Lemonade powered by AI: Profitability turning point and market revaluation

18:17 September 20, 2025 EDT

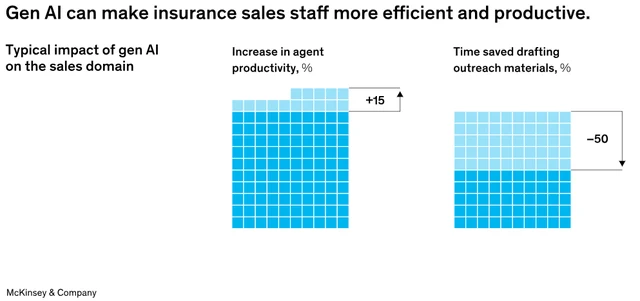

Lemonade has established a solid foundation for growth by leveraging AI algorithms, such as AI Jim, to resolve over 40% of claims within minutes. For example, the AI Maya chatbot service guides users through the policy purchase process through an intuitive and user-friendly experience. As a result, Lemonade's agent efficiency has increased by over 15% and the need for outreach materials has been reduced by over 50%.

Source: Lemonade

Lemonade hasn't yet fully leveraged AI integration, both in its current position and that of incumbents. Lemonade has an advantage over incumbents because, while it can already record over 40% of claims processing within 3 minutes, incumbents still allocate 70% of their IT spending to legacy systems. This means it may take incumbents longer to become AI-first, which is precisely where Lemonade leads. Insurance companies still use 97% of claims data, which is unstructured and not conducive to large-scale model training.

Another perspective is revenue. The company's total revenue exceeded expectations by 4% in its latest quarter, indicating the start of a long-term uptrend. Consequently, the company has raised its Q3 2025 revenue forecast to an average of $184 million, representing 34.7% year-over-year growth, higher than the 34.51% year-over-year growth projected for Q2 2025. In my view, this revenue growth is driven by the company's strength in AI efficiencies.

Company Profile

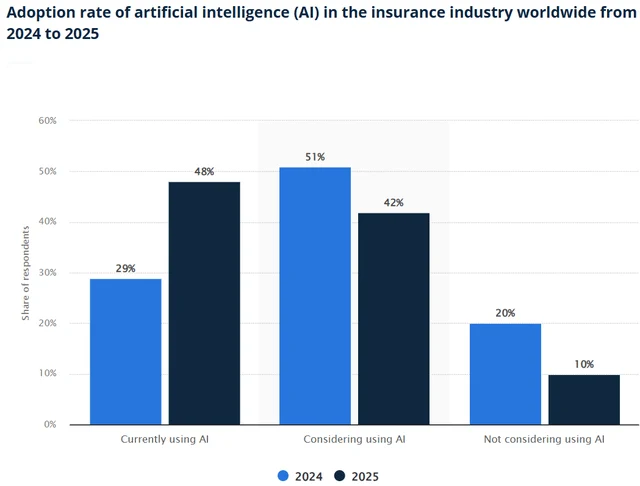

Lemonade Inc. currently offers a range of insurance products for renters, landlords, pet owners, life insurance policyholders, car owners, and homeowners, including property damage or theft and personal liability coverage. The company also acts as an agent for other insurance companies. Its services cover the US, Europe, and the UK. Founded in 2015, the company is headquartered in New York. Combining the market context of existing companies with the above explanation, it is clear that the AI hurdles faced by existing companies are far greater than Lemonade's AI capabilities, and therefore do not pose a significant threat to Lemonade. On the other hand, taking the insurance industry as an example, revenue in 2024 will reach $975.7 billion, with 20% coming from the five largest insurance companies: Allstate Corp. ($64.1 billion), Berkshire Hathaway Inc. ($80.8 billion), The Travelers Companies, Inc. ($46.8 billion), State Farm Mutual Automobile Insurance Co. ($123 billion), and Liberty Mutual Automobile Insurance Co. ($123 billion). Compared to these larger companies, Lemonade remains a smaller company, with annual revenue of $526.5 million in fiscal 2024 and an expected revenue of $713 million in fiscal 2025, representing an upside of 35.41%. This demonstrates that despite the market being dominated by the Big Five, Lemonade's AI efficiencies are taking over. While 51% of insurers were considering using AI in 2024, this percentage dropped to 42% by 2025, reflecting the challenges facing insurers I've previously explained, particularly the 70% of IT funding being diverted to legacy spending.

Growth opportunities

Globally, 48% of insurers will still be using AI in 2025, up from 29% in 2024, representing a significant untapped opportunity.

Ideally, Lemonade will be able to compete favorably with established incumbents and giants in the insurance industry. The company's ability to settle claims within two minutes, far exceeding the typical three-to-five-day processing time, has attracted numerous customers. In the second quarter of 2025, the company's claims volume reached $2,693,107 million, a 24% increase. Consequently, in-force premiums (IFP) increased by 27% to $1.083 billion.

Given this advantage, AI integration has consistently reduced the company's operating expenses (OPEX) relative to IFP. After the second quarter of 2022, OPEX fell from $87 million to $80 million. Meanwhile, IFP also saw a significant increase over the same period, from $609 million to $1.083 billion. This demonstrates the company's demonstrated efficiency gains from AI, which are expected to be a sustainable growth driver, with revenue projected to reach $413 million. This forecast is highly likely given IFP's 22% compound annual growth rate and its potential to drive higher premiums per customer. For example, premiums per customer increased from $396 in the first quarter of 2025 to $402 in the second quarter of 2025. Looking ahead, with AI expected to drive further growth in IFP to $1.215 billion in fiscal 2025, a 12.19% increase, the market remains bullish on Lemonade's continued upward trend. Given the continued growth of AI integration, let's delve deeper into the financials.

Lemonade is a technology-driven insurance company leveraging artificial intelligence, behavioral economics, and a fully digital model to disrupt property and casualty insurance. Founded in 2015, the company offers a broad range of personal lines in the US and select European markets, sold directly through its website and app without agents. An AI-powered chatbot enables instant quotes, dynamic pricing, and rapid claims settlements. Its model, which blends premium retention and selective reinsurance and has recently been scaled back to improve economics, targets digitally native customers and high-growth segments such as telematics-based, usage-driven auto insurance.

Today, Lemonade's growth algorithm is built on three mutually reinforcing drivers: risk selection based on vehicle telematics, iterations of Europe's rapidly evolving automotive regulatory landscape, and the structural reduction of proportional reinsurance, which allows more unit economics to be maintained on the underwriting balance sheet as underwriting results become increasingly stable.

At the July 1st plan renewal, management reduced the full account allocation from 55% to 20%. This prudent decision was driven by the improvement in the gross loss ratio to 70% over the past 12 months, with the quarterly gross loss ratio down to 67%, a 12 percentage point decrease compared to the same period last year. Because earned premiums are rolled over based on a risk-based premium, this reduction will allow revenue growth to outpace in-force premium growth for several quarters.

Financials: Q2 2025 Highlights and Valuations

The company has seen an average revenue growth of 66.31% since September 2021. Assuming this trend continues through 2025, driven by AI efficiencies, Q2 2025 revenue could reach over $272 million by Q3 2025. This is in line with the company's Q3 2025 average revenue forecast of $184 million. This revenue outlook is feasible given the catalysts I discussed above.

In terms of profitability, the company has yet to achieve profitability. However, net losses have narrowed from $57.2 million in the second quarter of 2024 to $43.9 million in 2025. Given the efficiency of AI and the company's average revenue growth rate of 66%, there is every reason to believe that the company will achieve profitability in the near term.

Speaking of valuation, we can use the price-to-sales ratio to assess Lemonade's valuation compared to its competitors, Mercury General Corporation and Selective Insurance Group, Inc. Compared to its peers, the company has the highest price-to-sales ratio at 6.91. This means it's priced at a premium relative to its peers.

LMND's impressive growth rate of 24.55% is significantly higher than its peers' negative growth rates, justifying its premium valuation.

With this backdrop, we can estimate a target price for the company as of the fourth quarter of 2025. We can begin by forecasting revenue and net income for fiscal years 2025 and 2026. In my forecasts, I assume a 35% growth rate in 2025 and a 60% growth rate in 2026, which would mark a return to a growth rate of around 60%, driven by the aforementioned AI catalysts. I also expect the company's net loss margin to improve from over 38% in 2024 to around 28% in 2026. Based on these assumptions, I estimate revenue of approximately $1.14 billion in 2026, slightly below the consensus estimate of $1.16 billion.

Based on these estimates, I would target a valuation of 8 times sales, higher than the trailing P/S ratio of 6.91. I believe the market may value this stock at a higher multiple given its promising revenue growth outlook, making my target P/S ratio reasonable. Keep in mind that the stock's five-year average P/S ratio is 10.55, suggesting it may be undervalued, making an 8x valuation very achievable. Based on these assumptions, the stock would reach $123.13 in 2026, representing an upside of approximately 115%.

Growth opportunities

Lemonade's reliance on artificial intelligence exposes it to regulatory oversight of AI and data collection that could hurt pricing, underwriting, and claims processing, which are all important revenue levers.

Furthermore, Lemonade is still expanding but not yet profitable, making it subject to the cyclical nature of the insurance industry. This can lead to periodic fluctuations that impact pricing power and profitability. These periodic fluctuations could impact LMND's ability to execute and put pressure on its financial forecasts.

Unit economics in the two most contentious areas—Automotive and Europe—are developing synergistically, rather than competing for resources. Automotive's gross loss ratio decreased to 82%, a 13 percentage point year-over-year increase, the highest level since launch. Automotive premiums in force increased 12% quarter-over-quarter, exceeding the company average for the second consecutive quarter. Telematics signals, appearing earlier in the funnel, increased conversion rates by approximately 60% compared to the fourth-quarter baseline, facilitating price segmentation, thereby lowering prices to appropriate risk levels and reducing loss cost volatility.

Europe is rapidly becoming the second largest growth engine, with attractive margins. In-force premiums in Germany, France, the UK, and the Netherlands grew by over 200% annually, reaching $43 million, contributing over 20% of net new customers. Europe's gross loss ratio widened by approximately 15 percentage points year-over-year, reaching just over 80%. Because Europe enables faster pricing and underwriting iterations without publishing actual rates, feedback loops are compressed, allowing AI stacks to accumulate faster with fewer local employees. This creates a structural efficiency advantage, reflected in higher new business per unit of growth expenditure compared to similarly sized US companies.

Solid earnings quality and extended capital base

Essentially, earnings quality has improved in terms of durability. Net premium income increased by 26% to US$112.5 million, and reinsurance commission income increased by 84%, demonstrating that the variable commission mechanism is effectively improving loss ratios.

The balance sheet provides runway. Cash, cash equivalents, and investments totaled approximately $1.03 billion at quarter end, of which approximately $277 million was held as regulatory surplus in regulated insurance subsidiaries. In its fourth-quarter 2010 financial results, the company reported $386 million in cash and cash equivalents and $646 million in investments. Borrowings on General Catalyst's Synthetic Agent Financing Facility totaled $123.5 million, with disclosed interest expense included in general and administrative expenses (G&A).

The plant can absorb 80% of growth expenses, return 16%, and maintain production capacity through 2026. While this increases short-term financing costs, it allows brand and channel investments to act as off-balance sheet growth capital, repaid by the customer base they help create, preserving equity options as revenue scales.

As leading U.S. economic indices decline further, potentially signaling potential macroeconomic headwinds, Lemonade's capital-light, AI-driven model can provide resiliency by maintaining growth and underwriting discipline even as traditional insurers face cyclical pressures.

Reducing the reinsurance ratio from 55% to 20% increases retained underwriting risk and earnings volatility. This risk has already been mitigated through per-peril and catastrophe excess of loss protection provided by Lemonade. However, extreme weather or model underestimations could put pressure on capital and trigger a recession due to economic weakness. The sustainability of this reduction depends on further reductions in the total loss ratio (which rose to 67% in the second quarter) and on maintaining this trajectory across all market cycles.

Even with the apparent progress, execution risks remain in auto insurance. Telematics and market segmentation have driven a 13 percentage point year-over-year decline in the auto loss ratio, but the insurance sector remains vulnerable to social inflation, rising repair costs, and a competitive pricing cycle. Any reversal of these advantages would erode the expected earnings growth from improved premium retention.

Strong growth in Asia and Europe (European in-force premiums increased by over 200% year-over-year) brings scale advantages, but also localized and regulatory complexities. While faster pricing iterations are beneficial in these markets, mistakes or overfitting can quickly escalate and potentially impact group profitability. Future currency fluctuations could trigger secondary earnings noise.

From a capitalization perspective, General Catalyst's Synthesis Agent Financing Facility effectively finances growth spending without diluting equity, but its 16% return commitment is substantial. If acquisition efficiency declines, such repayments will compress free cash flow as EBITDA changes.

Finally, model governance and rules are a constant danger. Lemonade's underwriting and claims automation relies on proprietary machine learning. A high-profile glitch, security vulnerability, or apparent bias could draw further attention, slowing iteration and diminishing the compounding benefits provided by its learning system.

Lemonade is transitioning from a reinsurance-buffered growth model to a retention-driven operator, ultimately winning with its model rather than its marketing. Assuming that its European and automotive businesses maintain their paired growth and loss ratio expansion, and that the reinsurance business resets to increase revenue without introducing volatility, the market's valuation of this franchise could rise again in this scenario.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates