This Week in Markets: Fed’s Preferred Inflation Gauge Kicks Off Heavy Week with Fed Speakers, Batch of Key Data

23:07 September 21, 2025 EDT

FoolBull Brings You This Week’s Market Highlights:

Market Focus

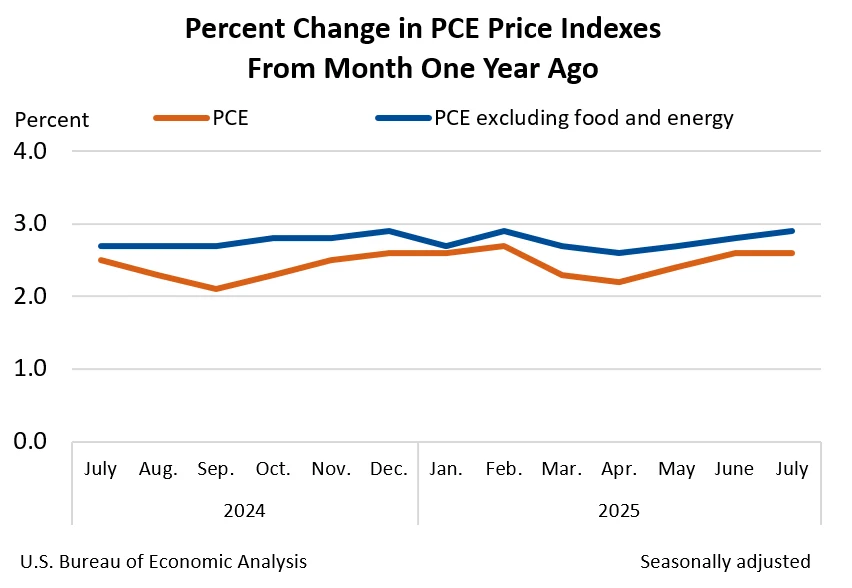

August Core PCE Price Index Release

On September 26, the Federal Reserve's preferred inflation gauge will be released. Current market expectations forecast a 0.1% month-over-month (MoM) increase and a 2.3% year-over-year (YoY) increase for the PCE. The Core PCE Price Index is expected to rise 0.2% MoM. At the September press conference, Fed Chair Jerome Powell stated he anticipated the August PCE inflation rate to rise 2.7% YoY, with Core PCE expected to rise 2.9% YoY.

Source: BEA

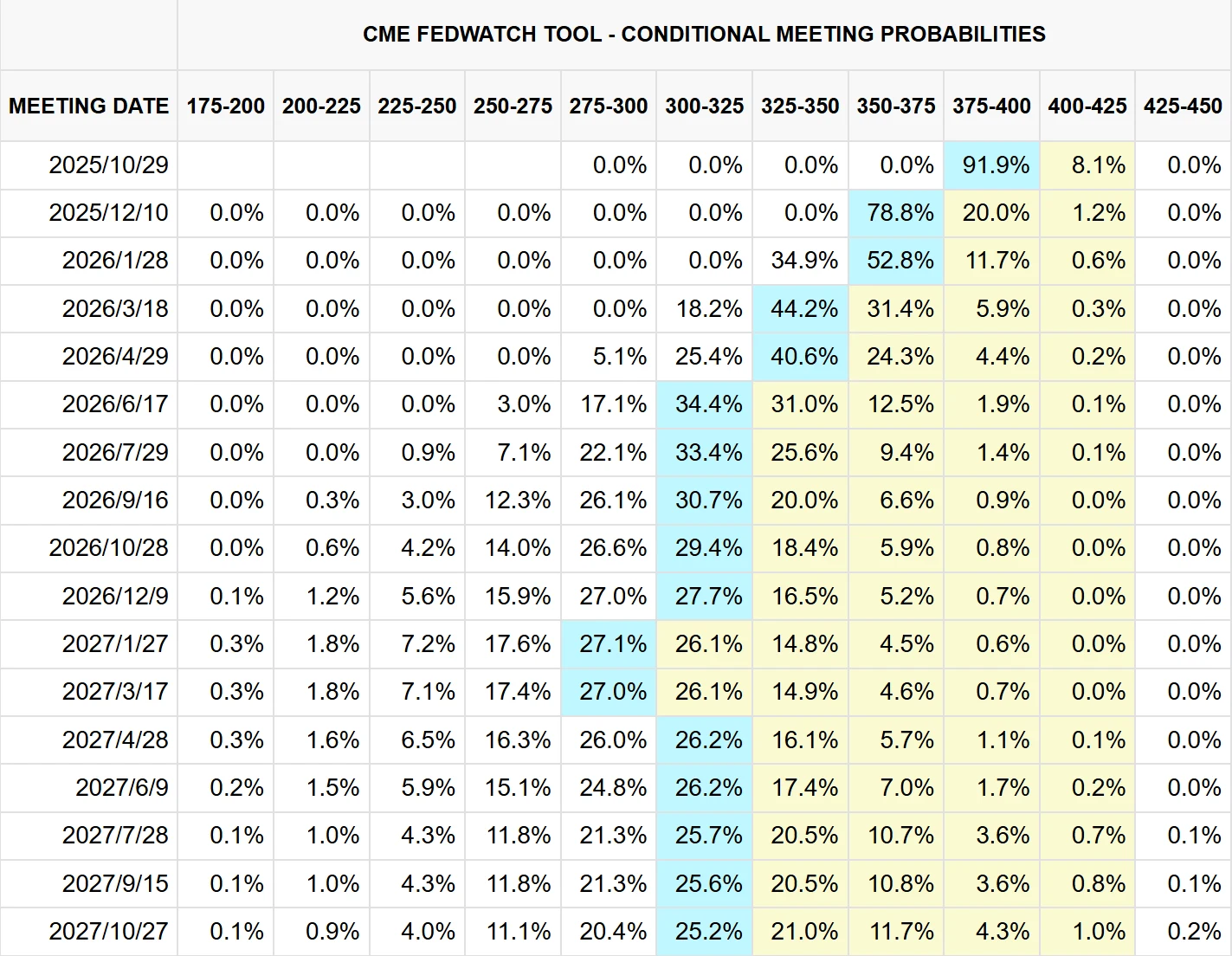

The market remains focused on whether tariffs will push up domestic U.S. price levels. If data shows a limited impact, it would further clear the path for subsequent Fed rate cuts. Following the 25-basis-point rate cut in September, the market widely expects the Fed to cut rates two more times in its two remaining meetings this year.

Source: CME

Notably, on September 19, 2025, Minneapolis Fed President Neel Kashkari stated that he supported the Fed's decision to cut rates by 25 basis points this week and believed it would be appropriate to cut rates by the same magnitude once more at each of the final two meetings this year.

In an article, Kashkari wrote that back in June, he thought only two 25-bp rate cuts for the entire year would be needed. However, since then, U.S. job growth has clearly slowed, a phenomenon only partially attributable to reduced immigration and more likely reflecting weaker labor demand, which prompted him to change his view. He believes the risk of a significant rise in the unemployment rate warrants Fed action to support the job market.

Kashkari also stated that unless there is a substantial future increase in tariff rates or other supply-side shocks, he finds it difficult to see inflation climbing above 3%, given the current tariff levels and the small share of imported goods in overall U.S. consumption. He believes the neutral interest rate has risen to 3.1%, implying current Fed policy is less restrictive than he previously assumed.

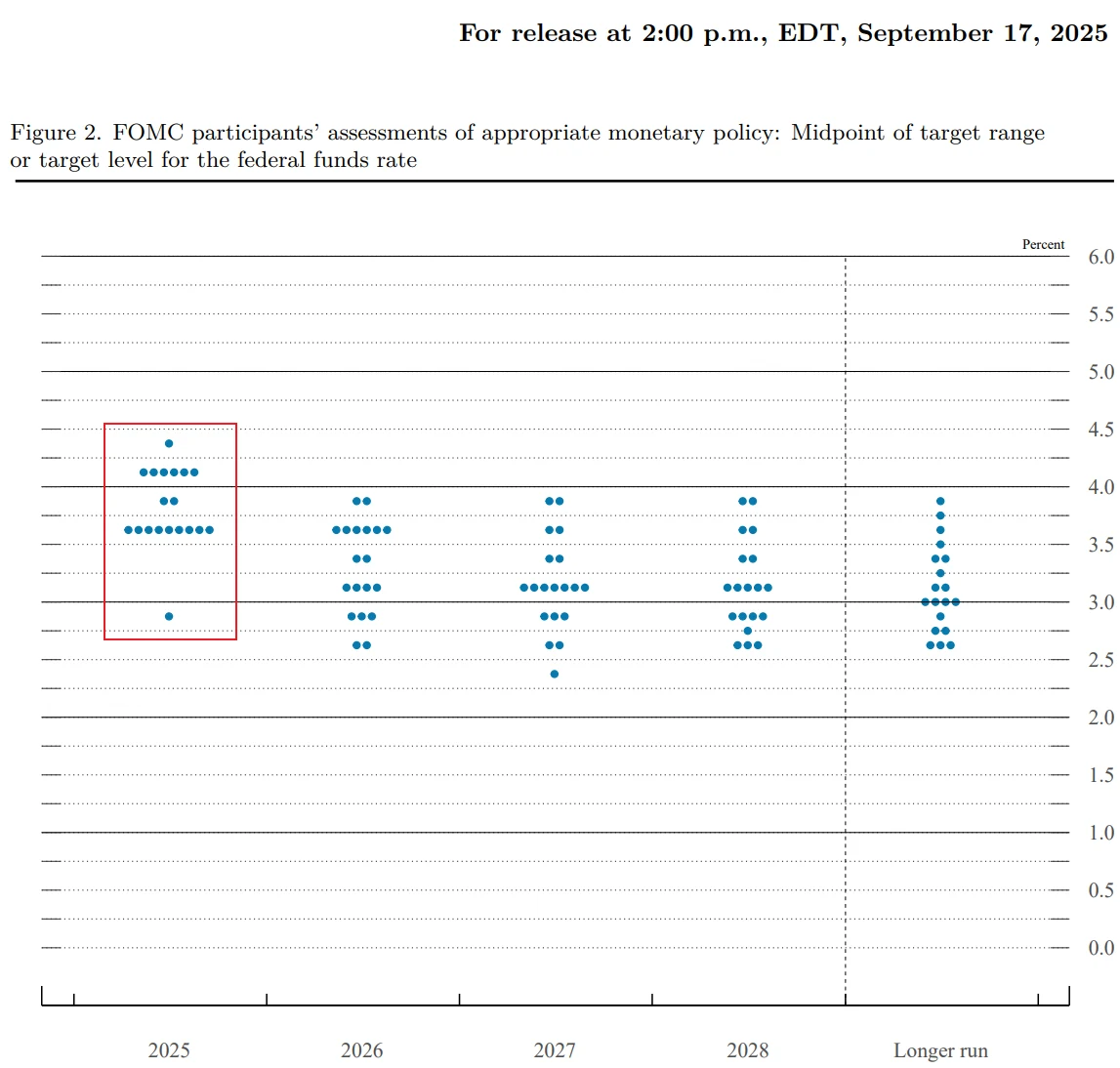

According to the dot plot released on September 17, Kashkari's view of "two more rate cuts this year" is shared by 8 other Fed officials. However, another 8 officials believe the Fed may only need to cut once more or not at all, indicating greater caution on inflation.

Source: Federal Reserve

Fed Governor Milan Elaborates on Interest Rate Views

On September 20, 2025, newly appointed Fed Governor Stephen Milan stated that he had only a brief conversation with President Trump before this week's rate decision and felt no pressure regarding how to vote. Milan emphasized his independent analysis based on data and economic interpretation. At this week's FOMC meeting, he was the sole dissenter advocating for a larger 50-bp rate cut, while the other 11 voting members supported a 25-bp cut. He also said it would be reasonable to gradually reach the neutral rate with successive 50-bp cuts.

Milan is scheduled to speak at the Economic Club of New York next Monday (September 23) to "detail" the significant differences between his views and those of other Governors, provide a comprehensive public explanation, systematically outline his economic views, and "thoroughly explain the logic and calculations behind the data."

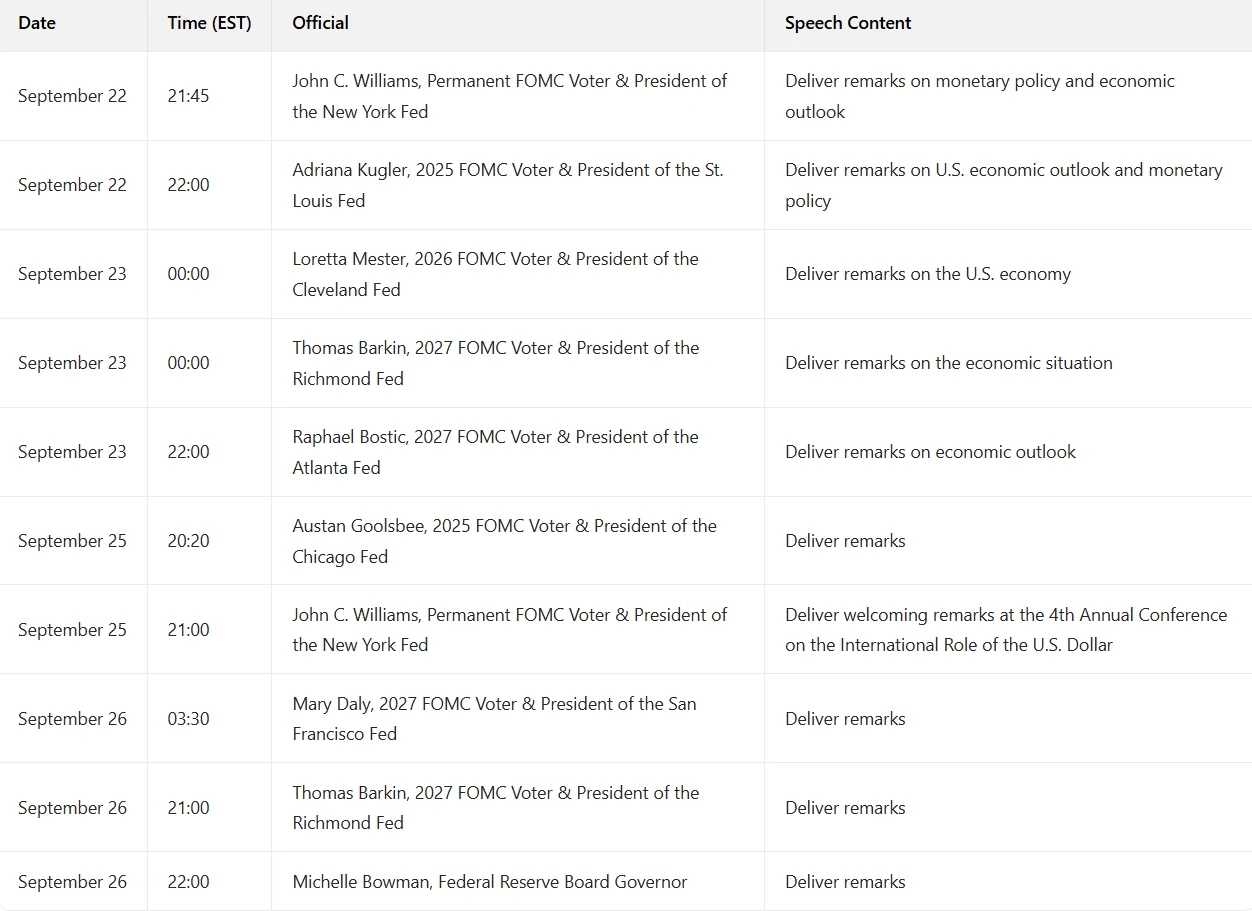

Furthermore, several Fed officials are scheduled to speak this week, further conveying their views on monetary policy and the economic outlook to the market.

Multiple Key Economic Data Releases

Besides the Core PCE, several other important economic data releases this week will allow the market to assess whether the U.S. economy is continuing to weaken. Specifically:

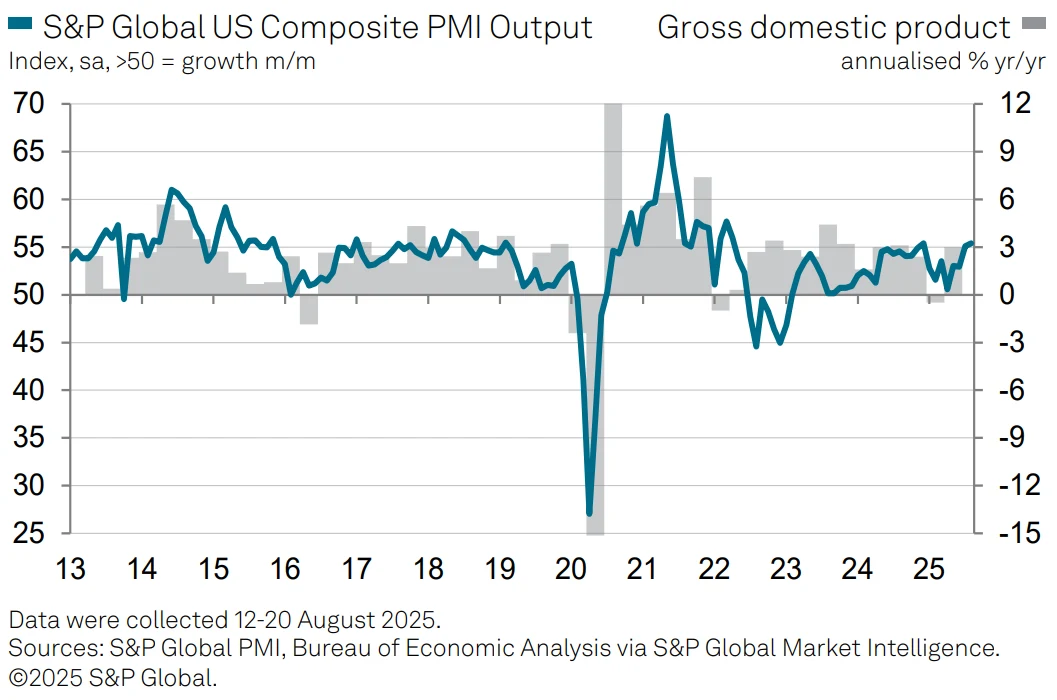

The September S&P Global Manufacturing PMI Flash will be released on September 23. The August S&P Global Manufacturing PMI was strong at 53.3 (prior 49.8), a 39-month high, indicating a significant improvement in manufacturing activity at the start of Q3. The final reading was 53, slightly below the preliminary estimate but still the highest since May 2022.

Source: S&P Global

Additionally, August Durable Goods Orders, the Q2 GDP Annualized QoQ Final reading, and Weekly Initial Jobless Claims will be released on Thursday. Current market sensitivity to "recession trading" is high. Should multiple of these data points deteriorate, it could trigger a shift of funds into defensive sectors (e.g., utilities, healthcare) and boost safe-haven assets like Treasuries. U.S. stocks might also fluctuate due to economic concerns. Against the backdrop of a cooling labor market, worse-than-expected data could further reinforce the market's "recession trading" narrative.

U.S. Q2 Earnings Season Winding Down, Q3 Approaching

The U.S. Q2 earnings season is nearly over, with the Q3 season approaching. With U.S. stock markets at historic highs and continued optimism regarding corporate profit growth expectations, the market rally may have room to continue.

As of August 6, 399 S&P 500 companies had reported Q2 earnings, with approximately 80% beating analyst estimates. For Q3 guidance, data shows that among S&P 500 companies that have issued guidance, over 22% expect to exceed analyst expectations, the highest in a year; the proportion issuing below-expectation profit forecasts has dropped to a four-quarter low. Furthermore, Wall Street analysts expect Q3 earnings growth for S&P 500 companies to reach 6.9%, higher than the 6.7% forecast at the end of May.

The improved market sentiment reflects growing investor confidence in companies' ability to withstand tariff impacts. For instance, 3M raised its profit guidance and stated it had taken measures to mitigate tariff-related costs, including production shifts and price adjustments. However, some analysts note that this earnings season isn't a "broad-based boom," as earnings growth shows structural divergence, and Q3 risk events and global macroeconomic slowdown could pose some disturbances for U.S. stocks.

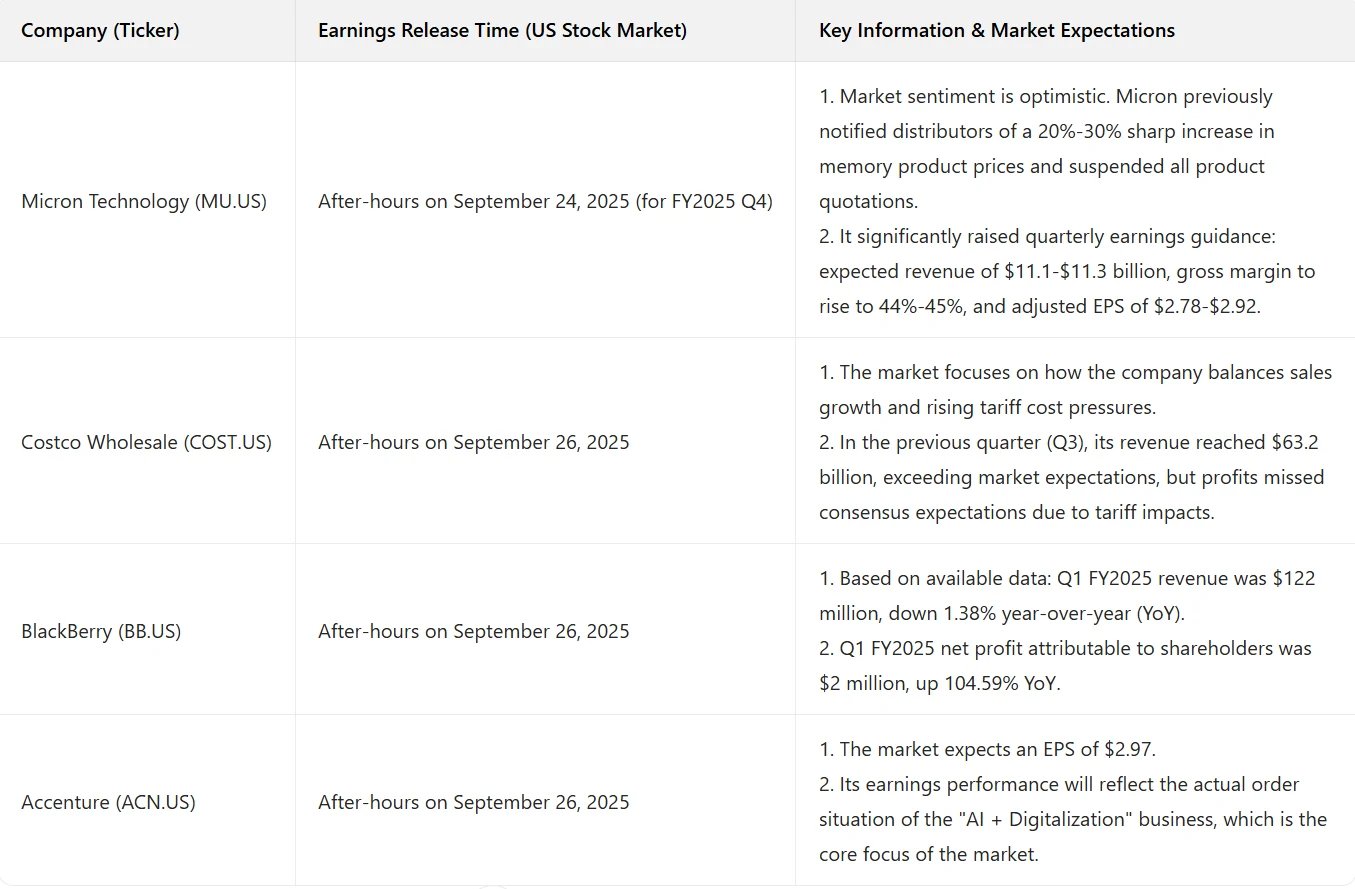

Companies reporting this week include Micron Technology, Costco, BlackBerry, and Accenture.

Market Review

Last week, boosted by the positive news of the Fed rate cut, the three major U.S. stock indices collectively rose, all setting new record highs. As of Friday's close, the Dow Jones Industrial Average gained 1% for the week, closing at 46,315.27 points; the Nasdaq Composite rose 2.2%, closing at 22,631.48 points; and the S&P 500 climbed 1.2%, closing at 6,664.36 points.

Source: TradingView

Individual stocks, particularly mega-cap tech stocks, performed notably.

Alphabet (Google's parent) gained 5.8% for the week, with its market capitalization surpassing $3 trillion. A U.S. court ruling allows Alphabet to maintain control of its Chrome browser and Android mobile operating system, while also preserving Google's lucrative "default search engine deal" with Apple. This ruling rejected the most severe demands for break-up, significantly alleviating investor concerns about structural risks and clearing obstacles for the company's future business expansion.

Source: TradingView

On September 18, NVIDIA announced a $5 billion investment in Intel and a comprehensive cooperation agreement. Stimulated by this news, Intel's stock price surged 22.77% to close at $30.57, marking its best single-day performance in nearly 38 years.

Source: TradingView

Under the agreement, NVIDIA will purchase Intel common stock at $23.28 per share, resulting in approximately a 4% stake post-issuance. The companies will jointly develop personal computer and data center chips. Intel will design customized data center central processing units (CPUs) for NVIDIA and manufacture x86 system-on-chips (SoCs) integrating NVIDIA RTX graphics. NVIDIA plans to package these CPUs with its AI chips (GPUs).

Tesla rose over 7% for the week, primarily driven by progress in its Robotaxi business, Musk's share purchases, and positive delivery news.

Source: TradingView

On September 11, news emerged that Tesla had received approval from the state of Nevada to test its Robotaxi service on public roads there, pushing the stock up about 6% that day. On the 12th, confirmation from Nevada authorities further bolstered investor confidence in Tesla's expansion prospects in autonomous driving and AI, prompting continued stock gains.

Furthermore, according to a Tesla filing with the SEC, Musk purchased over 2.5 million Tesla shares on September 12, worth approximately $1 billion. Musk's buying was seen as a strong vote of confidence in Tesla's future, providing positive momentum for the stock price.

Commodities: Following the Fed's announcement of a 25-bp rate cut, COMEX gold futures briefly spiked to a record high of $3,744/oz before quickly pulling back. As of September 18, COMEX gold futures were oscillating around $3,670/oz. On September 19, spot gold (London) fell to $3,627/oz before rebounding somewhat; it is currently hovering near $3,685/oz.

Source: TradingView

Regarding gold's outlook, institutions generally believe that, in the short term, rate cut expectations are fully priced in, and post-policy implementation, volatility could increase due to "buy the rumor, sell the fact" dynamics. However, from a medium-to-long-term perspective, an easing cycle typically accompanies falling real interest rates and a marginally weaker U.S. dollar信用, potentially accelerating "de-dollarization." Coupled with strong central bank gold buying demand and persistent geopolitical risks, these factors are expected to provide solid support for gold prices going forward.

Michael Hsueh, precious metals analyst at Deutsche Bank, significantly raised his 2026 gold spot price forecast from $3,700/oz to $4,000/oz. Citigroup also raised its gold price forecast, expecting prices to reach $3,800/oz within three months, up from a previous $3,600/oz, citing cyclical and structural factors likely supporting prices in the near term.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates