Repsol: Sound financials and transformation pressure coexist

10:26 September 20, 2025 EDT

Business Strategy and Outlook

While Repsol is increasing its investment in low-carbon businesses to achieve its long-term emissions targets and successfully navigate the energy transition, its oil and gas business will continue to contribute the majority of its earnings and cash flow over the next five years.

Upstream operations will no longer grow, but will instead generate free cash flow to fund other investments and shareholder returns. Repsol's production will remain flat or decline slightly through 2027 as it focuses on investing in high-return brownfield projects and developing recently discovered and acquired fields it currently operates. While production will remain relatively flat, Repsol estimates that its cash flow generation will improve due to the addition of new, high-margin production.

Likewise, Repsol expects its industrial division – oil refining and chemicals production – to increase cash flow by lowering breakeven levels, expanding its trading organization and improving the quality of its chemicals portfolio. Growth will come from renewable fuels in the Iberian Peninsula and potentially in the United States.

Repsol expects the Upstream and Industrial divisions to generate a projected total free cash flow of 9 billion euros to 11 billion euros between 2024 and 2027, assuming an oil price of $70 per barrel, while free cash flow from low-carbon-related businesses will remain negative during this period.

The low-carbon power generation business lacks free cash flow due to the significant investment required to achieve its target of increasing total installed capacity from 3.7 GW by the end of 2024 to 9-10 GW by the end of 2027. The new capacity will be achieved through a portfolio of solar and wind power, primarily in Spain, with further expansion into the US to follow.

However, over time, low-carbon businesses, particularly renewable energy, will become a larger value driver. By 2027, low-carbon businesses, including retail and industrial sectors, could account for more than 33% of capital expenditures and more than 40% by 2030, while contributing about 15% of cash flow.

Financial strength

At mid-2025, net debt is €5.7 billion, and the reported adjusted net debt/capital ratio is 18% higher than the 6.7% at the end of 2023. Leverage decreases following the sale of a 25% stake in the upstream business, but increases in 2024 as low-carbon investments, including acquisitions, increase. These figures include €3.8 billion in lease contracts. Overall, Repsol's leverage is relatively low.

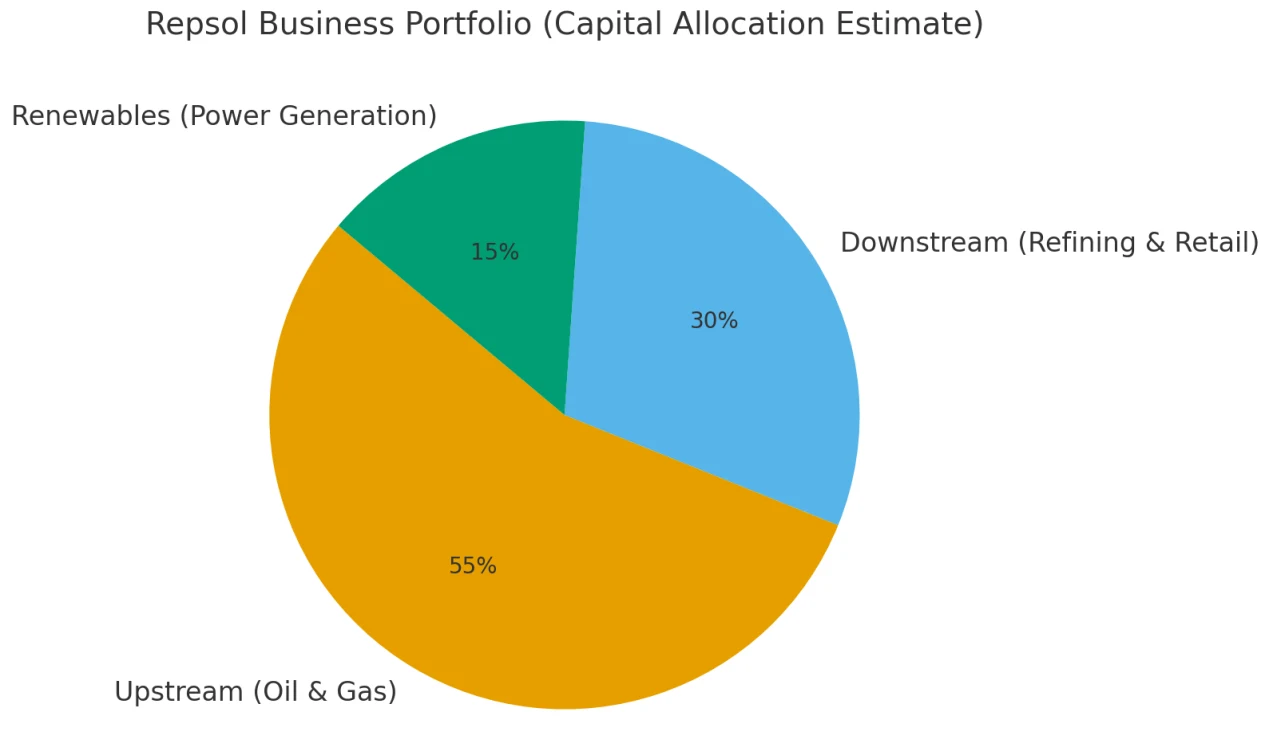

Repsol plans to achieve net capital expenditures of €3.5 billion to €4 billion in 2024 (including proceeds from the sale of renewable assets), bringing total net investments to €16 billion to €19 billion between 2024 and 2027, after divestments and renewable farm closures. The majority of funds will be allocated to conventional oil and gas activities in the upstream and industrial sectors, but 15% to 25% of capital expenditure will be allocated to low-carbon power generation and 10% to 15% to low-carbon projects in the industrial sector.

Management cut the dividend to €0.60 per share in 2021 but has since increased it several times, including to €0.90 per share in 2024, with €0.975 per share to be paid in 2025. Going forward, management plans steady annual increases of 3%.

Management expects to distribute 25%-35% of cash flow through buybacks and dividends going forward. Total dividend distributions are expected to be approximately €10 billion from 2024 to 2027. Even in an oil price scenario below $55 per barrel, Repsol still expects to distribute approximately €8 billion to shareholders.

Economic moat

Repsol does not have an economic moat because its assets cannot generate excess returns at our assumed long-term oil price of $65/bbl.

Among global integrated oil companies, Repsol's upstream portfolio is weak, with a large presence in natural gas, resulting in lower margins and lower returns than its peers. While capital discipline and a focus on brownfield and high-quality new projects should improve the competitiveness of its portfolio, this is insufficient to materially improve segment returns and secure a moat. Recent high global oil and gas prices have boosted returns, but this is insufficient to bring about the long-term structural changes that would ensure excess returns and a moat. The divestiture of a 25% stake in the business would not impact our moat rating as asset quality remains unchanged. Repsol's announcement to place its UK assets in a joint venture with NEO Energy Group creates cost savings opportunities, estimated by the group at $1 billion, but this is insufficient to secure a moat for Repsol's entire portfolio.

Repsol's production will not increase over the next five years, but its portfolio will be revitalized through acquisitions, divestitures, and natural decline. Approximately 70% of upstream investment will be in brownfield and greenfield projects. Brownfield projects have low capital intensity and short payback periods of approximately three years because they leverage existing infrastructure in core US onshore areas (Eagle Ford and Marcellus), the Gulf of Mexico, Brazil, and the North Sea. New project investment will be concentrated in Mexico, the Gulf of Mexico, Alaska, and Brazil.

The most attractive of Repsol's upstream assets is its holdings in Brazil's rich pre-salt oil fields. Thanks to its early entry, Repsol was able to acquire stakes in many concessions in the region. However, Repsol sold 40% of its original stake to raise funds for development. The 2015 acquisition of Talisman gave it access to most of its onshore oil fields in the United States, but at the time, Talisman viewed these assets as lacking a moat and potentially challenging their economics if prices did not rise. Repsol also does not hold fields in the Permian Basin, which boasts the highest quality and highest returns among US unconventional oil fields.

Repsol's downstream portfolio is in a better position, as recent investments have increased production of cleaner products and enhanced its refineries' capacity to process low-priced heavy crude oil. It also benefits from higher distillate production, which has seen rising margins in recent years. However, to achieve a "moat," refining assets require relative cost advantages, typically through access to low-priced feedstocks, which Repsol lacks. Furthermore, Repsol's refineries are primarily located in Europe, where demand growth has stagnated and competition from low-cost, export-oriented facilities overseas is increasing. Even so, the downstream business, including its retail assets, has achieved double-digit returns on invested capital over the past nine years (excluding 2020).

The renewable energy generation business, while not yet contributing significant earnings, is one of the factors underlying our no-moat rating. Free cash flow from the business is likely to remain negative until 2027, as it grows to 20% of capital employed by that year and to around 25% by 2030. While the business is expected to generate stable earnings, return certainty is low. Similar to other integrated oil companies, Repsol plans to increase typical utility returns (5%-6%) by 3%-4% through operational management and leverage, and has set a 10% equity return threshold for its investment in the business. However, with numerous players competing for renewable energy projects using similar strategies, the success of this strategy remains uncertain.

We typically assign moats to this sector based on the quality and duration of power purchase agreements (PPAs), which guarantee above-market prices and thus high returns for renewable energy projects. However, it's unclear whether these contracts will remain attractive in the future if more developers bid for them. European countries have begun removing subsidies for such projects. Therefore, it's premature to assign a moat to Repsol in this sector.

Repsol faces several ESG-related risks, but we believe these risks do not impact its moat rating, given their long-term impact on the company and their low probability and significance, which would result in significant loss of value. Repsol's primary ESG risks stem from carbon emissions from its operations and product use, emissions from its operations, wastewater and waste (e.g., oil spills), and poor community relations.

The risk of carbon emissions is most likely to be realized through the imposition of a carbon tax, which would increase the price of final products, reduce demand over time, and threaten Repsol's core business. We expect carbon taxes to be more widely adopted over time, but we believe their impact on hydrocarbon demand will still take more than a decade to become apparent.

Repsol's strategy to reduce full-cycle emissions, including Scope 3 emissions, will put it in a better position to withstand rising carbon costs. While Repsol's decarbonization efforts should lower carbon costs, it is unlikely to gain the competitive advantage needed to build a competitive moat. Furthermore, any efforts to reduce Scope 3 emissions will have little impact on final product prices and mitigate demand, the true purpose of a carbon tax.

Investing in renewable hydrogen is also gaining increasing attention as a way to combat emissions. Repsol aims to become a leader in renewable hydrogen on the Iberian Peninsula through a low-cost deployment, leveraging Spain's strengths in renewable energy generation. However, as the hydrogen industry is still in its infancy, material production will not be available until after 2025, and relative costs remain uncertain.

Oil spills are a constant risk for offshore oil companies, and as BP's Macondo incident in the Gulf of Mexico demonstrated, they can be devastating to a company's value. While oil companies frequently cause spills, most are small, with associated fines and cleanup costs being manageable. Furthermore, large spills like Macondo are extremely rare and therefore not considered in any of our scenario models.

Finally, Repsol operates in border regions, such as the Amazon Basin in Brazil and Peru, where oil and gas development may create friction with local communities. In such cases, poor community relations could lead to development delays, cost increases, or concession disputes. In more established regions, such as Libya, Repsol has experienced social unrest that has led to operational disruptions. Furthermore, following territorial violations by China, the Vietnamese government ordered Repsol to halt drilling operations in the South China Sea. However, these risks are territorial-related and we believe them to be manageable. Delays or disruptions in any one project are unlikely to materially impact the value of a company of Repsol's size.

Fair value and profit drivers

After incorporating the latest commodity prices, updated medium-term oil prices, recent strong refining margins and updated exchange rates into our model, we raise our fair value estimate from €12.0 to €13.3.

The fair value estimate represents a forward enterprise value/EBITDA multiple of 4.2x our 2026 EBITDA forecast of €5.9 billion. Our fair value estimate is derived using a standard three-stage discounted cash flow (DCF) methodology. This methodology derives a terminal value based on our assumptions about long-term earnings growth and returns on newly invested capital. This valuation methodology also more explicitly incorporates our moat rating, which reflects how long we expect a given company to achieve excess returns on invested capital based on a DCF analysis.

In our DCF model, we assume Brent crude oil prices of $69 per barrel in 2025 and $65 per barrel in 2026. Our long-term oil price assumption is $60 per barrel. We assume a cost of equity of 9.0% and a weighted average cost of capital of 7.1%.

In line with management's guidance, we forecast production of approximately 550 million barrels per day (bpd) in 2024, with modeled production remaining flat over our forecast period. Repsol's downstream operations have experienced strong profitability over the past few years, driven by record margins following the Russian invasion of Ukraine. These margins have now normalized, and we model this accordingly. However, margins could decline in the short term if the global economy slows. Renewable energy investments are expected to generate negative cash flows over the next few years, thus having a minimal impact on our fair value but supporting our terminal value.

Risks and uncertainties

Repsol's uncertainty rating is High, based on its fundamental exposure to commodity prices; its assessment of environmental, social, and governance (ESG) risks; and the range of return outcomes used in our Star Rating system. ESG-related risks include the implementation of carbon taxes or other climate change policies that could lead to higher costs or lower demand. As an oil producer, Repsol is also exposed to litigation risks related to corruption or large-scale oil spills, both of which could result in significant losses from lost revenue, fines or penalties, or the revocation of its operating license.

However, according to our framework, the aggregate magnitude of ESG-related risks is not sufficient to alter the uncertainty ratings determined by our scenario-based analysis. Social unrest, protests, and sabotage could lead to delays or disruptions, while rising costs or concession disputes could result in production losses.

Even after the seizure of its Argentinian assets, Repsol maintained significant exposure in South America and Libya. In Latin America, its primary region of operations, Repsol's oil and gas operations faced stringent regulations, which limited its profits. Economic turmoil throughout Latin America, such as hyperinflation and recession, impacted currency values and demand for oil products.

In the long term, the adoption of electric vehicles is likely to reduce demand for oil and refined products. While expanding into renewable energy generation could capitalize on long-term demand growth, it is a relatively new area for Repsol, and the return on capital employed is uncertain.

Capital Allocation

Under our capital allocation framework, which assesses the soundness of the balance sheet, the appropriateness of the investment strategy and shareholder distributions, Repsol receives a Standard Capital Allocation Rating.

Our framework suggests Repsol's balance sheet is strong, given its manageable debt levels. We forecast that the net debt/EBITDA ratio will remain below 2.0x over the next five years, with relatively modest near-term debt maturities. Repsol's net debt/capitalization ratio (including leases) is well below its 25% target. Repsol's business operates at a moderate level of leverage, with high revenue cyclicality. Nevertheless, a flexible capital plan and variable shareholder returns should prevent a significant increase in debt from declining commodity prices.

Based on our framework, we believe Repsol's investment strategy is sound. Repsol will invest €16 billion to €19 billion by 2027, with the majority (30% to 40%) allocated to upstream operations. Furthermore, capital expenditures and production volumes remain flexible and dependent on commodity prices, ensuring free cash flow generation even in oil prices below $40 per barrel. Exploration activities will be further streamlined, with Repsol focusing primarily on high-yield basins to shorten investment cycles.

By 2027, approximately 50% of capital will be allocated to decarbonizing existing operations, circular economy projects, and renewable energy generation. While low-carbon investments will reduce Repsol's carbon intensity over time, they generally offer lower returns than upstream investments and rely on leverage to achieve significant returns. While this strategy is similar to that of its peers, it remains uncertain whether integrated oil companies can successfully leverage their experience and execute in areas distinct from their traditional oil and gas businesses. Increasing competition in renewable energy could limit access or reduce expected returns. Given our long-term outlook for oil and gas demand, we expect to see greater relative investment in hydrocarbons. However, the expected implementation of carbon pricing and stricter carbon emissions regulation will mitigate the impact of declining returns, and Repsol sees value in a more proactive transformation strategy. Finally, given growing demand driven by global fuel blending mandates, biofuels could be an attractive way to support downstream margins.

We believe Repsol's shareholder distribution policy is reasonable, given its introduction of a flexible dividend and buyback payout program tied to cash flow. Setting a minimum dividend and increasing it only when cash flow is high reduces the likelihood of a dividend cut. Repsol has clearly established its dividend policy and growth targets, providing investors with an understanding of what to expect.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates