Fed Resumes Easing Cycle: Widening Global Monetary Policy Divergence and Impacts

04:37 September 18, 2025 EDT

Key Points:

The Federal Open Market Committee (FOMC) announced a 25-basis-point cut to the federal funds rate target range, formally restarting its easing cycle after a nine-month pause.

However, the Fed's move in the current cycle has been relatively delayed compared to some of its peers. Its gradual easing approach contrasts with the more aggressive rate-cutting by the European Central Bank (ECB) and the Bank of Canada (BoC), while the wait-and-see stance of the Bank of Japan (BoJ) and the Bank of England (BoE) further widens the divergence in global policy paths.

When major economies pursue divergent policy directions, cross-border capital flows and exchange rate volatility tend to amplify, thereby increasing financial vulnerabilities in emerging markets.

On September 17, 2025, the Federal Open Market Committee (FOMC) announced a 25-basis-point reduction in the target range for the federal funds rate to 4.00% - 4.25%. This decision marks the formal resumption of the Fed’s easing cycle, following three consecutive rate cuts in December 2024 (totaling 100 basis points) and after a nine-month hiatus.

The rate cut was primarily triggered by dynamic shifts in the labor market and inflation landscape. The FOMC statement dropped previous language describing labor market conditions as “robust,” instead emphasizing that “job gains have slowed and the unemployment rate has edged up but remains low.” In the post-meeting press conference, Fed Chair Jerome Powell characterized the move as a “preemptive risk management decision,” aimed at cushioning downside risks to employment while maintaining close monitoring of inflation to avoid a premature policy shift that could reignite price pressures.

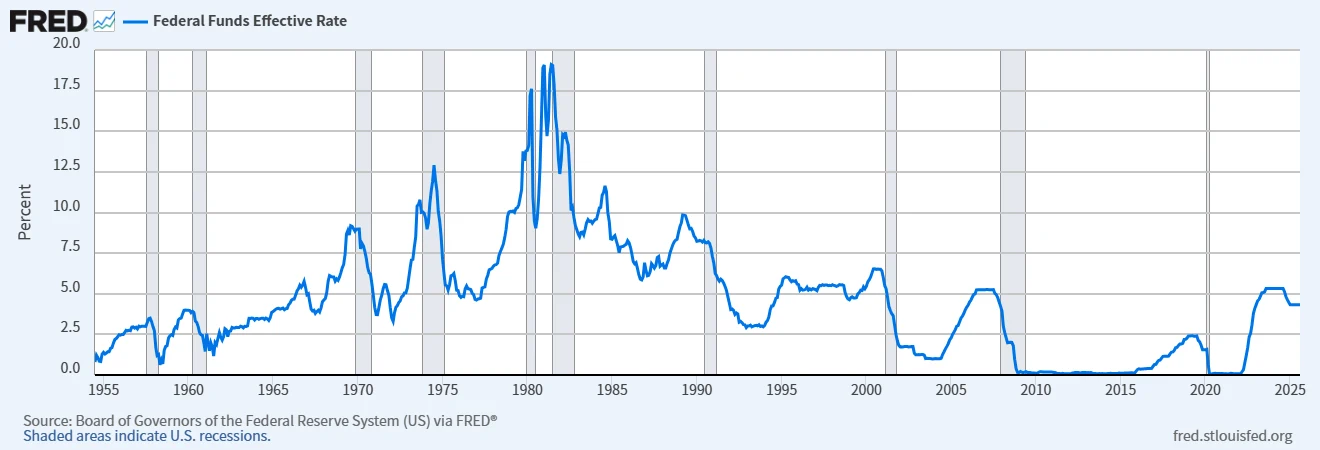

This action further underscores the ongoing divergence in global monetary policies. Since the euro’s introduction in 1999, the world has witnessed four major easing cycles, including the current one. In the first three, the Fed often played a leading role: during the 2001-2003 dot-com bubble burst, it cut rates by 550 basis points ahead of peers, triggering synchronized global easing; in the 2008 global financial crisis, it slashed rates by 525 basis points and launched quantitative easing (QE), spurring worldwide liquidity injections; and during the 2019 trade war cycle, its “mid-cycle adjustment” of 75 basis points in cuts prompted over 60 central banks to follow suit within months.

Source: FRED

However, in the current cycle, the Fed’s move has lagged behind some of its counterparts. According to the latest data, the European Central Bank (ECB) has already cut rates by a cumulative 200 basis points, and the Bank of Canada (BoC) by 250 basis points, while the Fed’s total easing so far amounts to only 125 basis points. Meanwhile, the Bank of Japan (BoJ) has maintained its policy rate at 0.5%, and the Bank of England (BoE) and Swiss National Bank (SNB) have retained relatively hawkish stances. The People’s Bank of China (PBoC), on the other hand, has opted to inject liquidity via cuts to reserve requirement ratios (RRR) and policy rates. These differences reflect varying economic conditions and cycles across nations and point to potentially heightened cross-border capital flows and foreign exchange market volatility.

Gradual Easing Framework

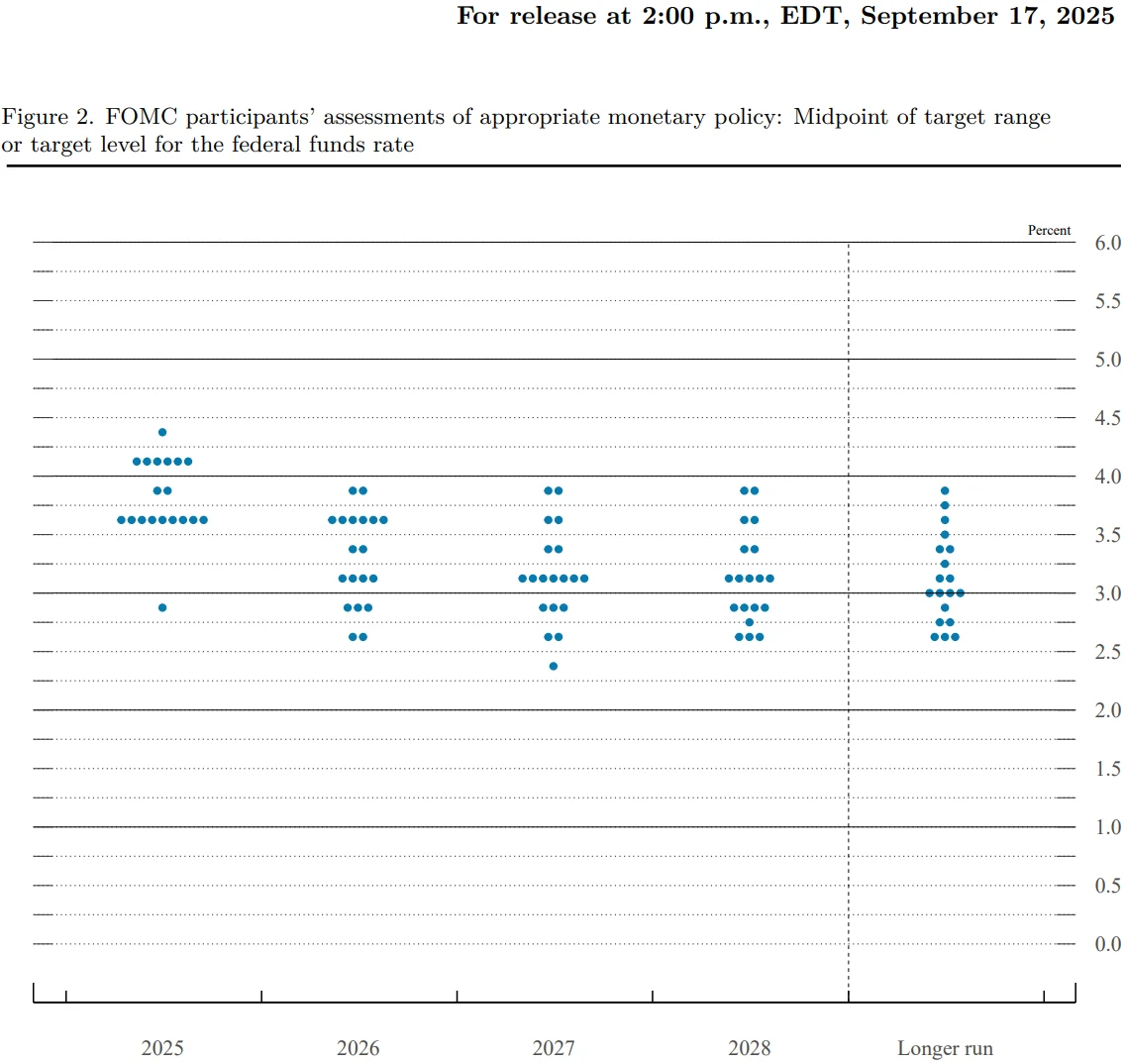

The latest "dot plot" from the Federal Reserve indicates that the median forecast of most FOMC members suggests an additional 50 basis points of rate cuts for the remainder of 2025, which will likely come in two 25 basis point moves. For 2026 and 2027, further cuts of 25 basis points each are expected, with the federal funds rate gradually approaching its long-term neutral level of around 3%. This path is more dovish compared to the June forecast, reflecting an increased focus on the downside risks to the labor market.

Source: Federal Reserve

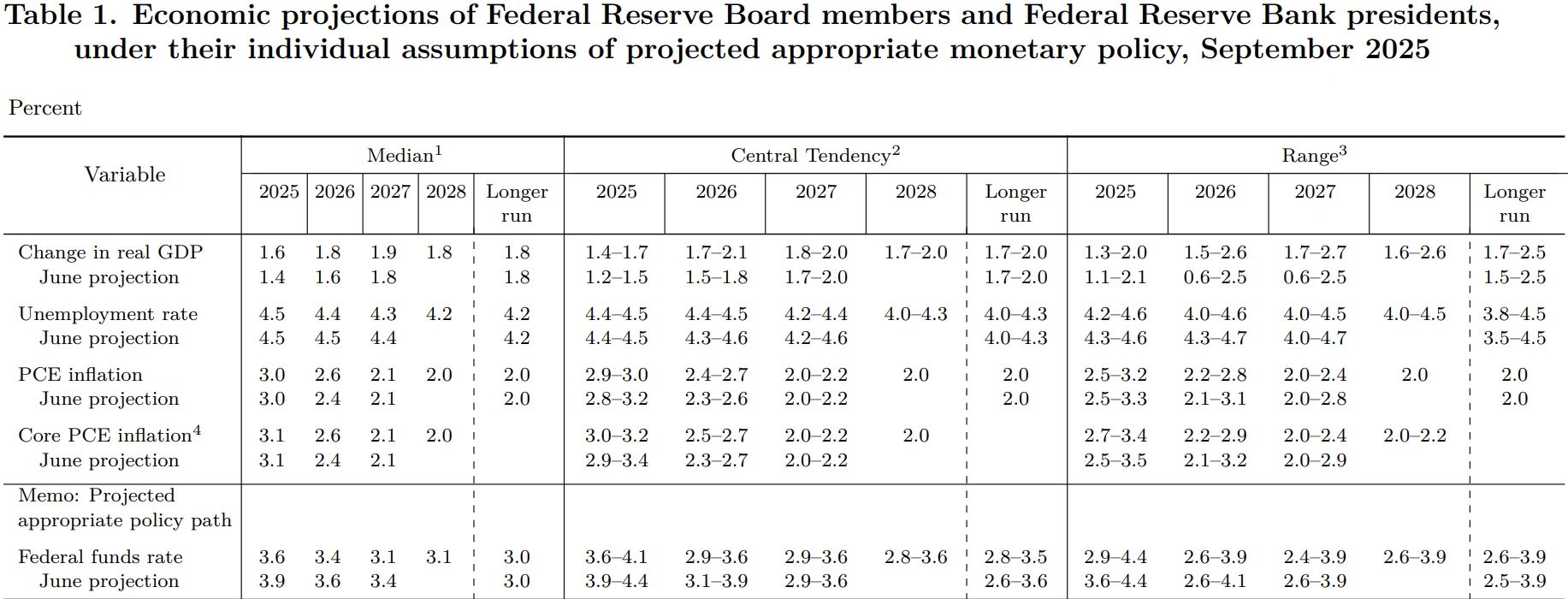

At the same time, the "Summary of Economic Projections" (SEP) also revised its macroeconomic outlook. The median forecast for 2025 GDP growth has been raised to 1.6% (up from 1.4% previously), with the unemployment rate held steady at 4.5%, and the PCE inflation rate projected at 3.0%, with core PCE at 3.1%. These projections suggest that the Fed expects the economy to experience a slowdown without tipping into recession, projecting a "soft landing" scenario akin to the 2019 cycle, when GDP still grew by 2.3%, and the unemployment rate fell to 3.5%.

Source: Federal Reserve

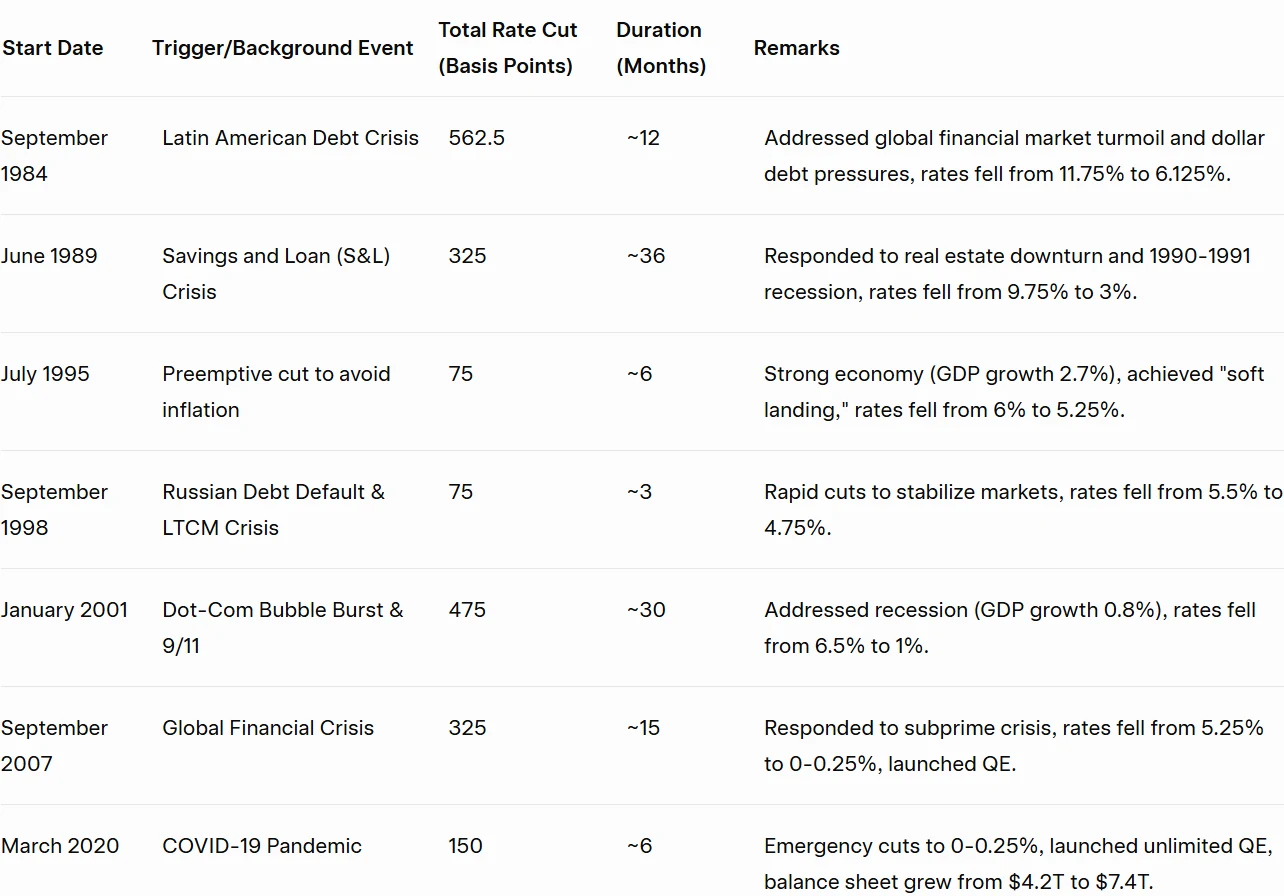

From a historical perspective, the Fed's easing cycles have typically been tied to specific economic pressures. Since 1980, there have been seven major rate-cutting cycles, averaging 26 months in duration, with a cumulative rate cut of 6.35 percentage points.

In this context, the gradual rate cuts expected between 2025 and 2027, totaling 100 basis points, are more in line with the "insurance" cuts of 1995 and 1998, rather than the large-scale easing seen during times of crisis.

Global Central Bank Policy Divergence

At the same time that the Federal Reserve embarks on a rate-cutting cycle, the policy paths of other major central banks have shown notable divergence. On September 11, the European Central Bank (ECB) kept its interest rates unchanged for the second consecutive meeting, maintaining its deposit facility rate at 2.00%. ECB President Christine Lagarde emphasized that the disinflation phase in the Eurozone is largely over, with inflation expected to be 2.1% in 2025 and dropping to 1.7% by 2026, thus allowing the ECB to remain on hold. However, the potential for euro appreciation and external tariff shocks could undermine growth momentum, making the policy outlook more uncertain.

Meanwhile, the Bank of Japan (BoJ) is widely expected to keep its benchmark interest rate at 0.5% during its meeting on September 19. This is driven not only by domestic core CPI remaining around 2%, but also by political instability—such as Prime Minister Shigeru Ishiba's resignation—and the potential impact of external tariffs.

In contrast, the Bank of England (BoE) has already reduced its benchmark rate by 25 basis points to 4.00% in August, while the Bank of Canada (BoC) has maintained its rate at 2.5%. The Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) are expected to lower rates by only 40-60 basis points by 2026, reflecting their cautious stance. The Swiss National Bank (SNB) has kept rates at 0.50%, while emerging market central banks continue to battle high inflation with elevated interest rates. For example, the Reserve Bank of India (RBI) has set its benchmark rate at 6.50%, and it is expected to follow the Fed’s actions in October, while the Central Bank of Brazil keeps its policy rate at a high 15%. Meanwhile, the People's Bank of China (PBoC) has adopted more targeted easing measures, such as lowering the mortgage rate for outstanding loans to stimulate real estate and consumption, with expected savings of about 50 yuan per month on a typical mortgage.

This divergence highlights the uneven nature of global economic recovery. In the U.S., August PCE inflation remains at 2.7%, and while the labor market is slowing, it remains resilient, providing the Fed room to gradually ease policy. In contrast, core inflation in the Eurozone is projected to be just 1.8% by 2027, far below the 2% target, which limits the urgency of rate cuts. Japan, meanwhile, needs to maintain its rate hike expectations to stabilize inflation targets, while emerging markets generally face high inflation and capital outflow pressures, forcing them to keep rates elevated.

Historically, global monetary policy synchronization often occurs during systemic crises. In the four major easing cycles since 1999, the 2001-2003 period stands out as a typical example of global synchronized rate cuts, with an average cumulative reduction of 4%. The 2008 financial crisis was primarily led by the Fed, with global QE exceeding $10 trillion. In 2020, during the pandemic, over 60 central banks followed suit, with an average rate cut of 150 basis points.

However, some cycles have shown significant divergence. For example, in 2019, the Fed cut rates by a total of 75 basis points, while Australia only made a symbolic rate cut to prevent a housing bubble. The 2018 cycle was also highly divergent, with the Fed tightening rates, while Turkey was forced to maintain a 25% interest rate due to inflation exceeding 80%, and Argentina even raised rates by 15 percentage points to 60%.

This divergence bears some resemblance to the 2018 Fed tightening cycle. At that time, the U.S. alone pursued a tightening policy, leading to a $1 trillion capital outflow from emerging markets, with fragile economies like Argentina and Turkey facing severe currency crises. Today, although the direction is reversed, the effect may still amplify cross-border capital volatility.

Transmission of Foreign Exchange and Capital Flows

The most direct reflection of the policy divergence is seen in the forex market. On September 17, the U.S. Dollar Index rebounded by 0.74% to 96.92, though it remains close to its year-to-date lows. This push has driven the euro higher, with the EUR/USD exchange rate reaching approximately 1.1834, up nearly 15% year-to-date, approaching its largest annual increase since 2003. The European Central Bank (ECB) has already accounted for the impact of the euro's appreciation in its models, but the market has not fully priced in the risk of a further surge. If the euro continues to strengthen and suppress inflation, the ECB may be forced to restart its rate-cutting cycle, which would push the policy rate below the neutral range (1.75%–2.25%) into accommodative territory.

Source: TradingView

Historical experience offers valuable context here. The Fed's rate-cutting cycles are typically accompanied by a weaker dollar, with the EUR/USD exchange rate appreciating by an average of 10%–15%. In 2019, the euro appreciated about 8% amid the Fed's rate cuts, and emerging market currencies generally rose 5%–10%. During the 2001 cycle, the euro strengthened by 12%, although the Eurozone economy significantly slowed. This indicates that, while the exchange rate may provide support, economic fundamentals remain the key driver of a currency’s sustainability.

For emerging markets, the depreciation of the dollar is a double-edged sword. On the one hand, it alleviates external debt burdens and improves the capital inflow environment. On the other hand, policy divergence may amplify exchange rate volatility. In 2023, when the Fed was discussing rate cuts, the Central Bank of Turkey was still forced to maintain high interest rates to stabilize the lira, reflecting its vulnerability to depreciation risks. Currently, the Mexican peso has appreciated 5.6% year-to-date, benefiting from the weaker dollar and tightening domestic policies. However, if U.S. tariff risks rise again, the appreciation trend could quickly reverse.

In the stock market, the Fed's dovish stance continues to support risk assets. The S&P 500 has gained nearly 13% this year, with European and Japanese markets also showing strong performance. Strategists generally recommend continuing to overweight developed market equities, particularly in Europe and Japan, believing that these markets benefit from currency appreciation and global liquidity improvements. However, emerging markets may benefit less, as global capital tends to flow into markets with stable fundamentals and ample liquidity.

Source: TradingView

In commodities, a weaker dollar and improved liquidity typically drive up oil and metal prices, which could lead to inflationary pressures for some import-dependent economies, further complicating central banks' policy decisions.

Source: TradingView

Final Analysis

The Federal Reserve's decision to restart its rate-cutting cycle could signal the beginning of a new phase dominated by policy divergence across the globe. The Fed's gradual easing contrasts sharply with the rapid rate cuts seen in Europe and Canada, while Japan and the UK’s cautious stance further accentuates the differences in policy trajectories.

History reminds us that when major economies follow divergent policy paths, cross-border capital flows and exchange rate volatility are often amplified, increasing the financial vulnerability of emerging markets.

Investors should focus not only on the Fed's future rate cuts but also on whether global policy coordination can be restored. Without such coordination, the global economic growth forecast of 3.3% may face downside risks. In other words, while the Fed's rate cuts signal accommodative policies, the real challenge for global markets may just be beginning.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates