markets currently price the benchmark short-term rate to fall below 3% by the end of 2026, well under the current level slightly above 4% and below the Fed officials’ projection of 3.4%. CME FedWatch tools further indicate that as of September 25, the market assigns a 91% probability to a 25-basis-point rate cut in October, and nearly an 80% probability of a subsequent 25-basis-point cut in December.

Source: CME Group

Small-cap stocks generally rely on floating-rate debt, making their financial structures highly sensitive to interest rate changes. As such, rate cuts directly lower borrowing costs, improving profit margins and cash flow. Historical data show that across six rate-cut cycles since 1990, interest-rate-sensitive small- and mid-cap stocks delivered an average 12-month return of approximately 18.7% following the initial cut, well above the S&P 500’s roughly 11.2%, highlighting the direct benefit of easing for small caps.

Policy support further underpins the small-cap segment. Strict antitrust enforcement in the U.S. has constrained acquisitions by tech giants. Between 2024 and 2025, the approval rate for acquisitions by large technology firms such as Amazon and Microsoft fell by about 40% year-over-year, forcing more innovative startups to pursue IPOs as their primary exit strategy. Recently, growth-oriented companies like European payments leader Klarna and cryptocurrency exchange Gemini have filed for U.S. IPOs in close succession, injecting fresh dynamism into the small-cap market.

Additionally, ongoing tax policy optimization for small and mid-sized enterprises has reduced the average corporate income tax rate to roughly 21% in 2025, about 3 percentage points lower than for large-cap firms, further enhancing profitability. This policy mix not only alleviates financial burdens but also bolsters market confidence in small-cap growth potential.

Ultimately, the interest-rate easing effect from monetary policy, combined with supportive fiscal and regulatory measures, forms a robust foundation for small-cap valuation re-ratings and potential excess returns. Compared with large-cap tech stocks trading at elevated valuations with limited growth expectations, small- and mid-cap companies offer meaningful advantages in earnings improvement, capital efficiency, and market opportunities, providing investors with a compelling rationale to reassess small-cap allocations in the current market environment.

Agility as a Competitive Edge for Small and Mid-Caps

Currently, the agility of small-cap stocks in technology iteration and business model innovation is becoming increasingly evident. Michael Hubbard, Senior Portfolio Manager at Thrivent Small-Cap Growth Fund, notes that in emerging sectors such as artificial intelligence and data services, the average time for small-cap companies to bring new products from development to market is 14 months—approximately 60% faster than that of large-cap tech firms. This advantage stems from the so-called “innovator’s dilemma,” whereby large companies, due to organizational inertia and complex management processes, struggle to respond quickly to technological disruptions.

Statistics show that the average tenure of S&P 500 constituents in the index has dropped from roughly 60 years in the 1950s to just 7 years today, reflecting the relative disadvantage of large corporations when facing disruptive innovation.

This implies that small-cap stocks not only lead in innovation speed but can also optimize business models to achieve advantages in cost control and profitability, providing sustainable support for long-term returns. Importantly, the advantages of small- and mid-cap companies are translating into a trend of outpacing large-cap earnings growth.

Data indicate that in Q2 2025, S&P 500 earnings per share (EPS) grew approximately 10.6% year-over-year; excluding the “Big Seven” tech giants, growth was about 8%. In contrast, constituents of the Russell 2000 are projected to achieve year-over-year earnings growth of up to 20%, reversing two consecutive years of declining profits and highlighting a clear cyclical inflection point.

It is worth noting that this outperformance is not confined to a single sector but demonstrates significant breadth, with industries concentrated in small-cap stocks—such as energy services and education and training—showing particularly strong performance. Lincoln Education Services (LINC), for example, saw student enrollment rise 20.9% in H1 2025, driving a 16% year-over-year increase in revenue and prompting an upward revision of its full-year earnings outlook.

The improvement in earnings quality further strengthens the investment case. Energy wastewater treatment provider LandBridge (LB) reported Q2 2025 revenue up 83% year-over-year to $47.5 million, with adjusted EBITDA of $42.5 million, resulting in a profit margin of 89%.

Against the backdrop of the Fed’s rate cuts gradually lowering capital costs, profit margins for such companies are likely to continue improving, leaving significant room for earnings expansion. Real estate investment trust Millrose Properties (MRP), leveraging a “land bank + option sales” light-asset model, maintains a stable 8% yield. In a 10-year U.S. Treasury yield environment around 4%, these small-cap REITs offer a scarce allocation opportunity for income-focused capital.

Risks That Cannot Be Overlooked

It is important to emphasize that investing in small-cap stocks is not without risk. Volatility, economic sensitivity, liquidity, and structural valuation pressures constitute the main challenges that investors must carefully weigh.

One of the primary risks is the significantly higher volatility compared with large-cap stocks. The Russell 2000 Index has historically maintained an annualized volatility of around 28%, well above the S&P 500’s 18%. This gap is particularly pronounced during market downturns. For example, during the Fed’s rapid rate-hike cycle in 2022, the Russell 2000 experienced a peak-to-trough decline of over 30% for the year, while the S&P 500’s maximum drawdown was roughly 19%, indicating that small-cap stocks were under greater pressure. Because investor sentiment has a stronger impact on small-cap valuations, price movements often exhibit a “magnifier effect,” showing higher elasticity on the upside but amplified damage on the downside.

Source: TradingView

Economic sensitivity is another unavoidable risk in small-cap investing. Small-cap stocks are far more responsive to macroeconomic cycles than their large-cap counterparts, with earnings volatility typically 1.5–2 times that of large caps. Goldman Sachs’ quantitative models estimate that for every 1 percentage point decline in U.S. GDP growth, small-cap earnings growth could drop by 8–10 percentage points. This implies that during an economic downturn, small-cap profits may experience pressure well above the market average. Historical data confirm this: during the 2008 financial crisis, the Russell 2000 suffered a maximum drawdown of 59%, noticeably higher than the S&P 500’s 50%.

Liquidity risk also warrants attention. Compared with large-cap stocks, which often see daily trading volumes in the hundreds of millions of dollars, small-cap stocks typically trade less than $10 million per day, with some individual stocks trading under $1 million. During periods of market stress, this gap can quickly widen. For instance, during the global market collapse in March 2020 triggered by the COVID-19 pandemic, the Russell 2000’s maximum drawdown reached 45%, far exceeding the S&P 500’s 35%, with liquidity constraints acting as a key amplifier of losses.

For institutional investors, such liquidity limitations may also increase the cost of building or reducing positions.

Moreover, although the overall valuation of small-cap stocks is relatively low, internal structural disparities are significant. In particular, high-growth but unprofitable companies continue to trade at elevated valuations. FactSet data indicate that as of September 2025, roughly 35% of Russell 2000 constituents have yet to achieve profitability, a level near historical highs. Should interest rates fluctuate again, overvalued unprofitable tech stocks may be among the first to come under selling pressure, becoming focal points during market corrections.

Investors should also be cautious of past precedents: during the valuation-driven sell-off of growth stocks from late 2021 to 2022, the Russell 2000 Growth Index experienced a cumulative decline exceeding 40%, substantially higher than the drawdown in large-cap indices.

Final Thoughts

The small-cap rally may be just getting started. JPMorgan strategists note that small-cap stocks remain roughly 15% below their historical average relative valuations. Considering the ongoing rate-cut cycle and a favorable policy environment, this discount is likely to gradually narrow.

Investors should maintain a cautiously optimistic stance, focusing on high-quality small-cap stocks where valuations are aligned with earnings. We believe that in the context of the Federal Reserve’s rate-cut cycle and supportive policy measures, small-cap stocks are positioned to continue delivering excess returns, while remaining mindful of risks stemming from an economic slowdown and market volatility.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates