Worst September for U.S. Stocks Is Behind Us? How Long Will the Rate-Cut Rally Last?

04:43 September 22, 2025 EDT

Over the long-term statistical history of the U.S. stock market, September is widely regarded as the worst-performing month. Since 2000, the S&P 500 Index has recorded an average decline of approximately 1.4% in September.

However, in 2025, driven by the Federal Reserve (Fed)’s announcement of an interest rate cut in September and signals of potential further monetary policy easing ahead, the U.S. stock market has painted a vastly different picture. The three major U.S. stock indices have advanced for three consecutive weeks, with the Dow Jones Industrial Average (DJIA) and the S&P 500 repeatedly notching new all-time highs—suggesting the so-called "September curse" is seemingly being broken.

Source: TradingView

But how long will this round of rate-cut-driven market rally last?

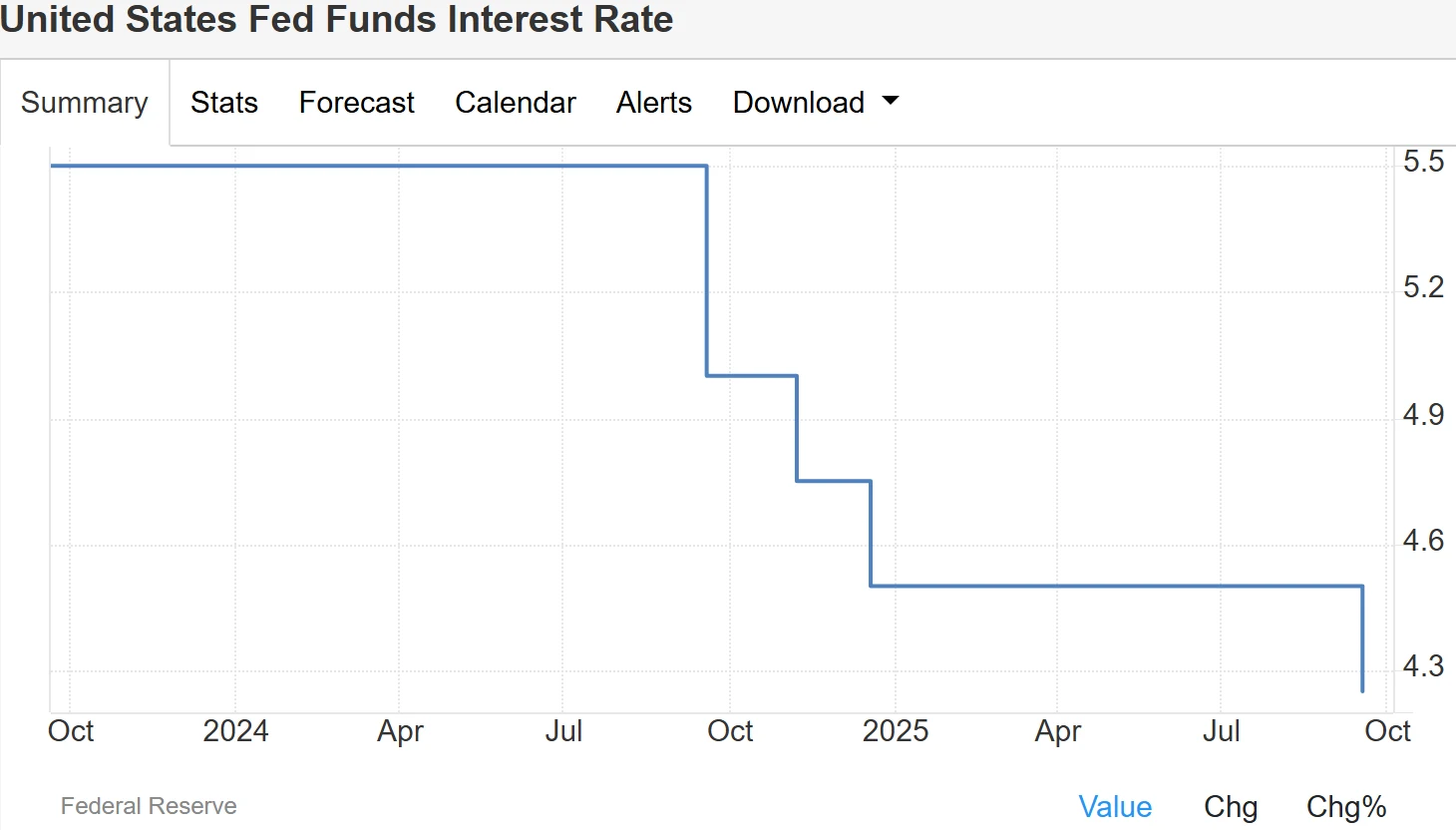

Federal Reserve's Monetary Policy Pivot

In September 2025, the Federal Reserve (Fed) announced its first 25-basis-point interest rate cut since December 2024, while signaling potential further rate cuts at its upcoming October and December meetings.

Source: TradingEconomics

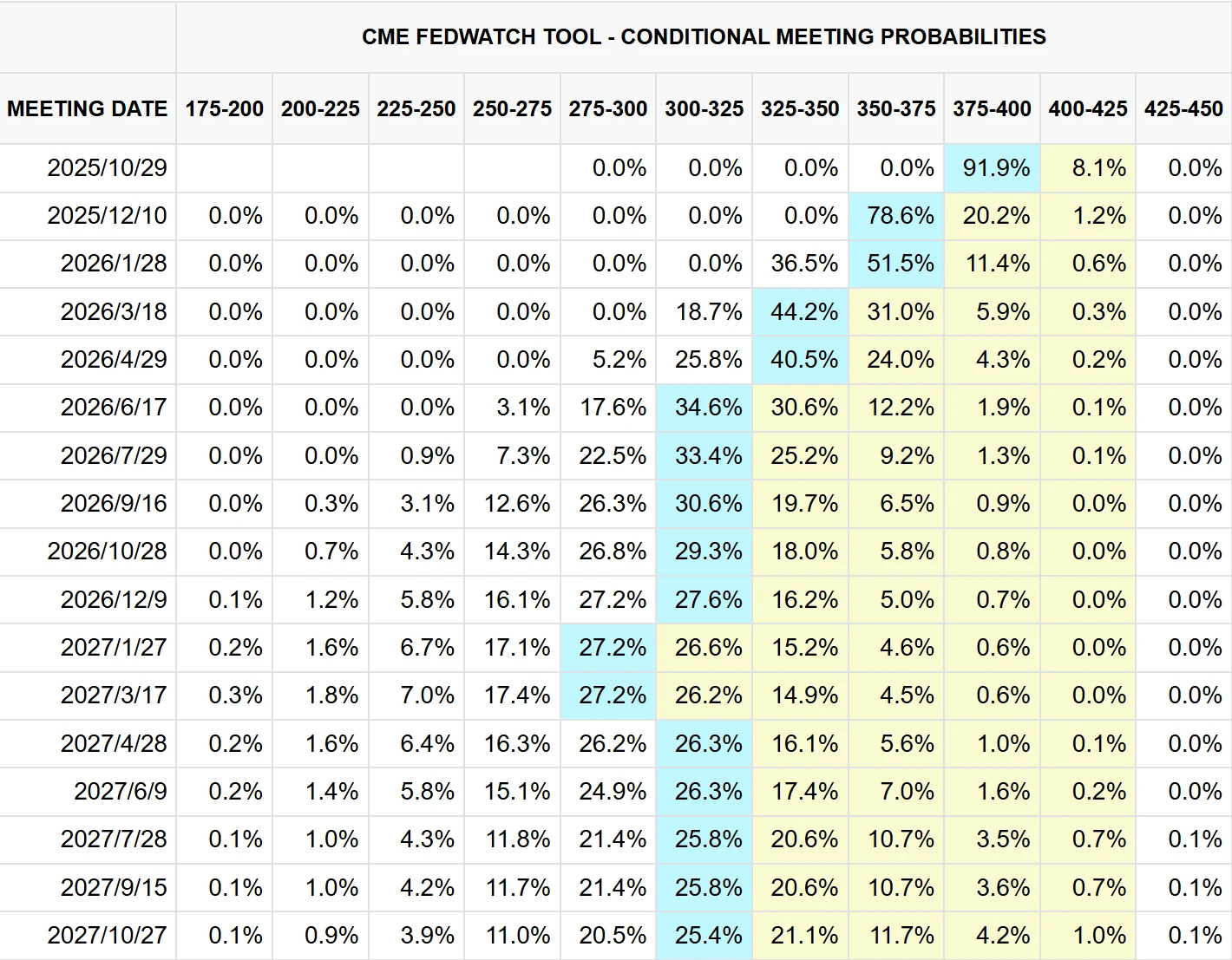

The market widely expects the Fed to deliver two additional 25-basis-point rate cuts before the end of the year. This policy adjustment comes against a backdrop of a moderate rise in the unemployment rate and signs of softening in the labor market.

Source: CME Group

Unlike the Fed’s previous stance of maintaining high interest rates for an extended period due to inflationary pressures, this pivot is viewed as a "risk mitigation signal," which has strengthened market confidence in a soft economic landing.

The market impact of the rate cut has been directly reflected in market performance. Goldman Sachs raised its year-end target for the S&P 500 Index from 6,600 to 6,800 points, and projected target levels of 7,000 points (over the next 6 months) and 7,200 points (over the next 12 months). Strategists at Wells Fargo, Deutsche Bank, and Barclays have also revised their forecasts upward—with Deutsche Bank being the most optimistic, lifting its 2025 target to 7,000 points. Wells Fargo expects the S&P 500 to climb to 7,200 points by the end of 2026.

This stands in stark contrast to earlier this year (2025), when some institutions lowered their target levels below 6,000 points amid concerns over tariff impacts and a potential recession.

In other words, marginal shifts in expectations around liquidity policy are guiding institutions toward a shift from a "defensive" to an "offensive" stance. This is evident not only in the upward revisions to index targets but also in the repricing of growth-oriented assets such as technology and artificial intelligence (AI) stocks. Data shows that since the second quarter of 2025, institutional allocation logic has undergone a notable change—shifting from defensive traditional consumer sectors to offensive sectors including tech growth and high-end manufacturing.

AI Investment Cycle and Valuation Framework

Beyond monetary policy easing, the artificial intelligence (AI) boom has emerged as a key driver of the U.S. stock market’s rally. Research from Bank of America shows that the "Magnificent Seven"—Tesla, Alphabet, Apple, Meta Platforms, Amazon, Microsoft, and NVIDIA—have rallied a cumulative 223% since the March 2023 lows, coming close to the average 244% gain seen in historical typical asset bubbles from their troughs to peaks. This indicates that while there are debates over tech stock valuations, they have not yet reached the critical point of a bubble burst.

Source: TradingView

From a valuation perspective, the S&P 500 Index’s forward price-to-earnings (P/E) ratio currently stands at approximately 23x, markedly higher than the 10-year historical average of around 18x. The Magnificent Seven have an average P/E ratio of roughly 39x, below the 58x level observed during historical bubble periods; their premium relative to the 200-day moving average is about 20%, which is lower than the 29% level seen in historical extreme market phases. Institutional investors generally agree that while valuations are elevated, they remain within a justifiable range.

Jeff Krumpelman, Chief Investment Strategist at Mariner Wealth Advisors, notes that the productivity gains and earnings improvements driven by AI can support higher valuations. He emphasizes that the current composition of the S&P 500 differs from past cycles, and higher return on equity (ROE) and profit margins explain the index’s current elevated valuation levels. He further stated: "This is not the S&P 500 in the traditional sense; the current market structure is highly concentrated in technology and communication services, with significantly improved earnings quality and growth potential."

Risks Beneath the Rally

While bullish sentiment currently prevails in the market, risks have not dissipated. The potential risk facing U.S. stocks today may not be "whether a decline will occur," but rather "whether the logic driving the rally will break down."

First, some strategists have warned of the risk of a "Melt-Up"—a scenario where the market rises rapidly amid no significant improvement in fundamentals, driven by investors’ fear of missing out on gains.

A "Melt-Up" is not a normal "rally," but an "irrational, frenzied surge": when investors stop focusing on corporate earnings or valuation logic and enter the market blindly solely due to "fear of missing out (FOMO)," the market falls into a "self-reinforcing bullish cycle." Such sentiment-driven rallies are often accompanied by high volatility, and a reversal in liquidity or earnings expectations can trigger a deep correction.

Historically, both the 2000 dot-com bubble and the 2021 meme stock frenzy began with "FOMO-driven" speculation and ended with "liquidity withdrawal"—and current market sentiment is moving in this direction.

Second, despite the S&P 500 hitting new all-time highs repeatedly, market breadth (measured by the share of advancing stocks) has continued to narrow. Since the start of 2025, the S&P 500’s gains have been largely driven by the tech sector, with just five mega-cap tech stocks contributing half of the index’s year-to-date gains. According to data from the Choice Financial Data Terminal, since January 2025, the average gain of the seven major U.S. tech stocks has been 70%, while the other 493 stocks in the S&P 500 have risen by an average of only 0.1%. This "index supported by a handful of stocks" structure is inherently highly fragile.

Institutions including Citi, Fundstrat, and Evercore ISI have all noted that the current market rally is overly concentrated in a small number of large-cap tech stocks. Without broader sector participation, the market structure will become even more vulnerable. Bill Smead, Chief Investment Officer (CIO) at Smead Capital Management, argues that AI-related assets have formed an "excessive concentration" similar to past bubbles, and a correction in these assets would pose a systemic impact on the broader index.

Additionally, structural issues at the macro level remain unresolved. Ed Yardeni has warned that the Federal Reserve’s decision to cut interest rates while the economy remains healthy may exacerbate FOMO-driven speculation among investors, rather than addressing long-term challenges such as labor supply shortages. Emily Roland of John Hancock Investment Management points out that the market "selectively processes information"—focusing only on the positive impact of rate cuts while downplaying potential risks such as a deteriorating labor market. She describes the current environment as "unusually favorable yet extremely fragile."

Wrap-Up

In the short term, expectations of further rate cuts by the Federal Reserve and the sustained release of AI-driven earnings are likely to sustain this rally; however, in the long term, whether this upward momentum can continue will still depend on corporations’ ability to deliver on AI-driven earnings and the market’s management of risk boundaries.

If the "Magnificent Seven" can consistently translate AI investments into revenue growth, and other sectors in the market can also keep pace with earnings improvements, then the current elevated valuations will be justified; conversely, if AI-driven earnings fall short of expectations, the "valuation bubble" will burst.

For retail investors, the current market is neither a time to blindly follow the trend nor a moment to take an outright bearish stance. Instead, it requires striking a balance between seizing opportunities and guarding against market overheating.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates