During this week's trading sessions, the U.S. stock market experienced moderate fluctuations driven by President Trump's new tariff policies, expectations of interest rate cuts, and upcoming Q2 earnings forecasts. The technology sector performed strongly, with semiconductor and artificial intelligence-related stocks in the spotlight, while tariff negotiations and Fed rate cut expectations continued to dominate market sentiment.

Index Performance

All three major U.S. stock indices posted gains, with the S&P 500 standing out with particularly strong performance. The S&P 500 opened lower at the start of the week, declining for two consecutive trading days, primarily due to President Trump's announcement of high tariffs on imports from Japan, South Korea, and other countries, effective August 1. This raised concerns about an escalation in trade tensions.

However, starting from July 9, the S&P 500 reversed course, rising steadily and reaching a historic high of 6290.22 points. As of the latest update, the upward trend remains intact. The AI boom and stronger-than-expected corporate earnings drove market sentiment, contributing to the rise. Year-to-date, the S&P 500 has posted eight new closing highs.

Source: TradingView

The Dow Jones Industrial Average rose from 44,406.35 points on July 7 to 44,650.64 points on July 10, reflecting a 4.95% gain year-to-date. The Dow initially dropped slightly this week, but rebounded with support from the aerospace and industrial sectors.

Source: TradingView

The Nasdaq Composite, driven by technology stocks, set new records for two consecutive days, closing at 20,630.66 points. Semiconductor and tech hardware sectors performed robustly, pushing the index higher.

Source: TradingView

Market breadth improved, with 347 of the 500 S&P constituents rising and 155 falling, a healthier trend compared to April (168 up, 331 down). Small and mid-cap stocks lagged behind the broader market, with the S&P MidCap 400 and SmallCap 600 indices down 2% and 5% respectively year-to-date, trailing the S&P 500 by about 5-8%.

Sector Movements

Over the past week, the technology, industrial, and utilities sectors led the market, while consumer staples and energy lagged behind.

Semiconductor and tech hardware companies stood out, with Nvidia rising approximately 1.8% during the week. Its market capitalization briefly surpassed $4 trillion, making it the first company in history to enter the "Trillion-Dollar Club." Although its closing market cap retreated to $3.97 trillion, this achievement highlighted Nvidia's dominant position in the artificial intelligence (AI) chip market.

Source: TradingView

Traditional chip stocks like Intel and Texas Instruments also recorded upward trends. The AI boom fueled a tech sector rebound, with the Information Technology sector holding the largest weight in the S&P 500 high-beta index.

Aerospace stocks performed well, with Delta Air Lines leading the sector higher by more than 3% following strong earnings reports. The industrial sector has been a leader year-to-date, with a cumulative gain of 12%.

Source: TradingView

Benefiting from market risk aversion and a decline in bond yields, the 10-year U.S. Treasury yield fell to 4.36%. In contrast, concerns over tariff-induced cost pressures for retailers weighed on the consumer sector. The high valuations of heavyweight stocks like Walmart and Procter & Gamble pushed up the overall valuation of the consumer staples sector.

Oil price fluctuations also impacted sector performance, with Brent crude oil stabilizing around $66 after rising 13% in June. Shell's stock fell 1.6% on expectations of weaker Q2 earnings.

Source: TradingView

Stock Movers

Nvidia rose 1.8% over the past week, with its market capitalization surpassing $4 trillion at the close on July 10, leading the "Tech Giants" in gains. Demand for artificial intelligence continued to drive its stock to new highs, with Blackwell GPU orders surging and TSMC’s earnings report showing robust demand for AI chips. Institutions raised Nvidia's target stock price to $250, reflecting strong market confidence in the long-term growth of AI. Nvidia now accounts for nearly 20% of the S&P 500's technology sector weight, significantly influencing market sentiment.

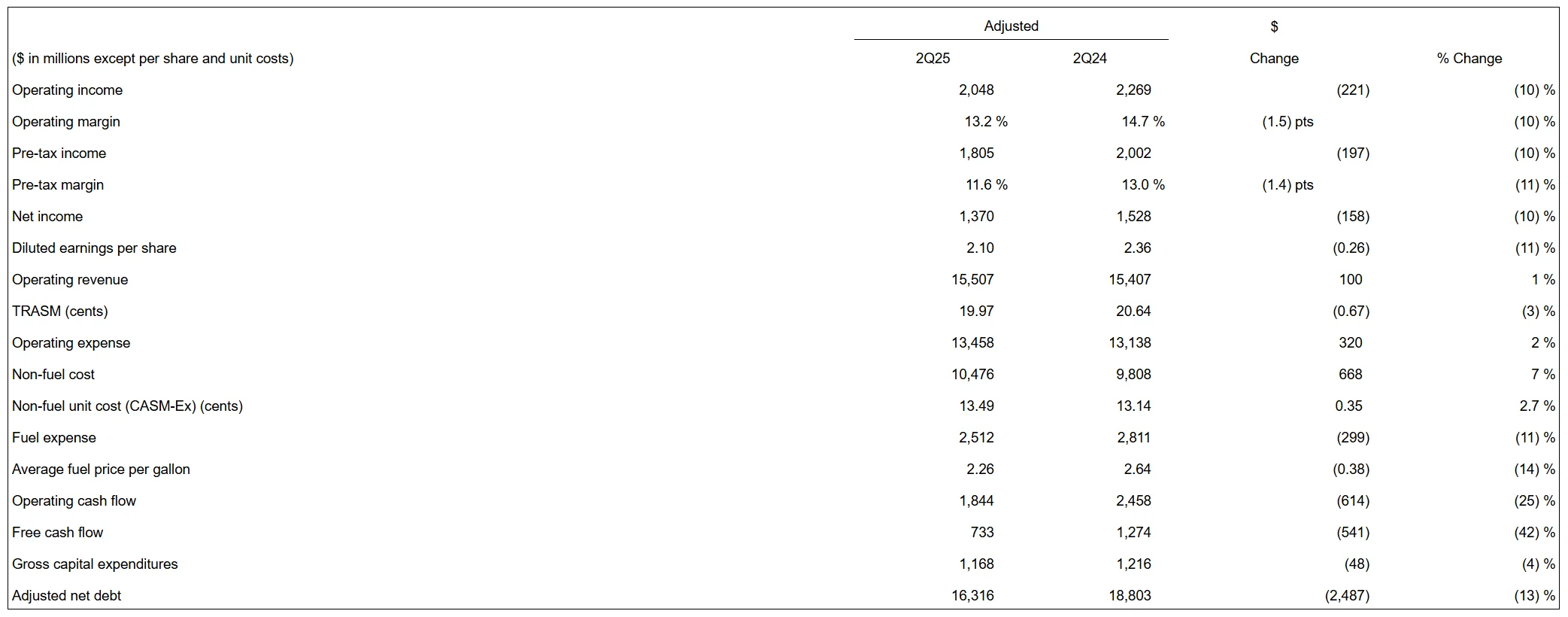

Source: Delta Air Lines

Delta Air Lines reported Q2 adjusted earnings of $2.10 per share, exceeding the expected $2.05, with revenue of $15.51 billion. Strong summer travel demand and the recovery of business travel led to an 11.99% jump in its stock price, boosting the shares of United Airlines, American Airlines, and others.

However, despite the strong performance during the week, the stock has dropped nearly 6% year-to-date, largely due to fuel costs and ongoing union negotiation pressures.

Tesla saw a sharp 7.6% drop on July 7 after Elon Musk announced the formation of the "American Party" and his involvement in political activities, raising concerns among investors about his divided focus. However, the stock rebounded 4.73% on July 10, as Musk revealed plans to expand its autonomous taxi service to the San Francisco Bay Area in "one or two months," which boosted investor confidence. The market remains highly sensitive to Tesla’s valuation (forward P/E of 70), given its volatility.

Source: TradingView

Focus for Next Week

This week, the main focus has been the ongoing tug-of-war between Trump's tariff policy and the Fed’s interest rate cut expectations. Trump's tariff adjustments and the progress in trade talks have helped alleviate the market fears sparked by the April "D-Day" tariff plan, pushing the S&P 500 and Nasdaq to record highs.

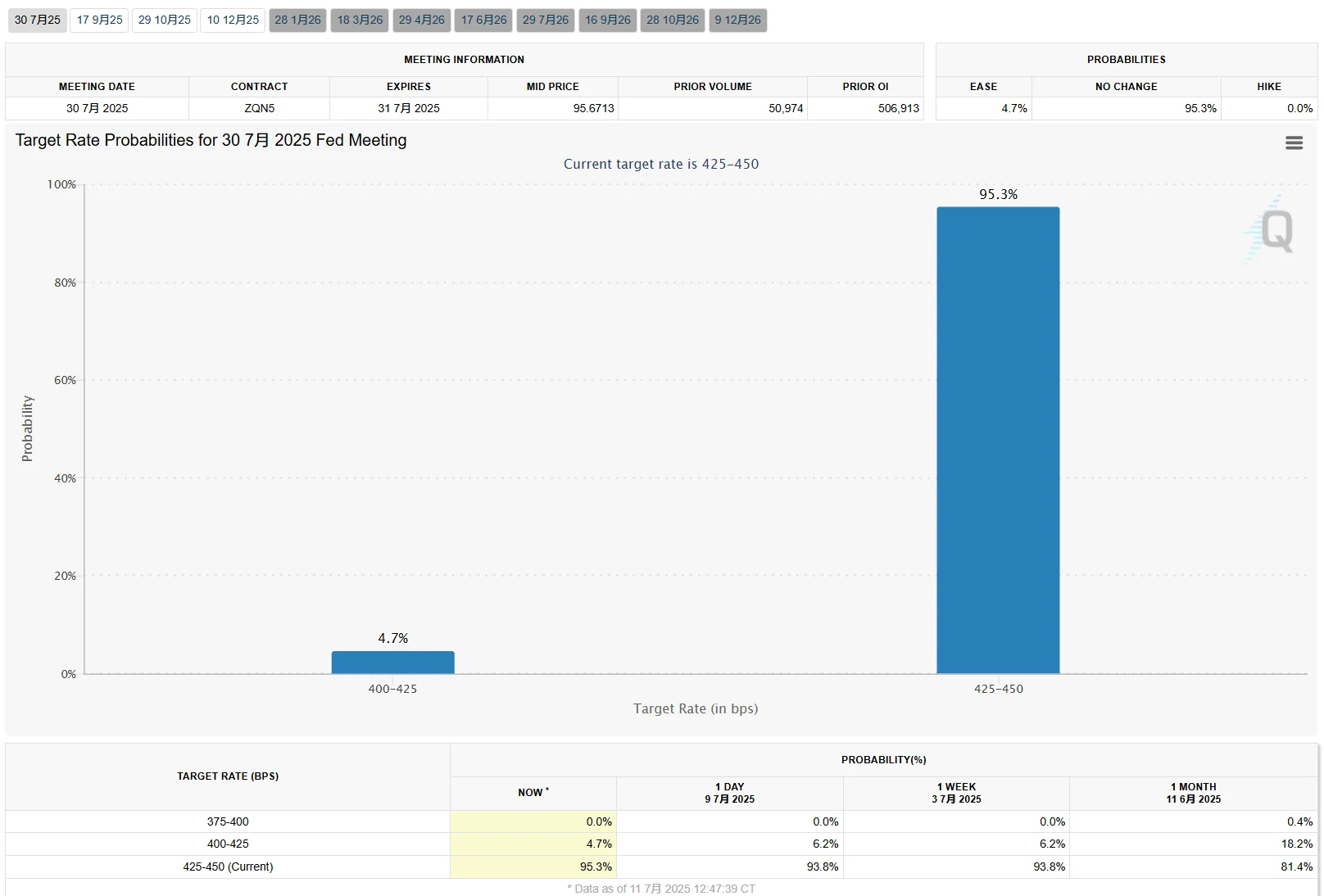

However, concerns about the potential inflationary impact of tariffs have kept the Federal Open Market Committee (FOMC) cautious. According to the CME FedWatch tool, the market’s expectations for a July rate cut have dropped to less than 10%. Trump's criticism of Chairman Powell and his intentions to replace him have raised concerns about the independence of the Federal Reserve. Should signs of political intervention intensify, long-term yields could rise, counteracting the impact of any rate cuts.

Source: CME

Next week's key focus will be the July 15th CPI data and the beginning of earnings season. Earnings reports from major financial institutions like JPMorgan Chase, Citigroup, Wells Fargo, and BlackRock are crucial for assessing the health of the financial sector and the overall economy. Reports from key companies in sectors such as healthcare (Johnson & Johnson, UnitedHealth), industrials (Honeywell), and consumer goods (Carnival Cruise Lines) will also be significant, as investors track industry earnings trends and forward guidance.

Currently, the S&P 500's valuation remains high (forward P/E of 22.2, well above the long-term average of 15.8), which could limit further upside potential. The tech sector will continue to benefit from the AI boom, but the consumer staples and energy sectors should be cautious of tariff cost pressures. The uncertainty surrounding tariff negotiations could lead to short-term volatility, and investors should closely monitor the FOMC meeting on July 29-30 and developments in trade agreements.