Cash Remains One of the Best Short-Term Investment Options After a Rate-Cut Cycle

05:51 September 18, 2025 EDT

In the context of the Federal Reserve restarting its easing cycle, bond investors are flocking to the high yields offered by long-term Treasuries. However, for investors planning on a monthly rather than annual horizon, cash equivalents—such as high-yield savings accounts, money market funds, and short-term Treasury bills—continue to provide reliable stability and real returns. Currently, the Fed has lowered the federal funds rate by 25 basis points to 4.00%-4.25%, and the market anticipates further easing. Cash serves not only as a defensive asset but also as a strategic choice for short-term objectives.

Consider a typical scenario: a household saving for a down payment six months ahead, or a business setting aside liquidity for seasonal expenses. These investors prioritize liquidity and protection against inflation erosion over chasing yields that could evaporate in the event of economic surprises.

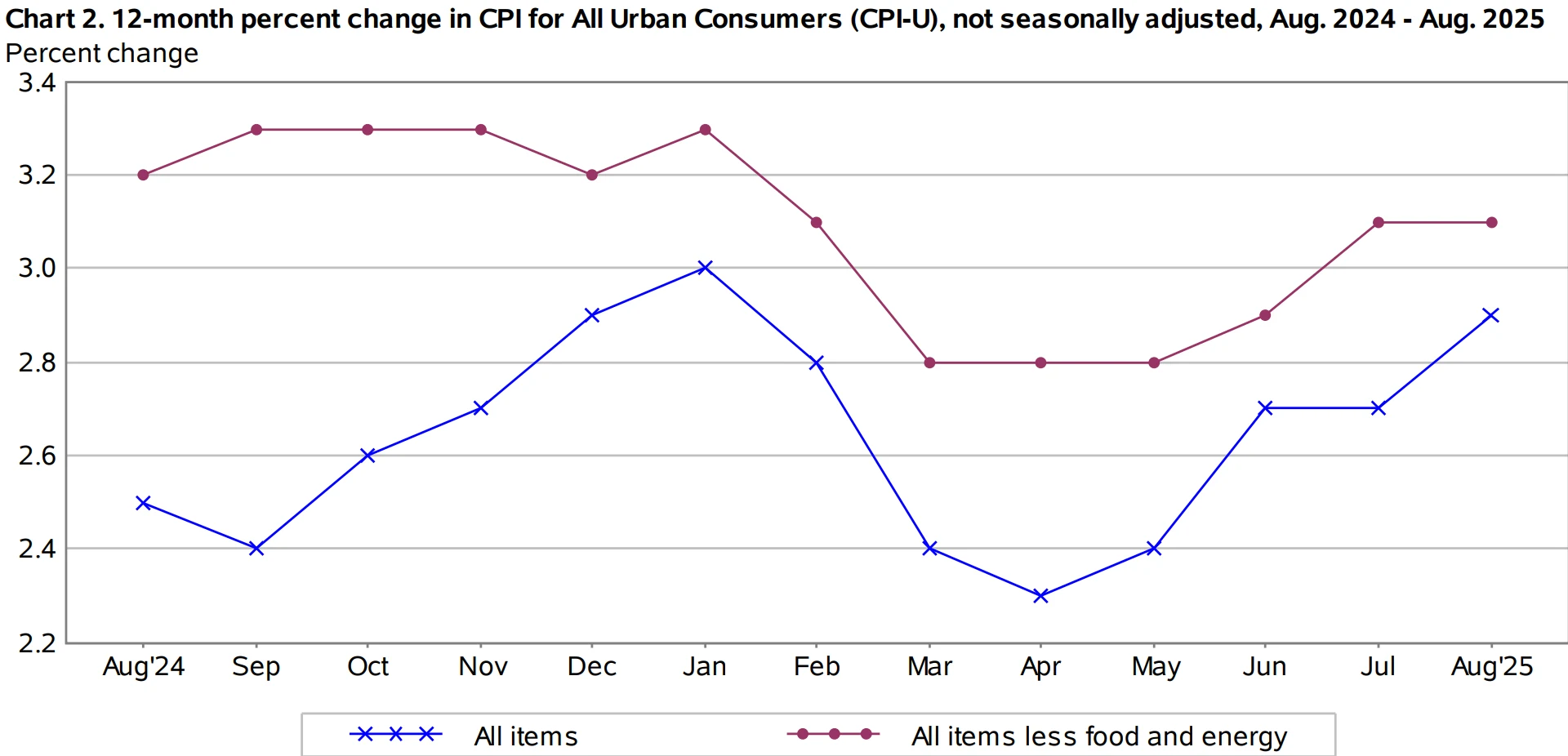

The latest data show that the annualized CPI rose to 2.9% in August, up from 2.7% in July, indicating persistent price pressures. According to the U.S. Bureau of Labor Statistics (BLS), the August unemployment rate increased to 4.3%, approaching a level that typically prompts policy caution. In this environment, cash functions as a short-term hedge and a key support for short-term financial planning.

Yield Curve Navigator

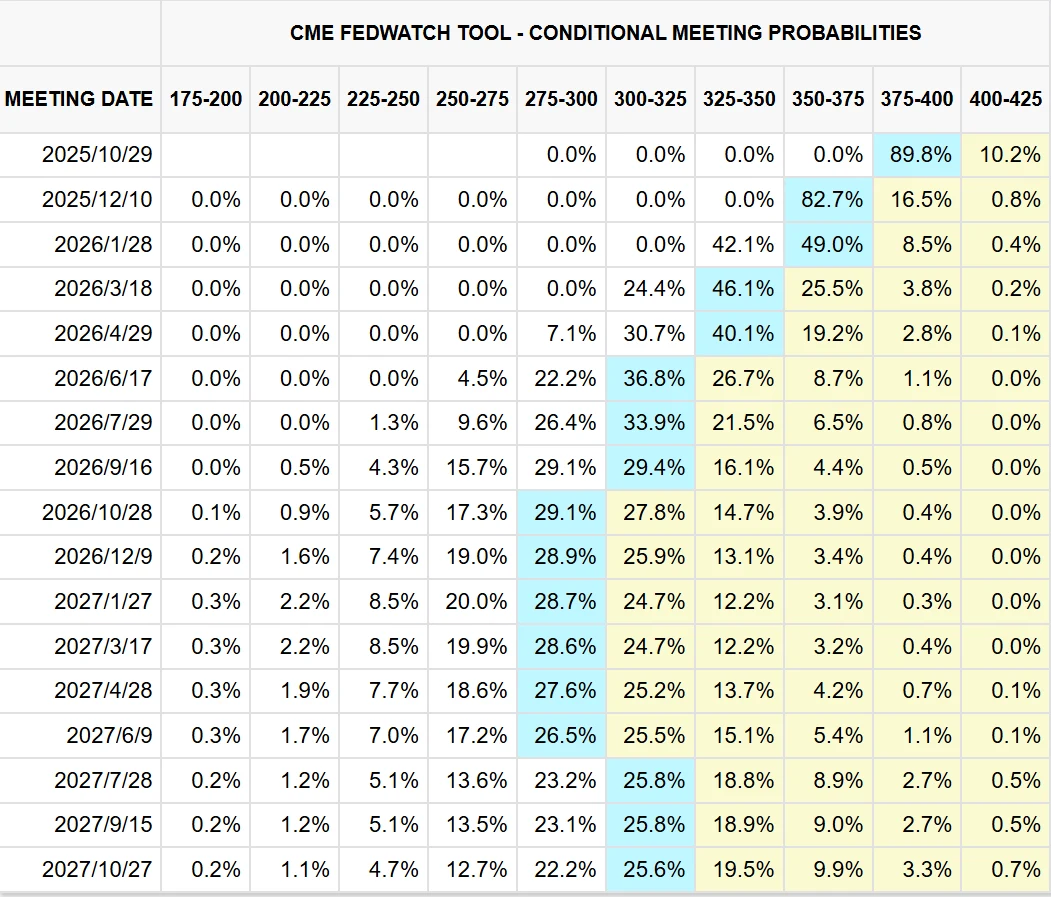

At its September 17 meeting, the Federal Reserve lowered the target range for the federal funds rate by 25 basis points to 4.00%-4.25%, marking the formal restart of its easing cycle. Market attention quickly shifted to the path of future rate cuts. According to the CME Group’s FedWatch tool, as of publication, traders assigned an 89.8% probability to a 25-basis-point cut at the October meeting (scheduled November 6-7), up from 74.3% the previous day, while the probability of a 50-basis-point cut was roughly 10.2%. For the December meeting (December 17-18), the market currently sees an 82.7% chance that the federal funds rate will fall to 3.50%-3.75% by year-end, implying a potential cumulative 50-basis-point reduction over the remaining two meetings, or 25 basis points each.

Source: CME Group

If economic data continue to show slowing employment, the Fed may accelerate easing; conversely, a rebound in inflation could limit cuts or keep rates unchanged.

The implications for interest rates are direct: short-term rates are likely to decline more quickly, while long-term rates remain constrained by economic resilience and inflation trends. The yield curve has already begun to steepen—three-month Treasury bills yield around 4.00%, two-year notes are down to 3.85%, while ten-year and thirty-year Treasuries have rebounded to approximately 4.05% and 4.65%, respectively.

Source: TradingView

If the Fed follows through with the expected additional 50-basis-point cuts, short-end yields could drop below 3.50%, further steepening the curve; however, long-end yields may remain elevated—or even rise slightly—due to fiscal deficit concerns, increasing bond price volatility and offering short-term investors a cash buffer that reduces duration risk.

Asset managers such as Morgan Stanley and MFS recommend increasing allocations along the intermediate and long end of the yield curve. Their rationale: in a falling-rate environment, extending duration can amplify capital gains. For example, if the 30-year Treasury yield (currently 4.65%) falls 100 basis points over the next year, its price could rise 15%-20%, based on duration sensitivity (Price change ≈ Duration × Yield change). Additionally, the long-end term premium—roughly 65 basis points above three-month bills—provides a cushion against modestly rising inflation expectations.

For short-term investors, however, this premium remains limited in historical context. According to the Federal Reserve Bank of St. Louis (FRED), the average spread between 30-year Treasuries and three-month bills over the past 44 years has been roughly 200 basis points, with wider swings during periods of high inflation or economic volatility. Today’s roughly 65-basis-point premium is relatively narrow, and if rates remain stable or rise, the potential gains from chasing long-term Treasuries may not adequately compensate for reinvestment risk.

Globally, this cautious stance is further reinforced. In Europe, the European Central Bank (ECB) has kept its deposit rate at 2.00% since pausing in July, resulting in a flatter eurozone yield curve; extending duration offers similar trade-offs but lower absolute returns. In emerging markets such as Brazil, central bank rates exceed 10%, making short-term cash instruments significantly more attractive than in the U.S. This highlights region-specific inflation dynamics and underscores the importance of factoring in global policy and inflation conditions when making investment decisions.

The Enduring Strength of Cash

The core advantage of cash lies in its real yield—the net return after accounting for inflation, taxes, and fees. As of August 2025, headline CPI stood at 2.9%, while core CPI (excluding food and energy) was 3.1%. Money market funds and high-yield savings accounts offered annualized yields (APY) between 4.5% and 4.8%, translating to a real return of roughly 1.4%-1.7%.

Source: U.S. Bureau of Labor Statistics

Consider a $50,000 emergency fund: at a 4.6% nominal yield, annual earnings would be $2,300. After adjusting for 2.9% inflation, the real return is about $860—enough to offset rising living costs without dipping into principal. By comparison, a two-year Treasury yielding 3.85% could see its price decline 2%-3% if sticky wages push core PCE above 3%, eroding returns.

Historical experience further underscores cash’s resilience. During the 2022-2023 Fed hiking cycle—when the central bank raised rates by a cumulative 525 basis points—cash yields surged from near zero to above 5%, preserving purchasing power, while the broader bond market suffered significant drawdowns (Bloomberg Aggregate Bond Index down 13% in 2022). During the 2018 “taper tantrum,” ten-year Treasury yields spiked 80 basis points in just a few months, inflicting heavy losses on long-term bondholders.

For retirees or investors with short-term objectives, cash offers both stability and flexibility. Vanguard’s 2024 research indicates that 68% of U.S. households with short-term goals (within three years) underperformed due to duration mismatch, with overexposure to bonds often creating liquidity strains.

Forecasting Traps

Forecasting Federal Reserve policy remains highly uncertain, as 2024 clearly demonstrated. At the start of the year, markets widely anticipated seven rate cuts by year-end, totaling 175 basis points, largely driven by recession fears. In reality, only three 25-basis-point cuts occurred, totaling 75 basis points, as Q2 annualized GDP growth of 3.3% and core PCE around 2.6% provided a buffer of economic resilience.

Currently, August nonfarm payrolls increased by just 22,000, below the 75,000 estimate, while the unemployment rate rose to 4.3%, reigniting expectations for modest easing. Yet the Fed faces a delicate balancing act under its dual mandate of maximizing employment and maintaining 2% inflation: a 4.3% unemployment rate remains below its estimated long-term natural rate of 4.5%-5.0%, while core inflation rising to 3.2% signals the need for caution.

Market experts remain cautious. PIMCO Chief Investment Officer Daniel Ivascyn noted in September 2025 that “labor market resilience could limit rate cuts to two this year,” citing 7.2 million job openings in the JOLTS report. BlackRock CIO Rick Rieder added that the projected 2025 fiscal deficit of 6.2% of GDP may keep long-term yields elevated, constraining the steepening of the yield curve.

From a global perspective, uncertainty persists. Japanese investors have repatriated funds following the Bank of Japan’s benchmark rate increase to 0.5%, indirectly pushing up short-term U.S. rates, highlighting that cross-border capital flows can continue to create market volatility.

Long-Term Bonds: Attraction and Risk

Long-term U.S. Treasuries remain attractive, but their potential risks cannot be ignored. The Morningstar U.S. Long-Term Government Bond Index fell 4.6% over the 12 months ending August 31, 2025, primarily due to concerns over the fiscal deficit—U.S. debt has reached 130% of GDP—and yield volatility. In 2024, the 10-year Treasury yield rose from 3.95% at the start of the year to 4.58% by year-end, driven in part by a surge in annual Treasury auction issuance to $2.5 trillion.

Even “safe” ultra-short-term bond funds are not entirely risk-free. Analysis shows that during the 2008 financial crisis, this category suffered average losses of 8.4% as credit spreads widened 500 basis points, and in Q1 2020, it lost an average of 1.8% amid liquidity stress. While performance has been relatively stable over the past year (annualized return around 4.98%), such funds are best suited for 1-2 year horizons rather than true cash-equivalent substitutes, as they still carry credit risk and potential redemption delays.

Real-world cases further underscore the risks. The March 2023 collapse of Silicon Valley Bank demonstrated that even holdings with an average duration of just 0.3 years can face run pressures when yields spike. Cash, by contrast, entirely avoids this type of risk, providing reliable support for short-term liquidity and defensive positioning.

Conclusion

Ultimately, cash’s core advantage for short-term objectives lies in its alignment with the time horizon. Although the International Monetary Fund (IMF) projects global economic growth of roughly 3.2% in 2025, tariff pressures and geopolitical frictions continue to cloud the Fed’s policy path. In this environment, opting for cash as a short-term saver is not a surrender of opportunity—it is a strategic positioning for potential future inflection points.

Amid the pursuit of yield, cash’s stability should not be seen as dull but rather as a rational strategy. Investors considering bonds can start with small allocations and adopt a laddered approach to extend duration, while for immediate liquidity needs, cash remains the most dependable ally.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates