Rithm's acquisition proposal: Has the real estate industry recovered?

11:57 September 24, 2025 EDT

Rithm Capital Corp. announced plans to acquire real estate investment trust Paramount Group, Inc. The $1.6 billion deal would acquire all of PGRE's shares for $6.60 per share, a 38% premium to the price at the time of its strategic review on May 16, but down from approximately $7.10 before the announcement. As a result, PGRE's stock price plummeted to $6.50, reversing the gains that had been driven by deal speculation.

Rithm Capital has become a comprehensive real estate firm with businesses spanning loan origination/servicing, bridge lending, unsecured consumer lending, and credit and equity real estate investments. The acquisition of Paramount Group will expand Rithm Capital's equity investment capabilities into the commercial real estate ("CRE") equity markets in New York and San Francisco.

Rithm's market capitalization of $6.4 billion and enterprise value of $39 billion are significantly higher than Paramount's market capitalization (approximately $1.4 billion) and enterprise value (EV) of $5.6 billion, respectively, resulting in similar leverage for both companies. Rithm plans to finance the transaction using its existing liquidity (approximately $2.15 billion at the end of the previous quarter) and its joint venture partners. However, following the announcement, the company also issued new preferred stock, raising $190 million and yielding 8.75%.

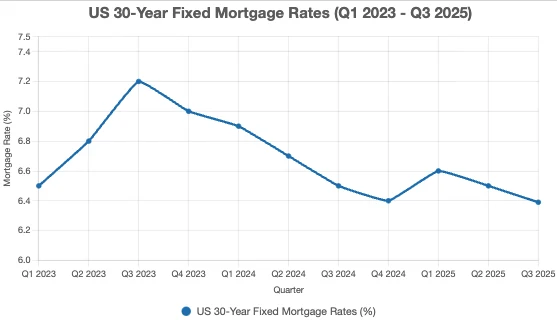

The health of the New York real estate market has long been a source of skepticism among most investors. As the company refinanced at higher interest rates, its interest costs would have climbed, eating into its profits. Since then, its TTM rolling interest expense has risen by approximately 20%, while earnings per share have been chronically negative. Earlier this year, the stock fell to around $4 (from $4.75) before rebounding to over $7 on expectations of rate cuts, representing a 37% increase since the publication of the article.

Rithm Capital has gained 32% since 2023, a remarkable total return of 69% thanks to its yield of approximately 8.3%. At the time, the market anticipated that rising interest rates would have a more direct impact on mortgage credit risk. Delinquency rates have since risen slightly, with pressure increasing at a faster pace in recent quarters, but not enough to weigh on the stock. Investors remain neutral because RITM trades well below its book value and, with an 11% yield at the time, offers a substantial return relative to its higher risk.

From a risk perspective, I believe RITM may be overvalued, as market expectations for a return to pre-COVID-19 "golden conditions" are excessive. Most data points to increased stress in the rental market, and mortgage and bridge loan risks remain elevated. Compared to 2023, RITM's yield premium may not be sufficient to offset market concerns.

Grade A office space may remain vacant

Most investors and analysts likely believe that Rithm's acquisition of Paramount was well-timed, given its low price (strictly speaking, a significant discount to its pre-announcement price). Furthermore, with falling interest rates, Paramount's prospects should improve. However, are interest rates the fundamental issue? Will they actually fall enough to drive a revenue recovery for office REITs?

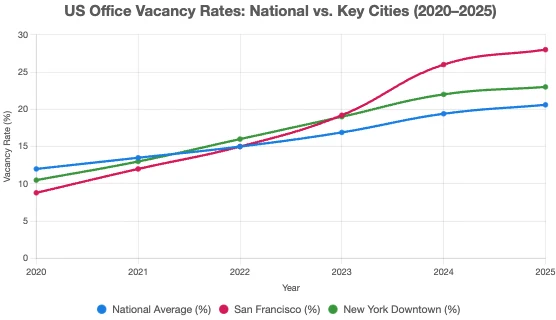

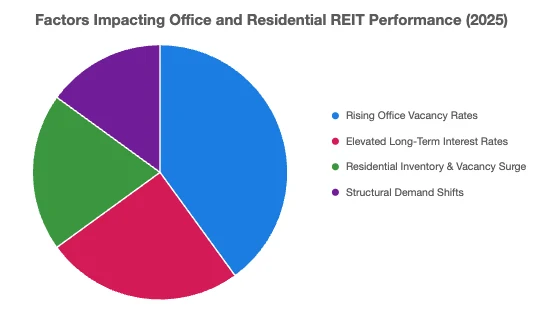

First, investors need to understand that interest rates are secondary, and changes in employment data are causing some office buildings to become obsolete. Since the COVID-19 pandemic, we have seen a continued rise in urban office vacancies, reaching a record high in August. San Francisco has the highest vacancy rate, at approximately 28%, followed closely by downtown New York City at 23%. So far, all companies that have mandated a "return to the office" have done so, but this may not be to increase employee efficiency, but rather to leverage existing leases. Only when a company is not tied to a lease can it save on working from home. In fact, recent surveys show that a third of companies ordered a "return to the office" to leverage existing leases.

Furthermore, according to a JPMorgan Chase survey, about half of the two-thirds of companies that own office space have leases that expire in 2028 or later, which may dictate that their RTO policies last longer. The report found that about 14% of companies have leases expiring in 2024 or 2025.

When these leases expire, about 23% of companies plan to reduce their leased space, with one-third saying they will reduce office hours and 8% saying they will discontinue their RTO policies.

These findings suggest a long-term trend toward rising office vacancy rates. While many companies may not transition to remote work within the next five years, such a scenario presents businesses with the prospect of an "ecosystem collapse" in many urban office markets. Fewer employees are going to offices, local retailers that serve office workers are closing, urban homelessness is on the rise, local tax revenues are declining, and urban areas are becoming less attractive to companies and their employees. On the other hand, a potential reactionary electoral outcome could produce leaders with anti-business tendencies (see New York).

This vicious cycle may not affect all urban areas. While some may prefer working in city offices, this process is evident in many areas across the country. Crucially, it's a slow process that may not end until 2040, as it inherently contributes to declining city tax revenues. However, I expect a potential economic recession or a reduction in bank lending to accelerate this process.

However, its correlation with Paramount Group is significantly offset by the fact that Class A office buildings have been relatively unaffected by this process so far. CBRE Group, which has been almost universally optimistic about the real estate market (given its business), predicts a recovery in the office market, citing a shortage of high-quality office space and a sharp decline in office construction. Paramount Group (soon to be renamed Rithm) owns only these "prime" properties and has therefore been shielded from the worst of the vacancy rate crisis so far.

Paramount's revenue has remained nearly stable, and while it hasn't kept pace with inflation and operating costs, it's still outperforming the general office commercial real estate industry. Nevertheless, its profit margins are declining, and its interest expense currently remains significantly higher than its earnings before interest and taxes.

A significant reduction in interest rates could return Paramount's earnings to positive territory. Investors shouldn't ignore depreciation, as all buildings naturally depreciate over time and require ongoing capital expenditures to maintain them. Nevertheless, Paramount generated $205 million in operating cash flow and $0.72 in operating cash flow per share, suggesting it's not in a solvency or liquidity crisis despite these pressures. Assuming the Class A office market remains strong, a rate cut would address its biggest concern.

We can’t be sure whether the “office bifurcation” trend will persist. Across nearly every sector of the economy, the “bifurcation” has become a fundamental narrative. In recent years, large-cap, high-quality stocks have accounted for most of the S&P 500’s performance. High-earners have been the primary drivers of average wage growth in the United States. Consumer-oriented companies focused on high-income groups have thrived, while those focused on the middle class have languished (see airline stocks).

From a business perspective, a large tech company might generate millions of dollars in revenue per employee, but the amount of sales spent on leasing might be a small fraction of that. If an RTO order increases the productivity of an employee earning over $1 million per year by 10-20%, the leasing costs should be easily recouped. The opposite is likely true for a more typical office-based employee, who averages closer to $200,000 per employee.

That said, many studies dispute this, generally arguing that remote work leads to productivity losses and a reduction in the competitive value of top talent. Therefore, in the long term, we still expect the majority of office workers to shift to remote work. Paramount Group's assets are expected to perform well over the next 5-10 years and may be among the last to be affected, but I highly doubt they are immune. Similarly, the economic slowdown is putting pressure on large tech companies, leading to the replacement of white-collar jobs with artificial intelligence and overseas outsourcing, which could accelerate this trend.

Without a crisis, interest rates are unlikely to reach 1%

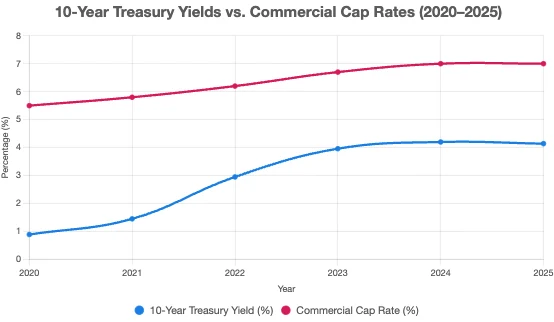

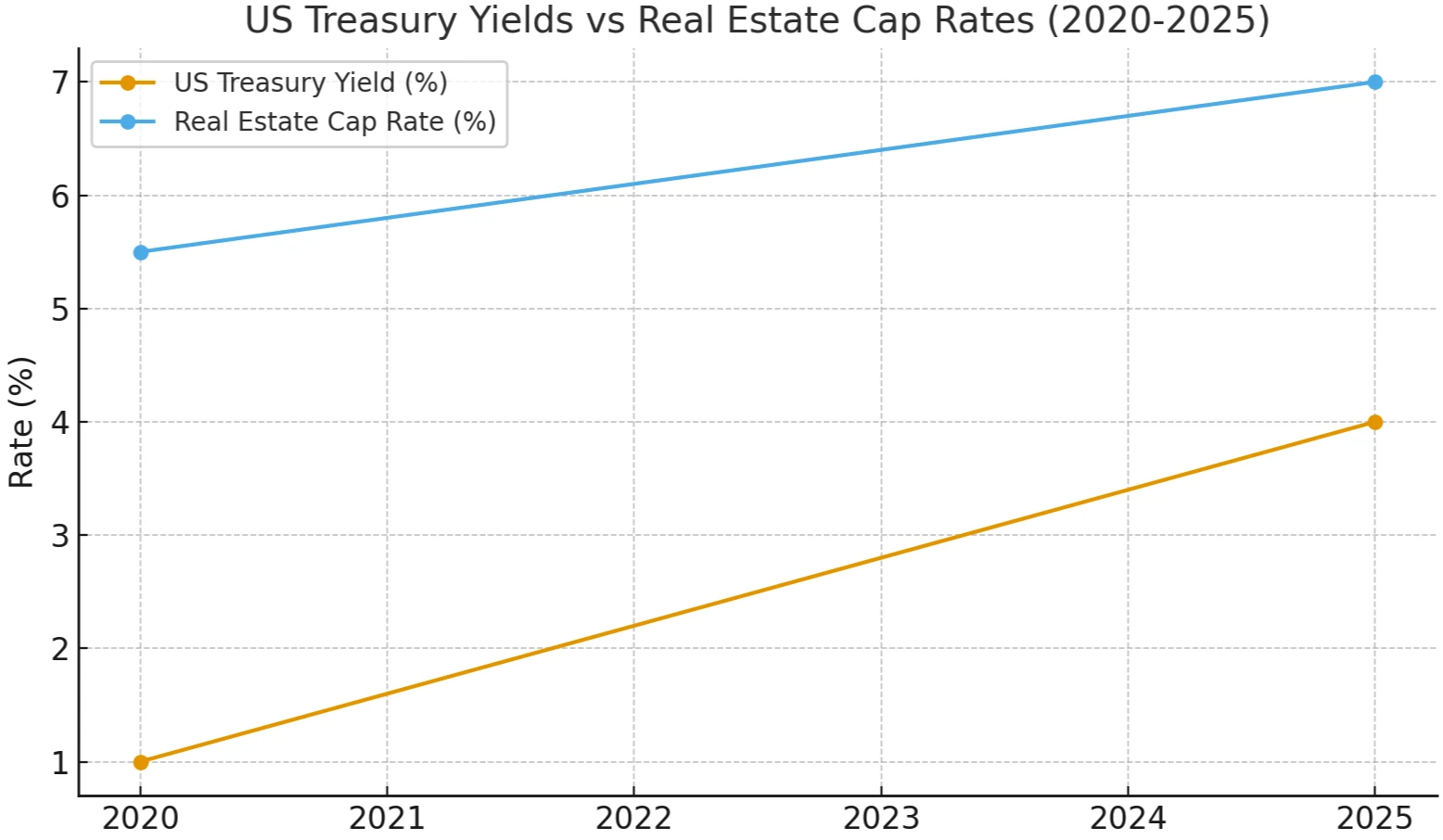

Valuations for both PGRE and RITM reflect an extended period of interest rate cuts. Long-term, real estate capitalization rates (net operating income divided by price) correlate with Treasury bond rates. Both have increased, but interest rates have risen more significantly, from approximately 1% in 2020 to 4% today, while capitalization rates have risen from approximately 5.5% to approximately 7%. Most commercial mortgage rates remain around 6-7%, so the only way to achieve a net profit in commercial space is to hope for (or invest in) rising rents. Office rents generally fail to keep pace with inflation, prompting upgrades to "higher-tier" buildings (such as Paramount's 60 Wall Street project) and residential conversions.

For years, residential has been the shining star of commercial real estate, significantly outperforming office space. However, as housing inventory rebounds, we are seeing rising residential rental vacancies, putting negative pressure on both prices and rents.

Affordability in both residential markets (rentals and homes) has hit record lows, but a "housing shortage" factor has supported the market. Consequently, until the past few months, we haven't seen rents and home prices fall due to very low supply. However, even with home sales reaching 2009 levels, builders are still starting housing at a high rate, and office building owners are competing to convert their buildings into residential properties.

While rising interest rates are the primary factor driving negative changes in the housing market, inventory and vacancy rates are the most important. Based on construction trends, we know that the supply of homes nationwide will continue to rise, while I believe demand will decline as immigration decreases and baby boomers begin to downsize.

Moreover, the view that interest rates will return to around 1% remains largely unfounded. Ultra-low interest rates were the norm for much of the 2010s, driven by low inflation, which in turn was driven by exceptionally low commodity prices (e.g., surging US oil production). Since around 2020, business spending on capital investment (which stimulates supply) has slowed sharply, while the US budget has fallen into extreme deficit.

Furthermore, the surge in gold and precious metals prices reflects growing global concerns that the US will need to pursue overly dovish monetary policy to reduce its "real debt" burden, thereby generating a "curve steepening" inflationary effect. The recent interest rate cuts demonstrate the Fed's pro-inflationary bias. The majority of RITM and PGRE assets are primarily exposed to rising long-term interest rates, while the Fed can only lower short-term rates. Excessively lowering short-term rates could reduce short-term borrowing costs and thus temporarily boost profits, but if this inflates inflation expectations, the long-term result would be higher interest rates and inflationary pressures.

This series of events unfolded between 2020 and 2022, driven by fiscal policy supporting deficit spending. Therefore, if unemployment rose sufficiently, we could see overnight interest rates fall below 1%, but I believe this would exacerbate long-term pressures (as was the case in 2022). Furthermore, while a recession may improve borrowing costs, it is typically accompanied by tighter banking standards and increased profit pressure across much of the real estate sector.

Conclusion

Overall, the common belief that lowering interest rates will trigger a housing market recovery is inaccurate. In my view, lowering interest rates is likely to be counterproductive in the long run because it encourages increased borrowing, which I believe is the primary economic problem (excessive leverage) facing most economies (governments, businesses, and households). Debt crises cannot be "solved" by increasing debt; it only prolongs and exacerbates them.

Yes, in the short term, RITM investors should consider the impact of short-term borrowing, but I believe mortgage costs are likely to be higher by the late 2020s. Furthermore, the likelihood that interest rates will fall sufficiently to make refinancing unprofitable is also low, barring a severe recession, in which case RITM's operating margins would likely come under pressure.

This isn't so much a matter of interest rates as it is the fact that even prime office buildings will struggle to maintain their value over the next decade or two. So, will this impact PGRE's short-term performance (which determines its value to RITM)? Probably not. Currently, the forecast of a significant shift to remote work models won't impact its Class A properties. That said, Class A properties should see rising rents or declining vacancy rates over the next year or two.

Rithm trades at a price-to-book ratio of approximately 1, so its assets aren't trading at a significant discount. Its dividend is currently just under 8.4%, which puts its premium to the "risk-free rate" well below where it will be in 2023. Its leverage ratio (assets to equity) has remained consistently around 5x, which, while high, isn't abnormal given its business model.

Therefore, Rithm's risk profile is not favorable. While the market anticipated an upward interest rate cycle, expectations now suggest further rate cuts, leaving its long-term fundamentals unchanged. The factors driving interest rates higher remain in place, and the trends that have been weighing on commercial real estate continue. With rising housing inventory and rental vacancy rates, the residential market may face further pressure. While Rithm's credit risk is largely supported by an institutional guarantee, investors should remain cautious about its investment value.

Therefore, I maintain a bearish view on RITM, believing its valuation is excessive and its acquisitions are ill-timed, arguing that holding a substantial cash reserve would be a more sensible option. An upgrade of RITM's rating would require an estimated 8% premium to the risk-free rate (yielding approximately 11.5%), implying a ~26% share price reduction. This would more fairly reflect the high risk of declining distributable cash flow over time.

That said, while we see growing economic and unemployment concerns in the short term, these concerns are offset by falling short-term interest rates. Fundamentally, RITM's outlook aligns with my view that the US real estate market is largely "overdeveloped and undermaintained." There's not a shortage of housing or office space overall, but rather a shortage of high-quality, reasonably priced space. Therefore, by 2035, as properties improve, capital investment requirements will be higher (thus reducing free cash flow), while rent increases are unlikely to outpace inflation. While neither company is heavily invested in "low-end" real estate, investors should be aware that as the trend of "economic divergence" continues, we may see accelerated urban building decay in many regions.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates