After Cutting Interest Rates by 25 Basis Points as Expected: The Federal Reserve's Future Policy Path

01:41 September 18, 2025 EDT

Key Points:

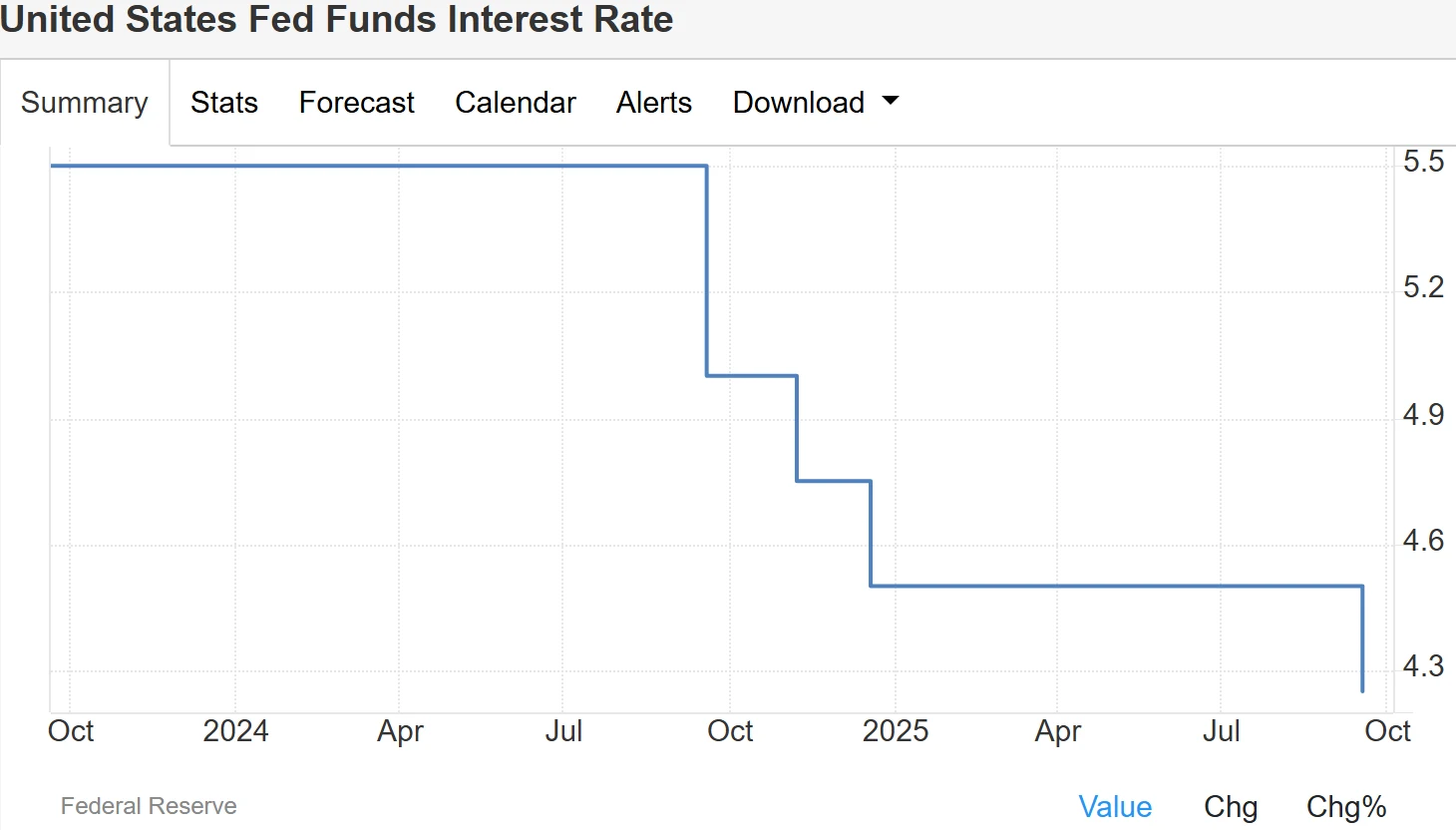

The FOMC lowered the target range for the federal funds rate by 25 basis points to 4.00% - 4.25%. This marks the Fed's first rate cut since December 2024.

Fed projections indicate an additional 50 basis points of easing by year-end, followed by 25 basis points each in the next two years. Officials' "dot plot" forecasts one rate cut in 2026 and another in 2027.

Powell's remarks during the press conference signaled a shift in the Fed's policy focus: "Given the labor market's noticeable cooling, the central bank is gradually pivoting from its prolonged emphasis on suppressing inflation toward a greater concern for the 'maximum employment' objective within its dual mandate."

On September 17, 2025, the Federal Open Market Committee (FOMC) announced a 25-basis-point cut to the federal funds rate, lowering the target range to 4.00% - 4.25%. The decision was approved by an 11-1 vote.

Source: TradingEconomics

This represents the first interest rate cut since December 2024, aligning with broad market expectations. It signifies a shift in the Fed's monetary policy stance from persistently restraining inflation toward addressing growing downside risks in the labor market. Following this widely anticipated easing move, market attention is now squarely focused on the future trajectory of the Federal Reserve's policy path.

Decision-Making Context

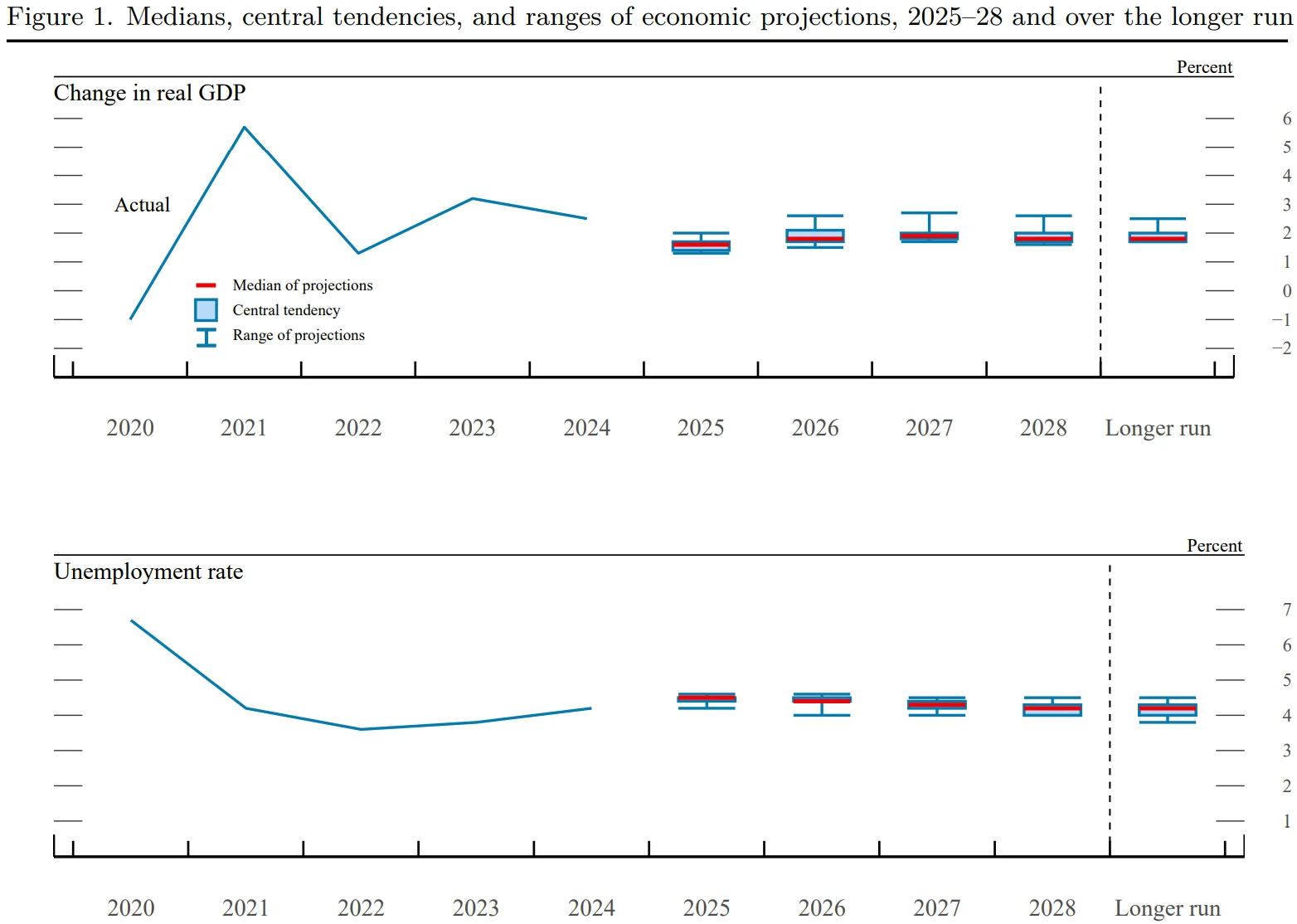

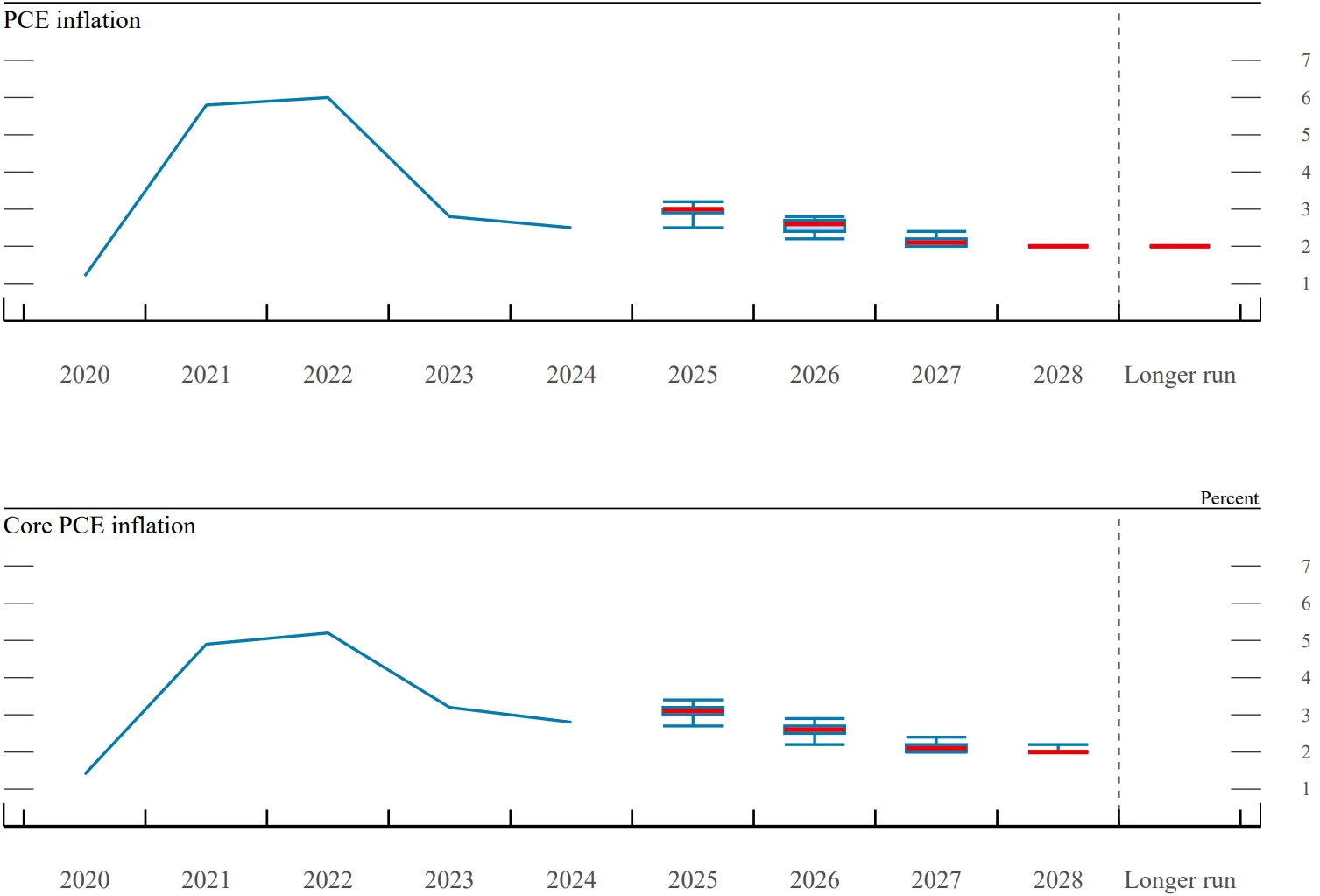

The Fed's decision to cut rates was primarily based on its latest assessment of the fundamental conditions of the U.S. economy. The FOMC statement explicitly noted that economic activity showed signs of moderating in the first half of 2025, consistent with the median projection of 1.6% real GDP growth for the year in the Summary of Economic Projections (SEP). The modest upward revision of 0.2 percentage points from the June forecast reflects policymakers’ cautious acknowledgment of the economy's resilience.

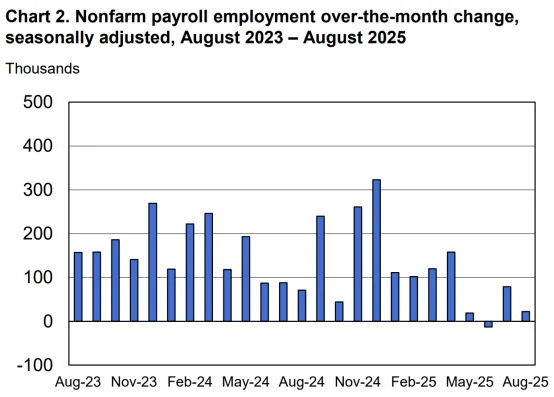

However, the key drivers behind the policy adjustment were dynamic changes in the labor market and inflation landscape. The statement dropped previous language describing labor market conditions as “robust,” instead emphasizing that “job gains have slowed and the unemployment rate has edged up but remains low.” This shift in tone is supported by actual data: U.S. nonfarm payrolls increased by just 22,000 in August, well below market expectations; initial jobless claims surged to 263,000; more notably, the Bureau of Labor Statistics substantially downward revised employment figures for the past year, reducing the initially reported job gains by 911,000 positions over the 12 months through March 2025—the largest such revision since 2000.

Source: U.S. Bureau of Labor Statistics

During the press conference, Powell noted that the labor market has “lost some vitality and softened somewhat,” adding that downside risks to employment have escalated to a level warranting policy response.

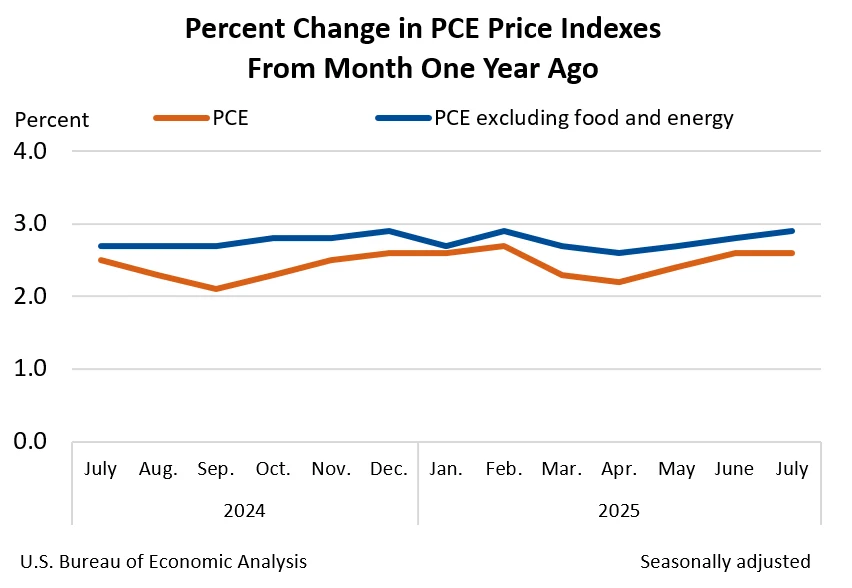

The inflation picture is more complex. Although the July headline Personal Consumption Expenditures (PCE) price index rose 2.6% year-over-year and core PCE increased 2.9%—the highest since February 2025 and still above the Fed’s longer-run 2% target—policymakers noted structural shifts in inflationary pressures.

Source: Bureau of Economic Analysis

Powell pointed out that inflation “has fallen significantly from its mid-2022 highs but remains elevated,” and specifically mentioned that tariffs are contributing roughly 0.3 to 0.4 percentage points to core PCE. He characterized this as a “one-time price increase” rather than a signal of persistent inflationary pressure. This interpretation provided justification for initiating rate cuts before inflation had fully returned to target.

From a policy perspective, this rate cut is viewed as a “risk management decision.” Powell emphasized that the adjustment is a response to the current “complex economic environment with two-sided risks” and should not be interpreted as the beginning of a prolonged easing cycle. This framing highlights the Fed’s dilemma: a weakening labor market calls for accommodative policy, while persistent inflation constraints the extent of easing. As Powell stated, “This is a classic two-sided risk environment; there is literally no risk-free choice.” Understanding this balancing act is key to interpreting the current decision.

Dot Plot Divergence

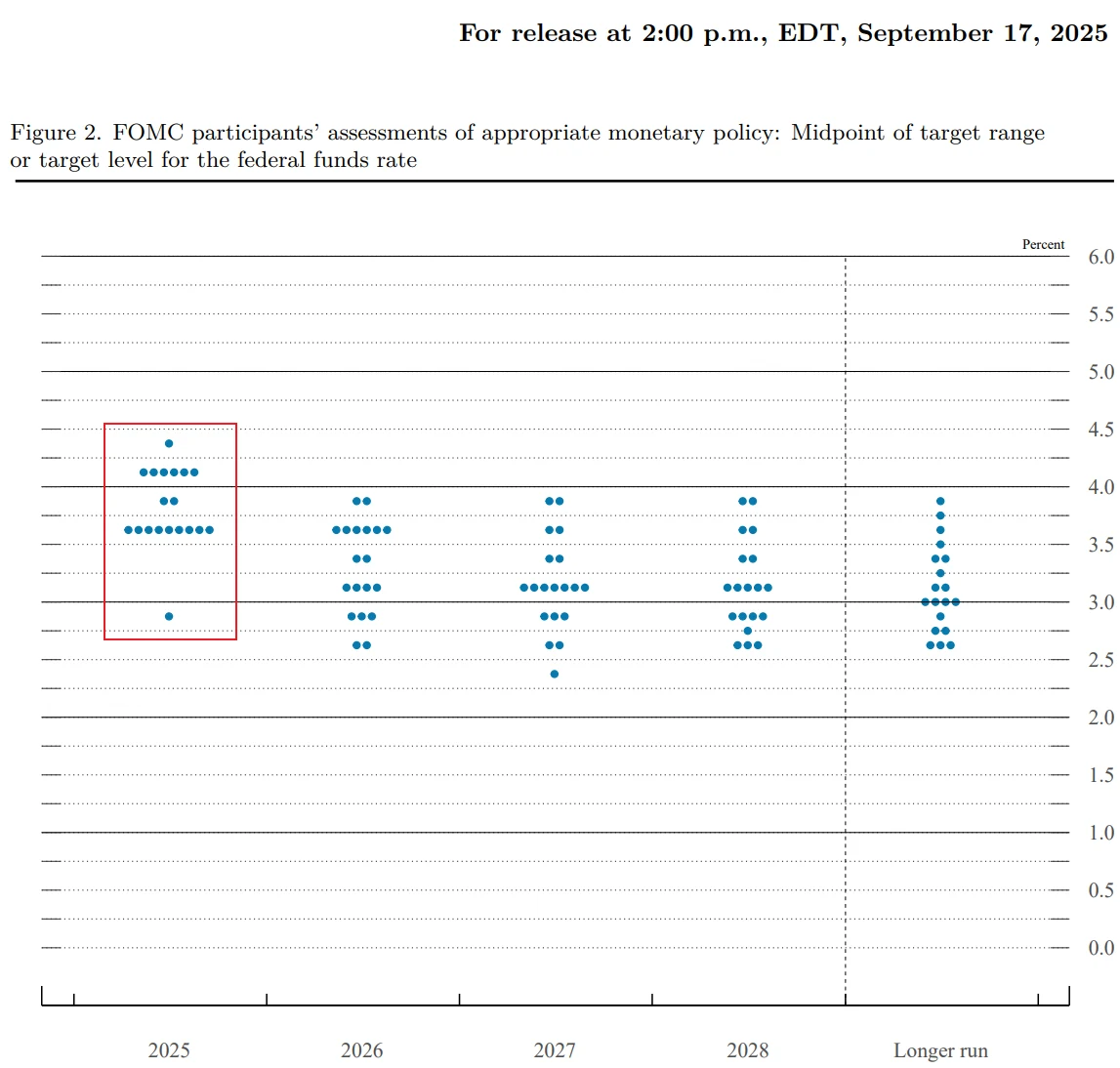

The dot plot released alongside the policy decision provides insight into Federal Reserve officials’ outlook for the future path of interest rates. It indicates that, following the September rate cut, the median expectation among officials is for an additional 50 basis points of easing in 2025—equivalent to two standard 25-basis-point adjustments. This aligns with market expectations and reflects a Committee consensus in favor of gradual monetary easing.

Source: Federal Reserve

However, the distribution of projections among the 19 officials (including Stephen Milan) reveals notable divergences. The aggressive stance of newly appointed Governor Stephen Milan has drawn particular attention. Having just joined the Federal Reserve Board this week in his capacity as a White House economic adviser, Milan cast the sole dissenting vote against the 25-basis-point cut, advocating instead for a 50-basis-point reduction. His dot plot submission projects at least 100 basis points of additional easing by year-end—a sharp contrast with the expectations of other officials.

Quantitative analysis shows that, excluding Milan’s outlier projection, the remaining 18 officials exhibit a diverse range of rate expectations: one official favors one additional rate hike by year-end, six support holding rates at current levels, two anticipate a further 25-basis-point cut, and nine expect an additional 50 basis points of easing (i.e., two standard 25-basis-point cuts).

It is worth noting that although the nine officials supporting 50 basis points of additional easing, together with Milan, form the statistical basis for the median projection, this does not necessarily imply endorsement of his aggressive rationale. Their stance appears to reflect broader concerns about employment risks.

Expectations for the medium- to long-term rate path are relatively more consistent. The dot plot suggests an additional 25 basis points of cuts in both 2026 and 2027, bringing the median federal funds rate projection to 3.1% by 2027—gradually approaching the long-run neutral rate of around 3%. This aligns with the Fed’s moderate outlook for the economic fundamentals: median GDP growth projections for 2025–2028 are 1.6%, 1.4%, 1.8%, and 1.8%, respectively, while the unemployment rate is expected to remain within a low range of 4.2%–4.5%.

Source: Federal Reserve

Upward revisions to inflation expectations add complexity to the policy outlook. Compared with the June projections, both the headline and core PCE inflation forecasts for 2026 were raised by 0.2 percentage points to 2.6%, indicating that policymakers recognize the process of returning inflation to target may take longer than previously anticipated. This adjustment, coupled with a modest upward revision to GDP growth, reflects both the persistent nature of current inflation and suggests that economic resilience may continue to support price pressures. During his press conference, Powell specifically emphasized that “inflation risks are tilted to the upside” in the near term—a judgment that preserves flexibility for future policy adjustments.

Source: Federal Reserve

The divergences within the dot plot also highlight external pressures facing the Fed. Milan’s unique role as a White House economic adviser has led markets to interpret his policy stance as a direct channeling of “the White House’s desire for rate cuts” into the Fed’s decision-making process. This has sparked broad discussion about the central bank’s independence. Although Powell stressed that “operating based on data and not considering other factors is core to our culture,” the potential influence of political considerations on monetary policy is becoming a variable that can no longer be ignored.

Historical experience suggests that the effectiveness of Fed policy heavily depends on market trust in its independence. How the current fragmented outlook could influence the policy transmission mechanism warrants continued market attention.

Shift in Policy Focus

During the press conference, Powell clearly signaled a shift in the Fed’s policy focus: “In light of clear cooling in the labor market, the central bank—within its dual mandate—is gradually pivoting from its prolonged emphasis on curbing inflation toward greater attention on the goal of ‘maximum employment’.” This recalibration is largely an evolutionary response to changing economic data, reflecting a recalibration of the balance of risks between employment and inflation.

From a data perspective, downside risks in the labor market now clearly outweigh upside risks to inflation. Beyond the previously mentioned nonfarm payroll and initial jobless claims figures, the simultaneous cooling on both the supply and demand sides of the labor market is particularly notable. Powell pointed out that job growth has now fallen “below the breakeven level needed to hold the unemployment rate steady,” and a rise in unemployment among minority groups is a particularly concerning signal. This shift from an “overheated” to a “moderately cooling” labor market provides the empirical basis for the adjustment in policy priority.

Changes in the nature of inflationary pressures also support this pivot. Although overall inflation remains elevated, Powell attributed it to transient factors like tariffs, stating that “the effect of tariffs on inflation is likely to be short-lived.” Federal Reserve estimates suggest that tariffs are currently contributing roughly 0.3 to 0.4 percentage points to core PCE inflation. While this effect is expected to persist through this year and next, it is viewed under the baseline scenario as a transitory shock. This assessment reduces the constraint that persistent inflation imposes on monetary policy, thereby creating room to address employment risks.

Source: Federal Reserve

Furthermore, the operational rationale for policy tools has correspondingly adjusted. Unlike the decisive rate hikes during the 2022-2023 period to combat high inflation, the current decision to cut rates emphasizes flexibility, operating on a “meeting-by-meeting basis dependent on the data.” Powell noted that “there was not broad support for a 50-basis-point cut at this meeting” and that “there is no need to move rates rapidly.” This cautious stance stems both from vigilance against rebounding inflation and a commitment to carefully evaluating the effects of policy actions.

Regarding the use of policy tools, the Fed also announced it will continue to reduce its holdings of U.S. Treasury securities, agency debt, and agency mortgage-backed securities, maintaining the current pace of balance sheet runoff. This indicates that the combination of quantitative tightening (QT) and interest rate easing remains in effect.

Nevertheless, this rebalancing effort faces unique policy challenges. Powell described the current situation as a “difficult and relatively uncommon” scenario: a weakening labor market coexisting with elevated inflation, deviating from the traditional macroeconomic pattern where the two typically move inversely. This complexity requires the Fed to place greater emphasis on expectations management in its communication—it must both convey its focus on the labor market to stabilize growth expectations and reaffirm its commitment to the inflation target to anchor price expectations.

Future Focus

This meeting took place amid heightened concerns surrounding the Federal Reserve’s independence. The White House has recently taken a series of actions aimed at influencing the central bank, including publicly criticizing Fed policy, appointing White House economic adviser Stephen Milan to the Board, and pursuing legal action against Governor Lisa Cook. These moves have raised concerns about the politicization of monetary policy and became a focal point during Powell’s press conference.

In response, Powell stated, “The Fed makes decisions based on data, not political factors, and will firmly safeguard its independence.” When asked how the public should judge whether the Fed has lost its autonomy, he replied, “Just watch what we do,” emphasizing that data-dependent decision-making is central to the Fed’s culture. While his remarks helped ease market anxieties, the unusual role and aggressive stance of Governor Milan have undoubtedly added policy uncertainty. As the most prominent “voice of the White House” in the dot plot, Milan’s votes and forecasts will remain under intense scrutiny, and his interactions with other officials may shape future policy directions.

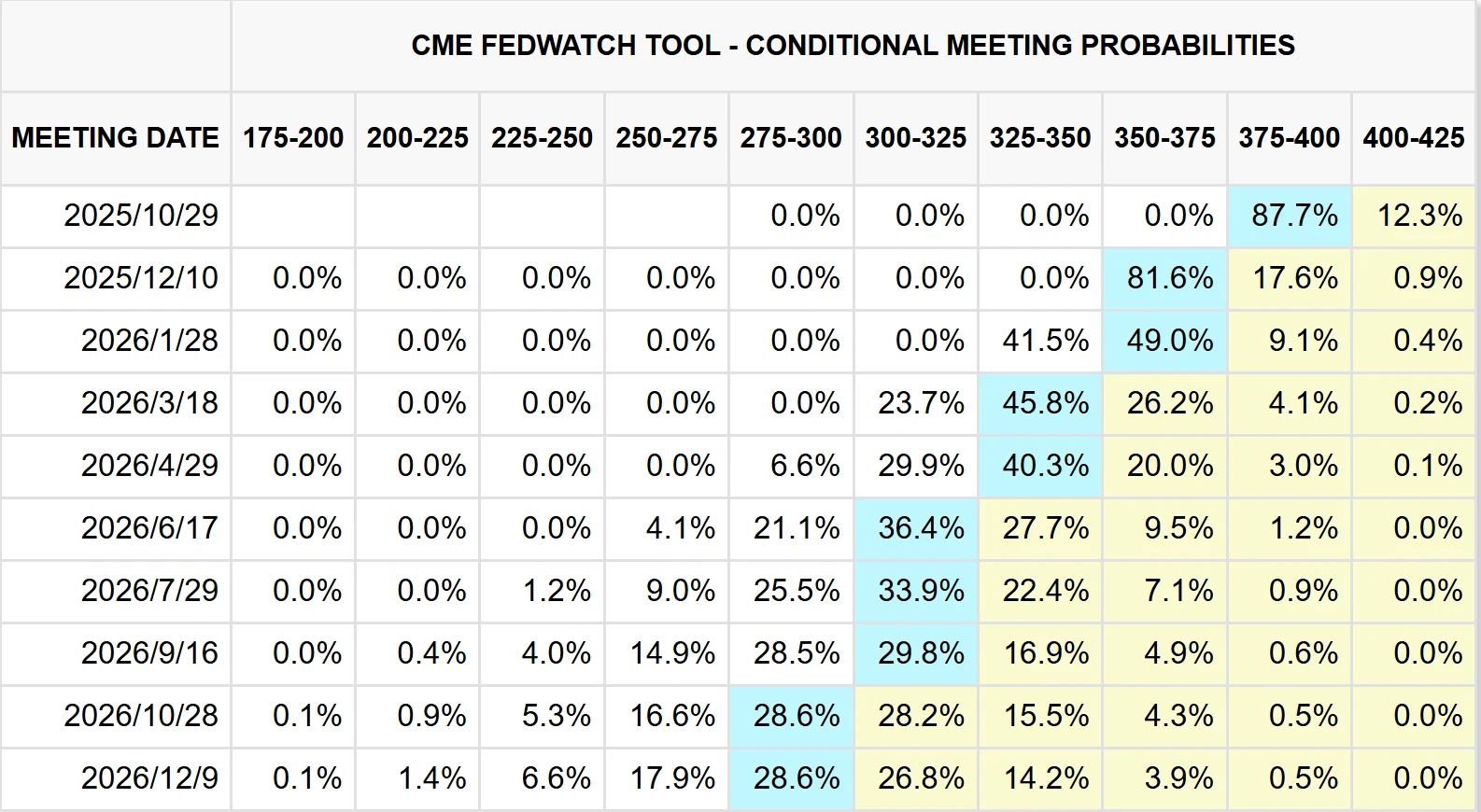

Going forward, the Fed’s policy path will continue to depend on marginal changes in economic data. Although the dot plot and Powell’s comments suggest a gradual easing approach—with an additional 50 basis points of cuts expected in 2025, followed by 25 basis points each in 2026 and 2027, bringing rates closer to the neutral level of around 3%—the trajectory is not predetermined. Decisions will remain meeting-by-meeting and data-dependent, with employment and inflation serving as core influencing factors.

Source: CME Group

In terms of the meeting schedule, the Fed has two remaining rate decisions in 2025 (October 30 and December 11). Market expectations widely anticipate a potential rate cut at the December meeting.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates