Santos capital allocation logic: Currently relying on pure oil production to achieve growth balance

00:22 September 20, 2025 EDT

Business Strategy and Outlook

Santos is Australia's second-largest pure-play oil and gas exploration and production company (after Woodside Petroleum). Its interests cover all of Australia's oil and gas producing regions, as well as Papua New Guinea. Santos is currently one of Australia's largest coal seam methane producers, with substantial reserves. It is also Australia's largest domestic natural gas supplier.

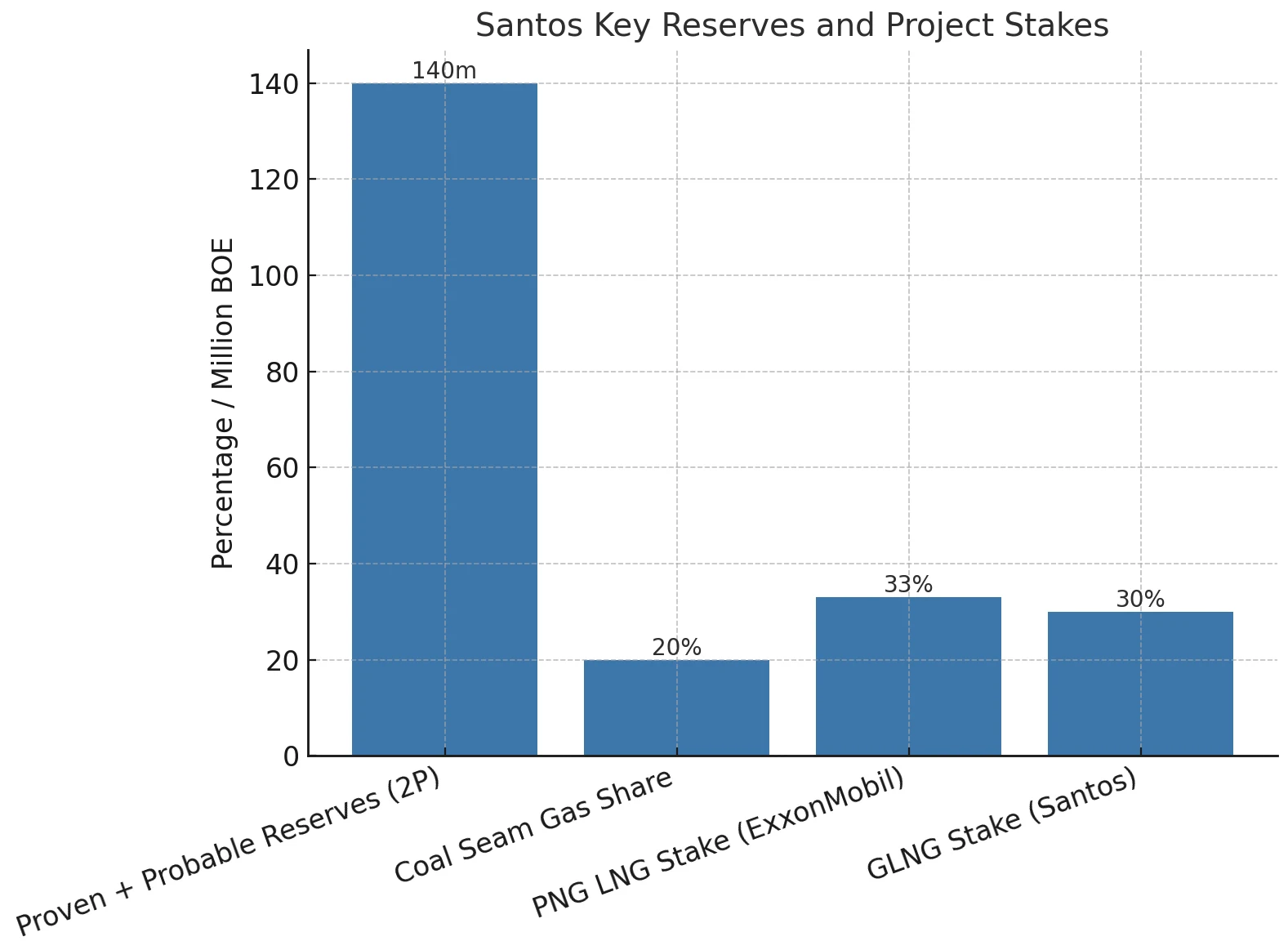

In the mid-2000s, coal seam gas (CSM) purchases increased reserves, and the sale of some of these reserves generated cash profits, laying a solid foundation for Santos' improved performance. The group's proved and probable reserves (2P) doubled to 1.4 million barrels of oil equivalent (BOE), primarily from East Australian CSM. CSM currently accounts for approximately 20% of the group's 1.6 million BOE 2P reserves.

The project partners are trustworthy. American energy giant ExxonMobil, the world's largest publicly listed oil and gas company, owns a 33% stake in the Papua New Guinea LNG project and serves as its operator. The Gladstone LNG project is being built and operated by GLNG Operating Company, a joint venture between Santos (30%), Petronas (27.5%), Total (27.5%), and Korea Gas Corporation (15%). Petronas is Malaysia's national oil and gas company and the world's second-largest LNG exporter. French energy giant Total is the world's fifth-largest publicly listed oil and gas company, and Korea Gas Corporation is the world's largest LNG buyer. Santos has a strong partner.

Overall, we expect Santos to have a strong future, driven by margin and earnings growth from its Gladstone and Papua New Guinea LNG projects. The company's natural gas enjoys export pricing. In addition to Santos' Gladstone LNG project, several other third-party East Coast LNG projects have contributed to higher domestic natural gas prices. As the largest domestic natural gas supplier, Santos has reaped significant rewards, capturing higher prices with limited additional capital or operating costs.

Financial strength

Free cash flow increased 30% to $620 million in the second quarter of 2025. Santos is well-positioned to sustain its existing business, achieve growth, and deliver shareholder returns. Its gearing ratio is only 20.5%, and its forward net debt/EBITDA ratio is 1.4, which remains robust and expected to remain at this level. Santos has no debt maturities as of September 2027.

Despite Santos' capital expenditures on expansion projects and ongoing buybacks, we expect its debt ratio to remain conservative. Santos' debt covenants offer ample headroom and are not threatened by current oil prices. The weighted average maturity is approximately 5.5 years.

Even with this capex expansion, we expect the net debt/EBITDA ratio to not exceed 1.5 (which is still moderate), and, all else being equal, to fall back to 1.0 by 2028. Capital expenditure on major projects is expected to decline significantly in 2026 with the delivery of the Barossa LNG project and the Pico 1 project.

We estimate capital expenditure of $13 billion between 2024 and 2027, including the PNG LNG and Papua LNG expansion projects, the Barossa to Darwin LNG upgrade, and the Pikka field. However, this expenditure is highly cost-effective and will nearly double the group's production to approximately 165 million barrels of oil equivalent by 2030. Efficient capital development and rapid upfront cash flows from the Pikka field should ensure Santos' leverage remains manageable.

Economic moat

We believe Santos lacks a moat.

The competitive advantage of resource stocks lies primarily in maintaining lower costs than their peers, and we do not believe Santos has an advantage in this regard.

LNG is an upfront capital-intensive business, and Australia's remote location and underdeveloped industrial base make capital costs particularly high compared to more developed service-sector markets like the United States. Santos's low cash operating costs are largely offset by its high capital costs, meaning it is not a low-cost operator overall.

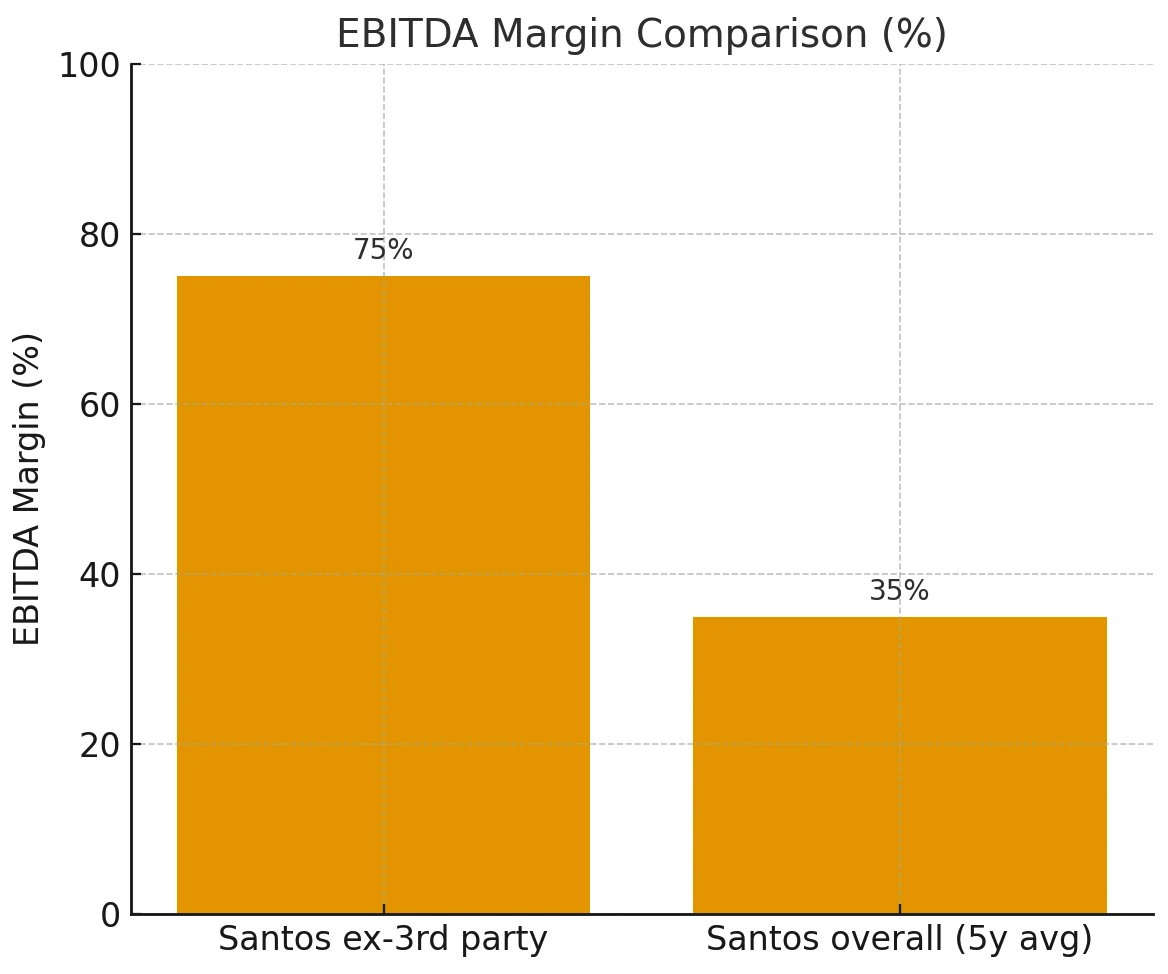

Santos' Gladstone and Papua New Guinea LNG projects offer large scale, long lifespans, low cash operating costs, and expansion potential. These projects are also located near major Asian markets, with freight costs approximately one-fifth of the cash cost of shipping from Australia to Asia. Based on prevailing freight rates, shipping costs from Australia to Asia were one-third of shipping from the United States to Asia via Panama or one-fifth of shipping from the United States to Asia via South Africa. Low operating costs ensure cash profits throughout the commodity cycle—Santos' EBITDA margin has averaged a high 75% over the past five years, excluding third-party sales. Unit operating costs are approximately $15 per barrel of oil equivalent. However, high capital costs have weakened and hindered the formation of a competitive moat. EBITDA margins have averaged approximately 35% over the past five years.

We do not expect Santos' return on invested capital to be materially above its cost of capital until the mid-2030s. During periods of favorable commodity prices, Santos' return on invested capital has occasionally exceeded its weighted average cost of capital. However, significant capital expenditures, including significant cost overruns, on the Gladstone and PNG LNG projects between 2011 and 2014 resulted in mostly single-digit returns. Construction costs for the PNG LNG and Gladstone projects were inflated by the Australian energy boom, permanently inflating the invested capital base and reducing returns. Currently, significant capital expenditures are recurring on the Barossa to Darwin LNG project and the Pica oil field in Alaska, further suppressing near-term returns. Production from the Barossa and Pica oil fields will improve after 2025, but will not be materially above Santos' cost of capital.

If Gladstone actually completes the expanded LNG trains, returns are expected to improve. Expanding to four trains would improve capital efficiency over the initial two-train configuration. Existing infrastructure, such as pipelines and terminals, is sufficient to support the expansion, eliminating the need for further costly dredging. However, given the scarcity of natural gas resources, we doubt that expanding the number of trains will generate returns. Furthermore, it is unclear whether the expansion will be sufficient to correct past inflated spending and enable the group's returns to exceed its weighted average cost of capital.

We do not expect Santos' economic moat potential to be compromised by a significant reduction in shareholder value due to environmental, social, and governance (ESG) risks. ESG risks are primarily based on sectoral risks, which are incorporated into our base case analysis. Natural gas is a key value driver for Australian exploration and production companies like Santos. Natural gas has a lower carbon intensity than coal or oil and, at least in the medium term, will benefit from efforts to reduce emissions. This is because renewable energy sources such as wind and solar, while rapidly expanding, will not fully meet global energy needs for decades, if ever.

This allows everyone to feel that Santos' production methods are more different for the general consumer group.

In recent years, the share of hydrocarbons in primary energy consumption has declined, but has increased in absolute terms. Their share has been replaced by renewable energy. In absolute terms, hydrocarbons have grown more than three times faster than renewable energy. Natural gas has played a leading role, with consumption increasing by more than one-third. As the most effective way to rapidly and effectively reduce emissions, we expect this growth trend in natural gas to continue, at least in the medium term. Over the past decade, natural gas's share of primary energy consumption has increased to approximately one-quarter of total consumption.

Furthermore, exploration and production companies are increasing their efforts to reduce emissions from their operations. Santos plans to reduce carbon emissions by 26%-30% by 2030 and achieve net zero emissions by 2040. The company also owns the Moomba CCS project, which plans to store 1.7 million tons of CO2 annually.

Another ESG risk factor for E&P companies is the potential loss of oilfield access due to poor community relations. Santos also sparked community unrest at Narrabri, New South Wales. The coal seam gas project ultimately received approval from the New South Wales Independent Planning Commission in 2020, but not before numerous farmers raised concerns about its potential impact on groundwater. Only time will tell how large the project ultimately becomes. Regardless, we believe the project is less critical for Santos, as its Queensland coal seam gas leases are more significant and enjoy greater public and political support.

Fair value and profit drivers

We have raised our medium-term Brent crude oil price forecast by $5 to $65 per barrel. Future supply constraints will push our price forecast higher. We expect real oil prices to remain stable through 2035, typically around $60 to $70 per barrel. As we approach the middle of the next decade, we expect demand to decline, but much less than supply, leading to significant price volatility.

We have slightly raised our fair value estimate for Santos from A$9.50 to A$9.60. As prices rise, we expect overall industry inflation to lead to higher operating and capital costs. This will constrain any upward movement in fair value.

The overall fair value change was limited by the fair value share of XRG Consortium's $8.89 offer. On a standalone basis, Santos' fair value rose 5% to $10.50.

Our fair value estimate of A$9.60 is roughly midway between the independent fair value estimate of A$10.50 and XRG's bid price.

Our fair value assumes a five-year compound annual growth rate (CAGR) of 12% for group EBITDA, reaching $6 billion by 2029. Our previous target was $5.6 billion. This includes an 80% increase in production to 160 million barrels of oil equivalent, initially from the new Barossa LNG and Pikka Phase 1 projects, followed by growth from the Dorado field and PNG LNG.

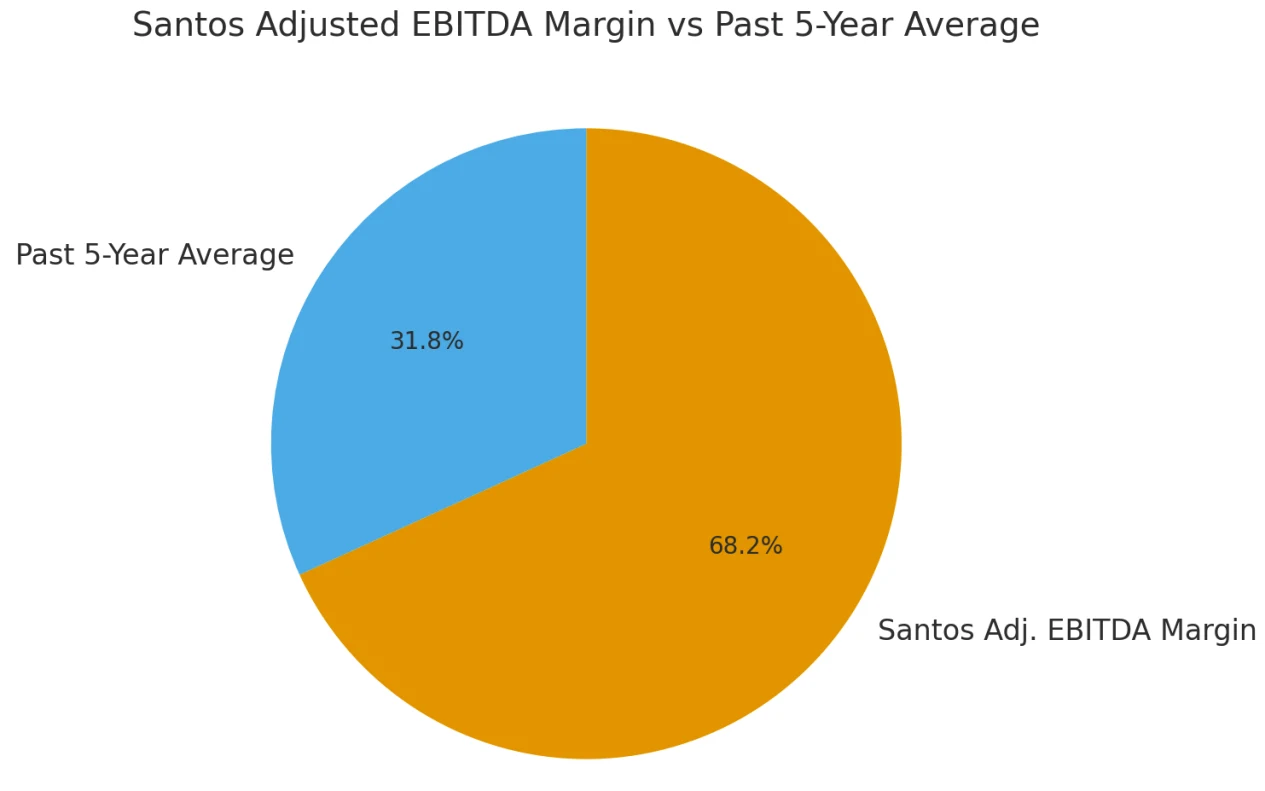

We assume a medium-term EBITDA margin of 77.5% (excluding third-party sales), up from 71% in the first half of 2025. Furthermore, we expect cost reductions at Barossa and Pikka, with management anticipating potential annual structural cost savings of $150 million.

Our fair value estimate for Santos incorporates a weighted average country risk premium of 1.0%, including a 3.0% country risk premium for Papua New Guinea assets and a standard 0% country risk premium for Australian assets. Its weighted average cost of capital (WACC) is 9.6%. Excluding the country risk premium, the fair value estimate would be approximately 2% higher.

Risks and uncertainties

We assign a "High" uncertainty rating to Santos, whose moderate debt levels support an 11.0% cost of equity. High corporate risk reflects commodity price volatility. To put this rating in perspective, we assess exposure to all Australian resources and energy businesses, including Woodside, as medium-high risk, despite Woodside's greater commodity and geographic diversification and enhanced scale advantages. Santos faces environmental and operational risks inherent in the oil and gas industry, as well as country-specific risks associated with some of its non-Australian assets. Santos is relatively small compared to other oil and gas majors.

Significant ESG risk exposure presents additional risks for E&P investors. Within the sector, the most significant exposures are to greenhouse gas emissions (both from extraction operations and downstream consumption), as well as other emissions, wastewater, and waste (primarily oil spills). Beyond reputational threats, these issues could compel more climate-conscious consumers to shift away from fossil fuels, leading to a long-term decline in demand. Climate concerns could also trigger regulatory interventions, such as bans on hydraulic fracturing, moratoriums on drilling permits, and even direct taxes on carbon emissions, measures already implemented in some jurisdictions.

These ESG risks are primarily based on the sector risks already incorporated into our baseline scenario analysis. Natural gas is a key value driver for Australian exploration and production companies like Santos. Natural gas has a lower carbon intensity than coal or oil and, at least in the medium term, will benefit from efforts to reduce emissions. This is because renewable energy sources such as wind and solar, while rapidly expanding, will not fully meet global energy demand for decades, if ever.

Capital Allocation

We have a Standard capital allocation rating on Santos .

Santos has a strong balance sheet. Santos is well-positioned to sustain its existing business, achieve growth, and deliver shareholder returns. Debt, net of lease payments, is a healthy 20.5%. Net debt/EBITDA is approximately 1.4 and is expected to remain healthy. The company has no outstanding debt maturities as of September 2027.

Despite Santos' capital expenditures on expansion projects and ongoing buybacks, we expect its debt ratio to remain conservative. Santos' debt covenants offer ample headroom and are not threatened by current oil prices. The weighted average maturity is approximately 5.5 years.

On the investment side, we believe Santos' performance is acceptable. Due to cost overruns on the $18.5 billion Gladstone LNG project, the company has underperformed in capital allocation. As a result, average returns over the past decade have fallen to the low single digits, well below its cost of capital. This is partly because the Gladstone project was built with expansion in mind, and any future growth will be more capital-efficient than the current two LNG trains. Santos could potentially expand to three trains, provided it secures gas supply and LNG procurement, and achieves capital cost savings by better utilizing existing tanks, terminals, and surrounding infrastructure.

We estimate that Santos' return on invested capital could exceed our assessed weighted average cost of capital of 9.6% by the 2030s. However, this reflects the commissioning of the Barossa to Darwin LNG project and the potentially prolific Dorado oil project, not the Gladstone project. Our base case forecast currently excludes the Gladstone expansion. We project capital expenditure of $13 billion from 2024 to 2027, including the Papua New Guinea LNG project and the Papua LNG expansion, the upgrade of the Barossa to Darwin LNG project, and the Pico oil project. However, this expenditure represents excellent value for money, nearly doubling the group's production to approximately 165 million barrels of oil equivalent by 2030. Efficient capital development and the rapid upfront cash flows from Pico oil should ensure that Santos' leverage remains manageable.

Finally, we believe the dividend payout is slightly low, resulting in a mixed rating. Santos reinstated its dividend in 2018 after a three-year hiatus due to rising debt levels caused by the Gladstone payout. The payout ratio has been maintained at a relatively conservative 30%. Santos' latest policy is to distribute at least 40% of free cash flow. We assume a future payout ratio of 50%, with half as dividends and half as buybacks. While Santos has taken a conservative stance in restructuring its operating model to achieve a $25/bbl free cash flow breakeven oil price, we believe an increase in the dividend payout ratio is justified to reward long-suffering shareholders without jeopardizing the now-stronger balance sheet.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates