As Nvidia crosses the $4 trillion market cap mark to become the most valuable company in the world, investors are now turning their attention to the next tech giant likely to reach this historic milestone. Microsoft, the world’s second-largest company by market value, is closing in on the target. As of the U.S. market close on July 14, 2025, Microsoft’s market capitalization stood at $3.74 trillion—just a step away from the $4 trillion threshold.

Source: TradingView

But the more important question isn’t whether Microsoft can reach $4 trillion—it’s whether the company can continue to climb beyond that. The answer is yes. From fundamentals to industry trends to market sentiment, Microsoft appears to be at the beginning of a new cycle of medium- to long-term growth.

The Distance to $4 Trillion

Among the “Magnificent Seven” tech giants, Microsoft’s market cap trails only Nvidia, ahead of Apple ($3.12 trillion), Amazon ($2.4 trillion), Alphabet ($2.2 trillion), and Meta Platforms ($1.81 trillion). Microsoft needs just a 6.95% increase in market value to reach the $4 trillion mark, while Apple would require a 28.21% gain. In relatively stable market conditions, Microsoft’s proximity makes it the most likely candidate to cross the threshold next.

However, proximity is only the starting point. Microsoft’s edge also lies in the resilience of its business model against external shocks. The tariff policies implemented by the Trump administration in 2025 pose challenges to Apple, whose manufacturing operations are heavily reliant on an Asian supply chain.

Analysts have noted that Apple’s supply chain costs could rise by as much as 15% due to tariffs, potentially squeezing profit margins or forcing price hikes. In contrast, Microsoft’s core businesses—on-premise software licensing, subscription-based services, and data center operations—are less exposed to policy risks, giving it a stronger defensive position.

Earnings and Growth Momentum

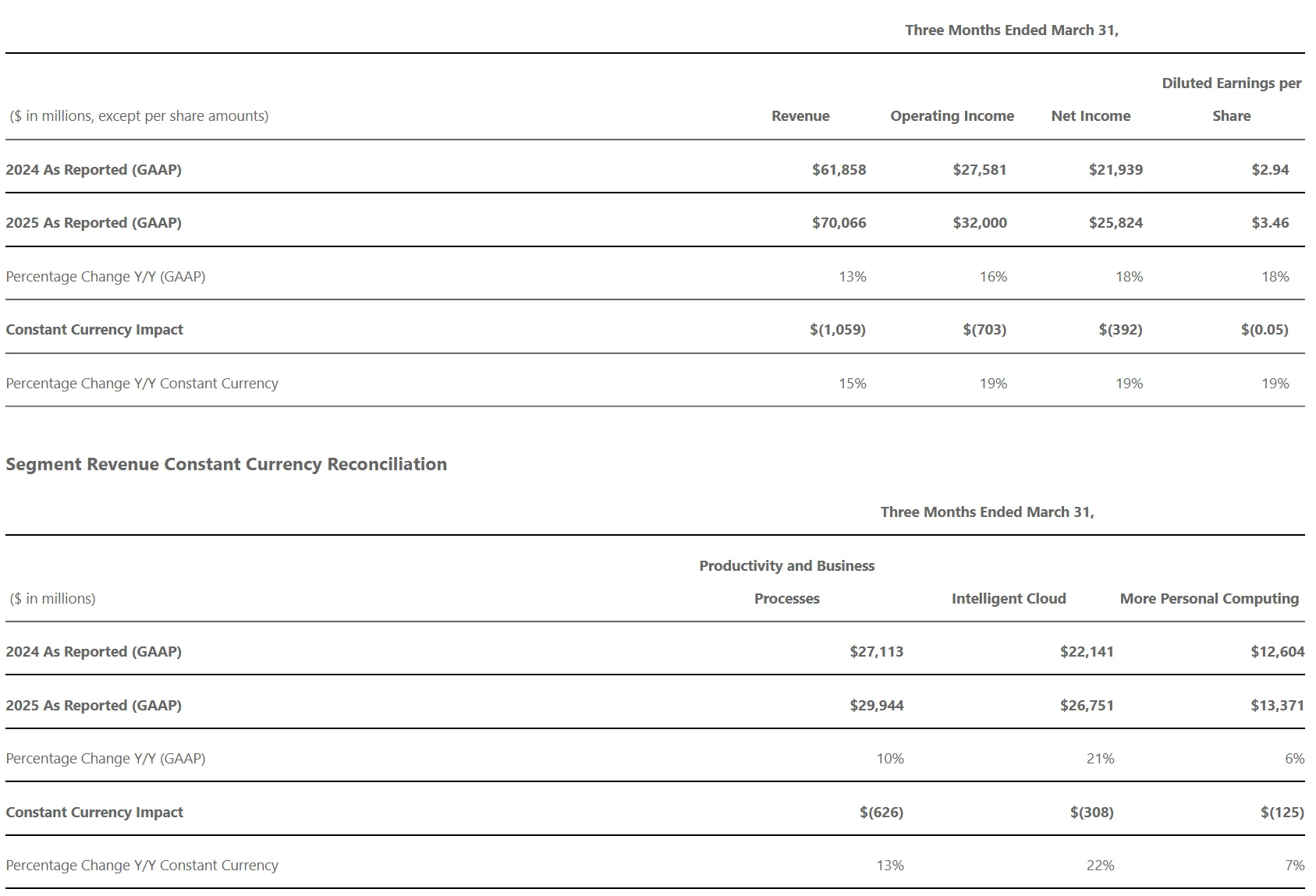

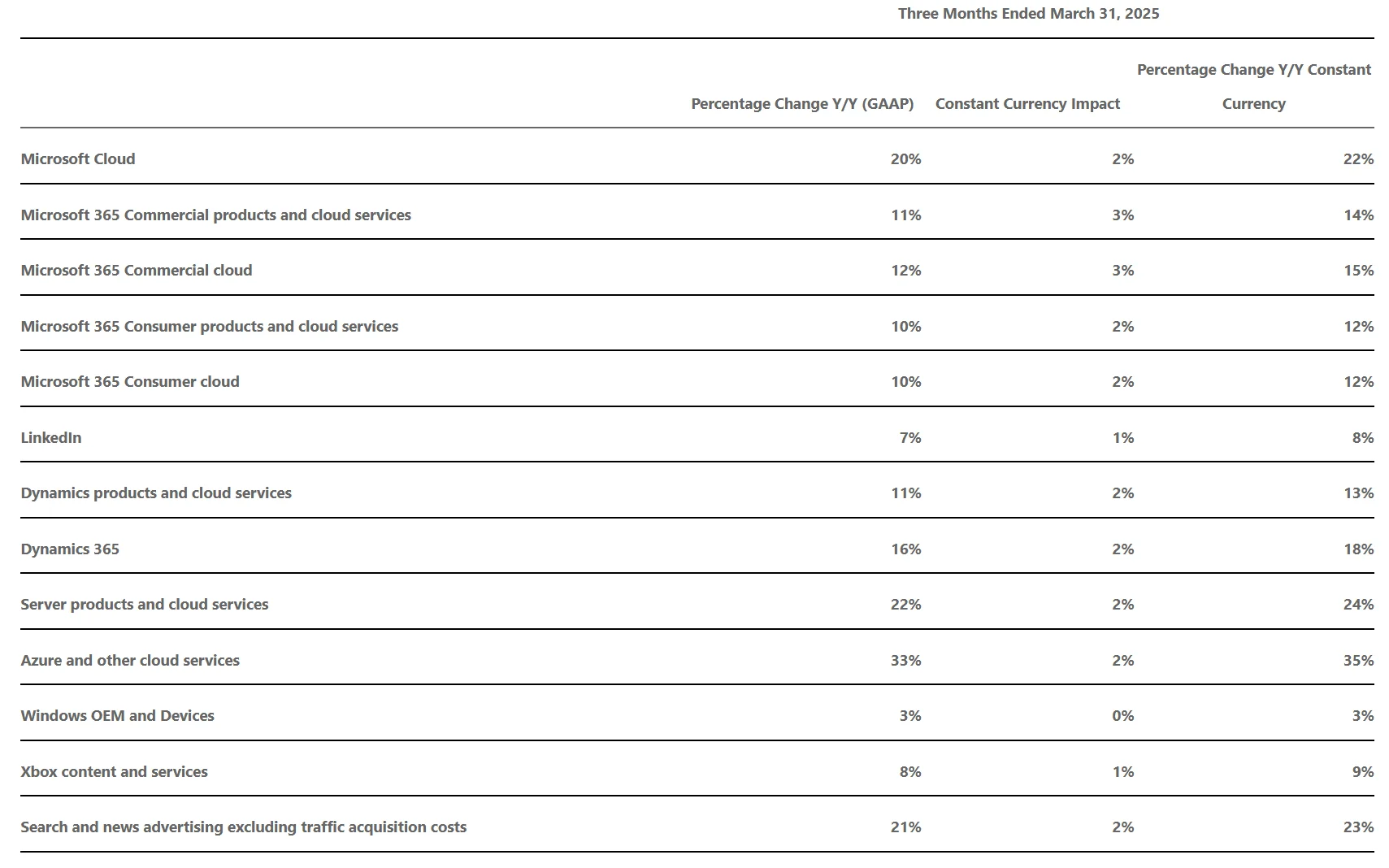

Microsoft delivered a stronger-than-expected report for its fiscal third quarter of 2025 (ended March 31), underscoring its dominance in cloud computing and enterprise services. Quarterly revenue surged 13% year-over-year to $70.07 billion, with the standout performance coming from the Intelligent Cloud segment—Azure grew 21%, highlighting strong enterprise demand for Microsoft's integrated AI and cloud solutions.

source: Microsoft

At the same time, operating income jumped 16% to $32 billion, reflecting Microsoft's ability to maintain cost control and operational efficiency even while expanding its top line. Notably, the company guided for fiscal Q4 revenue between $73.15 billion and $74.25 billion—well ahead of the market consensus of $72.26 billion. Despite global macroeconomic uncertainties, customer demand for Microsoft's services remains robust.

Azure remains the world’s second-largest cloud provider, with a 25% market share in Q2 2025, trailing only Amazon Web Services (AWS), according to Synergy Research Group. Azure’s momentum is driven by enterprise demand for hybrid cloud capabilities and AI integration. Microsoft’s ecosystem—spanning Azure, Office 365, and Dynamics 365—creates high switching costs and a durable competitive moat.

source: Microsoft

According to Gartner’s 2025 report, 70% of Azure’s enterprise clients also use other Microsoft services, boosting retention and ecosystem stickiness—an edge over AWS’s broader infrastructure-focused model.

AI as a Catalyst

Microsoft’s leadership in artificial intelligence is a key driver behind its march toward the $4 trillion valuation mark. Long before the AI arms race went mainstream, Microsoft made an early bet on OpenAI and swiftly integrated its GPT models into the Azure platform. Today, “Azure OpenAI Service” has become one of the go-to platforms for enterprises deploying large language models.

According to IDC's 2025 research, 40% of Fortune 500 companies are now using Copilot, contributing an estimated $4.2 billion in annual revenue. The global AI market is projected to grow at a 37% compound annual growth rate (CAGR) through 2030, and Microsoft’s first-mover advantage positions it well to capture long-term gains.

Crucially, this momentum isn’t driven by a single product—it reflects a broader acceleration in enterprise-scale AI adoption. Companies are moving from proof-of-concept to full-scale integration of AI into core business operations, especially across key verticals such as finance, manufacturing, healthcare, and retail. By contrast, Apple lags in AI innovation and lacks the enterprise ecosystem integration that gives Microsoft a structural edge.

Source: Microsoft

Wedbush analysts project that Microsoft’s AI-related businesses will generate an additional $25 billion in revenue by fiscal year 2026. This underscores how AI is evolving into a significant revenue engine, and reinforces the firm’s view that Microsoft can maintain its leadership in an increasingly competitive field. The firm maintains its “Outperform” rating on the stock, with a price target of $600.

$4 Trillion Might Just Be the Beginning

Some analysts project Microsoft’s market capitalization could reach $10 trillion by 2035, requiring a 10.4% compound annual growth rate from its current $3.74 trillion level. According to a 2025 McKinsey report, up to 80% of global IT spending is expected to shift to cloud services by 2030—up from just 15% in 2025. This shift could potentially double Microsoft Azure’s cloud revenue to $200 billion annually.

The growth potential of AI extends well beyond enterprise use cases. Microsoft’s investments in autonomous driving, healthcare AI, and intelligent infrastructure align closely with global innovation trends. A 2025 HIMSS survey found that 30% of U.S. hospitals use Microsoft’s healthcare AI platforms, generating $2 billion in annual revenue. These emerging verticals are expanding Microsoft’s long-term growth runway while reducing its reliance on traditional software products.

Investor sentiment remains bullish. A 2025 Morgan Stanley survey showed that 85% of institutional investors ranked Microsoft as their top tech pick, citing its strong exposure to AI and cloud computing. While Microsoft trades at a forward P/E of 34—relatively high by historical standards—it is not viewed as overvalued, thanks to projected 15% annualized earnings growth through 2028.