The Core Catalyst Behind Tesla’s Next Stock Rally

06:00 September 27, 2025 EDT

As of 2025, Tesla (TSLA) has maintained a solid upward trajectory. Despite a prolonged decline since the end of 2024 amid global supply chain pressures and macroeconomic uncertainty, the stock has returned to double-digit gains, trading above $430 with a market capitalization of roughly $1.44 trillion. Against this backdrop, investors are refocusing on Tesla’s future growth potential.

Source: TradingView

Some analysts project that, if the autonomous taxi business progresses smoothly, Tesla’s market value could surpass $2 trillion by the end of 2026. Both growth in EV sales and the company’s expansion into autonomous driving and energy sectors are expected to remain key drivers of Tesla’s stock performance.

Tesla’s Elevated Valuation

Tesla currently trades at a price-to-sales (P/S) ratio of approximately 15.57x, more than three to seven times higher than major EV competitors Rivian and Lucid Group. Even though Rivian and Lucid have total market capitalizations below $20 billion—implying theoretically higher growth potential—the market continues to assign a significant premium to Tesla.

Sales forecasts further highlight the valuation gap. Several analysts now project a decline in Tesla’s 2025 deliveries. For example, Evercore ISI analyst Chris McNally lowered Tesla’s full-year delivery forecast from 1.88 million units to 1.75 million, while UBS analyst Joseph Spak cut expectations to 1.7 million units.

In contrast, Rivian and Lucid are expected to see sales growth. Tesla’s deliveries are projected to rebound in 2026, but growth will still lag that of Rivian and Lucid. In the short term, sales growth alone is insufficient to justify Tesla’s current elevated valuation; the market is primarily valuing the company’s strategic opportunities over the long term.

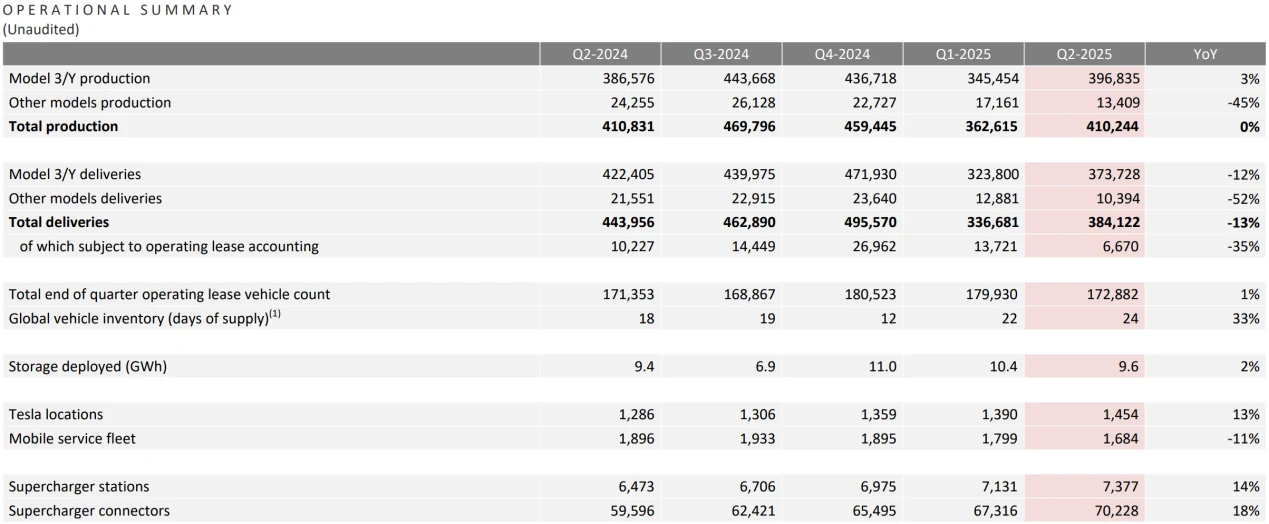

Financial data also indicate that Tesla’s core automotive business is facing growth constraints. In Q1 2025, vehicle deliveries fell 13% year over year to 336,681 units—the lowest quarterly total since Q3 2022—with Model 3 and Model Y accounting for 323,800 units, down 12.4% YoY. Revenue in Q2 rose sequentially to $22.496 billion but was still down 11.78% YoY, while net income fell 16.29% to $1.172 billion.

Source: Tesla

This performance contrasts sharply with a 16x P/S ratio, highlighting that relying solely on automotive production is insufficient to support the current valuation. Excluding autonomous-driving expectations, Tesla’s fair valuation would be in the $400–500 billion range, implying a “vision premium” of over $900 billion relative to its current market cap.

The rationale for this premium lies in Tesla’s positioning beyond a conventional EV manufacturer. The company is deeply investing in high-value emerging businesses—most notably autonomous taxi services. Leveraging scale advantages, strong brand recognition, and technological expertise, Tesla possesses unique long-term competitive strengths, leading investors to pay a premium for its future growth opportunities.

A $1 Trillion Growth Frontier

In the summer of 2025, Tesla officially launched its autonomous taxi pilot program in Austin, Texas, with other cities such as San Francisco and Los Angeles expected to join in the coming months. CEO Elon Musk projects that by the end of 2026, there could be 1 million or more Tesla autonomous taxis on U.S. streets.

Source: Tesla

Analysts widely believe this business could have a profound impact on Tesla’s long-term valuation. Dan Ives of Wedbush Securities estimates that the autonomous taxi segment could contribute roughly $1 trillion in incremental market value, while Cathie Wood believes the global autonomous taxi market could ultimately reach $10 trillion in potential value.

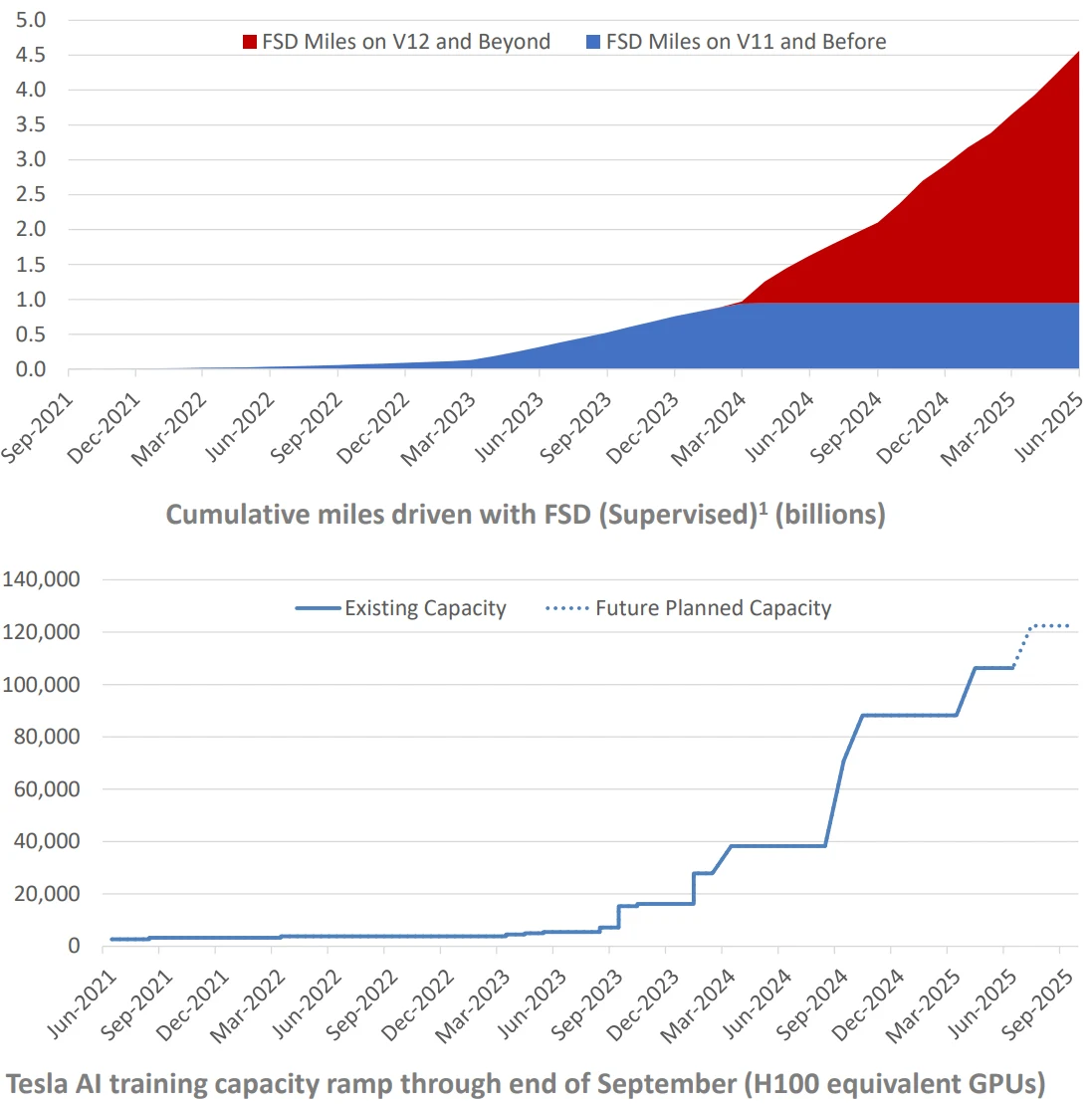

Tesla holds clear advantages in this space. First, it has significant production capacity, with global annual output around 1.5 million vehicles—sufficient to support large-scale Robotaxi deployment in the coming years. Second, the company has deep technological expertise: its Full Self-Driving (FSD) system has been iteratively refined over many years, with over 1.5 million Tesla vehicles contributing data to train its AI models. Third, ample cash reserves provide support for R&D, city deployment, and regulatory compliance efforts.

Source: Tesla

Even if initial deployment falls short of market expectations, the industry broadly sees autonomous taxis as a business with enormous long-term potential. Investors view it as a strategic initiative spanning a decade or even several decades, rather than a short-term revenue source—one of the primary reasons the market is willing to assign a premium to Tesla.

Energy Storage: A Reliable Hedge

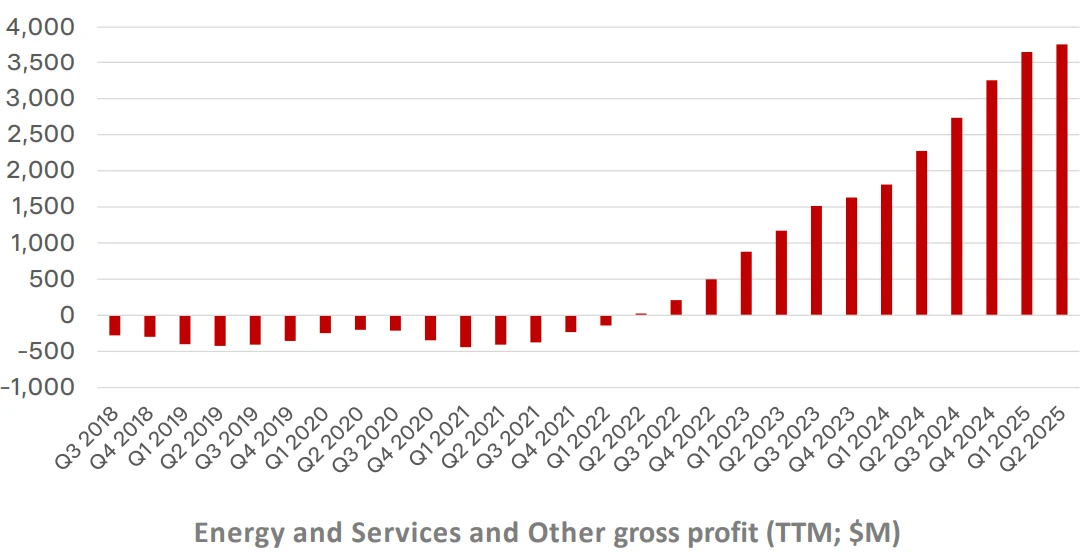

Amid slow progress in the commercialization of autonomous driving, Tesla’s energy business has emerged as a key source of valuation support. Often overlooked by the market, this segment is evolving from a complementary role to the automotive business into a second growth curve, providing a meaningful margin of safety for Tesla’s overall valuation.

In 2024, Tesla’s energy storage installations reached 31.4 GWh, doubling year over year. With the Shanghai energy “Gigafactory” coming online, Megapack production capacity will rise to 40 GWh annually—enough to meet the electricity needs of 40 medium-sized factories. Even more importantly, profitability continues to improve: the segment’s gross margin jumped from 18.9% in 2023 to 26.2% in 2024, surpassing the gross margins of most traditional automakers. Financial data show that energy storage revenue has grown from 8% of total revenue in 2022 to 12% in Q2 2025. At the current growth pace, it could exceed 20% by 2026, solidifying its role as a true second growth pillar.

Source: Tesla

Synergies between the energy and automotive businesses are also expanding. Both segments leverage Tesla’s global sales network, manufacturing expertise, and supply chain. Automated welding technology at the Shanghai factory supports production for both vehicles and energy products, while battery management algorithms are reused across EVs and Megapack systems. These synergies generate declining marginal costs, helping Tesla rapidly build a competitive edge in the energy storage market.

However, energy growth alone is insufficient to fully offset softness in the automotive segment. Tesla’s total revenue declined year over year in Q1 2025, indicating that strong growth in energy storage has yet to compensate for declining vehicle sales. Notably, the valuation logic for the energy business remains grounded in manufacturing fundamentals. Based on the current 26.2% gross margin and a 31.5% industry growth rate, a reasonable P/S ratio for the segment is roughly 5–6x—well below Tesla’s current overall 16x valuation. This implies that while the energy business provides valuation support, it cannot justify a premium; sustaining Tesla’s current market capitalization ultimately depends on a breakthrough in the commercialization of autonomous driving.

Expectation vs. Reality

It cannot be denied that while Tesla’s long-term growth potential remains substantial, the stock still faces certain near-term risks. First, valuation pressure is significant: the company’s P/S ratio far exceeds industry averages, and any shortfall in sales or profits could trigger a near-term pullback. Second, competition is intensifying, with Rivian, Lucid, and traditional automakers’ EV initiatives growing rapidly, potentially eroding Tesla’s market share. Additionally, the autonomous taxi business faces regulatory and technological uncertainties, as approvals across U.S. states and countries, along with the safety and reliability of FSD technology, could influence the pace of deployment.

Investors should note, however, that short-term performance fluctuations should not overshadow the strategic significance of Tesla’s long-term initiatives. The core support for its current valuation premium does not lie in traditional automotive operations, but in the potential value of the autonomous taxi segment. This multibillion-dollar market underpins Tesla’s premium valuation and fundamentally shapes its future growth trajectory.

For investors who are bullish on Tesla’s autonomous taxi strategy, the stock remains attractive. Conversely, those focused solely on near-term performance or unwilling to assume high-valuation risk should exercise caution. Overall, Tesla is transitioning from a pure EV manufacturer to a future mobility platform. Investors may benefit from evaluating its value over a decade-long horizon rather than relying solely on quarterly or annual performance. The rollout of the autonomous taxi business is expected to play a decisive role in determining Tesla’s long-term position within the global mobility ecosystem.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates